E-Commerce Logistics Market Size, Share, Trends and Forecast by Product, Service Type, Operational Area, and Region, 2025-2033

E-Commerce Logistics Market Size & Share:

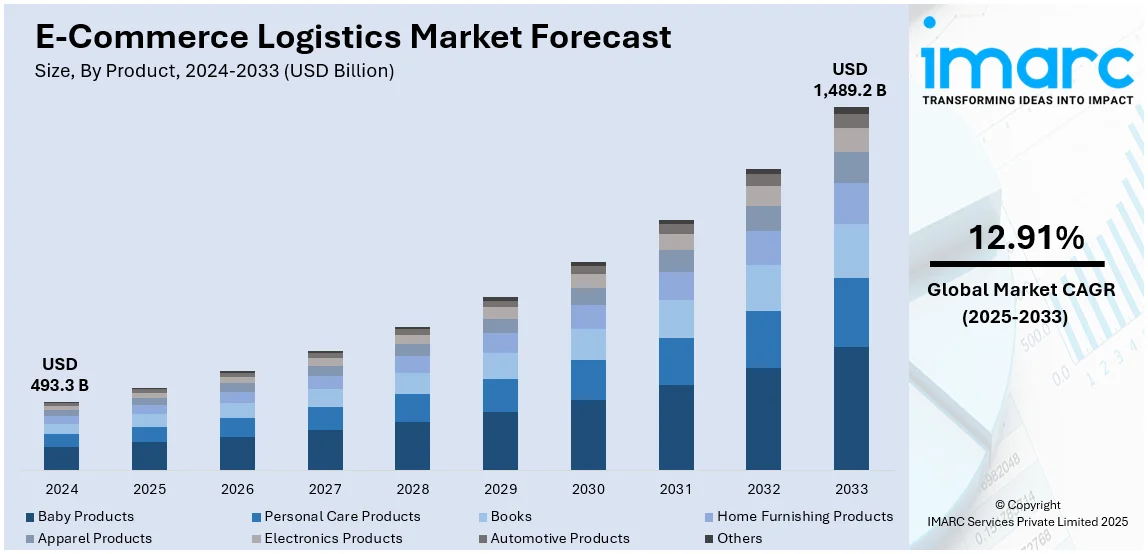

The global e-commerce logistics market size was valued at USD 493.3 Billion in 2024. Looking forward, the market is projected to reach USD 1,489.2 Billion by 2033, exhibiting a CAGR of 12.91% from 2025-2033. Asia Pacific currently dominates the market, holding an e-commerce logistics market share of over 34.6% in 2024. The market is driven by the surge in online retail adoption, the rise of omnichannel fulfillment strategies, and the growing demand for expedited deliveries. Logistics providers are investing in automation, AI-powered route optimization, and regional fulfillment centers to enhance service speed and scalability. Dominated by major players like FedEx, DHL, Amazon Logistics, and UPS, with Amazon and FedEx leading cross-border operations, the competitive landscape continues to improve rapidly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 493.3 Billion |

|

Market Forecast in 2033

|

USD 1,489.2 Billion |

| Market Growth Rate 2025-2033 | 12.91% |

The market is driven by the rapid expansion of online retailing, technological advancements, and evolving preferences of individuals. One of the most prominent trends in the market is the rise of omni-channel fulfillment. Retailers are increasingly integrating their physical stores, warehouses, and online platforms to provide seamless customer experiences across multiple sales channels. This approach is catalyzing the demand for flexible and agile logistics solutions capable of managing both online orders and in-store inventory. Additionally, people are expecting faster delivery options, including same-day and next-day delivery, which is propelling logistics providers to optimize their distribution networks and invest in regional fulfillment centers. Technology is a critical enabler of efficiency and innovation in the e-commerce logistics sector. The adoption of artificial intelligence (AI), machine learning (ML), and big data analytics is revolutionizing how logistics providers forecast demand, optimize routes, and enhance supply chain visibility. Warehouse automation, including the use of robotics, autonomous vehicles, and drones, is increasingly common as businesses seek to reduce labor costs and improve order accuracy.

To get more information on this market, Request Sample

The United States has emerged as a crucial region in the e-commerce logistics market owing to the increasing demand for enhanced online shopping experiences among the masses. The proliferation of omnichannel retail models, where businesses integrate physical and digital channels to create seamless customer experiences, is further driving the demand for robust logistics solutions. Omnichannel strategies are putting significant pressure on logistics providers to handle a mix of online and in-store orders efficiently. Retailers are also utilizing their brick-and-mortar locations as fulfillment centers to enable same-day and next-day deliveries, driving the need for optimized supply chains and advanced inventory management systems in the country. Automation in warehousing and fulfillment processes is another critical trend. Robotics and automated guided vehicles (AGVs) are being deployed in warehouses to handle tasks such as picking, packing, and sorting with greater speed and accuracy than traditional labor-intensive methods. Autonomous delivery solutions, including drones and self-driving vehicles, are also being piloted to address challenges in last-mile delivery and reduce reliance on human drivers. As a result, key market players are focusing on the creation of many autonomous solutions. For example, California based company Vayu Robotics announced the deployment of an autonomous on-road delivery robot in 2024. The robot is rolled out in the US with an e-commerce customer.

E-Commerce Logistics Market Trends:

Sustainability and Environmental Concerns

Individuals are recognizing the environmental effects of logistics, which is encouraging businesses to implement sustainable practices. This encompasses initiatives, such as lowering carbon footprints with electric vehicles (EVs) and renewable energy sources, lowering packaging waste with recyclable materials, and improving transportation routes to lesser fuel usage. Logistics companies are making investments in technology and infrastructure to meet these requirements, not just to follow the rules but also to match client desires for eco-friendly goods and services. By giving importance to sustainability, logistics companies are improving their brand image, appealing to individuals who care about the environment, and setting themselves apart in the market while also contributing to environmental objectives. In September 2023, FedEx revealed the deployment of three EVs in the UAE as the initial step in its eco-friendly fleet growth plan to lessen environmental effects and improve last-mile delivery services in high-traffic areas across the UAE.

Collaborative Expansion and Network Integration

Logistics firms are frequently creating alliances and extending their networks to improve service abilities and geographical coverage. Collaborations allow providers to exchange strengths, unique knowledge in various areas or industries, and provide comprehensive logistics solutions. By merging networks, businesses can improve supply chain efficiencies, cut costs, and improve delivery speeds, satisfying the growing need for quick and dependable shipping. This cooperative method also facilitates advancements in logistics technology and infrastructure, enabling the adoption of innovative tracking systems, automated warehouses, and eco-friendly delivery practices. In March 2023, Deutsche Post DHL Group and Poste Italiane introduced a strategic collaboration to oversee road parcel deliveries in Europe, improve express services for Italian clients, and co-invest in a network of parcel lockers in Italy to strengthen logistics operations. In addition, in October 2023, iThink Logistics and FedEx revealed a planned collaboration to transform India's international online shopping industry. The partnership includes discounted FedEx services to improve shipping effectiveness and global market reach for Indian merchants. The partnership made account setup easier and improved global shipping procedures, offering smooth integration and affordable options for online business owners.

Growing Individual Expectations

The rising user demands for quick and dependable delivery services are contributing to the market growth. Modern buyers expect smooth experiences with features, like same-day and next-day shipping, along with easy returns and live order tracking. As per the e-commerce logistics market overview, major logistics providers are making investments in infrastructure upgrades, expanding delivery networks, and training their workforce to manage peak periods in order to meet these demands efficiently. Logistics companies are innovating to maintain a competitive edge in the market that focuses heavily on user satisfaction. They are exploring cutting-edge technologies, including AI-powered route optimization and automated warehouses, to enhance efficiency and delivery precision. In May 2024, FedEx Corporation showcased its specialized logistic solutions for e-commerce businesses at Seamless Middle East 2024 in Dubai. The presentation featured solutions like FedEx Compatible Solutions, as well as digital services, such as WhatsApp notifications and Picture Proof of Delivery, to improve supply chain management and user confidence in global e-commerce activities.

E-Commerce Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-commerce logistics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, service type, and operational area.

Analysis by Product:

- Baby Products

- Personal Care Products

- Books

- Home Furnishing Products

- Apparel Products

- Electronics Products

- Automotive Products

- Others

Apparel products stand as the largest component in 2024, holding 26.5% of the market. Apparel products exhibit a clear dominance as per the e-commerce logistics market outlook because of the rapid expansion of online fashion retail. The segment encompasses a broad range of products, including clothing, footwear, and accessories, catering to diverse demographics and style preferences. The growing popularity of fast fashion styles, along with the rise of shopping apps and social media trends, are driving online clothing sales. Furthermore, improvements in logistics technologies like automated warehouses and AI-powered inventory management systems help to increase supply chain efficiency and accommodate the rapid turnover seen in the apparel industry. In May 2024, Geek+ joined forces with BlueSkye Automation to implement advanced automated warehouse systems for improving sorting speed. The goal of this partnership was to strategically tackle the rise of e-commerce and the lack of workers by utilizing cutting-edge robotic innovations.

Analysis by Service Type:

- Transportation

- Warehousing

Transportation leads the market with 58.6% of market share in 2024. Transportation accounts for the majority of the market share, playing a vital role in supporting the effectiveness and quickness of online retail. This section covers all the various tasks related to transporting products, ranging from vendors to buyers, such as transportation, final delivery, and quick package deliveries. The popularity of online shopping is increasing the amount and regularity of shipments, encouraging shipping companies to improve and expand their transportation capacities. Moreover, online shopping is enabling people to avoid the hassles of standing in long lines and travelling to the stores. Due to this, businesses are making large investments in innovative transportation technologies like route optimization software, electric delivery vehicles, and drone deliveries to improve efficiency and environment-friendliness.

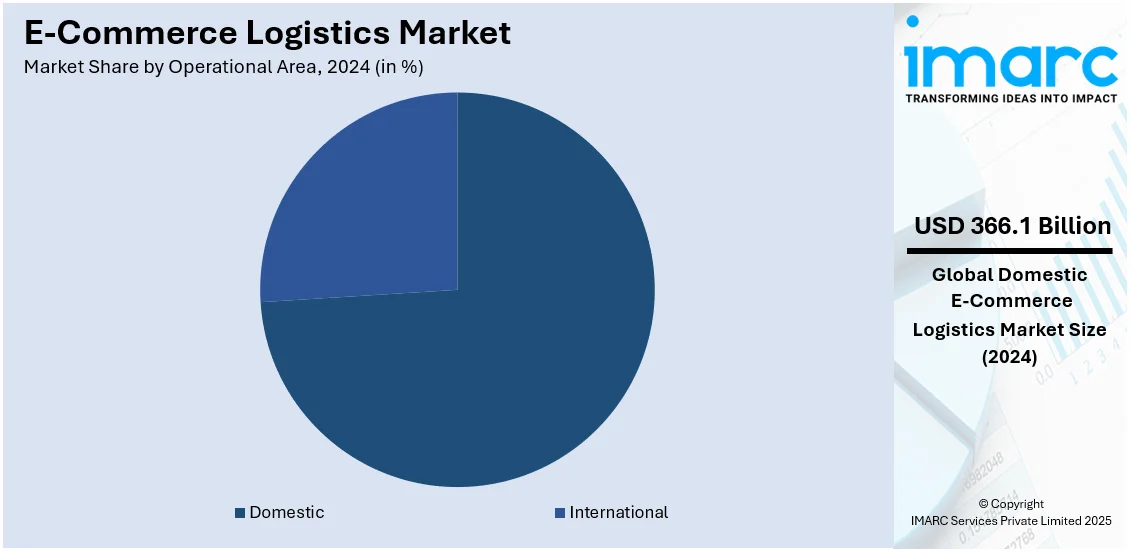

Analysis by Operational Area:

- International

- Domestic

Domestic leads the market with 74.2% of market share in 2024. Domestic comprises logistics activities that concentrate on moving and distributing products within one country to meet the needs of local buyers. The rise in local e-commerce is driven by the growing convenience of online shopping, expansion of local online platforms, and the emergence of direct-to-consumer (DTC) brands. Domestic logistics providers are optimizing their networks to meet the demand for rapid delivery, often within the same day or the next day. Deploying modern technologies, such as automated sorting systems and route planning powered by AI is increasing efficiency and cutting costs in domestic operations. Moreover, domestic logistics holds a significant advantage in the e-commerce logistics market demand due to its ability to navigate local regulations and utilize existing infrastructure.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 34.6%. Asia Pacific leads the market, driven by the rapid digital adoption and the increasing online retail activity in the region. The large population in the area and higher internet and smartphone usage is driving the demand for e-commerce services. Logistics companies in the Asia Pacific region are expanding their operations and investing in cutting-edge technologies for managing the high volume and fast pace of the online retail industry in the region. In March 2024, FedEx Express partnered with eBay CBT to deliver cross-border e-commerce logistics services, offering Korean companies reduced international shipping rates and organizing educational webinars on e-commerce strategies and customs clearance to assist their global market growth. Additionally, upgrading infrastructure and introducing creative methods of delivery are essential to fulfil the demands of users for fast and dependable service.

E-Commerce Logistics Regional Takeaways:

US E-Commerce Logistics Market Analysis

The e-commerce logistics market in the United States holds 88.50% share in the North American region. It is experiencing rapid growth as retailers are increasingly adopting omnichannel strategies, integrating online and offline sales channels. Companies are optimizing their supply chains by implementing real-time tracking technologies, which are enabling them to improve delivery speed and customer satisfaction. Consumers are continually demanding faster, more flexible delivery options, such as same-day and next-day shipping, which is driving investments in automated warehouses and fulfilment centers. According to Census Bureau, e-commerce sales increased by USD 244.2 Billion or 43% in 2020, the first year of the pandemic, rising from USD 571.2 Billion in 2019 to USD 815.4 Billion in 2020. Retailers are leveraging advanced robotics and AI-powered systems to streamline inventory management, reducing operational costs and delivery times. The growing preference for sustainable practices is pushing companies to invest in eco-friendly packaging and electric delivery vehicles, as they aim to minimize their environmental footprint. At the same time, regional and local fulfilment hubs are proliferating, allowing companies to reach customers more quickly and efficiently, especially in densely populated urban areas. Moreover, the rise of third-party logistics providers (3PLs) is enabling smaller e-commerce businesses to scale quickly without significant upfront investment in infrastructure. Retailers are constantly evolving their delivery models, utilizing advanced data analytics to forecast demand and optimize routes, all while responding to the increasing pressure for seamless, cost-effective logistics operations.

Asia Pacific E-Commerce Logistics Market Analysis

The e-commerce logistics market in Asia Pacific is experiencing rapid growth, driven by the increasing adoption of advanced technologies like artificial intelligence (AI) and automation in warehouses. Companies are integrating AI to optimize inventory management and streamline order fulfilment, significantly enhancing operational efficiency. Additionally, the expansion of last-mile delivery solutions is improving delivery speed, with companies investing heavily in electric vehicles (EVs) and drones to reduce carbon footprints while meeting consumer demand for faster delivery times. The growing popularity of cross-border e-commerce is also pushing businesses to refine their logistics strategies, with many regional players forming partnerships with global logistics providers to handle international shipments more effectively. As consumer expectations for real-time tracking and seamless returns grow, logistics companies are upgrading their tracking systems and improving reverse logistics capabilities. Moreover, the rise of mobile commerce in countries like India and China is prompting e-commerce platforms to tailor their logistics networks to accommodate mobile-driven purchases and micro-market deliveries. According to India Cellular and Electronics Association (ICEA), percentage of smartphone users above age of 25 has increased from 40 per cent in 2013 to 54 per cent in 2018. Retailers are continuously optimizing their supply chains to cater to the shift in consumer behavior, while governments in the region are offering incentives to boost logistics infrastructure.

Europe E-Commerce Logistics Market Analysis

The e-commerce logistics market in Europe is currently experiencing rapid growth due to several key factors. Retailers are increasingly adopting omnichannel strategies, blending physical and digital shopping experiences, which is driving demand for more efficient logistics solutions. Consumers are expecting faster deliveries, and companies are responding by optimizing last-mile delivery operations, using technologies like drones and autonomous vehicles to improve speed and reduce costs. E-commerce platforms are leveraging advanced data analytics and artificial intelligence to enhance route optimization, predict demand patterns, and manage inventory more effectively. At the same time, the rise in cross-border shopping within the European Union is pushing businesses to streamline international shipping operations, focusing on borderless and faster delivery solutions. Sustainability concerns are also playing a significant role as companies are adopting eco-friendly packaging and exploring alternative fuel options for transportation to meet growing environmental expectations. Retailers are collaborating with third-party logistics providers and expanding their warehousing capabilities in strategic locations, particularly in urban areas, to ensure quicker access to consumers. According to the Government of UK, in 2019, 56.3 Million people lived in urban areas (82.9% of England’s population). Additionally, the integration of flexible and scalable logistics solutions is enabling businesses to cope with fluctuating demand, especially during peak seasons like Black Friday or Cyber Monday, contributing to the market’s dynamic expansion.

Latin America E-Commerce Logistics Market Analysis

The e-commerce logistics market in Latin America is experiencing significant growth as consumers increasingly prefer online shopping, driving the demand for efficient and reliable delivery solutions. Companies are rapidly expanding their digital platforms to cater to a larger consumer base, prompting the need for enhanced logistics networks. The rise in mobile penetration and internet accessibility is enabling more people to shop online, particularly in urban and semi-urban regions, which is amplifying the demand for last-mile delivery services. According to the Brazilian Institute of Geography and Statistics (IBGE), the internet was used in 92.5% of the Brazilian households (72.5 Million) in 2023, a rise of 1.0 pp over 2022. At the same time, e-commerce businesses are adopting advanced technologies, such as artificial intelligence and data analytics, to streamline inventory management, route optimization, and predictive demand forecasting. E-commerce giants are investing in localized fulfilment centers to reduce delivery times and meet rising customer expectations for faster shipping. Governments are also implementing regulations and incentives that support the growth of e-commerce logistics, while local startups are increasingly entering the logistics space to provide innovative, cost-effective solutions. Moreover, the growing preference for environmentally friendly options is pushing logistics providers to adopt sustainable practices, such as electric vehicles and eco-friendly packaging. These factors are collectively shaping the dynamics of the e-commerce logistics sector in Latin America, driving further investments and innovations in the industry.

Middle East and Africa E-Commerce Logistics Market Analysis

The e-commerce logistics market in the Middle East and Africa (MEA) is currently experiencing significant growth due to several key factors. Companies are increasingly adopting advanced technologies like AI and automation to streamline their supply chains and improve delivery speed. E-commerce platforms are optimizing their delivery networks by setting up localized distribution centers to cater to the growing demand for fast and efficient services. As urbanization accelerates, more customers are opting for online shopping, driving demand for last-mile delivery solutions. According to Central Intelligence Agency, in 2023, 87.8% of total population lived in urbanized areas in UAE. Retailers are integrating omnichannel strategies, expanding their reach and making cross-border shipments more seamless. The rise of mobile commerce is pushing businesses to enhance their logistics capabilities to support mobile-driven transactions. Government initiatives, including investments in infrastructure like ports, airports, and roadways, are further enabling the efficient movement of goods. Consumers are becoming more concerned about sustainability, prompting logistics companies to adopt eco-friendly practices like electric vehicles and green packaging. Moreover, the shift towards cashless transactions is facilitating smoother financial operations, which in turn is fostering market growth. E-commerce logistics companies are also partnering with third-party logistics providers to enhance their capabilities, ensuring faster and more reliable delivery services across the region.

Competitive Landscape:

Key players are continuously innovating and implementing strategies to stay ahead in an industry shaped by rapid technological advancements, evolving customer expectations, and logistical complexities. They are reshaping their business models and operations to enhance efficiency, improve delivery speeds, optimize costs, and ensure customer satisfaction. These efforts span multiple areas, including last-mile delivery innovations, automation, sustainability initiatives, and expansion into new markets. Automation has become a central pillar of logistics operations as companies seek to improve efficiency and handle increasing order volumes. Key players in the market are integrating robotics, artificial intelligence, and machine learning across their supply chains. To capitalize on the global growth of e-commerce, major logistics providers are expanding their networks and forming strategic partnerships with online retailers. In 2024, CEVA Logistics (CMA CGM S.A.) finalized its acquisition of UK-based Wincanton for USD 719 Million. The acquisition aimed to leverage Wincanton's expertise across various sectors like retail, e-commerce, and defense, enhancing Ceva's contract logistics capabilities.

The report provides a comprehensive analysis of the competitive landscape in the e-commerce logistics market with detailed profiles of all major companies, including:

- Agility

- AllcargoGATI

- Aramex

- CEVA Logistics

- DHL eCommerce

- FedEx

- Kenco Group

- Kuehne+Nagel

- Rhenus Group

- United Parcel Service of America, Inc

Latest News and Developments:

- May 2025: DHL Supply Chain acquired IDS Fulfillment, a U.S.-based e-commerce logistics provider, expanding its North American operational footprint by over 1.3 million square feet of multi-customer warehouse and distribution space across key cities including Indianapolis, Salt Lake City, Atlanta, and Plainfield. This strategic move marks DHL’s second e-commerce acquisition in 2025, following the purchase of Inmar’s reverse logistics business, making DHL the largest returns processor in North America.

- May 2025: ClickPost, India's leading logistics intelligence platform, launched Atlas, a first-of-its-kind benchmarking solution for e-commerce logistics, powered by data from over 50 million monthly shipments. Atlas offers real-time, region-specific market comparisons on metrics such as fulfillment speed, return-to-origin (RTO) rates, last-mile efficiency, and delivery timelines—enabling brands to identify bottlenecks, benchmark performance, and uncover underserved geographies.

- April 2025: Delhivery Limited announced the acquisition of a controlling stake in Ecom Express Limited for INR 1,400 Crores (USD 168 Million), aiming to enhance operational synergies and strengthen its logistics capabilities across India. This strategic move is expected to combine Delhivery’s nationwide network—covering over 18,700 pin codes and fulfilling 3.4 billion shipments to date—with Ecom Express’s expertise in first-mile to last-mile e-commerce logistics, which has delivered nearly 2 billion shipments to 97% of Indian households.

- April 2024: Kuehne+Nagel International AG completed the purchase of City Zone Express from Chasen Holdings Ltd, enhancing its ability to provide cross-border road logistics services in Southeast Asia. This strategic decision quickly improved Kuehne+Nagel’s services in the area by utilizing City Zone Express’s large fleet and storage capabilities, specifically targeting growing industries like e-commerce and high-tech.

- August 2024: Logistics firm Delhivery launched a network of shared dark stores to enable e-commerce firms and direct-to-consumer brands to fulfil faster deliveries. This company already offers its warehouses to quick-commerce companies, the new network, coupled with last-mile delivery, will provide direct-to-consumer, or online-first, brands the chance to reach their products to consumers much faster.

E-Commerce Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, Others |

| Service Types Covered | Transportation, Warehousing |

| Operational Areas Covered | International, Domestic |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Agility, AllcargoGATI, Aramex, CEVA Logistics, DHL eCommerce, FedEx, Kenco Group, Kuehne+Nagel, Rhenus Group, United Parcel Service of America, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-commerce logistics market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-commerce logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-commerce logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce logistics market was valued at USD 493.3 Billion in 2024.

The e-commerce logistics market is projected to exhibit a CAGR of 12.91% during 2025-2033, reaching a value of USD 1,489.2 Billion by 2033.

Key factors driving the market include the rapid expansion of online retailing, continual technological advancements, rising demand for faster deliveries, and increasing adoption of omni-channel fulfillment. Additionally, ongoing innovations in automation, AI, and sustainability initiatives further contribute to market growth.

Asia Pacific currently dominates the e-commerce logistics market, accounting for a share exceeding 34.6%. This dominance is fueled by rapid digital adoption, growing online retail activity, and large populations with high internet and smartphone usage.

Some of the major players in the e-commerce logistics market include Agility, AllcargoGATI, Aramex, CEVA Logistics, DHL eCommerce, FedEx, Kenco Group, Kuehne+Nagel, Rhenus Group, and United Parcel Service of America, Inc, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)