Malaysia and Indonesia Takaful Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and States, 2025-2033

Market Overview:

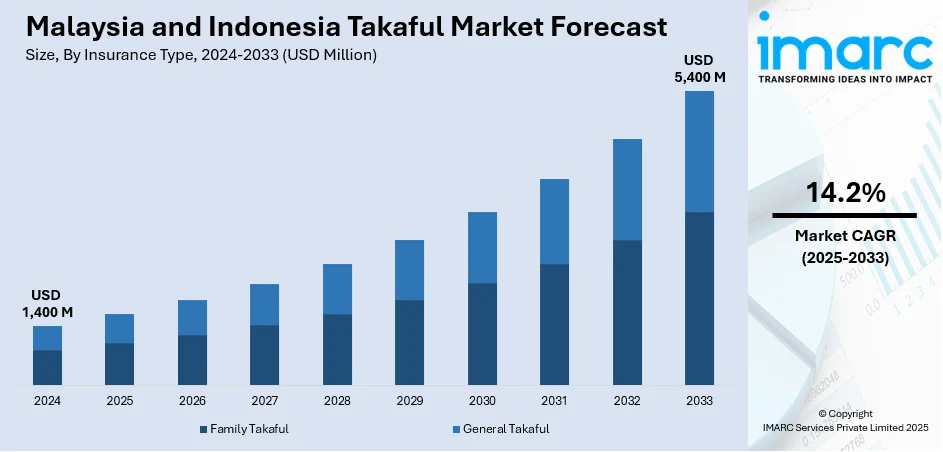

The Malaysia and Indonesia takaful market size reached USD 1,400 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,400 Million by 2033, exhibiting a growth rate (CAGR) of 14.2% during 2025-2033. The market is driven by the increasing demand for Shariah-compliant financial products and proactive government support, including regulatory initiatives and incentives promoting Islamic finance, attracting both local and foreign investments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,400 Million |

| Market Forecast in 2033 | USD 5,400 Million |

| Market Growth Rate 2025-2033 | 14.2% |

Takaful is a type of Islamic insurance based on the tenet of mutual cooperation, shared responsibility, and solidarity. In this system, participants contribute regular contributions or premiums into a common pool, which is then used to support and compensate those who suffer from specific losses or risks. Compared to conventional insurance, takaful operates in compliance with Islamic principles, such as avoiding interest (riba) and gambling (maysir). The risk-sharing concept promotes a sense of community and fairness among participants. Takaful is gaining popularity globally, especially in regions with a significant Muslim population, as it aligns with Islamic ethical guidelines.

To get more information on this market, Request Sample

The Malaysia and Indonesia takaful market is driven by their expanding Muslim populations and the growing awareness of the importance of adhering to Islamic principles in financial matters, including insurance. Besides this, the rising demand for Shariah-compliant products, such as takaful, is creating a favorable outlook for market expansion. Moreover, governments in Malaysia and Indonesia have been actively promoting and supporting Islamic finance and takaful initiatives through regulatory frameworks and incentives, which, in turn, is contributing to the market's growth. In addition to this, robust economic growth in both countries has resulted in a rising middle-class population with higher disposable incomes, driving the demand for insurance solutions, such as takaful products, thereby strengthening the market growth.

Malaysia and Indonesia Takaful Market Trends/Drivers:

Growing awareness and demand for Shariah-compliant financial products

One of the primary drivers of the takaful market in Malaysia and Indonesia is the increasing awareness and demand for Shariah-compliant financial products, including insurance. Both Malaysia and Indonesia have substantial Muslim populations that seek to align their financial practices with Islamic principles. Takaful, being based on the principles of mutual cooperation, shared responsibility, and ethical conduct, resonates with the Islamic values of fairness, transparency, and risk-sharing. Moreover, the increasing effort by financial institutions, including takaful operators, to educate the public about the benefits and compatibility of takaful with Islamic teachings is aiding in market expansion. The appeal of takaful extends beyond the Muslim population as ethical and socially responsible financial products gain traction globally.

Proactive support and promotion of Islamic finance by governments

The governments of Malaysia and Indonesia have been actively supporting and promoting Islamic finance, including the takaful sector, through regulatory initiatives and incentives. Both countries have established dedicated regulatory bodies, such as the Central Bank of Malaysia (Bank Negara Malaysia) and the Financial Services Authority of Indonesia (Otoritas Jasa Keuangan), that have introduced measures that create a conducive environment for takaful operators to broaden their offerings and reach a wider customer base. They have facilitated the development of innovative takaful products and provided guidance on compliance with Shariah principles. Additionally, tax incentives and other financial support offered to encourage the growth of the Islamic finance sector, attracting both local and foreign investments, are bolstering the market growth.

Malaysia and Indonesia Takaful Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Malaysia and Indonesia takaful market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on insurance type and distribution channel.

Breakup by Insurance Type:

- Family Takaful

- General Takaful

Family takaful represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes family and general takaful. According to the report, family takaful represented the largest segment.

The demand for family takaful is propelled by the increasing urbanization and changing demographics in Muslim-majority countries, leading to a higher awareness of the importance of financial protection and long-term planning. Family takaful products offer a unique blend of insurance and investment features, enabling individuals to safeguard their families' futures while complying with Islamic principles. In addition to this, the growing emphasis on social responsibility and ethical financial practices has attracted a broader audience to opt for family takaful over conventional insurance, creating a positive outlook for market growth. Furthermore, takaful operators' innovative product offerings and customer-centric approach have also contributed to building trust and confidence among potential customers, thus fueling the demand for family takaful solutions.

Breakup by Distribution Channel:

- Offline Channel

- Online Channel

Offline channel accounts for the majority of the market share

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline channel. According to the report, offline channel accounted for the largest market share.

In regions with limited internet penetration or access, offline channels remain the primary mode of communication and interaction. Utilizing traditional methods such as face-to-face interactions, seminars, and workshops, takaful providers can effectively connect with potential consumers and inform them about the benefits of takaful. Concurrent with this, some individuals, particularly older generations, may feel more comfortable discussing financial matters and making purchasing decisions in person rather than online. Moreover, offline channels also offer a personalized and human touch, allowing takaful agents to tailor solutions to customer's specific needs and address any concerns directly. By leveraging offline channels, takaful providers can tap into a broader market segment and foster stronger relationships with customers, thereby driving the demand for takaful through these traditional channels.

Breakup by States:

- Malaysia

- Johor

- Kedah

- Kelantan

- Kuala Lumpur

- Labuan

- Others

- Indonesia

- Jakarta

- East Java

- West Java

- Central Java

- Riau

- Others

Kuala Lumpur in Malaysia and West Java in Indonesia holds the largest share of the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Malaysia (Johor, Kedah, Kelantan, Kuala Lumpur, Labuan, and others) and Indonesia (Jakarta, East Java, West Java, Central Java, Riau, and others). According to the report, Kuala Lumpur in Malaysia and West Java in Indonesia enjoys the leading market position. Some of the factors driving the market include the increasing awareness of Islamic finance principles, supportive government regulations and policies, and a growing middle-class population with rising disposable income.

Competitive Landscape:

The competitive landscape of Malaysia and Indonesia's takaful market is distinguished by intense competition among established takaful operators and new entrants. The presence of well-established, reputable takaful companies with extensive experience and a wide range of Shariah-compliant products creates strong competition for market share. These companies have established a loyal customer base and brand recognition, making it challenging for new players to penetrate the market. Moreover, takaful operators are continuously developing new and tailored products that cater to specific customer needs, such as family takaful, health takaful, and investment-linked plans. Besides this, regulatory compliance and adherence to Islamic principles are paramount in the takaful market. Companies that demonstrate robust compliance with Shariah guidelines and transparent business practices build trust and credibility, enhancing their competitiveness.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AIA Group Limited

- Asia Capital Reinsurance Group Pte. Ltd. (Catalina Holdings (Bermuda) Ltd.)

- Etiqa General Takaful Berhad

- Hong Leong Msig Takaful Berhad

- MAA Group Berhad

- Munich Re Group

- Prudential BSN Takaful Berhad

- Sun Life Malaysia

- Syarikat Takaful Malaysia Keluarga Berhad

- Takaful IKHLAS (MNRB Holdings Berhad)

Malaysia and Indonesia Takaful Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Insurance Types Covered | Family Takaful, General Takaful |

| Distribution Channels Covered | Offline Channel, Online Channel |

| States Covered | Malaysia (Johor, Kedah, Kelantan, Kuala Lampur, Labuan, Others), Indonesia (Jakarta, East Java, West Java, Central Java, Riau, Others) |

| Companies Covered | AIA Group Limited, Asia Capital Reinsurance Group Pte. Ltd. (Catalina Holdings (Bermuda) Ltd.), Etiqa General Takaful Berhad, Hong Leong Msig Takaful Berhad, MAA Group Berhad, Munich Re Group, Prudential BSN Takaful Berhad, Sun Life Malaysia, Syarikat Takaful Malaysia Keluarga Berhad, Takaful IKHLAS (MNRB Holdings Berhad), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia and Indonesia takaful market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Malaysia and Indonesia takaful market?

- What is the impact of each driver, restraint, and opportunity on the Malaysia and Indonesia takaful market?

- What is the breakup of the market based on the insurance type?

- Which is the most attractive insurance type in the Malaysia and Indonesia takaful market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the Malaysia and Indonesia takaful market?

- What is the competitive structure of the Malaysia and Indonesia takaful market?

- Who are the key players/companies in the Malaysia and Indonesia takaful market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia and Indonesia takaful market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Malaysia and Indonesia takaful market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia and Indonesia takaful industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)