Medical Aesthetics Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Medical Aesthetics Market Size and Share:

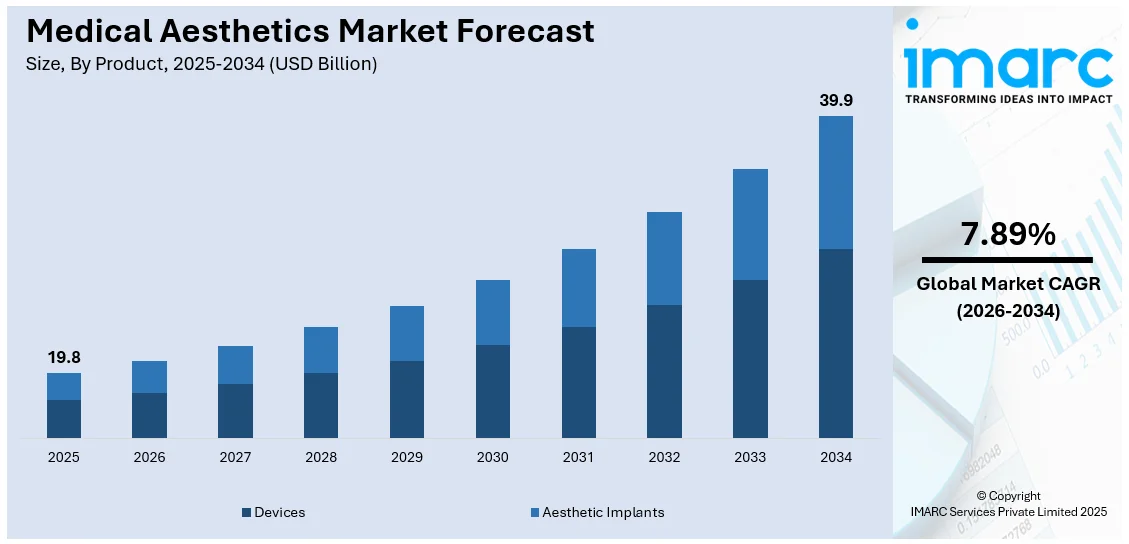

The global medical aesthetics market size was valued at USD 19.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.9 Billion by 2034, exhibiting a CAGR of 7.89% from 2026-2034. North America currently dominates the market, holding a market share of over 41.5% in 2025. The market is primarily driven by the rising emphasis on youthful appearance and self-confidence, the escalating consumer demand for non-invasive cosmetic procedures, the continuous technological advancements, and the widespread availability and accessibility of medical aesthetics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 19.8 Billion |

|

Market Forecast in 2034

|

USD 39.9 Billion |

| Market Growth Rate 2026-2034 | 7.89% |

One of the key drivers for the medical aesthetics market is the increasing demand for minimally invasive (MI) cosmetic procedures. Advancements in technology have made treatments like Botox, dermal fillers, and laser-based therapies safer, quicker, and more effective, appealing to a broader demographic. The growing societal focus on self-image, fueled by social media and beauty standards, has further accelerated adoption. Additionally, these procedures often require less downtime compared to surgical alternatives, making them attractive to busy individuals. The rising disposable income and expanding accessibility to such treatments in emerging markets are also contributing to the growing preference for non-surgical aesthetic enhancements.

To get more information on this market Request Sample

The United States is emerging as leading medical aesthetics industry, with 91.50% shares. It is driven by robust healthcare infrastructure and advancements in cosmetic treatments. As of 2023, healthcare spending in the U.S. reached approximately 17.8% of GDP, reflecting the sector's economic significance. The medical aesthetics segment benefits from increasing demand for MI procedures. The International Society of Aesthetic Plastic Surgery (ISAPS) reported a 5.5% increase in surgical procedures, totaling over 15.8 million, and 19.1 million non-surgical procedures. Over the last four years, the overall increase in aesthetic procedures has been 40%. Along with this, in 2022, 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the U.S., reflecting a 19% increase in cosmetic surgeries since 2019, according to the American Society of Plastic Surgeons (ASPS). Additionally, the U.S. leads globally in technology adoption for laser treatments, injectables, and skin rejuvenation techniques. Federal data highlights steady innovation in healthcare, including aesthetics, fueled by supportive regulatory frameworks and research funding. This has cemented the U.S. as a hub for aesthetic innovation and service delivery.

Medical Aesthetics Market Trends:

Growing Demand for Non-Invasive Procedures

The rising demand for non-invasive procedures is the primary driver of the market growth. In addition to this, the changing consumer preferences towards cosmetic enhancements are also driving the medical aesthetics market outlook. Furthermore, the increasing popularity of various beauty treatments, such as dermal fillers, Botox injections, and laser therapy is further boosting the market growth. For example, the Allergan 2022 report shows growing acceptance of non-invasive treatments, and the progress continues to emphasize delivering effective results with minimal downtime and less risk than traditional surgical procedures or even injectables. New muscles for treatment include the additional elbow and forearm muscles: brachialis, brachioradialis, pronator teres, and pronator quadratus. Nonetheless, technological advancements and the desire for minimal downtime have been major drivers for non-invasive procedures. The market grew by 6% for botulinum toxin procedures, whereas dermal fillers experienced growth of 4% in 2023. As a result, the usage of botulinum toxins in aesthetic medicine has remarkably surged. Botox injections are employed in the treatment of frown lines, crow's feet, and horizontal forehead lines. These are cosmetic indications which have been approved by the US FDA.

Emerging Technology Trends

Advancements in laser technology, injectables, and energy-based devices are major drivers in the development of the medical aesthetics market. This expansion is also due to their effectiveness and versatility in addressing increasingly sophisticated technologies for specific concerns related to the skin, like pigmentation, wrinkles, and tattoo removal. Among other examples, the trend towards the use of surgery robots, such as the da Vinci Surgical System, has revolutionized the very nature of surgery by affording enhanced precision, dexterity, and control through the minimally invasive surgery procedures. In addition, the popularity of longer-lasting and more natural-looking injectables has led to cosmetic enhancements becoming accessible and appealing to a wider range of people. For instance, GC Aesthetics is a well-established leader in breast aesthetics that collaborated with Bimini Health Tech, a pioneer in health care solutions, to revolutionize the world of breast reconstruction. This collaboration leverages the 40 years of GC Aesthetics experience in design, manufacturing, and distribution of Silicone Breast Implants in conjunction with Bimini's latest breast reconstruction innovations. Together, they are committed to offering world-class breast reconstruction solutions to women around the globe, from the USA to LATAM, EMEA, and APAC.

Increased Demand for Self-Esteem and Youths Appearance

There is immense growth in the medical aesthetics market. This is due to cultural changes that are more of self-confidence and seeking youthfulness. The regulatory authorities also approve various products, and this has enhanced the growth. For instance, Lumenis launched the Splendor X device in the United Kingdom in January 2022. It obtained CE clearance for hair removal, vascular issues, pigmented lesions, and wrinkles. The growing demand for botulinum toxin treatments, coupled with the growing number of aesthetically conscious individuals and an ongoing stream of new releases, is also fueling the growth of the market. Botulinum toxin is a neurotoxic protein found in Clostridium botulinum that acts by interrupting nerve impulses to the administered muscles upon injection. Apparently, the most common receivers of botulinum toxin type A cosmetic treatments are adults aged 31-45 years. In 2023, aesthetic procedures grew globally by 3.4%, totaling 34.9 million; surgical rose by 5.5%, and nonsurgical procedures rose by 1.7%. In the last four years, the cumulative number of procedures increased by 40%.

Medical Aesthetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical aesthetics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, application and end user.

Analysis by Product:

- Devices

- Aesthetic Implants

Aesthetic implants stand as the largest part of the 2025 market. Growth in aesthetic implant surgeries, particularly procedures like augmentation mammoplasty and other facial implants is largely backed by women as it gathers momentum in relation to soaring social media influences, with increased disposable incomes, as well as in improving the latest implant materials used including biocompatible metals and ceramics among others. Both hospitals and specialty clinics are increasing their portfolio offerings, thereby making aesthetic implants accessible. The growing popularity of body contouring and facial enhancements, along with rising acceptance of cosmetic surgery, further fuels the implant market.

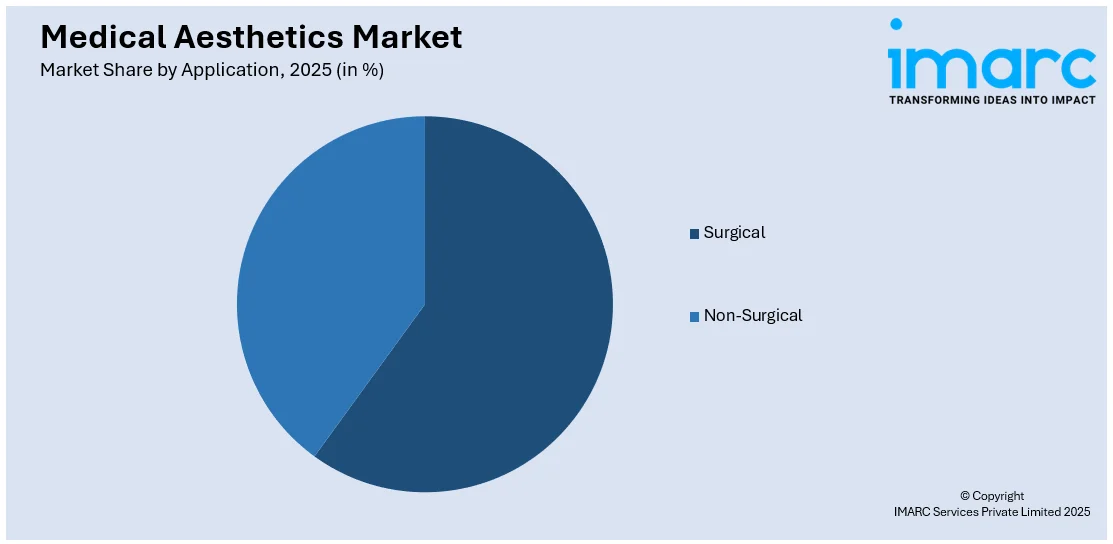

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Surgical

- Non-Surgical

Surgical dominated the market in 2025, with growth in demand for body contouring, facial surgeries, and enhancements. One of the most important factors is that aesthetic surgery is increasingly becoming acceptable due to improvements in surgical techniques and patient safety measures. Some of the most popular procedures are liposuction, facelifts, and rhinoplasty because these surgeries give the patient results that last long and are easily noticeable. Additionally, increased disposable incomes and greater emphasis on self-image, as amplified by social media, are contributing to the demand for surgical options. According to data from the International Society of Aesthetic Plastic Surgery (ISAPS), surgical procedures increased by 5.5% in 2023, further showing this trend.

Analysis by End User:

- Hospitals and Clinics

- Medical Spas and Beauty Centers

The market share for hospitals and clinics is around 49.8% in 2025 because they are capable of providing complete specialized services under one roof. These facilities range from non-invasive aesthetic treatments such as Botox and dermal fillers to more complex surgical procedures like facelifts and liposuction. Hospitals and clinics are trusted for their advanced technology, highly trained professionals, and adherence to regulatory standards, ensuring patient safety. Increasing aesthetic services investments in healthcare will also contribute to the use of these settings, alongside the increasing affordability and treatment accessibility. This consolidation enhances patient confidence in one single location, thus further accelerating the trend.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominated the market share in 2025, accounting for more than 41.5% due to high consumer demand for cosmetic procedures, an advanced healthcare infrastructure, and rising acceptance of non-invasive treatments. The U.S. remains a key contributor in this region, with a large population seeking aesthetic enhancements like Botox, dermal fillers, and laser treatments. Technological advancements, along with the presence of key market players, further fuel this growth. Also, the increasing concern of younger generations towards self-image and beauty, coupled with increasing disposable income, increases the demand for these procedures. North America's regulatory environment is supporting the expansion of the market by ensuring the safety and efficacy of medical aesthetics treatments.

Key Regional Takeaways:

United States Medical Aesthetics Market Analysis

Rising demand for non-invasive aesthetic treatments and a recent spate of increasing awareness about cosmetic procedures should fuel strong growth in the U.S. medical aesthetics market. The market for physician-dispensed skincare alone is expected to grow at 9.6% compound annual growth rate, reaching $37.3 billion by 2030. The high demand for medical-grade skincare products that are sought more and more by consumers due to the benefits they impart in rejuvenating and aging out the skin. Besides, emerging products like exosome-based skincare treatments from Elevai signify the larger trend of aesthetics solutions powered by biotechnology, as products are designed to advance skin regeneration, stimulate collagen production, and promote better skin health. The increase in obesity and the market for weight loss treatments are supporting the medical aesthetics market; the demand for body sculpting and rejuvenation is also rising, opening new avenues.

Europe Medical Aesthetics Market Analysis

The medical aesthetics market in Europe benefits hospitals and clinics by enhancing patient satisfaction and expanding service offerings. Non-invasive procedures such as dermal fillers and laser therapy are increasingly popular because they have minimal downtime and are in line with patient preferences. Healthcare expenditure in Germany reached approximately €474.1 billion (USD 507.3 billion) in 2021, with over 90% of the population covered, indicating the robustness of the nation's healthcare system. This rise in healthcare spending also boosts medical aesthetics, providing better access for patients to cosmetic treatments. In the UK, 43% of adults currently view non-surgical cosmetic procedures as part of a regular beauty routine. These treatments are considered an essential part of well-being and helps build customer loyalty. Higher revenue in clinics is established with reliable high tech solutions, giving patients the confidence to be regular visitors. Further growing the demand for minimally invasive options also drives innovation in equipment, thereby improving service quality and making processes more effective.

Asia Pacific Medical Aesthetics Market Analysis

Medical aesthetics in India continues to gain ground with increasing awareness and acceptance of non-surgical cosmetic treatments such as Botox, fillers, and laser treatments. It now presents more affordable solutions for those alternatives that could have been more conventional, like surgery, by offering such solutions to the broader market penetration of the middle-income earners. Technological advances in aesthetic medicine, including laser and micro-needling devices, have further fueled this growth with innovation in traditional beauty practices. Training programs for professionals have also become more accessible, meeting the demand for skilled practitioners. This also explains why its young population of more than 554 million aged 15-64 plays a part in the rising demand because most of these people give much importance to self-care and personal appearance.

Latin America Medical Aesthetics Market Analysis

Brazil is actually the fourth biggest cosmetic market around the world and is driven by large and diverse populations, and growing demand for beauty products, as well as thriving export sectors. Latin America is a principal region for Brazilian exports where 79.3% of total cosmetic sales are recorded to be in that region; Argentina, Chile, and Mexico are amongst the destinations. The innovation of applying local ingredients boosts Brazil's competitive edge across the border. There is also growing interest in non-invasive beauty procedures, supported by the region's expanding middle class and evolving consumer preferences for accessible and effective aesthetic solutions.

Middle East and Africa Medical Aesthetics Market Analysis

The medical aesthetics market is growing rapidly in the Middle East and Africa, supported by the growing number of medical spas and non-invasive procedures. As of 2024, the UAE has 50 medical spas, an increase of 6.25% from 2023, and mostly operated independently. Treatments such as dermal fillers and laser therapies are very popular due to their natural results and minimal downtime. The integration of wellness with beauty and advanced technology is also boosting client satisfaction. Growing awareness of skin health and youthfulness further supports the market's expansion.

Competitive Landscape:

The medical aesthetics market has a high degree of rivalry, with several companies dealing with a wide range of treatments and products. These include main industry players that have dominated the global market with established portfolios of injectable treatments, dermal fillers, and botulinum toxin products. Such companies consistently innovate by developing new technologies and formulations to satisfy the growing demand from consumers for non-invasive cosmetic procedures. Apart from the above companies, several new players are entering the market and trying to gain ground with their focus on cutting-edge treatments such as laser technologies, regenerative medicine, and aesthetic devices. Increasing demand for personalized treatments is also a reason for competition that compels companies to use advanced AI and ML in their product development. Regional players also play a role in the competitive dynamics, especially in Asia Pacific and Latin America, where the market for medical aesthetics is also witnessing strong growth.

The report provides a comprehensive analysis of the competitive landscape in the medical aesthetics market with detailed profiles of all major companies, including:

- A.R.C. Laser Gmbh

- AbbVie Inc.

- Alma Lasers Ltd.

- Bausch Health Companies Inc.

- Cutera Inc.

- Cynosure

- El.En. S.p.A.

- Fotona d.o.o.

- Johnson & Johnson

- Lutronic

- Merz Pharma GmbH & Co. KGaA

- Venus Concept

Latest News and Developments:

- January 2024: United Aesthetics Alliance (“UAA” or “the Company”), a holding company created to consolidate market-leading, clinically differentiated plastic surgery practices and affiliated medical spa service providers, today announced it has recently established a new partnership with The Bengtson Center for Aesthetics & Plastic Surgery (“BCAPS” or “the Practice”).

- February 2024: Galderma, the emerging pure-play dermatology category leader, presented “NEXT by Galderma.” A ground-breaking report, NEXT takes a deep-dive into the global aesthetics trends set to shape 2024 and beyond. This project is the culmination of a year of comprehensive trend-forecasting research, conducted in collaboration with a network of renowned experts.

- March 2024: Merz Aesthetics, the one of the world’s largest dedicated medical aesthetics businesses, announced the latest extension of their first-of-its kind, multi-year campaign, ‘Beauty on Your Terms’ with the addition of award-winning actor and musician Demi Lovato as the newest XEOMIN (incobotulinumtoxinA) brand partner.

- October 2023: GC Aesthetics, a long-established brand in breast aesthetics, and Bimini Health Tech (“Bimini”), a pioneer in healthcare solutions, announced their groundbreaking Joint Venture partnership aimed at revolutionizing breast reconstruction worldwide. This strategic collaboration combines GC Aesthetics' 40 years’ experience in design, manufacturing, and distribution of Silicone Breast Implants with Bimini's expertise in Breast Reconstruction innovation.

- March 2023: Galderma unveiled "FACE by Galderma," an innovative augmented reality (AR) tool designed to revolutionize aesthetic consultations. The platform allows aesthetic professionals and patients to visualize potential outcomes of injectable treatments in real time, fostering informed decision-making. By enhancing treatment planning and increasing transparency, this technology aims to boost patient confidence and satisfaction. This launch underscores Galderma's commitment to integrating cutting-edge technology in the medical aesthetics field.

Medical Aesthetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Devices, Aesthetic Implants |

| Applications Covered | Surgical, Non-Surgical |

| End Users Covered | Hospitals and Clinics, Medical Spas and Beauty Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.R.C. Laser Gmbh, AbbVie Inc., Alma Lasers Ltd., Bausch Health Companies Inc., Cutera Inc., Cynosure, El.En. S.p.A., Fotona d.o.o., Johnson & Johnson, Lutronic, Merz Pharma GmbH & Co. KGaA, Venus Concept |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical aesthetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical aesthetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical aesthetics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical aesthetics refers to non-surgical procedures designed to enhance appearance, typically involving treatments like Botox, dermal fillers, laser therapies, and body contouring. These procedures are minimally invasive, offering benefits such as improved skin texture, wrinkle reduction, and body shaping, with minimal downtime and recovery, providing natural-looking results.

The medical aesthetics market was valued at USD 19.8 Billion in 2025.

IMARC estimates the global medical aesthetics market to exhibit a CAGR of 7.89% during 2026-2034.

Key factors driving the global medical aesthetics market include the increasing demand for non-invasive cosmetic methods, rapid advancements in technology, and rising awareness of aesthetic treatments.

In 2025, aesthetic implants represented the largest segment by product, driven by growing demand for cosmetic procedures like breast augmentation and dental implants.

Surgical leads the market by application owing to procedures like facelifts and rhinoplasty driving demand for permanent, high-impact cosmetic results.

The hospitals and clinics are the leading segment by end user, driven by a range of advanced cosmetic treatments with professional expertise and state-of-the-art equipment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global medical aesthetics market include A.R.C. Laser Gmbh, AbbVie Inc., Alma Lasers Ltd., Bausch Health Companies Inc., Cutera Inc., Cynosure, El.En. S.p.A., Fotona d.o.o., Johnson & Johnson, Lutronic, Merz Pharma GmbH & Co. KGaA, Venus Concept, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)