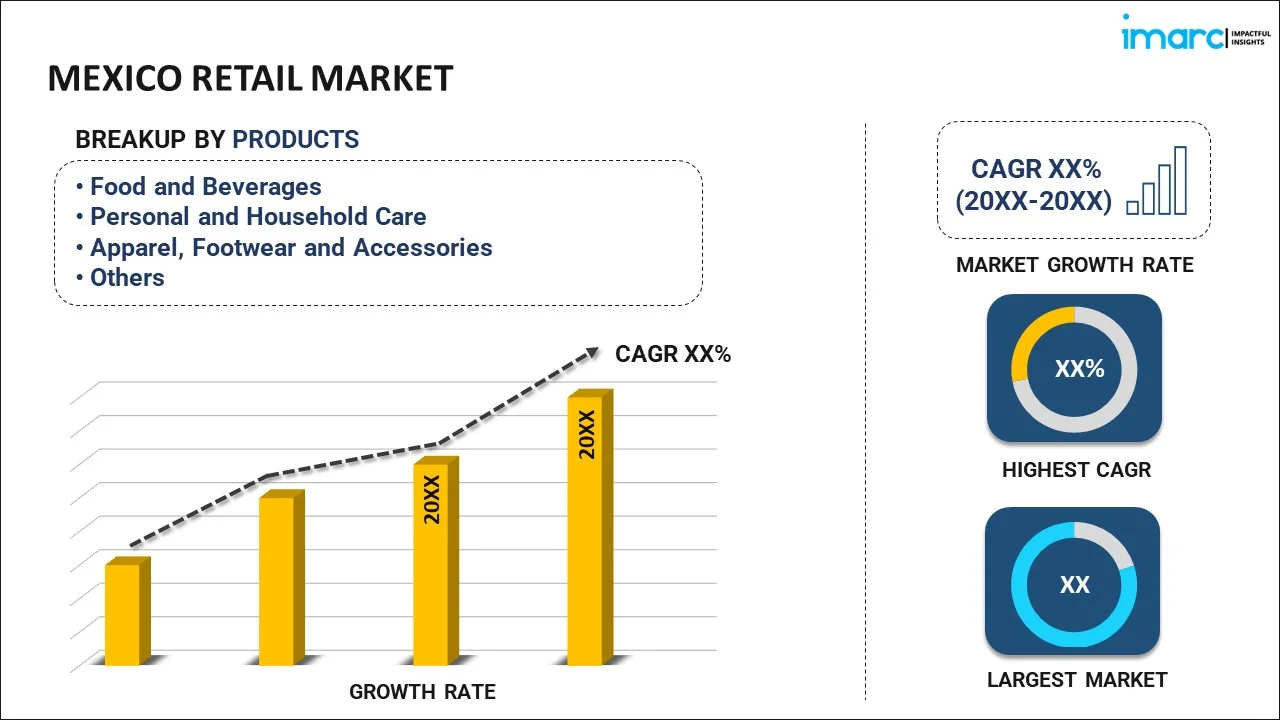

Mexico Retail Market Report by Product (Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2026-2034

Market Overview:

Mexico retail market size reached USD 475.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 698.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. The increasing advancements in technology, such as mobile shopping apps, augmented reality, and virtual reality experiences, which enhance the overall retail experience, are primarily driving the market growth across the country.

Mexico Retail Market Analysis:

- Omnichannel retailing enriches the consumer experience through frictionless digital-physical convergence.

- Discount stores expand by providing value-priced, localized basics to neighborhoods.

- Convenience formats win from urbanization and need for speedy buys.

- Retailers embrace artificial intelligence (AI) and data tools for customized shopping and productivity.

- Digital payment methods extend, simplifying checkouts and improving customer satisfaction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 475.2 Billion |

|

Market Forecast in 2034

|

USD 698.8 Billion |

| Market Growth Rate 2026-2034 | 4.38% |

Access the full market insights report Request Sample

Retail refers to the sale of goods and services directly to consumers through various channels such as physical stores, online platforms, or a combination of both. It is a crucial sector in the economy, encompassing a diverse range of products, from daily essentials to luxury items. Retailers play a pivotal role in connecting manufacturers and producers with end-users, facilitating the distribution and availability of goods in the marketplace. The retail industry is dynamic, influenced by consumer preferences, technological advancements, and economic trends. Successful retailers focus on creating positive customer experiences, optimizing supply chains, and adapting to changing market dynamics. Mexico retail market size with the rise of e-commerce, omnichannel strategies, and personalized shopping experiences, continues to evolve, shaping the way businesses interact with and meet the needs of consumers.

Mexico Retail Market Trends:

Emergence of Omnichannel Retailing

Mexican retailers are increasingly going omnichannel to serve a connected consumer base better. As consumers look for frictionless experiences between online and offline spaces, retail companies are converging operations to enable flexibility across browsing, buying, and returns. This is particularly evident among larger players who have ramped up mobile apps, real-time stock systems, and home delivery capabilities. As per the sources, in April 2024, Coppel and Home Depot announced Mexico expansion plans, including 112 new retail locations and sustainability improvements, signaling an investment drive in the changing Mexico retail sector. Moreover, shoppers want to look up products on the web and be able to purchase in a store or have it delivered to their home. Brick-and-mortar stores are being transformed into social spaces that enable online purchases through functions such as pickup stations or electronic kiosks, propelling Mexico retail market share. By enabling more immersive and seamless experiences, stores are building stronger customer relationships and increasing loyalty. Along with enhancing customer satisfaction, omnichannel models are also facilitating better data capture and operational effectiveness. This retail shift is redefining Mexican consumers' interactions with brands, making omnichannel experiences the hallmark of the Mexico retail market.

Discount and Convenience Retail Format Expansion

In the Mexico retail market growth, convenience and discount formats are increasingly prominent because of their capacity to deliver daily needs through affordability and accessibility. These retailers speak volumes to consumers who desire convenient shopping occasions that do not involve long distances or big expenses. Whether situated in urban concentrations or outlying towns, such formats address the need for necessities, small pack sizes, and speedy purchases. Store layouts, product assortments, and prices are constantly being optimized by retailers to be competitive and timely. Easy purchasing of ready-to-eat (RTE) food, drinks, and home goods is attractive to busy consumers. Also, convenience and discount stores are looking at collaboration with neighborhood suppliers to enhance regional tastes and drive loyalty. According to the reports, in May 2025, Mexico initiated a national retail campaign to support locally produced products with the goal of increasing shelf share for domestic goods and strengthening "Made in Mexico" labeling across retail channels. Furthermore, pursuing affordability, proximity, and speed, this trend is remaking shopper behavior and expectations. It also generates new market dynamics in retail, where formats need to evolve or face obsolescence in the emerging Mexico retail market.

Integration of Technology and Adoption of Digital Payments

In Mexico retail market analysis, technology is revolutionizing the modernization of retail operations. Starting with supply chain management to targeted promotions, digital platforms are aiding companies in becoming more efficient and engaging with customers. Retailers are using artificial intelligence and data analytics to maximize inventories, personalize offers, and gain insights into shopper behavior. Retail store technology such as self-checkout lanes, intelligent shelving, and mobile points of sale is enhancing convenience for employees and consumers alike. Concurrently, increasing use of digital payment solutions, such as mobile wallets and QR-based offerings, is making the checkout process more streamlined. This digital movement appeals to changing consumer expectations of quick, seamless transactions. Every retailer size is looking into these innovations in order to develop customer loyalty and maintain operational scalability. Digital solutions are also employed for developing targeted marketing campaigns that directly address consumer lifestyle and preferences. With growing accessibility of these technologies, their penetration in the Mexico retail market trends will intensify, fueling innovation and long-term retail transformation.

Mexico Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages, personal and household care, apparel, footwear and accessories, furniture, toys and hobby, electronic and household appliances, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

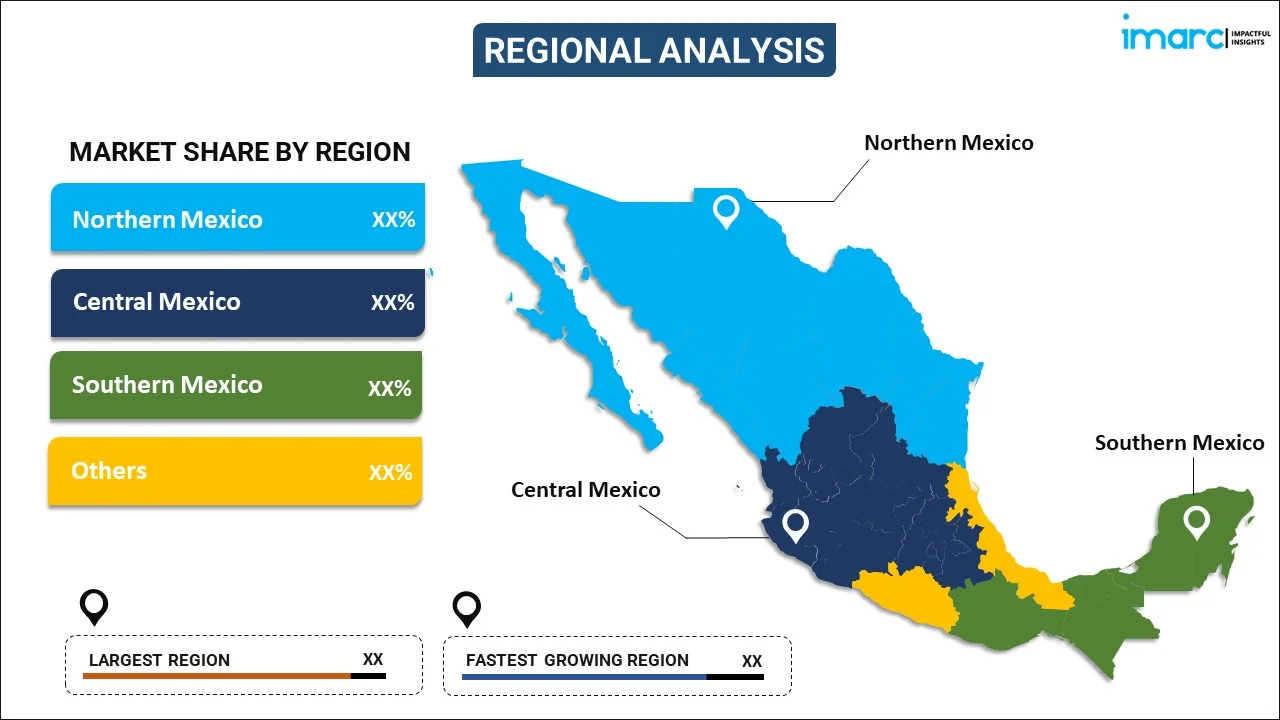

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In January 2025, Inditex debuted its first for&from store in Mexico City's Samara Shops. Operated by nonprofit group CONFE, the store facilitates inclusion for individuals with disabilities. This is the format's introduction outside of Europe, selling discounted previous-season merchandise and reinvesting profits in charitable initiatives supporting accessibility and social integration.

- In April 2025, Farm Rio, a Brazilian fashion brand, debuted in Mexico with its first store at Shopping Artz Pedregal, Mexico City. The boutique features more than 180 summer items and colorful design inspired by Brazilian art, which is the expansion of the brand in Latin America accompanied by a new e-commerce platform and upcoming retail spaces.

Mexico Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The retail market trend in Mexico emphasizes omnichannel experiences, rising demand for convenience formats, and digital transformation. Retailers are integrating physical and online channels, expanding small-format stores, and adopting technologies like digital payments and AI. These shifts reflect changing consumer preferences for speed, affordability, and seamless shopping, driving modernization across the Mexico retail sector.

The Mexico retail market was valued at USD 475.2 Billion in 2025.

The Mexico Retail market is projected to exhibit a (CAGR) of 4.38% during 2026-2034, reaching a value of USD 698.8 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)