Polyisobutylene Prices in the USA Stand at USD 1,820/MT Amid Stable Market Conditions

18-Dec-2025

Polyisobutylene (PIB) is a synthetic elastomer produced through the polymerization of isobutylene, often incorporating trace amounts of isoprene, resulting in a flexible polymer exhibiting exceptional resistance to moisture, gases, acids, bases, and environmental weathering. Its unique properties including elasticity, adhesiveness, and impermeability make it indispensable across diverse sectors such as automotive tire manufacturing for inner liners that retain air pressure, sealant and adhesive production, pharmaceutical formulations, lubricant additives that enhance viscosity and oxidation stability, and chewing gum where it provides texture and flexibility. Market valuations remain closely tied to feedstock isobutylene costs, downstream demand intensity from key consuming industries, and shifts in production economics across major manufacturing regions.

Global Market Overview:

Globally, the polyisobutylene industry reached USD 2.58 Billion in 2025. Projections suggest the market could grow to USD 3.51 Billion by 2034, with a compound annual growth rate (CAGR) of 3.48% during 2026-2034. Expansion is underpinned by escalating utilization in high-performance lubricant formulations, broadening adoption within adhesives and sealants manufacturing, and consistent incorporation into fuel additive and polymer modification applications, demonstrating robust technological progress and material innovation across core end-use sectors worldwide.

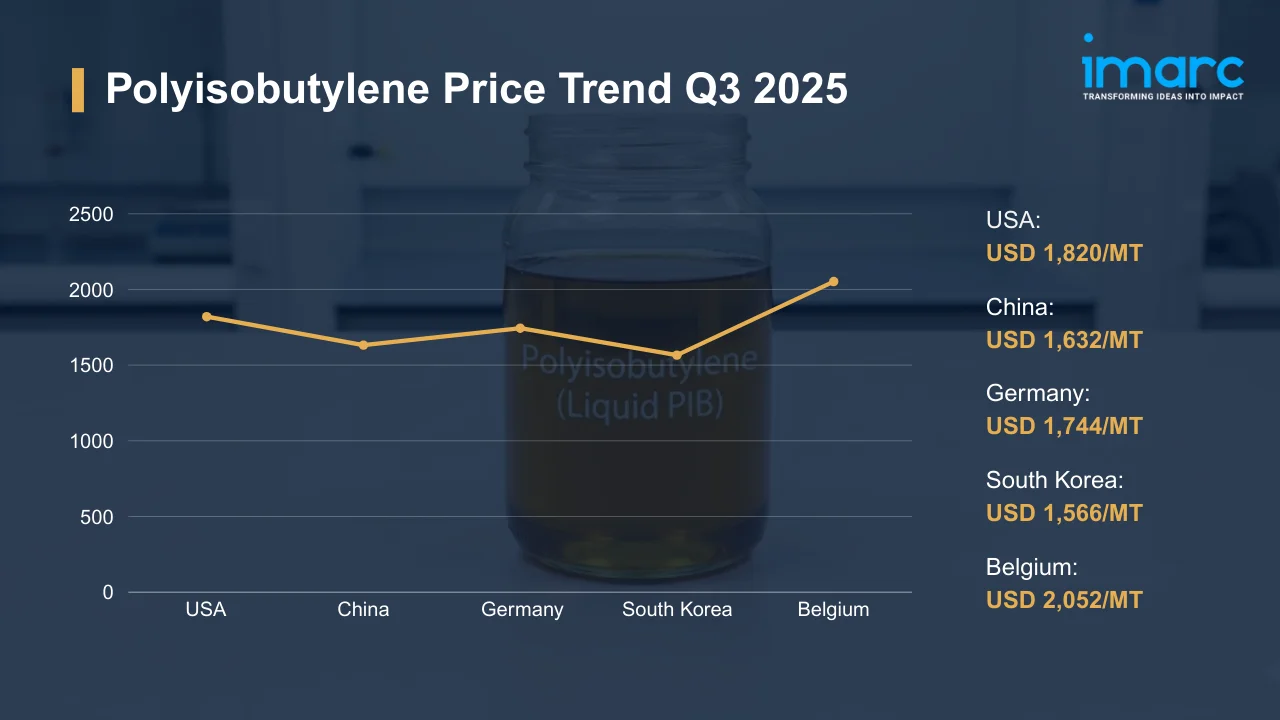

Polyisobutylene Price Trend Q3 2025:

Regional prices (USD per MT) and QoQ change vs Q2 2025:

| Region | Price (USD/MT) | QoQ Change | Direction |

|---|---|---|---|

| USA | 1,820 | -1.5% | ↓ |

| China | 1,632 | -3.1% | ↓ |

| Germany | 1,744 | -1.6% | ↓ |

| South Korea | 1,566 | +1.7% | ↑ |

| Belgium | 2,052 | +1.3% | ↑ |

To access real-time prices Request Sample

What Moved Prices:

- USA: Polyisobutylene prices declined to USD 1,820/MT as demand from lubricant additive and automotive sectors weakened across key consuming regions. Domestic manufacturing units operated at consistent throughput levels while heightened material availability and competitive import quotations introduced downward pressure on negotiated prices. Logistics improvements reduced freight-related bottlenecks at distribution terminals, enabling wholesalers to adopt more flexible pricing strategies. Contract allocations prioritized long-standing customers while spot market transactions became increasingly subject to competitive bidding conditions.

- China: Valuations fell to USD 1,632/MT amid softer consumption from adhesives and industrial rubber manufacturing segments. Inventory accumulation occurred despite steady production schedules at prominent facilities, reflecting subdued downstream urgency. Limited export traction redirected producer attention toward domestic offtake, fostering cautious market sentiment. Periodic price concessions emerged as suppliers sought to maintain order flows and clear excess stocks accumulated during periods of tempered demand.

- Germany: Prices retreated to USD 1,744/MT following moderated procurement activity from sealants, tire production, and engineered rubber compound manufacturers. Enhanced supply availability from European production sites maintained steady material flow while marginal easing in energy-linked expenses enabled producers to present more competitive commercial terms. Delays in industrial demand recovery influenced purchasing behavior across multiple German manufacturing hubs, prompting distributors to recalibrate pricing expectations.

- South Korea: Prices advanced to USD 1,566/MT supported by intensified demand from lubricant additives and polymer modification applications. Scheduled maintenance activities at select domestic production units constrained near-term material availability for prompt delivery requirements. Export commitments to specialized Asian markets absorbed surplus volumes, reinforcing upward adjustments in producer pricing strategies. Steady feedstock conditions and consistent operational performance provided foundational support for the firmer market environment.

- Belgium: Valuations climbed to USD 2,052/MT as downstream industrial consumption remained resilient, particularly within adhesives and specialty materials sectors. Inventory positions at key distribution points faced constraints stemming from earlier supply chain disruptions while inland transportation networks encountered episodic congestion. These conditions created a tighter market structure favoring sellers, especially for premium higher-viscosity grade specifications where availability became increasingly limited during peak demand periods.

Drivers Influencing the Market:

Several factors continue to shape polyisobutylene pricing and market behavior:

- Lubricant Additive Demand Variations: Fluctuations in automotive and industrial lubricant production directly impact polyisobutylene consumption as it serves as a critical viscosity modifier and dispersant additive. Regional automotive sector performance, seasonal maintenance cycles, and shifts toward synthetic lubricant formulations all influence demand intensity, creating cyclical pressure on pricing dynamics across major consuming markets.

- Feedstock Isobutylene Availability and Cost: Production economics remain tightly linked to isobutylene feedstock costs, which fluctuate based on crude oil derivatives pricing, refinery operating rates, and C4 stream processing economics. Feedstock availability constraints during refinery turnarounds or shifts in refinery product slates can squeeze raw material supply, elevating production costs and influencing final polyisobutylene pricing structures globally.

- Adhesives and Sealants Sector Activity: Construction activity levels, automotive assembly rates, and packaging industry growth significantly affect polyisobutylene consumption as it functions as a key component in pressure-sensitive adhesives, hot-melt formulations, and sealing compounds. Economic conditions influencing construction starts, durable goods manufacturing, and consumer packaging demand create corresponding shifts in polyisobutylene order flows and pricing momentum.

- Tire Manufacturing Trends: Polyisobutylene serves as an essential material for tire inner liners due to its superior impermeability, making automotive tire production volumes a key demand driver. Shifts in passenger vehicle sales, commercial vehicle fleets expansion, and replacement tire market dynamics influence consumption patterns, while technological advances in tire design and competing material adoption affect long-term demand trajectories.

- Regional Production Capacity Utilization: Operating rates at polyisobutylene production facilities across North America, Europe, and Asia-Pacific directly impact regional supply availability. Planned maintenance turnarounds, unplanned outages, capacity expansion projects, and production optimization initiatives create short-term supply tightness or surplus conditions, influencing pricing negotiations and contract terms between producers and downstream consumers.

- Logistics and Transportation Efficiency: Freight costs, port congestion, inland transportation bottlenecks, and shipping route disruptions affect landed costs and delivery timelines for polyisobutylene, particularly for import-reliant markets. Rail network performance, trucking capacity constraints, and container availability influence regional pricing differentials as logistical inefficiencies translate into elevated landed costs and reduced supply chain flexibility.

- Energy Cost Movements: Polyisobutylene production is energy-intensive, making natural gas prices, electricity costs, and steam generation expenses critical cost components. Regional energy market volatility, particularly in Europe where energy costs remain elevated, influences production economics and compels producers to adjust pricing strategies. Energy cost differentials between regions create competitive advantages or disadvantages affecting interregional trade flows and pricing competitiveness.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In September 2025, researchers based in Iran have developed an advanced, high-reactivity polyisobutylene by applying cationic polymerization to a blended C4 feedstock. Their work highlights improved performance characteristics that make the material particularly suitable for use in lubricant and adhesive additive production. In addition, the study showcases notable advances in catalyst regulation strategies, resulting in superior polymer properties and expanding the scope of possible industrial applications across a wide range of end-use markets.

- In August 2025, the A. V. Topchiev Institute of Petrochemical Synthesis at the Russian Academy of Sciences published a study examining the influence of molecular weight distribution on the adhesion strength of pressure-sensitive adhesives based on non-crosslinked polyisobutylene. The results offer valuable insights for designing high-performance, solvent-free adhesive formulations that comply with environmental standards and promote more sustainable production methods within the adhesives sector.

Outlook & Strategic Takeaways:

Looking ahead, the polyisobutylene market is expected to maintain moderate growth momentum driven by expanding lubricant additive applications, steady adhesives and sealants consumption, and ongoing polymer modification demand. Regional pricing dynamics will continue reflecting supply chain efficiency variations, feedstock cost movements, and downstream sector performance, requiring adaptive procurement strategies.

To navigate this complex landscape, stakeholders should:

- Monitor Regional Price Differentials Continuously to identify arbitrage opportunities and optimize procurement decisions. Significant pricing gaps between North American, European, and Asian markets create opportunities for strategic sourcing adjustments. Tracking monthly price movements across key regional hubs enables procurement teams to time purchases during favorable pricing windows and negotiate contracts with greater leverage based on prevailing market conditions and competitive benchmarking.

- Assess Feedstock Market Dynamics Regularly as isobutylene cost movements directly impact polyisobutylene production economics and pricing structures. Understanding refinery operating rates, C4 stream availability, and crude oil price trends provides early visibility into potential supply constraints or cost pressures. Establishing relationships with multiple feedstock suppliers and monitoring refinery maintenance schedules can help anticipate feedstock availability disruptions that may affect polyisobutylene supply chains.

- Track End-Use Sector Performance Indicators including automotive production volumes, construction activity metrics, and packaging industry trends. These sectors drive polyisobutylene demand through lubricant additives, adhesives, and tire manufacturing applications. Leading indicators such as automotive sales forecasts, construction starts data, and packaging material consumption trends enable demand forecasting and inventory planning, allowing buyers to adjust procurement strategies proactively rather than reactively.

- Evaluate Logistics Cost Components Systematically as transportation expenses and supply chain efficiency significantly influence landed costs, particularly for import-dependent markets. Freight rate volatility, port congestion, and inland transportation constraints can substantially affect total acquisition costs. Assessing alternative shipping routes, consolidating shipments, and negotiating favorable logistics terms with carriers can mitigate cost pressures and improve supply chain reliability during periods of transportation network strain.

- Diversify Supply Sources Strategically to reduce dependency on single suppliers or geographic regions and enhance supply chain resilience. Establishing relationships with producers across North America, Europe, and Asia-Pacific provides flexibility during regional supply disruptions caused by maintenance outages, logistics bottlenecks, or geopolitical developments. Multi-sourcing strategies also strengthen negotiating positions and provide access to grade-specific products that may not be available from all producers.

- Monitor Energy Market Developments particularly in energy-intensive production regions where natural gas and electricity costs significantly impact production economics. European energy market volatility, North American natural gas price movements, and Asian energy policy changes all influence regional competitiveness and pricing structures. Understanding energy cost trends enables better prediction of producer pricing strategies and helps identify regions with favorable production economics.

- Stay Informed on Production Capacity Changes including planned expansions, maintenance schedules, and facility closures that affect regional supply availability. Scheduled turnarounds at major production sites create temporary supply tightness that may elevate prices, while new capacity additions can introduce surplus conditions. Tracking announcements from major producers regarding capacity expansions, debottlenecking projects, and operational changes provides advance notice of potential supply shifts affecting market balances.

- Explore Alternative Grade Specifications where technically feasible to access broader supplier options and improve procurement flexibility. Different polyisobutylene molecular weight ranges and viscosity grades may offer similar performance characteristics in certain applications while providing access to alternative supply sources or more favorable pricing. Technical evaluations of grade equivalency can unlock procurement options during periods of supply constraints or elevated prices for preferred specifications.

- Assess Currency Exposure Implications for cross-border polyisobutylene transactions as exchange rate movements affect landed costs and relative pricing competitiveness between regions. Dollar strength or weakness influences the attractiveness of imports versus domestic supply, while euro-dollar and yuan-dollar exchange rates impact European and Chinese sourcing decisions. Implementing currency hedging strategies or adjusting sourcing patterns based on exchange rate trends can optimize total acquisition costs.

- Maintain Flexible Inventory Strategies that balance carrying costs against price volatility and supply chain reliability considerations. Strategic inventory building during favorable pricing periods or ahead of anticipated supply disruptions can mitigate procurement costs, while just-in-time approaches reduce carrying expenses during stable market conditions. Regularly reassessing optimal inventory levels based on price trends, lead times, and demand forecasts ensures alignment between working capital efficiency and supply security objectives.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates — 12 deliverables/year

- Quarterly Updates — 4 deliverables/year

- Biannual Updates — 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)