IMARC Report Highlights RBD Palm Oil Price Fluctuations Across Key Markets in Q2 Update

04-Sep-2025

Amid shifting supply conditions and evolving trade regulations, the global RBD palm oil industry is witnessing notable pricing fluctuations, according to IMARC Group’s latest publication, RBD Palm Oil Price Trend, Index and Forecast Data Report 2025 Edition, which provides updated insights for Q2 2025. The report highlights the way the industry is adjusting to production recoveries in Southeast Asia, shifting government policies, and global demand pressures. Key markets shaping this trend include North America, Asia Pacific, and Europe, where supply, regulatory, and logistical factors continue to influence pricing momentum.

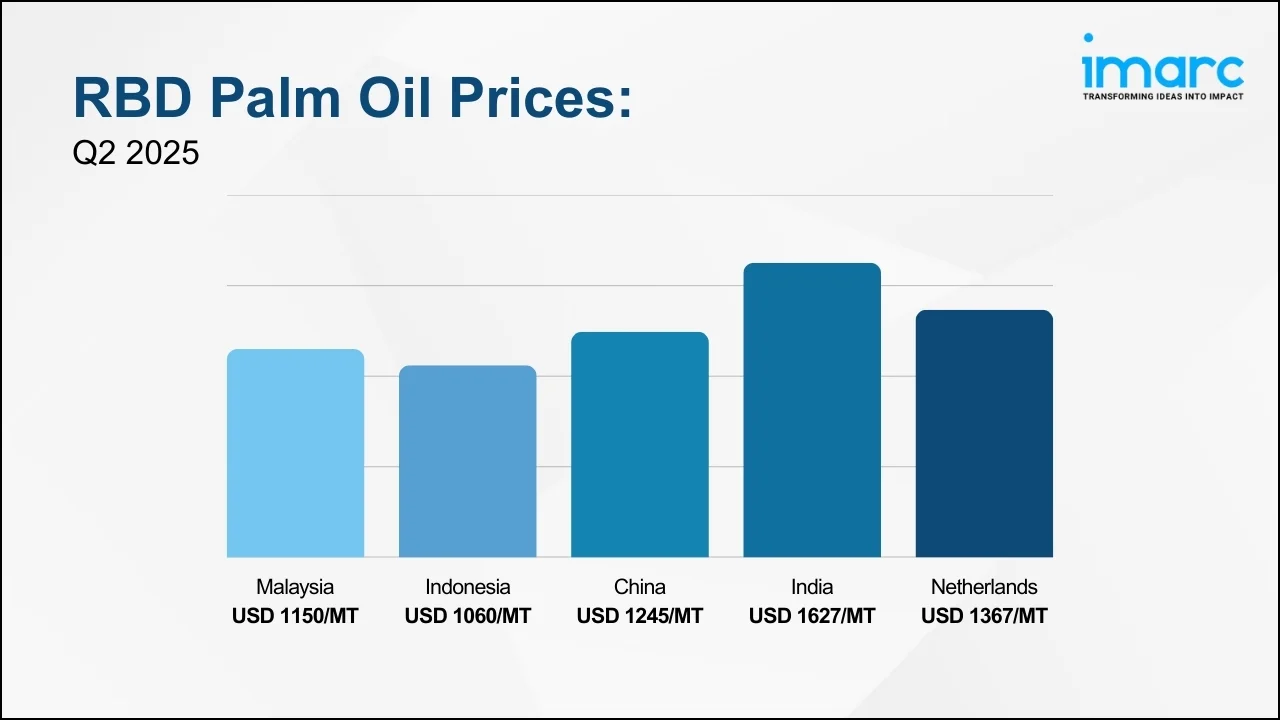

Q2 2025 RBD Palm Oil Prices:

- Malaysia: USD 1150/MT

- Indonesia: USD 1060/MT

- China: USD 1245/MT

- India: USD 1627/MT

- Netherlands: USD 1367/MT

To access real-time prices Request Sample

The current RBD palm oil prices highlight the material’s essential role in food, energy, and industrial applications, with sustained demand and supply constraints contributing to a stable to upward global price trajectory.

Key Regional Price Trends and Market Drivers:

Malaysia

In Q2 2025, Malaysia RBD palm oil prices reached USD 1150/MT in June 2025. Palm oil production in Malaysia experienced slight improvements following earlier periods of labor shortages and adverse weather conditions. This stabilization and modest recovery in output helped balance supply and demand, supporting price stability after volatility earlier in the quarter.

Indonesia

In Indonesia, RBD palm oil prices settled at USD 1060/MT in June 2025. The Indonesian government’s periodic adjustments in palm oil export policies, including levies, quotas, and restrictions, directly influenced price trends. Exchange rate fluctuations also played a major role in shaping the competitiveness of Indonesian palm oil in global markets.

China

China’s RBD palm oil prices reached USD 1245/MT in Q2 2025. Tight global inventories and logistical challenges limited stock levels, creating upward pressure on prices. Speculative buying by traders, anticipating further increases due to global supply constraints, added additional volatility.

India

RBD palm oil prices stood at USD 1627/MT in June 2025. Import duties and regulatory adjustments in Q2 2025 directly influenced the landed cost of palm oil in India. Rising energy costs, particularly for fuel, further increased shipping and transportation expenses, contributing to higher overall prices.

Netherlands

Priced at USD 1367/MT, the Netherlands market reflected strong demand for certified sustainable palm oil, influenced by European consumer preferences and regulatory frameworks. Premiums for certified products elevated prices, while competition from other vegetable oils also shaped market dynamics.

Q2 vs. Q1:

| Country | Q2 2025 | Q1 2025 | Q2 vs. Q1 Trends |

|---|---|---|---|

| Malaysia | USD 1150/MT | USD 1130/MT | Prices rose in Q2 slightly as production recovered from weather-related disruptions in Q1, stabilizing supply |

| China | USD 1245/MT | USD 1293/MT | Prices declined in Q2 as improved availability from key producing regions eased tightness, despite continued exchange rate and logistics pressures |

RBD Palm Oil Industry Overview:

The global RBD palm oil market size reached USD 43.32 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 58.03 Billion, growing at a CAGR of 3.14% during 2025–2033. This steady growth is due to advances in agricultural methods such as precision farming, sustainable plantation management, and modern refining technologies which improve yields, efficiency, and product quality.

The market is driven by rising population growth, higher per capita edible oil consumption, and the material’s affordability compared to alternative vegetable oils. Its versatility in cooking, baking, and food processing has cemented its role in household and industrial applications. In developing economies, the expansion of the middle class and increasing preference for oil-intensive diets further amplify demand.

Recent Market Trends and Industry Analysis:

RBD palm oil demand is also expanding across non-food sectors. Its derivatives are widely used in the cosmetics and personal care industries for soaps, shampoos, and lotions due to their natural and moisturizing qualities. According to the RSPO, at least 70% of cosmetics globally contain palm oil or palm kernel oil derivatives. Additionally, about 2% of global palm oil and palm kernel oil is used in cosmetics, while 3% is consumed in home care products.

The biodiesel industry represents another significant growth driver, with palm oil serving as a critical feedstock for biofuel production. The shift toward renewable energy, encouraged by environmental policies and government mandates, has strengthened this demand. Advances in agricultural and processing technologies, such as precision farming, sustainable plantation management, and modern refining methods, have further enhanced productivity and product quality, ensuring consistent market growth.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)