Personal Hygiene Market Size, Share, Trends and Forecast by Product Type, Pricing, Usability, Distribution Channel, and Region, 2025-2033

Personal Hygiene Market Size and Share:

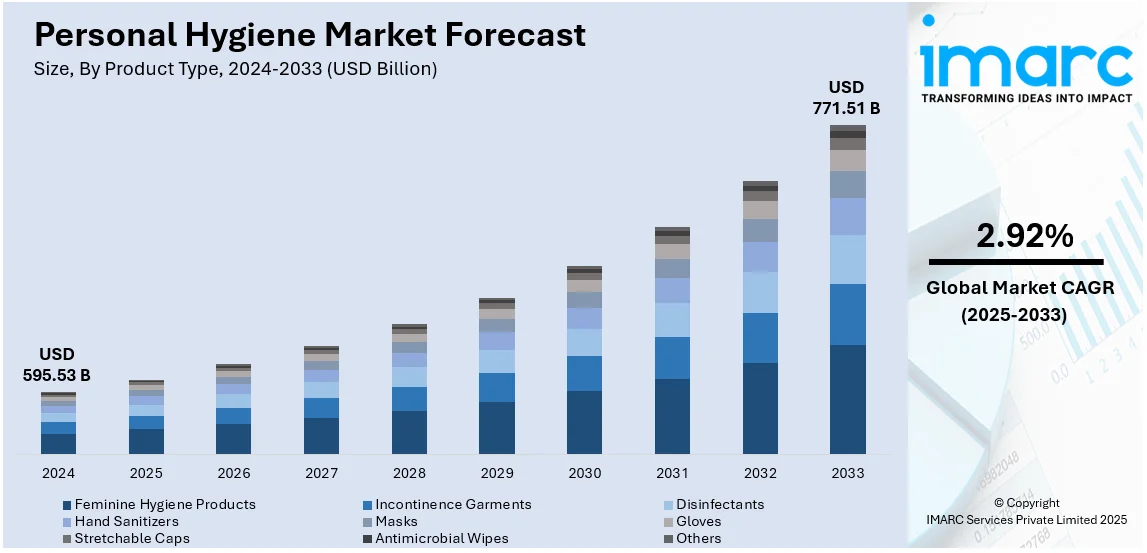

The global personal hygiene market size was valued at USD 595.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 771.51 Billion by 2033, exhibiting a CAGR of 2.92% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.8% in 2024. The market is propelled by the increasing awareness about health and hygiene, growing disposable income, rapid urbanization, rising demand for premium and organic products, expansion of e-commerce and digital marketing, and significant innovation in product formulations and packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 595.53 Billion |

|

Market Forecast in 2033

|

USD 771.51 Billion |

|

Market Growth Rate (2025-2033)

|

2.92% |

A key trend in the personal hygiene industry is growing consumer concern for health and hygiene. Growing fears about the transmission of infectious diseases and increased focus on cleanliness have increased usage of personal care items like soaps, hand sanitizers, and disinfectants. Government campaigns and public health programs for promoting hygiene habits also fuel market growth. Furthermore, consumers are focusing on antibacterial and natural ingredients in products, leading to increased demand for organic and green products. The growth of e-commerce has also brought hygiene products closer to consumers, making them more widely consumed worldwide. This trend is especially robust in urban cities, where rising disposable incomes and lifestyle shifts drive the increasing demand for premium and specialty hygiene products.

The U.S. personal care hygiene market is fueled by increased consumer consciousness, robust purchasing power, and an increasing desire for premium and eco-friendly products. The market currently holds a total share of 87.50% owing to the greater emphasis on hygiene, particularly in the post-pandemic era, has resulted in continued demand for hand sanitizers, antibacterial soaps, and personal care wipes. The growth of organic and green hygiene products is also driving purchases, with consumers looking for chemical-free and biodegradable options. Subscription models and e-commerce have extended product availability even more, stimulating sales among demographics. Market growth is also caused by innovations in skincare, oral care, and deodorants, as well as celebrity and influencer endorsement. Private-label competition from retailers growing stronger by the day due to stricter hygiene regulations on standards further influences competition.

Personal Hygiene Market Trends:

Increasing Awareness about Health and Hygiene

One of the main drivers for the global personal hygiene market is rising health and hygiene awareness. Consumers have prioritized cleanliness and personal care as fundamental parts of their everyday routine as a result of this increasing awareness. Differing health campaigns and education drives by governments, non-governmental organizations (NGOs), and businesses have gone a long way in disseminating information on the significance of maintaining hygiene to stay away from disease and ensure good health, and thus shaping the positive personal hygiene market sentiment. The COVID-19 pandemic drastically boosted this, as people were more aware than ever before that they needed to practice personal hygiene to avoid virus transmission. The need for hygienic products like hand sanitizers, soaps, and disinfectants experienced unprecedented growth during the pandemic. To give an example, according to the IMARC GROUP, the market for global hand sanitizers has grown up to USD 4.9 Billion in 2023 and is anticipated to reach USD 3.4 Billion by the year 2032. Furthermore, greater exposure in the media and access to information through the internet and social media have raised public awareness further.

Growing Disposable Income Levels and Urbanization

The increase in disposable income, especially across emerging economies, is yet another crucial factor behind the growth of the global personal hygiene market. With rising income levels for individuals, they are in a better position to spend on discretionary items, including personal hygiene products. This is especially evident in urban regions, where the living standard and lifestyle are inclined towards convenience and quality, thereby driving a rising personal hygiene market growth. Urbanization is a vital factor in this process. As more people shift to the urban areas, there is increased exposure to new lifestyles and better living standards. This migration to the urban areas accounts for more demand for several types of personal cleansing products, ranging from low-end items like soap and toothpaste to more sophisticated ones like skincare products and grooming products. As per UNITED NATIONS, over half of the world's population is living in urban parts of the nation and are projected to grow approximately two thirds in 2050, which shows there is a large market for personal care products in urban regions. High disposable income also goes hand in hand with a greater willingness to spend on premium and branded items. They are not merely searching for plain hygiene items but also for ones that provide added benefits like anti-bacterial activity, good fragrance, or natural ingredients.

Expansion of E-Commerce and Digital Marketing

The growth of e-commerce and online marketing is a major force behind the global personal hygiene market. The ease of shopping online, coupled with the ease of comparing products and prices, has transformed the manner in which consumers buy hygiene products. E-commerce websites offer varied alternatives, be it local or international brands, and at very competitive prices at that, along with the benefit of home delivery, this element is contributing in the revenue in the personal hygiene market. The COVID-19 pandemic also acted as a stimulus for online purchasing. During the time of lockdowns and social distancing, buyers used e-commerce to fulfill their personal hygiene requirements. This transition is not only a short-term phenomenon but a long-term movement as more people enjoy the convenience and security of shopping online. GITNUX reports that the worldwide e-commerce sales across the globe in the year 2020, totaled USD 4.28 Trillion. Digital marketing is also an important contributor to this growth. Businesses are using social media, search engine optimization, influencer collaborations, and targeted advertising to connect with more people. These online tactics enable brands to connect with customers, offer individualized suggestions, and foster brand allegiance.

Personal Hygiene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global personal hygiene market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, pricing, usability, and distribution channel.

Analysis by Product Type:

- Feminine Hygiene Products

- Sanitary Napkins

- Tampons

- Others

- Incontinence Garments

- Adult Diaper

- Protective Underwear

- Cloth Adult Diaper

- Others

- Disinfectants

- Hand Sanitizers

- Masks

- Gloves

- Stretchable Caps

- Antimicrobial Wipes

- Others

Women hygiene products represent the largest market share 34.7% of the personal hygiene industry, fueled by growing awareness, growing incomes, and increased availability of products. Increased education about menstrual health, aided by NGOs and government efforts, has raised the usage of sanitary napkins, tampons, and menstrual cups. Demand for eco-friendly and biodegradable products is also on the increase because of environmental factors. E-commerce and subscription models have also enhanced accessibility, especially in emerging markets. Urbanization and shifting lifestyles also fuel the demand for premium and innovative products, like fragrance-free and ultra-thin pads. Brand marketing campaigns and celebrity endorsements also influence purchasing behavior, contributing to the further expansion of feminine hygiene products worldwide.

Analysis by Pricing:

- Mass Products

- Premium Products

Mass products maintain a 70.0% market share within the personal hygiene segment, based on affordability, extensive availability, and robust demand by consumers. They are affordable to a large group of people, including price-conscious consumers, which translates into constant sales both in urban and rural settings. Their extensive distribution comes courtesy of supermarkets, hypermarkets, and online shopping. Also, private-label products by prominent retailers are an affordable alternative, fueling market competition. Government campaigns encouraging basic hygiene also contribute to mass product adoption, especially in emerging economies. The demand for basic personal care products such as soaps, shampoos, and oral care products continues to drive growth, while mass production and economies of scale facilitate competitive prices, contributing to mass products' leadership of the global market for personal hygiene.

Analysis by Usability:

- Disposable

- Reusable

Disposable personal care products have a 65.8% market share due to their convenience, affordability, and easy availability. Disposable products like sanitary napkins, diapers, wipes, and razors are preferred by consumers for their convenience and hygiene advantages. Growing health consciousness, urbanization, and hectic lifestyles further fuel demand for these products. The increasing number of elderly and higher birth rates in emerging economies also drive steady sales of baby and adult diapers. Moreover, the development of absorbent technology and skin-friendly materials improves product performance, increasing consumer preference. Although sustainability issues are on the rise, producers are countering with biodegradable and eco-friendly products, striking a balance between convenience and environmental stewardship and solidifying the supremacy of disposable hygiene products in the international market.

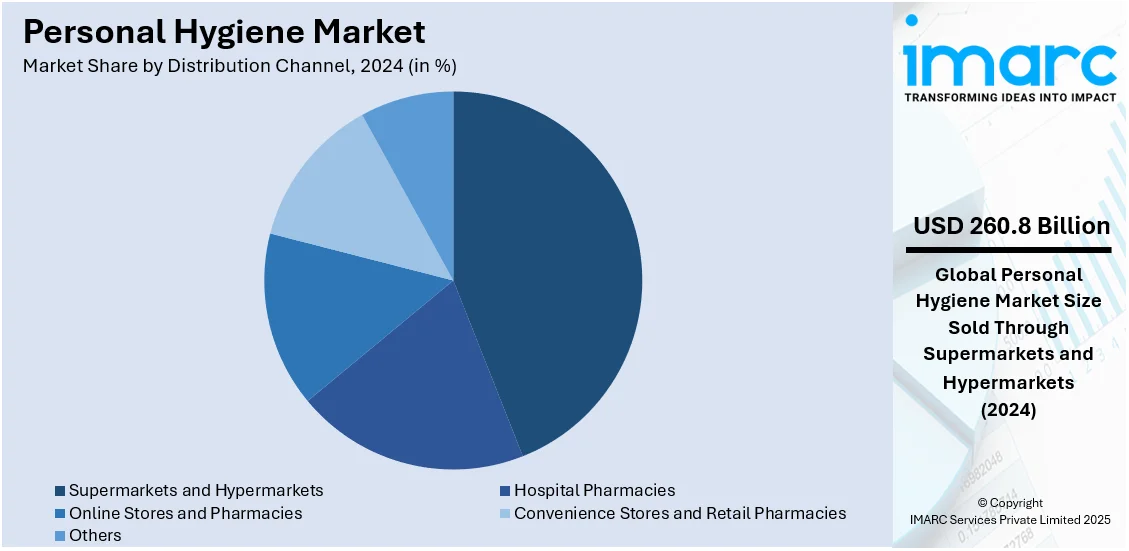

Analysis by Distribution Channel:

- Hospital Pharmacies

- Supermarkets and Hypermarkets

- Online Stores and Pharmacies

- Convenience Stores and Retail Pharmacies

- Others

Supermarkets and hypermarkets account for a 43.8% share in the market for personal hygiene because of the wide range of products, prices, and ease of access to them. A one-stop-shop experience is available at these supermarket chains, providing consumers with easy access to buying a variety of hygiene products, ranging from soap and shampoo to oral care. The availability of bulk purchases and special discounts induces consumer preference to shop at such outlets. Furthermore, urban and suburban strategic store locations increase convenience. Major retailers' private-label hygiene brands also drive market leadership by providing low-cost substitutes. Although e-commerce is increasing, physical stores continue to be the main sales channel because consumers would rather evaluate product quality and packaging upfront, supporting supermarket and hypermarket dominance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific enjoys 45.8% personal hygiene market share, led by a huge and expanding population base, rising awareness of health and wellness, and growing disposable income. Urbanization and enhanced lifestyle have spurred growth in demand for basic hygiene essentials like soaps, shampoos, and oral care. Sanitation and hygiene drives courtesy of government promotion also drive growth, especially for India and China. The rise of supermarkets, hypermarkets, and online portals has increased the availability of products, pushing sales higher. Additionally, the production base of the region facilitates low-cost production, and as such, the price of hygiene products remains less. The growth in the demand for organic and green hygiene products and widespread promotion by domestic and international brands also further strengthen the supremacy of the Asia Pacific market.

Key Regional Takeaways:

North America Personal Hygiene Market Analysis

The North American personal care market is transforming with rising consumer interest in natural, sustainable, and multi-purpose products. Increased health and wellness awareness has triggered innovations such as biodegradable packagings, plant-based recipes, and antibacterial products. Online shopping is a driving force for market growth with convenience and customized product offerings. Premium and dermatologically tested products are emphasized by leading brands with sensitive skin and environmentally friendly consumers in mind. The growth of wellness-focused lifestyles and increased hygiene concerns in the post-pandemic era continue to influence product innovation. Brands are using technology, including AI-powered recommendations and intelligent hygiene solutions, to drive consumer interaction and satisfaction.

United States Personal Hygiene Market Analysis

According to the World Economic Forum, American spending on menstrual items in 2020 was worth USD 2 billion, citing growing consumer interest in hygiene. The trend among the market signals a broader pattern of rising awareness of hygiene and health among consumers, namely among women. The demand for menstrual products, alongside demand for organic and natural ingredients, is driving expansion within the personal hygiene space. In addition, eco-friendly and sustainable products enjoy tremendous preference, where consumers tend towards biodegradable and clean-label products. Growth in online spaces and subscription products also facilitates expanded markets, which provide consumers easier access to body care products. Brands are innovating through new product offerings, like mushroom-derived skincare by brands like Neon Hippie, that appeal to wellness-conscious consumers looking for natural solutions. These trends, along with the increasing demand for hygiene products fueled by shifting consumer values, guarantee sustained growth for the U.S. personal hygiene market in the future.

Europe Personal Hygiene Market Analysis

In March 2024, Spain's Catalonia region, led by the government of Spain, began distributing free reusable period cups, cloth pads, and period underwear in pharmacies. This is within a broader campaign to provide more sustainable and environmentally friendly personal care products, aligning with rising consumer demands for greener goods. Similarly, the UK government implemented the Period Products Scheme in 2020, which has since reached 99% of schools and post-16 settings, further increasing the availability of menstrual products. All these efforts point to a larger European trend of prioritizing hygiene and sustainability, fueling the expansion of the personal hygiene market. Consumers are increasingly turning to reusable, organic, and biodegradable products, fueling the development of sustainable product lines. Policy measures and government incentives are also supporting declining barriers to access, guaranteeing that consumers can afford greener options. All these forces together are driving Europe's personal hygiene market continued growth.

Asia Pacific Personal Hygiene Market Analysis

The Asia Pacific personal care market is growing rapidly, with high demand for green and innovative products. L'Oréal Groupe partnered with Shinehigh Innovation, a Chinese biotech firm, in September 2023 to create ecologically sustainable beauty products. The takeover is a testament to the rising trend of green personal care in the region. In addition to this, Care Form Labs Private Limited, which is a start-up based in India, rolled out easy-to-use menstrual cups in March 2021 for meeting growing demands for reusable menstruation products. OrganiCup's entry of mini-menstrual-cups for teenage girls in 2020 is also a response to demand for appropriate age and eco-friendly menstrual products. Furthermore, the Indian Ministry of Health and Family Welfare's initiative to support adolescent menstrual hygiene, launched in 2022, provides subsidized sanitary napkins to increase availability and raise hygiene awareness. These initiatives, in association with the rising trend towards eco-friendly and natural products, are fueling Asia Pacific personal hygiene market development.

Latin America Personal Hygiene Market Analysis

The Latin American personal care market is expanding at a strong pace, influenced by a multitude of factors such as increasing consumer awareness, expansion in the e-commerce sector, and changes in lifestyles. According to Industry Reports, in 2021, personal care products accounted for 30% of the cosmetics market in the region, reflecting the high demand for personal care products, as per reports. Greater focus on well-being and health, especially with the COVID-19 pandemic, has further spurred the need for personal care items like hand sanitizers, disinfectants, menstrual care, and skin care. Higher disposable income and rising middle-class consumer bases in nations like Brazil and Mexico are also contributing to consumer spending in this category. Furthermore, increasing the usage of green and sustainable personal care items, such as biodegradable sanitary pads and menstrual cups, is shaping the market. This trend signals consumers' migration towards green consumerism buying decisions, which boosts market growth opportunities.

Middle East and Africa Personal Hygiene Market Analysis

The Middle East and Africa (MEA) personal hygiene market is witnessing high growth driven by several drivers. Active population on social media stands at 99% in the region as of 2022, with a higher saturation level in the UAE and Saudi Arabia of 98.99% and 82.3%, respectively, according to Industry Reports. All this high-level digital engagement has led to increased consciousness of body health and hygiene, which is in turn driving the increase in demand for hygiene items such as skincare, feminine care, and hand sanitizers. Increased disposable incomes and a rising young population are also driving consumption trends in the region. The growing emphasis on well-being and health, especially in the wake of the post-pandemic situation, is also propelling market growth. Expansion of e-commerce also facilitates simpler access to a wide range of hygiene products, enhancing consumer convenience. In addition to this, increased demand for environmentally friendly and organic personal hygiene products is also molding the market in MEA and is pushing the industry towards innovation.

Competitive Landscape:

Personal hygiene market leaders are spearheading expansion through a variety of strategic activities. A number of market leaders are investing significant amounts in research and development in order to develop and launch innovative new products catering to changing consumers' needs, including organic, green, and multi-functional hygienic products. In line with the forecast of the personal hygiene market, campaigns that emphasize health benefits and sustainability are increasingly being promoted, reaching more and more health-conscious and eco-aware customers. Companies are also broadening their distribution channels both offline and online to reach more consumers, building on the fast expansion of e-commerce. Strategic alliances through mergers and acquisitions are also prevalent, allowing businesses to diversify product portfolios and reach new markets. For example, collaborations with regional companies in emerging markets assist multinational enterprises in adapting their products to the tastes and regulatory needs of the region.

The report provides a comprehensive analysis of the competitive landscape in the personal hygiene market with detailed profiles of all major companies, including:

- 3M

- Auchan

- Carrefour S.A.

- Colgate-Palmolive Company

- Costco

- Henkel AG & Company

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Publix

- Reckitt Benckiser Group

- The Kroger Co.

- The Procter and Gamble Company

- Unicharm Corporation

- Unilever

Latest News and Developments:

- February 2025: Plush, a brand of personal hygiene products, is to expand its retail presence aiming to reach 2,000 stores in the next six months. This will be an addition to its present base of 500 stores in large cities like Bengaluru, Chennai, Mumbai, Delhi, and Hyderabad.

- September 2024: Pee Safe, a personal care brand, sold nearly one million units of its period panty on its website with a 45% repeat buying rate after launching a campaign for its disposable period panty.

- May 2024: PEE SAFE, a wellness and hygiene brand, introduced PeePal which is an AI-driven chatbot in order to spread awareness about hygiene and self-care practices.

- May 2023: CONTI, a leading industry participant in the personal hygiene sector has launched enhanced conti wet wipes. Engineered and produced in the UK, the Conti Wet Wipes offer an entire spectrum of cleansing options, engineered based on the specific requirements of those receiving care or support.

Personal Hygiene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Pricings Covered | Mass Products, Premium Products |

| Usabilities Covered | Disposable, Reusable |

| Distribution Channels Covered | Hospital Pharmacies, Supermarkets and Hypermarkets, Online Stores and Pharmacies, Convenience Stores and Retail Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M, Auchan, Carrefour S.A., Colgate-Palmolive Company, Costco, Henkel AG & Company, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Publix, Reckitt Benckiser Group, The Kroger Co., The Procter and Gamble Company, Unicharm Corporation, Unilever., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal hygiene market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personal hygiene market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personal hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal hygiene market was valued at USD 595.53 Billion in 2024.

The personal hygiene market was valued at USD 771.51 Billion in 2033, exhibiting a CAGR of 2.92% during 2025-2033.

Key factors driving the personal hygiene market include rising health awareness, increased demand for antibacterial and organic products, and expanding e-commerce accessibility. Innovations in skincare and hygiene solutions, coupled with government initiatives promoting cleanliness, further boost market growth. Urbanization and higher disposable incomes also contribute to increased product adoption.

Asia Pacific dominates the personal hygiene market due to rising population, increasing health awareness, and rapid urbanization. Growing disposable incomes and demand for premium hygiene products further drive growth. Government initiatives promoting sanitation, coupled with strong e-commerce expansion, enhance product accessibility, fueling market dominance across key economies like China and India.

Some of the major players in the personal hygiene market include 3M, Auchan, Carrefour S.A., Colgate-Palmolive Company, Costco, Henkel AG & Company, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Publix, Reckitt Benckiser Group, The Kroger Co., The Procter and Gamble Company, Unicharm Corporation, Unilever., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)