Saudi Arabia E-Learning Market Report by Technology (Online E-Learning, Learning Management System, Mobile E-Learning, Rapid E-Learning, Virtual Classroom, and Others), Provider (Services, Content), Application (Academic, Corporate, Government), and Region 2025-2033

Saudi Arabia E-Learning Market Size:

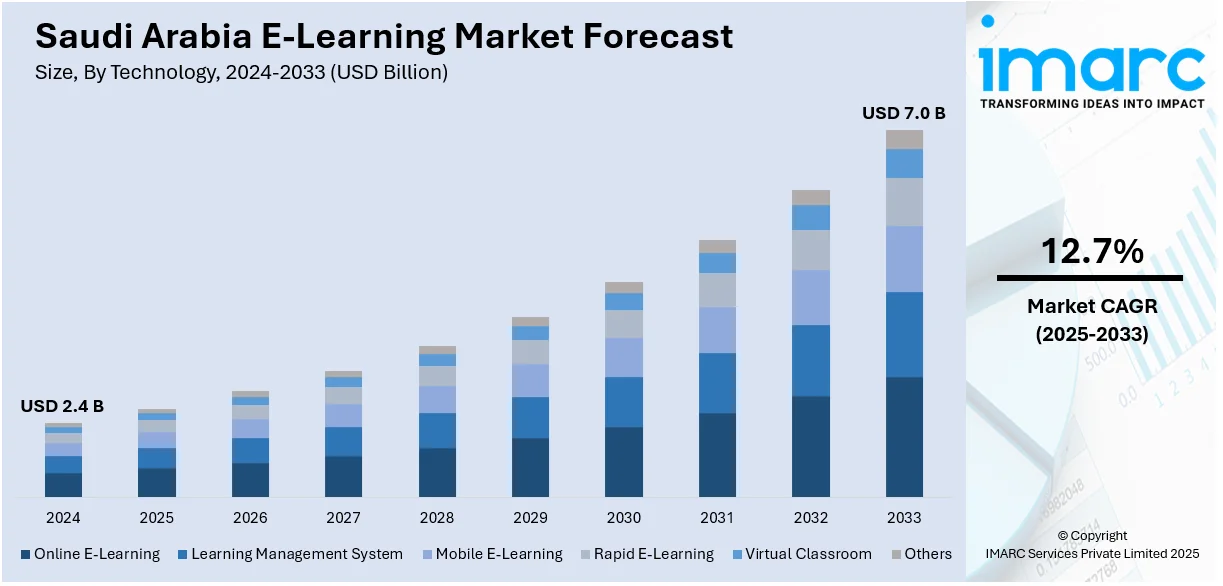

The Saudi Arabia e-learning market size reached USD 2.4 Billion in 2024. Looking forward, the market is expected to reach USD 7.0 Billion by 2033, exhibiting a growth rate (CAGR) of 12.7% during 2025-2033. The market is experiencing robust growth driven by the implementation of favorable government support, the rising demand for flexible learning, the growing penetration of internet and smartphones, significant technological advancements, and rising focus on skills development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.4 Billion |

|

Market Forecast in 2033

|

USD 7.0 Billion |

| Market Growth Rate 2025-2033 | 12.7% |

Saudi Arabia E-Learning Market Analysis:

- Market Growth and Size: The market is witnessing robust growth, driven by the increasing demand for online education and remote learning solutions. As more institutions and learners embrace digital education, the market is expected to continue expanding.

- Technological Advancements: Rapid technological advancements, such as the advanced learning management systems (LMS), interactive content, and adaptive learning platforms have played a pivotal role in enhancing the E-Learning experience in Saudi Arabia.

- Industry Applications: E-Learning in Saudi Arabia is widely adopted across various sectors, including K-12 education, higher education, corporate training, and vocational courses. It serves as a versatile tool for knowledge dissemination and skills development.

- Geographical Trends: E-Learning adoption in Saudi Arabia is not limited to major cities but has spread to less urban areas, making quality education more accessible across the country. This trend reflects the commitment of the government to bridging educational gaps.

- Competitive Landscape: The Saudi Arabian E-Learning market is characterized by a competitive landscape with both local and international players offering diverse educational solutions. This competition fosters innovation and drives the development of tailored content.

- Challenges and Opportunities: Challenges include addressing the digital divide, ensuring content relevance, and maintaining data privacy and security. Opportunities lie in the increasing interest in lifelong learning, upskilling, and the potential for international partnerships to enhance the quality of online education.

- Future Outlook: The future of the Saudi Arabia E-Learning market appears promising, with sustained growth expected. The market will likely be driven by government initiatives, increased demand for flexible and personalized learning, and continued investments in educational technology.

Saudi Arabia E-Learning Market Trends:

Favorable Government Initiatives and Support

The government of Saudi Arabia has been actively promoting digital education and E-Learning through various initiatives and policies. The "Vision 2030" plan, which aims to diversify the economy and enhance the education system, includes significant investments in technology-enabled learning. The Ministry of Education's "Madrasati" program and the "Distance Learning Initiative" have further accelerated the adoption of E-Learning across the country. These initiatives have resulted in increased funding for E-Learning projects, infrastructure development, and teacher training. They are a testament to the commitment of the government to modernize the education sector, making quality education accessible to a wider population.

Rising Demand for Flexible Learning

The demand for flexible learning solutions is a key driver of the E-Learning market in Saudi Arabia. Students and professionals alike are seeking alternatives to traditional classroom settings. E-Learning offers the flexibility to access educational content and resources at the pace and schedule of an individual, making it ideal for individuals with busy lifestyles. Additionally, the COVID-19 pandemic accelerated the adoption of E-Learning as schools and institutions had to pivot to online learning to ensure continuity in education. This shift in behavior has left a lasting impact, with many learners now preferring the convenience and accessibility of E-Learning.

Significant Technological Advancements

Advancements in educational technology have transformed the E-Learning landscape in Saudi Arabia. The availability of high-speed internet, mobile devices, and interactive learning platforms has significantly improved the quality of online education. Virtual classrooms, augmented reality (AR), and gamification elements have enhanced engagement and interactivity in E-Learning courses. These technological advancements have also made it easier for educational institutions and content providers to create and deliver high-quality digital content, catering to a diverse range of subjects and learning styles.

Rising Desire for Skills Development and Lifelong Learning

The desire for skills development and lifelong learning is propelling the E-Learning market. As the job market evolves, individuals recognize the need to upskill and reskill to remain competitive. E-Learning platforms offer a wide array of courses and certifications, allowing learners to acquire new skills or enhance existing ones conveniently. The commitment of the region to reducing unemployment rates by preparing its workforce for the future job market aligns with the E-Learning trend toward continuous learning and skills development.

Growing International Collaboration and Partnerships

The E-Learning market in Saudi Arabia has benefited from international collaborations and partnerships. Local educational institutions have joined forces with global E-Learning providers, bringing in diverse expertise and content. These collaborations ensure that learners in Saudi Arabia have access to world-class educational resources and certifications. Furthermore, international universities and institutions have established branch campuses or online degree programs, making higher education more accessible to Saudi students.

Saudi Arabia E-Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, provider, and application.

Breakup by Technology:

- Online E-Learning

- Learning Management System

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

Online e-learning accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on technology. This includes online E-learning, learning management system, mobile E-learning, rapid E-learning, virtual classroom, and others. According to the report, online E-learning accounted for the largest market share.

Online e-Learning refers to web-based educational content delivery. In Saudi Arabia, this segment has witnessed substantial growth due to its accessibility and convenience. Learners can access courses and materials from any location with internet connectivity, making it suitable for both formal education and professional development. Government initiatives have played a pivotal role in expanding online E-Learning, ensuring that quality content is available to students of all ages.

Learning Management Systems are platforms that manage, deliver, and track E-Learning content. LMS adoption has increased in the education and corporate sectors of the region. Institutions use LMS to streamline course administration, track learner progress, and offer interactive content. Corporations utilize LMS for employee training, compliance courses, and skill development programs. The user-friendly nature of LMS systems aligns with Saudi Arabia's commitment to enhancing the education experience.

Mobile e-Learning leverages smartphones and tablets to deliver educational content. The proliferation of mobile devices in Saudi Arabia has made this segment particularly popular. Mobile E-Learning allows learners to access courses on the go, facilitating flexible learning. The gamification of content and the availability of mobile apps have further fueled its growth, making it appealing to a tech-savvy population.

Rapid e-Learning involves the quick development of digital content, often using templates and authoring tools. This approach caters to the need for timely, cost-effective educational materials. In Saudi Arabia, rapid E-Learning has gained traction, especially in corporate training and short-term skill enhancement programs. It enables organizations to adapt to changing training needs efficiently.

Virtual classrooms provide a live, interactive learning experience through video conferencing and collaboration tools. The COVID-19 pandemic accelerated the adoption of virtual classrooms in Saudi Arabia. Educational institutions and training centers embraced this technology to ensure continuity in learning. Even beyond the pandemic, virtual classrooms continue to play a significant role in hybrid and remote learning scenarios.

Breakup by Provider:

- Services

- Content

Content holds the largest share in the industry

A detailed breakup and analysis of the market based on the method have also been provided in the report. This includes services and content. According to the report, content accounted for the largest market share.

E-Learning content providers play a pivotal role in the Saudi Arabian market by supplying the educational materials and resources that form the foundation of online learning experiences. These providers create a wide range of digital content, including video lectures, interactive simulations, e-books, and assessments. The content covers subjects ranging from academic courses to professional development and vocational training.

E-Learning services providers complement content providers by offering a range of essential services that facilitate the delivery and management of online education. These services encompass learning management system (LMS) implementation, technical support, teacher training, and consultancy on best practices in online education. In Saudi Arabia, services providers are instrumental in helping educational institutions, government bodies, and corporate entities transition to E-Learning seamlessly. They ensure that the technical infrastructure is in place, enabling smooth access to E-Learning platforms and content. Moreover, they offer ongoing support to resolve technical issues and provide guidance on optimizing the E-Learning experience.

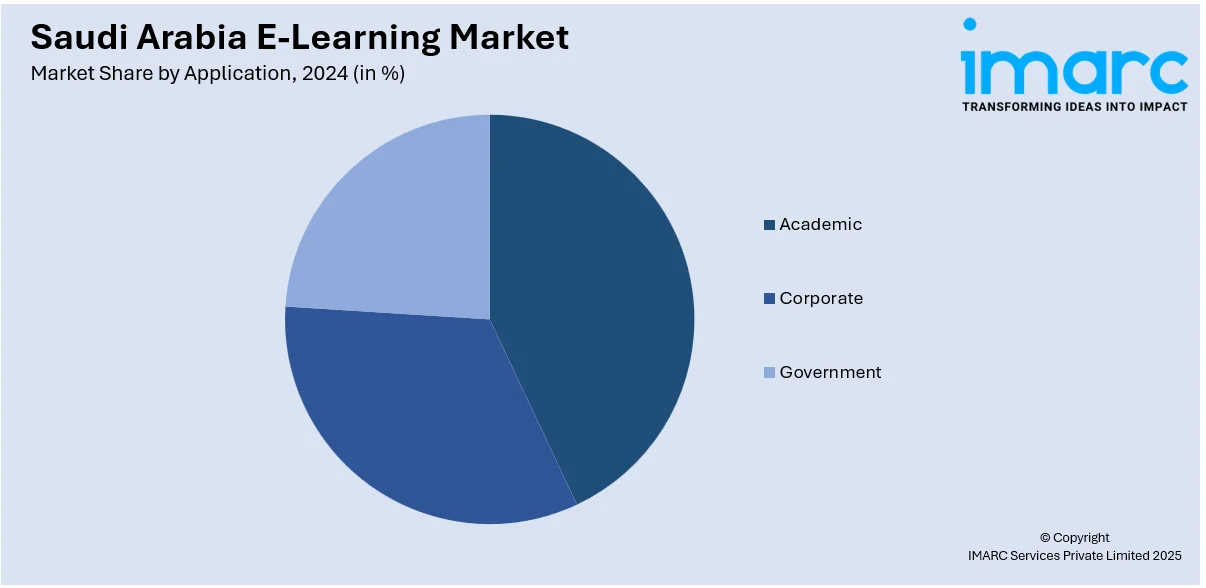

Breakup by Application:

- Academic

- K-12

- Higher Education

- Vocational Training

- Corporate

- Small and Medium Enterprises

- Large Enterprises

- Government

Academic represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes academic (K-12, higher education, and vocational training), corporate (small and medium enterprises, and large enterprises), and government. According to the report, academic represented the largest market share.

Academic e-learning in Saudi Arabia has witnessed significant growth and transformation in recent years. This segment primarily caters to K-12 schools, higher education institutions, and vocational training centers. The adoption of digital learning tools and platforms has become increasingly common in traditional educational settings. In K-12 education, E-Learning platforms offer interactive content and virtual classrooms that supplement traditional teaching methods. These tools have become vital, especially during the COVID-19 pandemic, ensuring uninterrupted learning for students. At the higher education level, universities and colleges have embraced E-Learning to provide a broader range of courses and degree programs, including online degrees. Vocational training centers have also benefited from E-Learning by offering specialized, job-oriented courses to equip individuals with practical skills and certifications needed in the job market.

The corporate e-learning segment in Saudi Arabia has experienced remarkable growth as businesses recognize the importance of upskilling and reskilling their employees. This segment primarily focuses on enhancing the skills and knowledge of the workforce to boost productivity and competitiveness. Corporate E-Learning solutions offer a range of training programs, from compliance and safety training to leadership development and technical skills enhancement. These programs can be tailored to meet the specific needs of each organization, ensuring that employees acquire the necessary skills for their roles. Saudi companies across various sectors, including oil and gas, finance, and healthcare, have implemented E-Learning initiatives to streamline training, reduce costs, and maintain a skilled workforce. The ability to track and assess employee progress and performance through E-Learning platforms has further strengthened its appeal to businesses.

Government agencies in Saudi Arabia have also leveraged E-Learning to enhance the skills and knowledge of public sector employees. This segment focuses on training and development programs for government workers, including civil servants and public educators. E-Learning platforms in the government sector facilitate training on various topics, such as public administration, cybersecurity, and digital literacy. These initiatives aim to improve the efficiency and effectiveness of government services and operations. Moreover, the government has played a significant role in promoting E-Learning adoption across the country by investing in infrastructure and providing incentives for educational institutions to embrace digital education. This support has catalyzed growth within both the academic and corporate E-Learning segments.

Breakup by Region:

- Eastern Region

- Central Region

- Western Region

- Southern Region

Eastern region leads the market, accounting for the largest Saudi Arabia e-learning market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Eastern region, Central region, Western region, and Southern region. According to the report, Eastern region accounted for the largest market share.

The Eastern Region of Saudi Arabia, encompassing major cities such as, Dammam and Khobar, is a significant hub for economic and industrial activities. This region has witnessed substantial growth in E-Learning due to its thriving business environment and a strong focus on education. Many corporate entities in the Eastern Region invest in employee training and development through E-Learning platforms. Educational institutions, both K-12 and higher education, have also embraced digital learning to enhance the quality of education. The presence of technology-savvy communities and an entrepreneurial spirit in this region contributes to the robust growth of the E-Learning market.

The Central Region, with Riyadh as its capital, is the political and administrative heart of Saudi Arabia. It hosts numerous prestigious universities, research institutions, and government agencies. E-Learning in the Central Region plays a vital role in delivering higher education and professional development programs. Riyadh, in particular, has a growing demand for online courses and training, with students and professionals seeking flexibility and accessibility. Government initiatives, such as the "Vision 2030" plan, have spurred investments in educational technology in this region, making it a focal point for E-Learning advancements.

The Western Region, including Jeddah and Mecca, is known for its diverse economic activities, including tourism and commerce. E-Learning has gained traction here, driven by the need for specialized vocational training and language courses to cater to the tourism industry. Moreover, the Western Region is home to a sizable expatriate population, and E-Learning offers a convenient way for them to acquire new skills and adapt to the Saudi Arabian environment. The presence of international schools and universities in cities such as, Jeddah has further fueled the demand for E-Learning options.

The Southern Region, comprising cities such as, Abha and Jizan, has shown robust growth in E-Learning adoption, especially in the realm of K-12 education. As part of the efforts of the government to improve education accessibility across the country, E-Learning initiatives have been expanded in the Southern Region, bridging educational gaps in remote areas. This region benefits from innovative learning methods, addressing the unique challenges of delivering education in diverse geographical and climatic conditions.

Leading Key Players in the Saudi Arabia E-Learning Industry:

The key players in the market are actively engaging in several strategic initiatives to enhance their presence and offerings. These initiatives primarily revolve around content development, technology integration, and expanding their reach: Leading E-Learning platforms are continuously developing and updating their content libraries to offer a diverse range of courses and certifications, catering to the evolving needs of learners in Saudi Arabia. They prioritize localized content to ensure relevance. Investments in cutting-edge technology, such as artificial intelligence (AI) and virtual reality (VR), are being made to enhance the interactivity and engagement of their platforms, providing learners with immersive educational experiences.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Saudi Arabia E-Learning Market News:

- June 2025: Saudi edtech company Taawoni raised USD 1.6M to expand its platform for matchmaking between employers and universities for co-op training programs. The platform simplifies internship processes and provides AI-driven mentorship tools to balance talent development with the needs of Saudi Arabia's labor market.

- May 2025: eWyse eLearning Agency entered into a strategic partnership agreement with NSK Consultants and NSK Tech, creating the company's first local presence in the Kingdom of Saudi Arabia. The historic partnership seeks to bring cutting-edge eLearning technologies to facilitate Saudi Arabia's Vision 2030 educational transformation plans, catering to the rising need for innovative digital learning solutions in corporate training, higher education, and workforce development programs.

- May 2025: South Africa-headquartered TTRO, a corporate training and digital learning solutions company, moved into Saudi Arabia with the launch of its Riyadh office. The strategic expansion, facilitated by AstroLabs, the Gulf region's premier business growth platform, supplements the international network of offices of TTRO in the UAE, New Zealand, and the UK.

- May 2025: The Saudi Data and Artificial Intelligence Authority (SDAIA), in collaboration with the Ministry of Education and the Ministry of Human Resources and Social Development, officially opened up registrations for the "One Million Saudis in AI" (SAMAI) initiative. The national program calls on all citizens across age groups and professions to register and start their AI journey via the official portal.

- April 2025: Oracle unveiled a partnership with the Ministry of Communications and Information Technology (MCIT) and National eLearning Center (NeLC) to train 50,000 Saudi nationals on the latest Artificial Intelligence and digital technologies that will enable them to be ready for the most sought-after technology-enabled careers of the future. Under the new collaboration, MCIT and NeLC will introduce Oracle’s ‘Mostaqbali’ (My Future) program to Saudi citizens to facilitate lifelong learning, aid local employment prospects and enable Saudi organizations accelerate digital transformation with readily available local talent. The Mostaqbali program will be delivered as a digital learning experience through Oracle MyLearn, Oracle’s inclusive training and enablement platform from Oracle University used by millions of technology trainees.

- March 2025: Riyadh-based deeptech company Intelmatix unveiled the “AI Academy”, a training curriculum to assists companies to add AI into their operations. The program presents online and in-person courses for both public and private sector applicants.

Saudi Arabia E-Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Online E-Learning, Learning Management System, Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| Providers Covered | Services, Content |

| Applications Covered |

|

| Regions Covered | Eastern Region, Central Region, Western Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia E-learning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia E-learning market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia E-learning industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

E-learning refers to the delivery of educational content and courses through digital platforms, such as the internet, mobile devices, and learning management systems, enabling flexible, accessible, and interactive learning experiences for students and professionals.

The Saudi Arabia e-learning market was valued at USD 2.4 Billion in 2024, reflecting significant growth in demand for digital learning solutions across various sectors..

The Saudi Arabia e-learning market is expected to grow at a compound annual growth rate (CAGR) of 12.7% from 2025-2033, reaching a value of USD 7.0 Billion by 2033.

Key drivers of the Saudi Arabia e-learning market include government support through initiatives like "Vision 2030," technological advancements, increasing demand for flexible learning solutions, internet and smartphone penetration, and a focus on skills development and lifelong learning.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)