Saudi Arabia Tire Market Size, Share, Trends and Forecast by Type, End-Use, Vehicle Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Tire Market Summary:

The Saudi Arabia tire market size reached 23.15 Million Units in 2025 and is projected to reach 25.68 Million Units by 2034, growing at a compound annual growth rate of 1.16% from 2026-2034.

The Saudi Arabia tire market is experiencing consistent expansion driven by rising vehicle ownership, expanding transportation and logistics operations, and ongoing infrastructure development under Vision 2030. The Kingdom's extreme climatic conditions and long travel distances necessitate frequent tire replacements, while the growing popularity of SUVs, off-road vehicles, and commercial fleets continues to stimulate tire demand across the Saudi Arabia tire market share.

Key Takeaways and Insights:

- By Type: Radial tires dominated the market with 92% share in 2025, driven by their superior heat dissipation, reduced rolling resistance, and extended tread life, making them particularly suitable for high-temperature desert environments and long-distance highway travel.

- By End-Use: Replacement leads the market with a 61% share in 2025, owing to accelerated tire wear from hot climate conditions, rough terrain, and extensive travel distances that characterize Saudi Arabia's driving environment, necessitating frequent tire replacements.

- By Vehicle Type: Passenger cars represent the largest segment with a 55% market share in 2025, supported by rising disposable incomes, increasing car ownership rates among Saudi families, and expanded female driving participation following regulatory reforms.

- By Distribution Channel: Offline channels dominate with an 82% market share in 2025, attributed to consumer preference for professional installation services, in-person product inspection, and established dealer networks across the Kingdom's major urban centers.

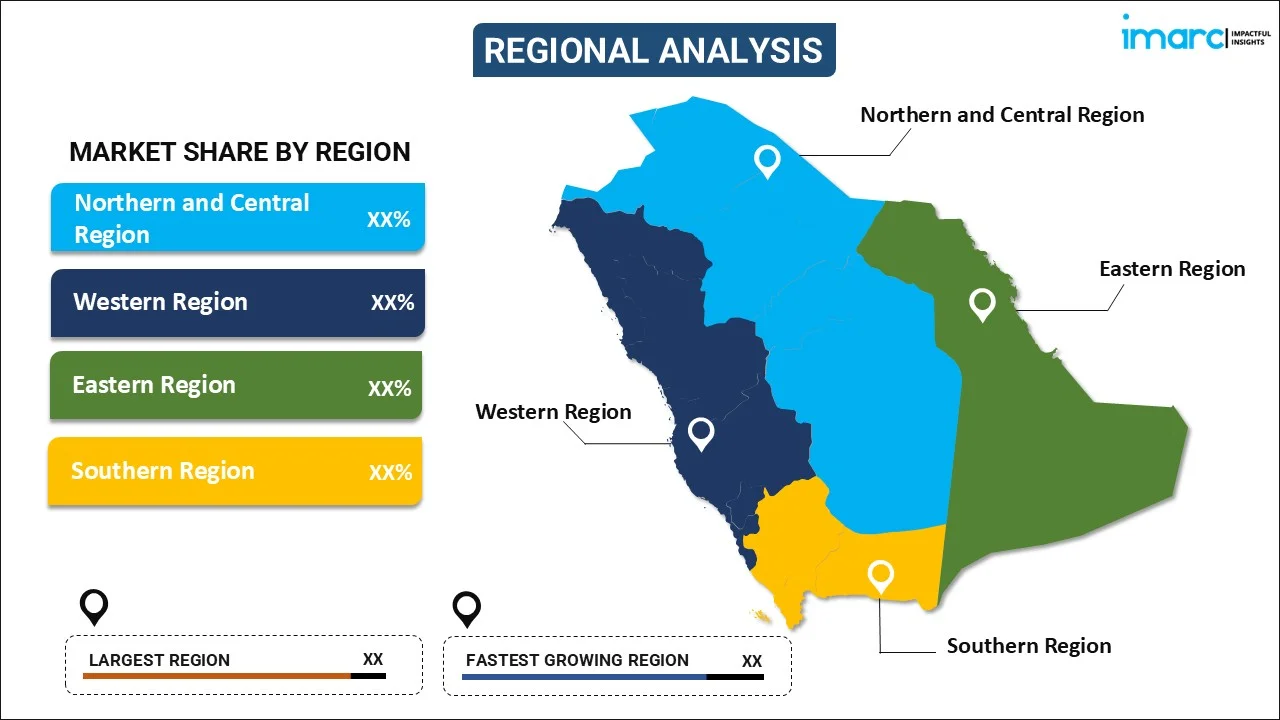

- By Region: Northern and Central region leads with a 45% share in 2025, driven by Riyadh's concentration of economic activity, industrial development, and the highest vehicle density in the Kingdom.

- Key Players: The Saudi Arabia tire market exhibits moderate competitive intensity, characterized by the strong presence of global manufacturers, alongside growing penetration of affordable Chinese tire brands. The market remains predominantly import-driven with emerging domestic manufacturing initiatives. Some of the key players operating in the market include Michelin Group, Bridgestone Corporation, Continental AG, Goodyear Tire and Rubber Company, Sumitomo Corporation, Pirelli & C. S.p.A, Yokohama Rubber Company, Hankook Tire and Technology, Toyo Tire Corporation, Kumho Tire, etc.

The Saudi Arabia tire market has evolved significantly as the Kingdom transforms its economic landscape through Vision 2030 initiatives. Record-breaking vehicle registrations exceeding one million units in 2024 marked a historic milestone, fundamentally reshaping tire demand dynamics across the automotive value chain. The convergence of infrastructure mega-projects, including NEOM, The Line, Red Sea Global, and Qiddiya is generating unprecedented demand for commercial and off-the-road tires. The Saudi Arabia logistics market size was valued at USD 52.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 81.2 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033, continues to drive commercial vehicle fleet expansion. The tourism sector's remarkable growth, welcoming 116 million domestic and international visitors in 2024, is further amplifying tire consumption through expanded rental fleets and tour transportation services. Strategic partnerships between international tire manufacturers and Saudi entities are establishing local production capabilities, positioning the Kingdom as a regional manufacturing hub.

Saudi Arabia Tire Market Trends:

Rising Adoption of Tubeless Tire Technology

Tubeless tires are gaining significant traction in the Saudi Arabia tire market due to their improved safety features, including slow air leakage that reduces sudden blowout risks. These tires offer better heat dissipation and reduced weight compared to traditional tube-type alternatives. The extreme weather conditions prevailing across the Kingdom, characterized by temperatures exceeding 45°C during summer months, make tubeless tires a more practical and durable choice for both passenger and commercial vehicles operating in harsh desert environments.

Increasing Preference for Radial Tire Construction

The shift from traditional bias-ply tires to radial construction represents a notable trend, particularly among fleet operators and commercial vehicle owners. Radial tires offer significant advantages, including superior heat resistance, reduced rolling resistance for improved fuel efficiency, and extended tread life that lowers total cost of ownership. As awareness of lifecycle cost advantages grows, buyers across all vehicle segments increasingly invest in premium radial tire solutions designed to withstand sustained high-speed highway driving common across the Kingdom's extensive road network.

Expansion of E-Commerce and Online Tire Retailing

Digital transformation is reshaping tire distribution channels as consumers increasingly leverage online platforms for product research, price comparison, and direct purchasing. The convenience of e-commerce, coupled with competitive pricing and home delivery or installation services offered by online retailers, is accelerating channel diversification. The Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. Traditional brick-and-mortar tire dealers are responding by developing integrated omnichannel experiences that combine digital convenience with in-store expertise, fundamentally altering competitive dynamics within the Saudi tire retail landscape.

How Vision 2030 is Transforming the Saudi Arabia Tire Market:

Vision 2030 is reshaping the Saudi Arabia tire market by accelerating economic diversification, infrastructure expansion, and mobility transformation. Large-scale investments in road networks, logistics hubs, tourism destinations, and industrial zones are increasing vehicle usage across passenger, commercial, and off-road segments, directly supporting tire demand. The push for local manufacturing and industrial localization is encouraging global and regional tire players to expand production, distribution, and after-sales capabilities within the Kingdom. Growing adoption of smart mobility, fleet management solutions, and safety regulations is driving demand for technologically advanced, durable, and heat-resistant tires. Additionally, sustainability goals under Vision 2030 are promoting interest in energy-efficient, longer-lasting, and environmentally responsible tire solutions.

Market Outlook 2026-2034:

The Saudi Arabia tire market outlook remains positive as the Kingdom advances toward its Vision 2030 economic diversification objectives. Continued infrastructure investment, expanding automotive manufacturing capabilities, and strategic localization initiatives are creating favorable conditions for sustained market expansion. The emergence of domestic tire production facilities, including joint ventures with global manufacturers, positions Saudi Arabia as a potential regional export hub. Increasing adoption of electric vehicles, supported by government incentives and expanding charging infrastructure, will drive demand for specialized EV tire solutions. The market size was estimated at 23.15 Million Units in 2025 and is expected to reach 25.68 Million Units by 2034, reflecting a compound annual growth rate of 1.16% over 2026-2034.

Saudi Arabia Tire Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Radial |

92% |

|

End-Use |

Replacement |

61% |

|

Vehicle Type |

Passenger Cars |

55% |

|

Distribution Channel |

Offline |

82% |

|

Region |

Northern and Central Region |

45% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Radial

- Bias

The radial dominates with a 92% market share of the total Saudi Arabia tire market in 2025.

Radial tire technology has achieved near-universal adoption in the Saudi Arabia tire market due to its inherent advantages in handling the Kingdom's demanding operating conditions. The tire construction, featuring cord plies arranged perpendicular to the direction of travel, delivers superior heat dissipation critical for ambient temperatures regularly exceeding 45°C during summer months. Radial tires demonstrate reduced rolling resistance that translates to improved fuel economy, a significant consideration given the long-distance highway driving common across Saudi Arabia's extensive road network connecting major urban centers.

The extended tread life offered by radial construction provides compelling total cost of ownership advantages that resonate strongly with both individual consumers and commercial fleet operators. Premium tire manufacturers have developed specialized compounds and tread patterns optimized specifically for desert conditions, addressing challenges including sand infiltration, extreme heat cycling, and abrasive road surfaces. As the Kingdom advances its domestic tire manufacturing capabilities through partnerships with global leaders, radial tire production represents the primary focus, further cementing segment dominance.

End-Use Insights:

- OEM

- Replacement

The replacement leads with a 61% share of the total Saudi Arabia tire market in 2025.

The replacement tire segment maintains substantial dominance driven by Saudi Arabia's unique operating environment that accelerates tire wear beyond typical global patterns. Extreme heat conditions cause faster rubber degradation, while abrasive sand particles and rough terrain in certain regions necessitate more frequent tire changes to maintain safety and optimal vehicle performance. The Kingdom's geography, characterized by vast distances between urban centers, results in higher average annual mileage that compounds wear factors and shortens replacement cycles across all vehicle categories.

Commercial fleet operators across logistics and transportation are major contributors to replacement tire demand, as fleet management practices increasingly focus on preventive maintenance and planned replacement cycles to improve reliability and operating efficiency. The growing adoption of smart monitoring technologies is helping operators anticipate wear, reduce downtime, and extend tire life through predictive maintenance approaches. At the same time, heightened awareness of road safety and the risks associated with worn tires, supported by stricter safety regulations, is reinforcing steady replacement demand among both commercial fleets and individual vehicle owners.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Off-The-Road (OTR)

The passenger cars exhibits clear dominance with a 55% share of the total Saudi Arabia tire market in 2025.

Passenger cars dominate the Saudi Arabia tire market due to the high number of privately owned vehicles and the growing preference for personal transportation across urban and suburban areas. The Kingdom’s extensive road network, coupled with increasing urbanization and rising disposable incomes, has fueled passenger vehicle sales, directly boosting tire demand. The Saudi Arabia sports utility vehicle market size reached USD 8,012.71 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,694.02 Million by 2033, exhibiting a growth rate (CAGR) of 4.29% during 2025-2033. The expanding SUV market reflects rising consumer preference for personal vehicles, especially larger, premium passenger vehicles. Additionally, passenger cars require regular tire replacement due to wear from frequent use in daily commuting and long-distance travel, sustaining consistent demand for a wide range of tire types across economy, mid-range, and premium segments.

Furthermore, government initiatives promoting road safety and vehicular maintenance indirectly drive tire consumption in the passenger car segment. Stricter safety regulations and awareness campaigns encourage proper tire upkeep, leading to timely replacement cycles. The adoption of advanced tire technologies, such as tubeless, radial, and energy-efficient tires, also aligns with consumer preferences for durability, fuel efficiency, and performance. Combined, these factors reinforce the passenger car segment’s dominant share in the Saudi Arabia tire market.

Distribution Channel Insights:

- Offline

- Online

The offline dominates with an 82% share of the total Saudi Arabia tire market in 2025.

Offline channels dominate the Saudi Arabia tire market due to the long-standing preference of consumers and commercial buyers for in-person purchasing experiences. Physical retail outlets, including authorized dealerships, service centers, and tire specialty shops, offer the advantage of direct inspection, expert guidance, and immediate availability. Customers can evaluate tire quality, tread patterns, and durability firsthand, ensuring confidence in their purchase. For fleet operators and logistics companies, offline channels also provide integrated services such as installation, balancing, and maintenance, making them a convenient, one-stop solution.

Additionally, established distribution networks and widespread physical presence across urban and regional centers reinforce offline dominance. Many buyers, particularly in industrial and commercial segments, rely on trusted local vendors to ensure timely supply and service reliability. Offline channels also benefit from strong brand representation, promotional campaigns, and loyalty programs that foster customer retention. Despite the rise of digital platforms, the hands-on experience, technical support, and operational convenience offered by offline outlets continue to make them the preferred choice in Saudi Arabia’s tire market.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region represent the largest share with 45% of the total Saudi Arabia tire market in 2025.

The Northern and Central region of Saudi Arabia drives tire market growth due to its high population density and rapid urbanization, particularly in Riyadh and surrounding cities. Expanding residential areas, commercial hubs, and industrial zones increase personal vehicle ownership and commercial fleet utilization, fueling tire demand. Additionally, the region’s extensive road infrastructure, including highways and urban road networks, requires frequent tire replacements for safety and performance, further strengthening the market. Consumer preference for high-quality, durable tires also supports steady growth in both passenger and commercial segments.

Moreover, government initiatives promoting road safety and stringent vehicle inspection standards encourage regular tire maintenance and replacement, boosting market adoption. The region hosts numerous logistics and transportation hubs, increasing demand for commercial vehicle tires to support freight and supply chain operations. Rising awareness of fuel efficiency, tire longevity, and advanced tire technologies also drives consumer and fleet investment in premium tire options. These combined factors make the Northern and Central region a key contributor to Saudi Arabia’s overall tire market growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Tire Market Growing?

Record Vehicle Sales and Expanding Automotive Fleet

The Saudi Arabia tire market is experiencing sustained growth driven by record-breaking vehicle sales that reached historic milestones in 2024. For the first time in the Kingdom's history, over one million vehicles were registered within a single calendar year, with total registrations reaching 1,000,201 units by late December 2024. Toyota emerged as the market leader with 225,743 registrations, followed by Hyundai with 144,970 units and Kia with 57,223 vehicles. This unprecedented expansion of the national vehicle fleet directly translates to increased tire demand across both OEM and replacement segments, creating fundamental growth momentum that will sustain market expansion throughout the forecast period as these vehicles require ongoing tire maintenance and replacement.

Thriving Transportation and Logistics Sector Expansion

The expansion of Saudi Arabia's transportation and logistics sector represents a significant driver of commercial tire demand. Saudi Arabia’s logistics sector has expanded significantly, driven by rising freight activity, goods distribution, and integrated supply chain operations. This growth relies heavily on large commercial vehicle fleets, increasing vehicle utilization across transportation, warehousing, and last-mile delivery services nationwide. The rise of e-commerce, accelerated industrial development, and expanding infrastructure projects are generating increased demand for trucks, vans, and heavy-duty vehicles that require regular tire replacement due to intensive utilization. The Saudi Arabia e-commerce logistics market size reached USD 4,578.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,666.01 Million by 2033, exhibiting a growth rate (CAGR) of 12.92% during 2025-2033. Fleet operators across the logistics industry are investing substantially in tire maintenance programs and replacement schedules to optimize operational efficiency and minimize costly downtime, creating sustained demand growth across commercial tire categories.

Booming Tourism Industry Driving Transportation Demand

Saudi Arabia’s fast-growing tourism industry is creating additional demand for tires by increasing overall vehicle usage across the country. Rising tourist activity has expanded the need for transportation services such as car rentals, tour buses, and private vehicles used for leisure travel. Vision 2030–led tourism development is encouraging greater mobility between cities and key destinations, leading to higher mileage and faster tire wear. This trend is especially pronounced in major tourism hubs such as Riyadh, Jeddah, and the holy cities, where sustained visitor movement shortens replacement cycles and supports steady demand for tires across passenger and commercial vehicle segments.

Market Restraints:

What Challenges the Saudi Arabia Tire Market is Facing?

Heavy Import Dependence and Supply Chain Vulnerabilities

The Saudi Arabia tire market remains predominantly import-driven, with the vast majority of tires sourced from international manufacturers in China, Japan, South Korea, and Thailand. This reliance on imports exposes the market to supply chain disruptions, shipping delays, and logistics constraints that can impact tire availability and pricing. Port congestion, container shortages, and geopolitical factors routinely extend lead times and escalate freight costs, creating challenges for importers and distributors.

Currency Fluctuations and Economic Volatility

Exchange rate volatility between the Saudi Riyal and major trading currencies impacts tire import costs and retail pricing stability. Economic fluctuations linked to global oil market dynamics can influence consumer purchasing power and commercial fleet investment decisions, creating demand uncertainty. Price sensitivity among consumers, particularly in the value-oriented tire segment, limits manufacturers' ability to pass through cost increases, compressing margins across the distribution chain.

Intensifying Competition and Margin Pressure

The Saudi tire market faces intensifying competitive pressure as Chinese tire brands expand their market presence through aggressive pricing strategies, capturing value-conscious consumer segments. Established premium brands respond with rebates and financing incentives that erode dealer margins while inventory proliferation increases marketing expenditures. The fragmented competitive landscape challenges smaller distributors to maintain profitability while investing in service capabilities expected by increasingly sophisticated consumers.

Competitive Landscape:

The Saudi Arabia tire market demonstrates a moderately consolidated competitive landscape, with established global manufacturers competing alongside rapidly growing international entrants. Companies differentiate themselves through technological innovation, stringent quality standards, and extended product warranties, while navigating an increasingly price-sensitive environment. Emerging domestic manufacturing initiatives, supported by government localization incentives and strategic partnerships, are gradually altering market dynamics. These efforts aim to build indigenous production capabilities in line with the Kingdom’s industrial diversification goals under Vision 2030, fostering greater self-reliance, strengthening local supply chains, and enhancing the overall competitiveness of the tire sector.

Some of the key players include:

- Michelin Group

- Bridgestone Corporation

- Continental AG

- Goodyear Tire and Rubber Company

- Sumitomo Corporation

- Pirelli & C. S.p.A

- Yokohama Rubber Company

- Hankook Tire and Technology

- Toyo Tire Corporation

- Kumho Tire

Recent Developments:

- November 2024: Saudi Arabia's Black Arrow Tire Co. (Blatco) partnered with Thailand's Golden Star Rubber Co. to establish the Middle East's largest tire manufacturing facility in Yanbu with a USD 470 million investment. The plant will initially produce 4 million tires annually for passenger vehicles, with plans to expand to 6 million units per year including truck and bus tires, creating over 2,000 local jobs.

- February 2025: The Goodyear Tire & Rubber Company launched its cutting-edge Tire Pressure Monitoring System (TPMS) in Saudi Arabia. This advanced solution integrates digital technology with Goodyear's tire expertise to deliver enhanced fleet management capabilities for logistics and mass transport providers operating in the Kingdom's demanding environmental conditions.

- May 2025: Hankook Tire & Technology signed a three-year title sponsorship agreement with Saudi Arabian professional football club Al-Ittihad, starting from the 2024/2025 season. The partnership aims to strengthen Hankook's brand presence in the Middle Eastern market through a strategic alliance with one of Saudi Arabia's most prestigious football clubs.

Saudi Arabia Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scopr of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Radial, Bias |

| End-Uses Covered | OEM, Replacement |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Region Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Michelin Group, Bridgestone Corporation, Continental AG, Goodyear Tire and Rubber Company, Sumitomo Corporation, Pirelli & C. S.p.A, Yokohama Rubber Company, Hankook Tire and Technology, Toyo Tire Corporation, Kumho Tire |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia tire market size reached 23.15 Million Units in 2025.

The Saudi Arabia tire market is expected to grow at a compound annual growth rate of 1.16% from 2026-2034 to reach 25.68 Million Units by 2034.

Radial tires dominate the market with a 92% share in 2025, driven by superior heat resistance, extended tread life, and improved fuel efficiency that make them particularly suitable for Saudi Arabia's extreme desert operating conditions.

Key factors driving the Saudi Arabia tire market include record vehicle sales exceeding one million units in 2024, expanding transportation and logistics sector valued at USD 52.7 billion, booming tourism welcoming 116 million visitors, and Vision 2030 infrastructure mega-projects.

Major challenges include heavy import dependence exposing the market to supply chain vulnerabilities, currency fluctuations impacting import costs, intensifying competition from Chinese brands compressing margins, and infrastructure gaps in tire recycling and sustainable end-of-life solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)