Turkey Packaged Food Market Report by Product Type (Bakery Products, Dairy Products, Beverages, Breakfast Products, Meals, and Others), Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail Stores, and Others), and Region 2026-2034

Turkey Packaged Food Market Overview:

The Turkey packaged food market size reached USD 24,460.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 41,943.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.99% during 2026-2034. The market is propelled by changing consumer lifestyles and habits, rapid expansion of modern retail channels, rapidly changing demographic of the region, stringent government regulations and food safety standards, and increasing disposable income levels of the individuals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 24,460.6 Million |

|

Market Forecast in 2034

|

USD 41,943.8 Million |

| Market Growth Rate 2026-2034 | 5.99% |

Access the full market insights report Request Sample

Turkey Packaged Food Market Trends:

Rapidly Changing Consumer Lifestyles and Habits

The shift in consumer lifestyles toward convenience and time-efficiency has been a major driver of the packaged food market in Turkey. Urbanization and an increase in dual-income households have led to a higher demand for ready-to-eat and easy-to-prepare food options. According to BRITANNICA, the urban population across Turkey reached 77.9% as of 2024. Consumers are increasingly opting for packaged foods that require minimal preparation time such as frozen meals, snacks, and pre-cut vegetables. This trend is driven by the need for convenience without compromising on quality and nutrition. Additionally, busy lifestyles have reduced the time spent on cooking from scratch, making packaged foods a practical choice for many households. Moreover, changing dietary habits among Turkish consumers, influenced by global food trends and health awareness, have also contributed to the demand for healthier packaged food options. Products that emphasize natural ingredients, reduced additives, and nutritional benefits are gaining popularity, reflecting a growing preference for balanced diets even within the packaged food category.

Expansion of Modern Retail Channels

The expansion and modernization of retail channels in Turkey have significantly boosted the accessibility and visibility of packaged foods. According to the INTERNATIONAL TRADE ADMINISTRATION, the e-commerce market in Turkey reached $23 Billion by the end of the year 2023. Supermarkets, hypermarkets, and convenience stores have proliferated across urban and suburban areas, offering a wide array of packaged food products to consumers. This development has not only increased the availability of packaged foods but has also enhanced consumer awareness and brand visibility through effective merchandising and promotional strategies. Modern retail formats have also facilitated the introduction of international brands and product varieties, catering to diverse consumer preferences and tastes. This competitive retail environment encourages manufacturers to innovate continuously, introducing new flavors, packaging formats, and product categories to attract and retain consumers. Furthermore, the growth of e-commerce platforms has further expanded the reach of packaged food products beyond traditional retail channels, enabling consumers to purchase a wide range of products conveniently from their homes.

Rapidly Changing Demographics

Demographic shifts, including population growth, urbanization, and changing age demographics, have significantly impacted the Turkish packaged food market. The young and growing population of Turkey, coupled with increasing urbanization rates, has expanded the consumer base for packaged foods. According to BRITANNICA, almost half of the population is below the age of 30 in Turkey. Urban dwellers, particularly millennials and dual-income households, represent a significant segment driving the demand for convenient and ready-to-eat food options. Moreover, changing household structures, such as smaller family sizes and increasing numbers of single-person households, have altered cooking and consumption patterns. These demographic changes have led to greater demand for single-serve and portion-controlled packaged food products that cater to smaller households and individuals. Additionally, an aging population in Turkey has also influenced the packaged food market, with older consumers seeking convenient meal solutions that require minimal preparation and cater to specific dietary needs.

Turkey Packaged Food Market News:

- 25 March 2024: The Turkish Cooperation and Coordination Agency (TIKA) organized Ramadan iftars, or fast-breaking dinners, and delivered food aid packages to families in need in Croatia, the Republic of Congo, Peru, Yemen, and Somalia. TIKA started the distribution of food packages to 1,000 families in need living in Croatia during Ramadan, a Muslim holy month for fasting from sunup to sundown and piety, according to a statement by the agency.

Turkey Packaged Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Bakery Products

- Dairy Products

- Beverages

- Breakfast Products

- Meals

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery products, dairy products, beverages, breakfast products, meals, and others.

Distribution Channel Insights:

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, specialty stores, convenience stores, online retail stores, and others.

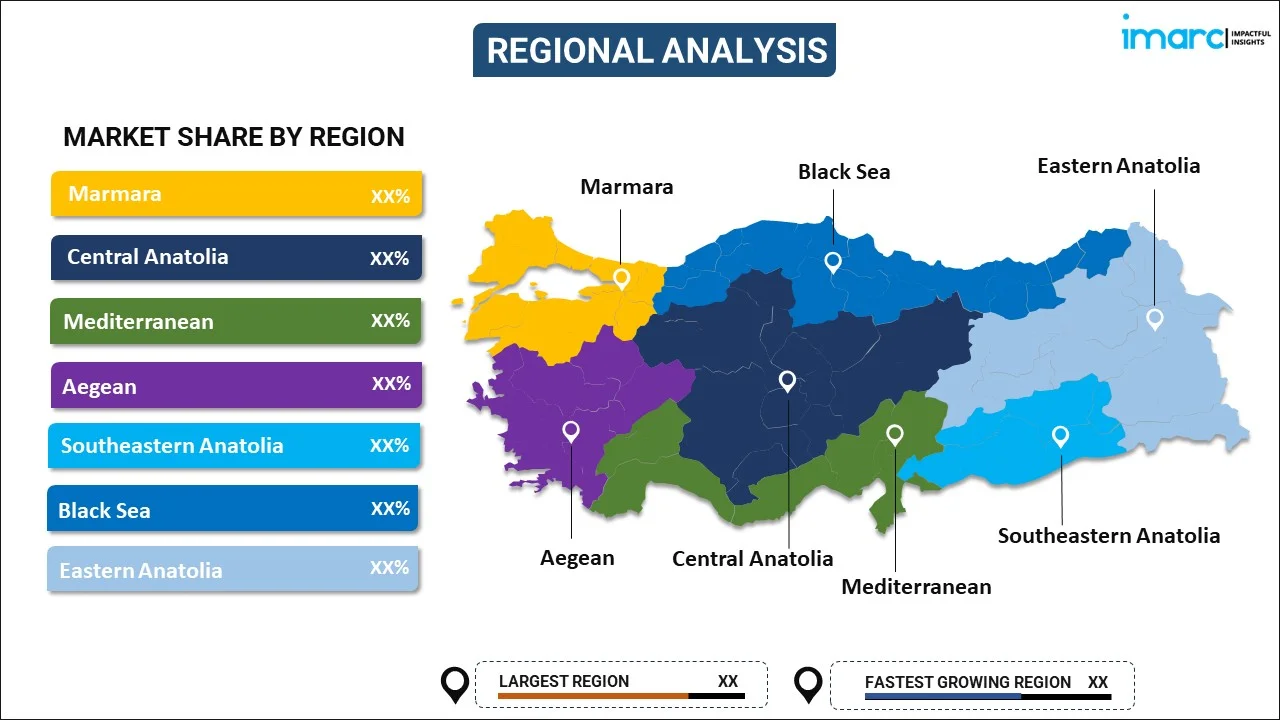

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Packaged Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Bakery Products, Dairy Products, Beverages, Breakfast Products, Meals, Others |

| Distribution Channels Covered | Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey packaged food market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey packaged food market on the basis of product type?

- What is the breakup of the Turkey packaged food market on the basis of distribution channel?

- What are the various stages in the value chain of the Turkey packaged food market?

- What are the key driving factors and challenges in the Turkey packaged food?

- What is the structure of the Turkey packaged food market and who are the key players?

- What is the degree of competition in the Turkey packaged food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey packaged food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey packaged food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey packaged food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)