United States Casein Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2026-2034

United States Casein Market Summary:

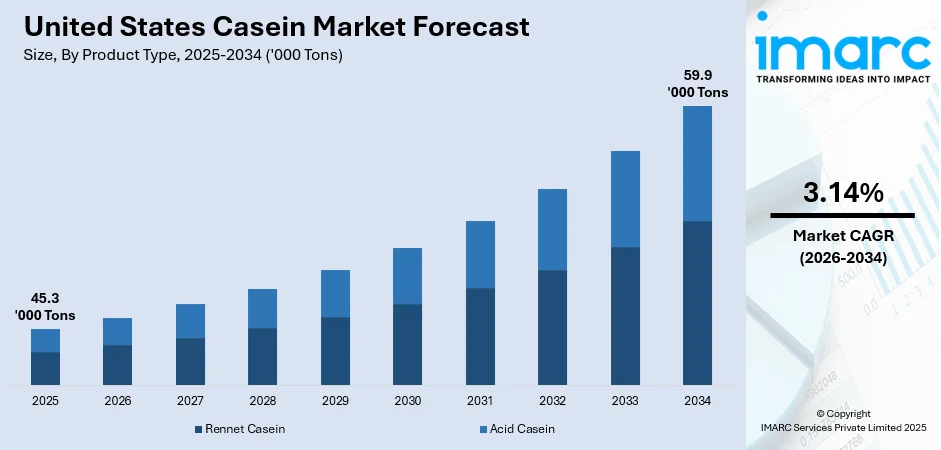

The United States casein market size reached 45.34 Thousand Tons in 2025 and is projected to reach 59.88 Thousand Tons by 2034, growing at a compound annual growth rate of 3.14% from 2026-2034.

The market is expanding steadily, driven by increasing consumer demand for protein-enriched foods and functional nutrition products across diverse end-use applications. The growing emphasis on health and wellness among American consumers continues to support casein adoption in food manufacturing, pharmaceutical formulations, and dietary supplements. Rising fitness consciousness and the popularity of slow-release protein sources for muscle recovery and weight management are fostering sustained consumption growth in the United States casein market share.

Key Takeaways and Insights:

- By Product Type: Acid casein dominates the market with a share of 58% in 2025, driven by its superior functional properties, including gel formation stability, fat emulsification capability, and texture enhancement characteristics, valued across food processing and industrial applications.

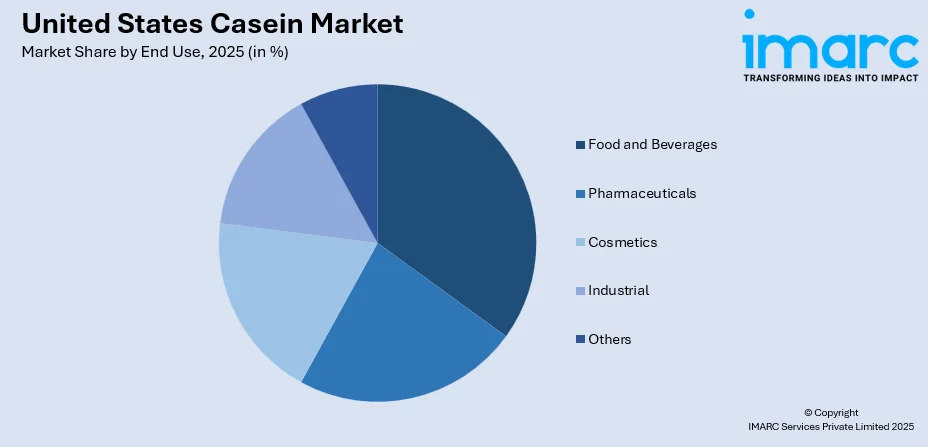

- By End Use: Food and beverages lead the market with a share of 71% in 2025. This dominance is driven by casein's extensive utilization in cheese manufacturing, protein supplements, bakery products, and nutritional formulations requiring high-quality dairy protein ingredients.

- By Region: South represents the largest region with a market share of 35% in 2025, supported by substantial dairy production infrastructure in Texas, favorable agricultural conditions, and proximity to expanding food processing facilities across the Southern states.

- Key Players: The United States casein market exhibits moderate competitive intensity, with established various multinational dairy corporations and specialized protein ingredient manufacturers competing through product innovations, quality differentiation, and strategic supply partnerships.

To get more information on this market Request Sample

The market benefits from robust domestic dairy infrastructure and advancing processing technologies that enable consistent supply of high-purity casein products. Consumer preferences continue to shift towards clean-label, minimally processed protein ingredients, encouraging manufacturers to invest in sustainable sourcing and transparent production methods. As per USDA, in September, milk output in the 24 leading states reached 18.3 Billion pounds, an increase of 4.2% compared to September 2024. The supplements sector remains particularly influential, with fitness enthusiasts and health-conscious consumers driving demand for casein-based protein products designed for overnight muscle recovery and sustained amino acid release. In parallel, industrial applications in adhesives, paper coatings, and specialty chemicals continue to expand due to casein’s durability and eco-friendly profile. Strong dairy production capacity in the United States supports stable raw material availability, encouraging manufacturers to scale operations.

United States Casein Market Trends:

Rising Demand for High-Protein and Sports Nutrition Products

The United States casein market is driven by growing interest in high-protein diets, sports supplements, and fitness-focused nutrition. As per IMARC Group, the United States sports nutrition market size is set to exhibit a growth rate (CAGR) of 6.34% during 2025-2033. Casein’s slow digestion and sustained amino acid release make it ideal for muscle recovery and long-lasting satiety. Athletes, gym-goers, and health-conscious consumers increasingly prefer casein-based powders, shakes, and bars.

Broadening of retail channels

The expansion of retail channels is significantly driving the market expansion in the United States by widening product accessibility through supermarkets, specialty nutrition chains, and rapidly growing e-commerce platforms. According to Trading Economics, in the United States, retail sales increased by 0.2% from August to September 2025. As organized retail spreads across both urban and suburban areas, casein-based products, such as protein supplements and functional food ingredients, gain stronger shelf presence and visibility. Retailers also promote premium, high-protein formulations, encouraging consumer trial and repeat purchases. This broader distribution network ultimately accelerates market penetration and boosts overall casein consumption in the country.

Growth in Industrial and Specialty Applications

Casein’s use in industrial applications significantly supports the market growth, owing to its film-forming, adhesive, and biodegradable properties. It is applied in paper coatings, packaging adhesives, paints, and textile finishing, where manufacturers prefer natural, eco-friendly materials over synthetic alternatives. As sustainability becomes a priority, industries are adopting casein-based formulations to reduce environmental impact while maintaining product performance. This diversification across non-food sectors adds resilience and long-term stability to the United States casein market.

Market Outlook 2026-2034:

The United States casein market is positioned for sustained growth throughout the forecast period, supported by expanding protein consumption trends and diversifying end-use applications. The market size was estimated at 45.34 Thousand Tons in 2025 and is expected to reach 59.88 Thousand Tons by 2034, reflecting a compound annual growth rate of 3.14% over the forecast period 2026-2034. Technological advancements in dairy processing and growing consumer emphasis on high-quality protein sources will continue to drive market expansion. The increasing popularity of functional foods and dietary supplements positions casein as a critical ingredient for manufacturers addressing evolving nutritional requirements.

United States Casein Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Acid Casein | 58% |

| End Use | Food and Beverages | 71% |

| Region | South | 35% |

Product Type Insights:

- Rennet Casein

- Acid Casein

Acid casein dominates with a market share of 58% of the total United States casein market in 2025.

Acid casein dominates the United States market due to its versatile functional properties essential for diverse manufacturing applications. The precipitation process using acids, such as lactic or hydrochloric acid, produces casein with superior gel-forming, emulsification, and texture modification capabilities highly valued in food product development. Acid casein finds extensive application in cheese production, bakery goods, confectionery items, and protein-enriched food formulations requiring stable binding and texturizing properties.

The segment benefits from growing demand in non-food industrial applications where acid casein serves as a critical component in adhesives, coatings, paper finishing, and specialty plastics manufacturing. A major portion of protein content and excellent film-forming characteristics make acid casein indispensable for technical applications requiring consistent quality and reliable performance. Manufacturers continue to invest in processing optimization to improve yield, purity, and functional attributes addressing evolving customer specifications.

End Use Insights:

To get detailed segment analysis of this market Request Sample

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Industrial

- Others

Food and beverages lead with a share of 71% of the total United States casein market in 2025.

The food and beverage segment commands market leadership through casein's fundamental importance in numerous product categories requiring high-quality dairy protein. Cheese manufacturing represents a substantial consumption channel where casein's coagulation properties and nutritional composition are essential for product development. The dietary supplement sector continues to expand rapidly, driven by consumer awareness about casein's slow-digesting characteristics ideal for muscle maintenance during extended fasting periods. As per IMARC Group, the United States dietary supplements market size was valued at USD 56.97 Billion in 2024.

Beyond traditional dairy applications, food manufacturers increasingly incorporate casein and caseinates into processed foods, bakery products, meat processing, coffee creamers, and fortified beverages requiring emulsification, viscosity control, and nutritional enhancement. The protein's neutral flavor profile and excellent compatibility with diverse formulations support expanding adoption across convenience foods, functional beverages, and specialized nutrition products. Sports nutrition brands particularly value casein for overnight recovery supplements, promoting sustained amino acid release that supports muscle protein synthesis during sleep.

Regional Insights:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 35% share of the total United States casein market in 2025.

The South leads the United States casein market due to its strong food and beverage (F&B) manufacturing base, especially in dairy processing, sports nutrition blending, and ready-to-drink protein beverages. Texas milk production increased from 16.6 Billion pounds in 2023 to 17.1 Billion pounds in 2024, demonstrating the expanding dairy capacity supporting casein manufacturing in the Southern region. The region’s large population, combined with a rising preference for high-protein diets, creates strong demand for casein-based products.

Additionally, the presence of major distribution hubs enables faster movement of ingredients to manufacturers, retailers, and export channels. The South also benefits from comparatively lower operational costs, supportive state-level business policies, and access to major ports along the Gulf Coast. These factors attract both domestic and international food-ingredient companies to set up production and distribution facilities. Moreover, the region’s expanding retail networks and rapid adoption of fitness and wellness trends further stimulate casein consumption, making the South a dominant market for both industrial and consumer-focused applications.

Market Dynamics:

Growth Drivers:

Why is the United States Casein Market Growing?

Increasing Consumer Focus on Protein-Rich Nutrition

The United States casein market is experiencing robust growth driven by escalating consumer emphasis on protein consumption for health optimization and fitness enhancement. As per findings from Cargill’s 2025 Protein Profile, individuals consumed more protein than ever, with 61% of Americans raising their protein consumption in 2024 compared to only 48% in 2019. Growing awareness about protein's role in muscle development, metabolic function, and weight management continues to expand demand for high-quality dairy protein ingredients across food and supplement categories. The fitness and wellness trend permeating American consumer culture has positioned casein as a preferred protein source, particularly valued for its sustained amino acid release supporting overnight muscle recovery. Health-conscious millennials and aging population seeking protein supplementation for muscle maintenance represent expanding consumer segments driving consistent market growth. The protein supplements market continues to attract substantial investment as manufacturers develop innovative casein-based formulations addressing diverse nutritional needs and consumption preferences.

Expanding Applications in Functional F&B Items

Market growth is accelerating through diversifying casein applications within the functional F&B industry responding to evolving consumer demands. Manufacturers increasingly incorporate casein into ready-to-drink protein beverages, meal replacement products, protein bars, and fortified dairy formulations offering enhanced nutritional profiles. The trend of utilizing convenient, on-the-go nutrition solutions supports casein adoption in portable protein formats designed for busy lifestyles. Ready-to-drink protein shakes and high-protein snacks utilizing casein's functional properties continue gaining market acceptance among mainstream consumers beyond traditional athletic demographics. Product innovations focusing on improved taste profiles, texture characteristics, and clean-label formulations broaden casein's appeal across expanding consumer segments.

Growing Pharmaceutical and Nutraceutical Utilization

The pharmaceutical and nutraceutical sectors represent expanding growth channels for casein consumption in the United States through specialized applications leveraging unique protein properties. Casein's biocompatibility, controlled-release characteristics, and bioactive peptide content support increasing adoption in drug delivery systems and therapeutic nutrition formulations. Clinical nutrition products targeting medical conditions requiring sustained protein intake increasingly utilize micellar casein for optimal amino acid availability. The aging population demographic is driving the demand for specialized nutrition products addressing sarcopenia, immune support, and overall health maintenance where casein-based formulations offer distinct advantages. The number of Americans aged 100 and above is anticipated to increase more than fourfold over the next thirty years, rising from an estimated 101,000 in 2024 to approximately 422,000 in 2054, based on estimates from the US Census Bureau. Nutraceutical manufacturers continue to develop casein-derived bioactive peptides demonstrating potential health benefits beyond basic nutrition.

Market Restraints:

What Challenges is the United States Casein Market Facing?

Competition from Plant-Based Protein Alternatives

The casein market faces increasing competitive pressure from expanding plant-based protein alternatives appealing to consumers seeking dairy-free nutrition options. Growing veganism, lactose intolerance awareness, and sustainability concerns are directing consumer preferences towards soy, pea, and other plant proteins displacing traditional dairy protein consumption in certain market segments.

Raw Material Price Volatility and Supply Fluctuations

Market participants encounter challenges from fluctuating milk prices influenced by agricultural conditions, feed costs, and supply-demand imbalances affecting production economics. Weather variations, dairy farming consolidation, and global trade dynamics contribute to price volatility impacting manufacturer margins and long-term planning capabilities.

Allergy Concerns and Dietary Restrictions

Casein protein allergies and dairy sensitivities among certain consumer populations limit market expansion potential in specific demographic segments. Increasing awareness about food allergies and mandatory labeling requirements necessitate careful product positioning and transparent communication regarding dairy-derived ingredient content.

Competitive Landscape:

The United States casein market features a moderately consolidated competitive structure with established multinational dairy corporations competing alongside specialized protein ingredient manufacturers. Leading players leverage extensive dairy processing infrastructure, research capabilities, and global distribution networks to maintain market positions. Competition centers on product quality differentiation, functional performance optimization, and sustainable sourcing practices addressing evolving customer requirements. Strategic partnerships between dairy cooperatives and food manufacturers facilitate reliable supply arrangements while supporting product development initiatives. Investments in processing technology upgrades and capacity expansion characterize competitive strategies among market leaders seeking to address growing demand for premium casein products.

United States Casein Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Rennet Casein, Acid Casein |

| End Uses Covered | Food and Beverages, Pharmaceuticals, Cosmetics, Industrial, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States casein market size reached 45.34 Thousand Tons in 2025.

The market is expected to grow at a compound annual growth rate of 3.14% from 2026-2034 to reach 59.88 Thousand Tons by 2034.

Acid casein dominates the market with a share of 58%, driven by its superior functional properties for food processing, industrial applications, and diverse manufacturing requirements.

Key factors driving the United States casein market include increasing consumer focus on protein-rich nutrition, expanding applications in functional foods and beverages, growing pharmaceutical and nutraceutical utilization, and rising demand from the sports nutrition sector.

Major challenges include competition from plant-based protein alternatives, raw material price volatility and supply fluctuations, allergy concerns limiting consumption among sensitive populations, and complex manufacturing requirements impacting production costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)