United States Fruit Juice Market Expected to Reach USD 77.5 Billion by 2033 - IMARC Group

United States Fruit Juice Market Statistics, Outlook and Regional Analysis 2025-2033

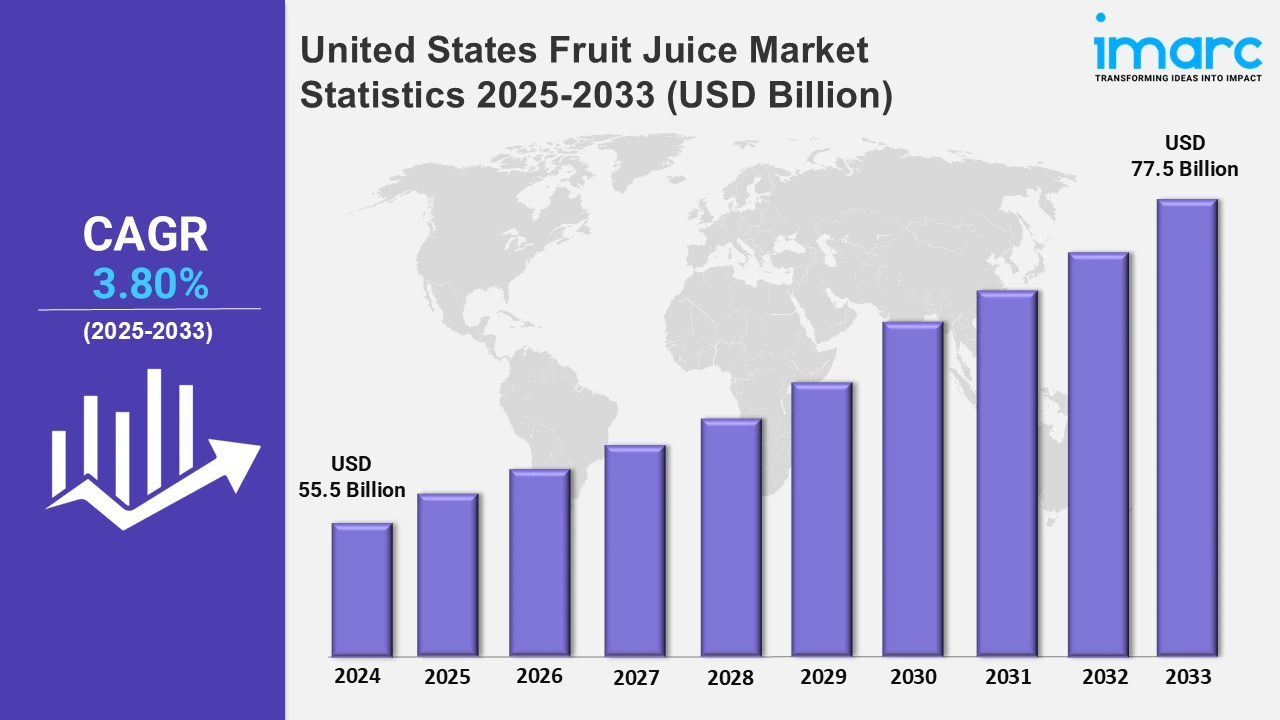

The United States fruit juice market size was valued at USD 55.5 Billion in 2024, and it is expected to reach USD 77.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% from 2025 to 2033.

To get more information on this market, Request Sample

Fruit juice companies are entering new markets, employing modern shop layouts and smart technologies to improve productivity and consumer experience. This method promotes regional expansion while keeping up with changing customer expectations for convenience, quality, and innovation in the beverage industry. For example, in June 2024, Clean Juice opened two additional sites in Eugene, Oregon, and Prosper, Texas, owned by BRIX Holdings. The openings promote nationwide expansion, with modernized shop designs and advanced technologies to boost productivity and customer satisfaction.

Moreover, fruit beverage producers are working on providing low-sugar and no-added-sugar choices for younger customers, which reduce sweetness while retaining nutritional value. These products are being launched in a variety of flavors and improving through online and retail channels, reflecting evolving consumer preferences for healthier and more accessible drink options. For instance, in March 2024, Michelle Obama's PLEZi Nutrition introduced PLEZi FiZZ, a sparkling fruit beverage designed for tweens and teens. The drink contains 70% less sugar, focusing on lowering sweetness while offering nutritional value. It comes in three flavors and is sold through Amazon and selected US retailers to expand accessibility. Furthermore, fruit juice factories in the US are progressively using automation and sustainable techniques to fulfill increased demand in the residential, commercial, and hospitality sectors. Companies are seeking to improve efficiency and reduce production costs by 50% by 2030 by integrating modern technologies such as PLC and SCADA systems, aligning with the Department of Energy's circular economy goals. For example, Louis Dreyfus Company (LDC) has developed a zero-waste juice manufacturing technique that uses every part of the fruit, i.e., extracting juice, recovering oils, and converting the residual pulp into animal feed pellets. LDC has also invested in the construction of a cutting-edge dry-peel factory, which will generate dry peel from ripe oranges, lemons, and limes for pectin extraction. These measures not only increase efficiency and reduce waste, but they also correspond with customer desires for sustainable products, demonstrating the industry's commitment to responsible manufacturing and distribution processes.

United States Fruit Juice Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. Elevating health consciousness and rising preference for natural and organic drinks in various regions of the US is significantly driving the growth of the market. Additionally, the shift toward ecological packaging boosts the growth of the market.

Northeast Fruit Juice Market Trends:

Consumers in the Northeast are increasingly turning to antioxidant-rich grape juices, particularly those prepared from locally grown Concord grapes. Welch's, headquartered in Concord, Massachusetts, leads this industry through partnerships with family-owned farms in New York and Pennsylvania. The firm sells grape juice in a range of flavors, including reduced-sugar and sparkling varieties, to health-conscious customers looking for natural and functional beverages.

Midwest Fruit Juice Market Trends:

Midwest customers prefer juices prepared from regional fruits, which helps local farmers and promotes fresh and farm-to-table drinks. Old Orchard Brands, based in Sparta, Michigan, obtains apples and cherries from Michigan's vast orchards. The firm provides no-sugar and blended juices, meeting the region's need for healthier and locally made juice choices.

South Fruit Juice Market Trends:

In the South, Florida's juice business is responding to citrus greening disease and variable orange production by releasing new citrus types and tropical mixes. Tropicana, founded in Bradenton, Florida, is at the vanguard of this trend, introducing mango, pineapple, and tangerine juices to its product portfolio. In addition, the company is supplementing its beverages with vitamins to preserve consumer faith amid declining orange production.

West Fruit Juice Market Trends:

Health-conscious consumers in the West are increasingly opting for functional juices with added health benefits, which is fueling innovation in plant-based and superfood-infused beverages. Jamba Juice, founded in San Luis Obispo, California, has embraced this trend by using ingredients such as acai, kale, and chia seeds. With a significant presence in Los Angeles and San Francisco, the brand continues to meet the need for wellness-oriented beverages.

Top Companies Leading in the United States Fruit Juice Industry

Some of the leading United States fruit juice market companies have been mentioned in the report. Key players are employing internet channels to increase individual involvement and streamline distribution via e-commerce platforms. Additionally, partnerships and acquisitions are undertaken to strengthen market presence and diversify product offerings, maintaining competitiveness in a changing market landscape. For example, in May 2024, Brix Holdings acquired Clean Juice, an organic juice bar franchise with 75 USDA-certified locations. The business intends to introduce 15-20 outlets more by 2025, while also overhauling operations and retail architecture. Key Clean Juice personnel have joined Brix Holdings to support these projects.

United States Fruit Juice Market Segmentation Coverage

- Based on the product type, the market has been segmented into 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others. 100% fruit juice provides pure and unsweetened options. Nectars contain fruit pulp with added water and sweeteners. Juice drinks combine juice with flavors and additives.Concentrates offer cost-effective and reconstitutable options. Powdered juice caters to convenience-focused consumers with a longer shelf life and easy storage.

- Based on the flavor, the market is categorized into orange, apple, mango, mixed fruit, and others. Orange juice is known for its high vitamin C content. Apple juice is popular for its gentle sweetness and digestive properties. Mango juice is gaining popularity due to its unique flavor. Mixed fruit juice provides distinct combinations for those who prefer diversity.

- Based on the distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, specialty food stores, online retail, and others. Supermarkets and hypermarkets provide a wide range of brands as well as bulk purchasing options. Convenience stores appeal to impulsive customers by offering ready-to-drink alternatives. Specialty food stores specialize in premium, organic, and focused items. Online retail, which is expanding together with e-commerce demand, offers subscription models and direct-to-consumer delivery to convenience-driven customers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 55.5 Billion |

| Market Forecast in 2033 | USD 77.5 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Fruit Juice Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)