U.S. Pasta Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channels and Region, 2025-2033

U.S. Pasta Market Size and Share:

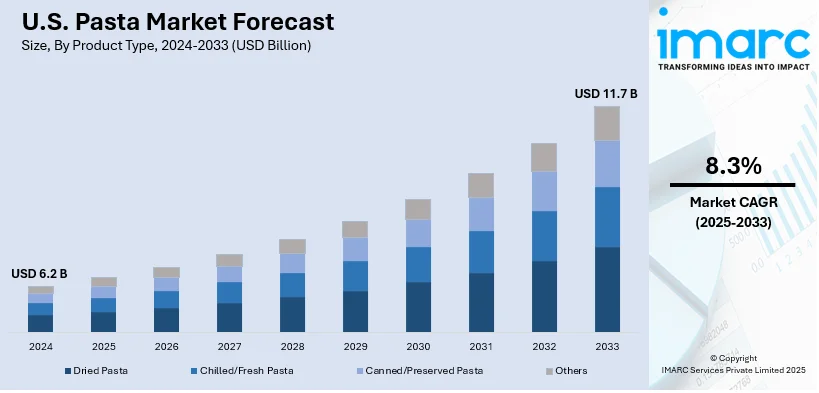

The U.S. pasta market size is anticipated to reach USD 6.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.7 Billion by 2033, exhibiting a CAGR of 8.3% from 2025-2033. The U.S. pasta market is driven by the increasing consumer demand for convenience foods, rising health-consciousness leading to whole grain and gluten-free options, continuous innovation in product varieties, and a growing preference for plant-based and organic pasta.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.7 Billion |

| Market Growth Rate (2025-2033) | 8.3% |

Italian food, particularly pasta, remains a significant cultural influence in the U.S., driving the growth of the pasta market. Italian restaurants, food chains, and cooking shows have contributed to increasing the popularity of pasta dishes. According to the National Restaurant Association, 61% of consumers reported eating Italian food at least once a month, with pasta being a prominent choice. As consumers attempt to replicate authentic Italian dishes using a wide range of pasta types, this cultural affinity has increased demand for pasta products in both restaurants and at home.

Besides this, the growth of online grocery shopping is another crucial factor driving the pasta market in the U.S. With the rise of e-commerce platforms like Amazon, Walmart, and specialized food delivery services, consumers now have easier access to a broad selection of pasta brands and products. For instance, the global online food delivery market is valued at $1.04 trillion, encompassing $640 billion from groceries and $390 billion from meal deliveries. This expansion of online grocery shopping and food delivery platforms offers consumers greater convenience, enabling U.S. pasta brands to reach a larger audience, boost sales, and cater to the growing demand for diverse pasta products, further bolstering the growth of the pasta market in the country.

U.S. Pasta Market Trends:

Rising demand for convenience foods

As consumers increasingly seek time-saving options, the demand for ready-to-eat (RTE) and easy-to-prepare meals has surged. Pasta, being a versatile and quick meal solution, has become a staple in many American households. The popularity of instant and microwavable pasta products, as well as pre-cooked pasta options, has expanded due to their ability to save time in meal preparation. These products appeal to busy professionals, students, and families, as they offer convenience without compromising on taste or nutritional value. Consequently, producers are continuously innovating and introducing different pasta flavors and shapes, further enhancing its appeal as a quick and filling meal choice, which is strengthening the market growth.

Health-conscious consumer preferences

Another crucial factor impelling the market growth is the expanding health-conscious consumer base. There has been a growing shift towards healthier eating habits among U.S. consumers, and this trend is influencing pasta consumption. Health-conscious buyers are increasingly looking for pasta made from whole grains, such as whole wheat or brown rice, as well as gluten-free alternatives. The rising awareness of gluten sensitivity and celiac disease has accelerated the demand for gluten-free pasta products. Moreover, there is a growing interest in plant-based and high-protein pasta varieties, such as those made from chickpeas, lentils, or quinoa. These pasta options cater to consumers who are looking for healthier, more nutritious alternatives to traditional pasta. The emerging trend towards clean-label products, with minimal additives and preservatives, encouraging manufacturers to produce healthier pasta offerings is aiding in market expansion.

Innovation in product varieties

The U.S. pasta market is experiencing continuous innovation as manufacturers introduces diverse pasta types and flavors to cater to changing consumer tastes. There is a notable shift towards specialty pasta, such as organic, low-carb, and keto-friendly varieties. Additionally, the increasing product incorporation into new meal formats, such as pasta salads, baked pasta dishes, and RTE bowls, are offering convenience alongside flavor variety. The advent of innovative flavors, such as pasta made with spinach, tomato, and even spices like saffron, is contributing to the market expansion. Furthermore, pasta producers are experimenting with different shapes and sizes to attract consumers looking for novelty in their food experiences. This trend caters to the demand for variety and reflects the growing culinary experimentation among consumers who are seeking new and exciting food options.

U.S. Pasta Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. pasta market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, raw material, and distribution channel.

Analysis by Product Type:

- Dried Pasta

- Chilled/Fresh Pasta

- Canned/Preserved Pasta

- Others

The extended shelf life, affordability, and convenience of storage of dried pasta are the main factors driving demand for the product in the US market. Consumers seeking price and convenience are likely to find it appealing, and popular options for home cooking include spaghetti, penne, and fusilli.

In line with this, fresh or chilled pasta is becoming highly popular since it tastes better than dried spaghetti and has a better texture. It is preferred by customers looking for luxurious meals at home and is frequently regarded as a premium product. Its shorter shelf life makes it more perishable, but increasingly popular choice.

Moreover, for busy customers, the pasta that has been canned or preserved provides a quick and easy RTE option. It usually comes in precooked forms, including spaghetti with sauce, which appeals to people who are searching for quick meal options. An increasing demand for easily prepared shelf-stable food is amplifying the segment's expansion

Furthermore, growing health consciousness among customers with dietary restrictions is fueling demand for additional categories, such as specialty pasta products like gluten-free, organic, or high-protein pasta variants. This market segment is developing as more consumers are seeking pasta alternatives, enhancing the market's variety and choices.

Analysis by Raw Material:

- Durum Wheat Semolina

- Wheat

- Mix

- Barley

- Rice

- Maize

- Others

Pasta is primarily made of durum wheat semolina due to its high gluten concentration, which gives firm texture. It enhances the flavor and authenticity of Italian pasta and is used for creating classic pasta varieties like spaghetti and penne.

Concurrently, soft wheat, is widely used for pasta production due to its availability and versatility. The gluten content is lower than that of durum wheat, forming the base for various varieties of pasta. Wheat-based pasta is usually affordable and accessible to a broader consumer base.

Moreover, pasta produced from a combination of various grains or flours, like wheat and rice or wheat and maize, is referred to as being in the mix category. These combinations enable the production of specialty pasta varieties with unique flavors or textures, appealing to niche customers such as those who prefer gluten-free or organic pasta.

Furthermore, due to its high fiber and nutritional value, barley is frequently utilized in specialty pasta products. Customers searching for healthier substitutes for conventional wheat pasta find it appealing. Pasta made from barley is promoted as a whole-grain choice which improve digestive health and appeal to the expanding wellness trend.

Besides that, rice-based pasta is highly popular in gluten-free diets and Asian cuisine. It has a soft, delicate texture which is amplifying its demand is growing with a rising number of consumers opting for gluten-free lifestyles. Rice pasta is a major component of catering to dietary restrictions and alternative pasta options.

Moreover, corn or maize is used for the production of gluten-free pasta, which makes this an important raw material in the growing segment of consumers sensitive to gluten. Maize pasta has a special texture and is also highly nutrient-rich, containing fiber which is appealing in health-conscious markets.

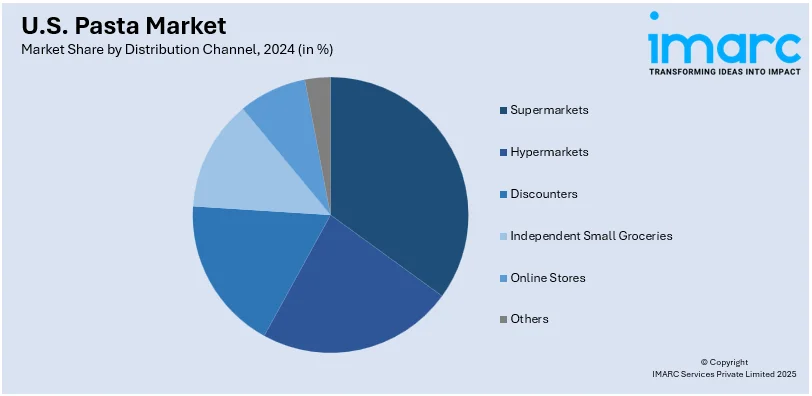

Analysis by Distribution Channel:

- Supermarkets

- Hypermarkets

- Discounters

- Independent Small Groceries

- Online Stores

- Others

Pasta continues to be largely distributed through supermarkets, which offer a broad selection of brands and products. They serve mass-market customers by offering frequent promotions, competitive pricing, and convenience. These markets are frequently preferred by customers due to their convenient location and one-stop shopping experience.

Additionally, hypermarkets offer a wider variety of pasta products at affordable rates by combining the features of department stores and supermarkets. Their growing market share is attributed to being able to draw in budget-conscious customers by offering a wider range of international pasta brands in addition to bulk choices.

Furthermore, discount stores concentrate on providing pasta at reduced costs, which makes them a popular choice for customers on a restricted budget. These shops frequently carry basic pasta brands in large quantities, serving families and individuals looking for affordable meal options. Pasta sales among price-conscious consumers gained momentum from their expanding visibility.

Moreover, independent small grocery stores cater particularly to local markets by carrying artisanal or specialty pasta brands. These shops offer individualized attention and an appropriate selection to consumers looking for gourmet, gluten-free, or organic pasta variations. Despite having a smaller reach, they are crucial for meeting the various needs of customers.

Along with this, online stores have gained major popularity for their convenience from which people can order an unlimited amount of pasta varieties from their home. Two of the largest players of e-commerce portals are Amazon and Walmart, which enable customers to compare prices with other merchants, purchase specialty items online, and take advantage of home delivery.

Also, the "Others" category includes other distribution channels, such as foodservice providers, restaurants, and direct sales from manufacturers. This is an important segment for pasta brands as they cater to specific market needs, such as catering services, institutional sales, and bulk purchasing by foodservice operators.

Regional Analysis:

- Northeast

- Midwest

- South

- West

A diversified, health-conscious population that prefers premium, organic pasta options precisely defines the Northeast region. The consumption of pasta is largely influenced by cities like New York and Boston, where multicultural influences and culinary trends are boosting up demand for gourmet and premium pasta variations.

Additionally, pasta is traditionally consumed in the Midwest, where family-sized portions and reasonably priced alternatives are highly preferred. The demand for dry pasta is driven by consumers in this region which place a high emphasis on convenience and affordability. The development of locally derived pasta, especially wheat-based variants, is further encouraged by the region's agricultural influence.

Moreover, the consumption of pasta is amplifying in the South, especially with the popularity of comfort food and fast-casual dining. The region is witnessing a boost in interest in gluten-free alternatives for pasta products, which reflects shifting dietary choices, with a high demand for affordable choices.

Furthermore, the pasta market in the West is thriving due to consumers who have concerns about their health and the environment. Pasta products that are gluten-free, plant-based, and organic are in high demand. A broad culinary culture is reflected in the leading adoption of specialized and niche pasta variants in cities like Los Angeles and San Francisco.

Competitive Landscape:

The competitive landscape of the U.S. pasta market is highly fragmented, with a mix of large, established brands and smaller, innovative companies. Prominent players dominate the market, offering a wide range of traditional and specialty pasta products. However, the market is also characterized by the presence of niche brands that focus on gluten-free, organic, and high-protein pasta options. The competition is driven by factors such as price, product quality, convenience, and innovation. E-commerce has become a key channel for brands to reach consumers, allowing them to offer a diverse selection of pasta products directly to consumers. Besides this, health and wellness trends are pushing companies to explore alternative pasta options like whole-grain, low-carb, and plant-based products. As the market becomes more dynamic, companies are focusing on product differentiation, sustainability, and leveraging new technologies to improve pasta texture, flavor, and nutritional content.

The report provides a comprehensive analysis of the competitive landscape in the U.S. pasta market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Barilla, the world’s leading pasta maker, launched a limited-edition pasta, Barilla Snowfall, for the holiday season. Inspired by fun shapes, 46% of Americans are interested in trying new pasta forms, with 54% eager for seasonal variations. Barilla Snowfall features three unique shapes symbolizing snowflakes, poinsettias, and hearts, reflecting tradition, joy, and love. The pasta offers home chefs a chance to create holiday-inspired dishes like Creamy Chicken, Broccoli & Barilla Snowfall Pasta.

- In September 2024, Barilla expanded its Pesto sauce line with three new varieties Creamy Tomato Pesto, Sweet and Spicy Pepper Pesto, and Vegan Pesto exclusively available at Kroger starting in October 2024. These new flavors cater to diverse tastes, offering creamy, spicy, and sweet notes. Matt Michaels, Pesto Brand Manager, emphasized that the sauces bring authentic Mediterranean flavors, aiming to inspire culinary creativity and become a beloved staple in kitchens across the U.S. this fall.

- In January 2024, Seviroli Foods acquired a portfolio of Italian frozen pasta products, including ravioli, tortellini, and other specialty foods, from Ajinomoto Foods North America. This acquisition expands Seviroli's product offerings in the foodservice and retail markets, strengthening relationships with customers and suppliers. Paul Vertullo, CEO of Seviroli, stated that the acquisition accelerates the company’s growth and strategic vision, enhancing its ability to serve customers across all food channels.

U.S. Pasta Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dried Pasta, Chilled/Fresh Pasta, Canned/Preserved Pasta, Others |

| Raw Materials Covered | Durum Wheat Semolina, Wheat, Mix, Barley, Rice, Maize, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discounters, Independent Small Groceries, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. pasta market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. pasta market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pasta refers to pasta products manufactured and consumed including various types such as spaghetti, macaroni, and fusilli. It is often made from durum wheat semolina or other grains, with a focus on convenience and versatility.

The U.S. pasta market size is anticipated to reach USD 6.2 Billion in 2025.

IMARC estimates the U.S. pasta market to exhibit a CAGR of 8.3% during 2025-2033.

Some of the key factors supporting the market growth is the increasing consumer preference for convenient, quick meals, a growing demand for healthier pasta options like gluten-free and organic varieties, and rising popularity of international cuisines. Additionally, strong retail distribution channels and innovations in pasta products further boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)