United States PET Packaging Market Report by Packaging Type (Rigid Packaging, Flexible Packaging), Form (Amorphous PET, Crystalline PET), Pack Type (Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, and Others), Filling Technology (Hot Fill, Cold Fill, Aseptic Fill, and Others), End User (Beverages Industry, Household Goods Sector, Food Industry, Pharmaceutical Industry, and Others), and Region 2026-2034

Market Overview:

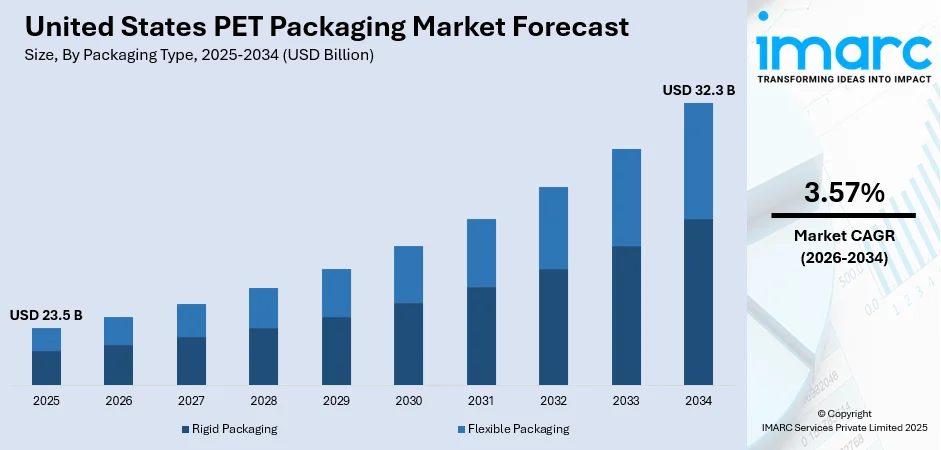

The United States PET packaging market size reached USD 23.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 32.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.57% during 2026-2034.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 23.5 Billion |

| Market Forecast in 2034 | USD 32.3 Billion |

| Market Growth Rate 2026-2034 | 3.57% |

Access the full market insights report Request Sample

Polyethylene terephthalate, or PET, is a thermally stable, durable and unbreakable plastic. It is resistant to microorganisms and has emerged as an innovative and attractive packaging solution in numerous industries. It maintains the quality of the packaged content and protects it from degradation by exhibiting high dimensional stability and resistance to moisture, alcohol, or solvents. PET packaging also provides resistance to diluted alkalis and halogenated hydrocarbons. It is manufactured by melting pellets of PET resin and extruding the molten liquid into various shapes as per requirement.

To get more information on this market Request Sample

The United States PET packaging market is primarily driven by the growing presence of strict food security policies. The increasing awareness regarding eco-friendly products is also propelling the growth of the market. Additionally, there has been a rise in the demand for multi-packs and combination products with the emerging trend of convenient and on-the-go food consumption. Furthermore, its low production and shipping costs are also prompting manufacturers to adopt PET packaging.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the United States PET packaging market report, along with forecasts at the country and regional level from 2026-2034. Our report has categorized the market based on packaging type, form, pack type, filling technology and end user.

Breakup by Packaging Type:

- Rigid Packaging

- Flexible Packaging

Breakup by Form:

- Amorphous PET

- Crystalline PET

Breakup by Pack Type:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Breakup by Filling Technology:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

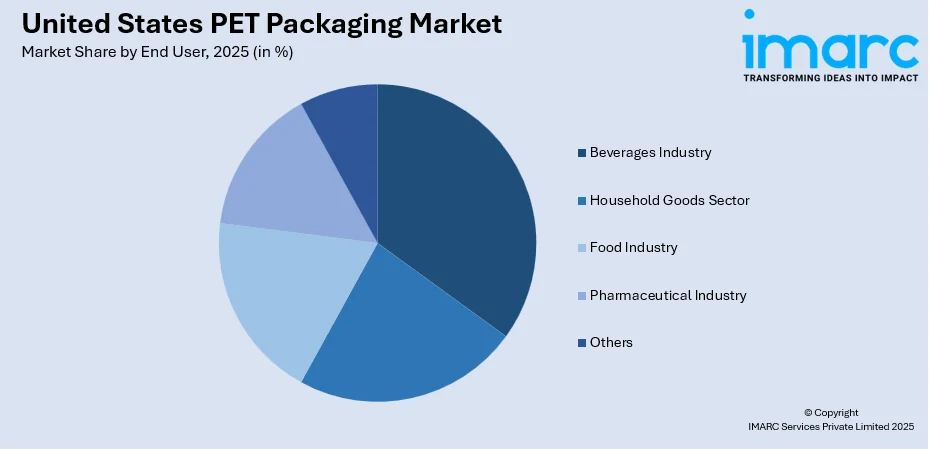

Breakup by End User:

To get detailed segment analysis of this market Request Sample

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Packaging Type, Form, Pack Type, Filling Technology, End User, Region |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States PET packaging market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States PET packaging market?

- What are the key regional markets?

- What is the breakup of the market based on the packaging type?

- What is the breakup of the market based on the form?

- What is the breakup of the market based on the pack type?

- What is the breakup of the market based on the filling technology?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States PET packaging market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)