Global Water Treatment Chemicals Market Expected to Reach USD 57.35 Billion by 2033 - IMARC Group

Global Water Treatment Chemicals Market Statistics, Outlook and Regional Analysis 2025-2033

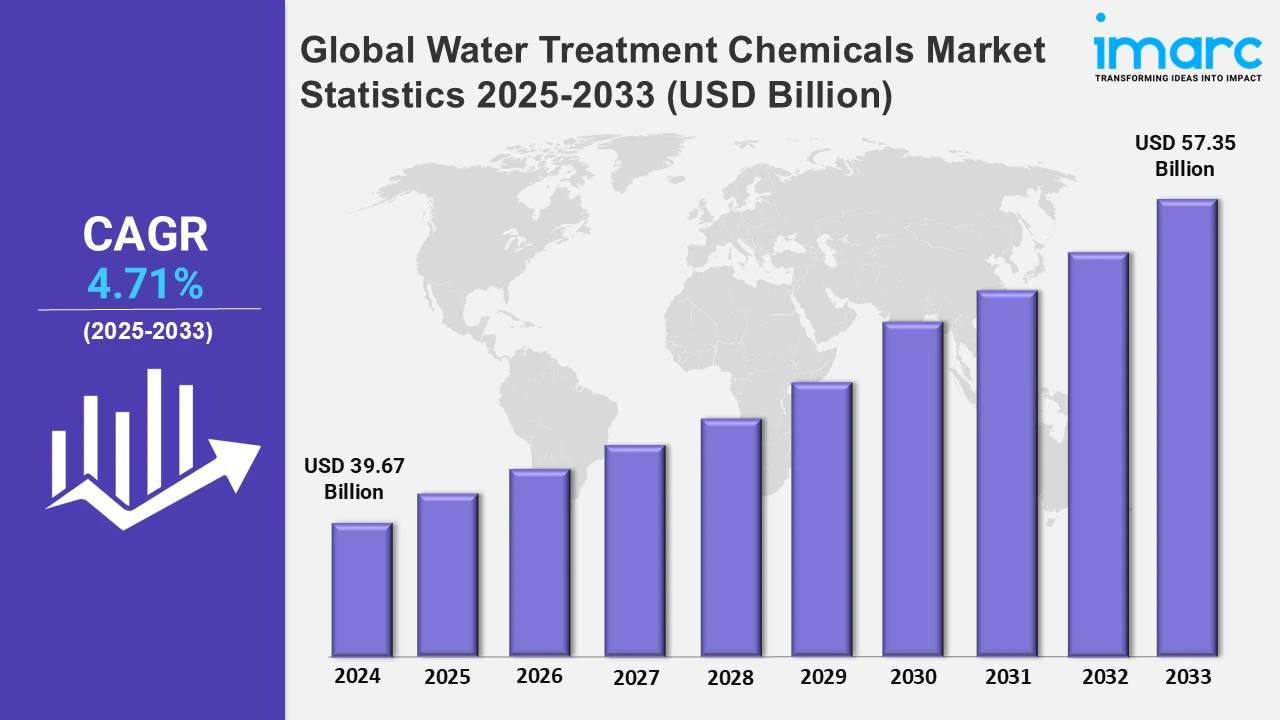

The global water treatment chemicals market size was valued at USD 39.67 Billion in 2024, and it is expected to reach USD 57.35 Billion by 2033, exhibiting a growth rate (CAGR) of 4.71% from 2025 to 2033.

To get more information on this market, Request Sample

The global market is primarily driven by the increasing demand for clean and safe water in both industrial and municipal sectors. Rapid industrialization, coupled with stringent government regulations on wastewater treatment, is significantly enhancing the need for chemical solutions to ensure environmental compliance. Industries such as power generation, food and beverage, oil and gas require substantial volumes of treated water, which is increasing the demand for water treatment chemicals. Furthermore, rising global awareness of water scarcity and pollution has encouraged investments in advanced water treatment technologies, fostering market growth. Additionally, ongoing innovations in chemical formulations, such as eco-friendly and biodegradable options, are also gaining traction, meeting both regulatory standards and consumer expectations for sustainable solutions. On 17th July 2024, Kurita America partnered with Solugen to develop carbon-negative, bio-based water treatment solutions as alternatives to traditional phosphorus and petroleum-based additives. This collaboration aligns with Kurita’s CSV initiative, aiming to enhance sustainability by reducing CO2 emissions, water usage, and industrial waste while improving performance. A key innovation includes the Tower NG series, utilizing Solugen’s biodegradable corrosion inhibitor for effective and eco-friendly water treatment.

In addition, the rising urbanization and population growth, which place immense pressure on water resources, is favoring the market expansion. Municipal water treatment facilities are scaling operations to provide safe drinking water and manage wastewater effectively. Thus, this is also significantly supporting the market demand. Concurrently, the growing adoption of desalination processes in water-scarce regions, particularly in the Middle East and Africa, is escalating the use of treatment chemicals. Emerging economies are also witnessing increased infrastructure investments in water management systems, further propelling market growth. On 5th December 2024, PTx Trimble launched WM-FieldForm, an advanced system enabling farmers to manage water flow for improved land shaping, grading, and irrigation across diverse climates. Designed to enhance crop yields and support sustainable farming, WM-FieldForm reduces soil erosion, limits nutrient loss, and enhances water efficiency. The system empowers farmers with tools to optimize field surfaces while preserving topsoil and resources. Moreover, the expanding use of chemicals such as coagulants, flocculants, and biocides underline their critical role in maintaining water quality across diverse applications.

Global Water Treatment Chemicals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, urbanization, and increasing investments in water management infrastructure. The region's demand is also driven by agricultural needs, wastewater recycling, and advancements in desalination technologies.

Asia-Pacific Water Treatment Chemicals Market Trends:

Asia Pacific dominates the global water treatment chemicals market, driven by rapid industrialization, urbanization, and growing population levels. The region’s growing industrial sectors, including power generation, manufacturing, and food processing, contribute to a high demand for water treatment solutions to meet operational and regulatory standards. Additionally, countries such as China, India, and Japan are heavily investing in municipal water treatment infrastructure to address water scarcity and pollution challenges. Increased agricultural activities and the rising need for wastewater recycling further enhance the demand for treatment chemicals in the region. At the Singapore International Water Week, SUEZ announced three major water management projects in Asia, focusing on sustainability and resilience on 20th June 2024. Highlights include a Smart Water Grid Analytics Platform for Singapore's PUB, a large-scale desalination plant in Iloilo, Philippines, serving 50,000 households, and an industrial wastewater recycling facility in China’s Jining Industrial Park, achieving 100% water reuse. These initiatives showcase SUEZ's commitment to innovative, circular water solutions. Moreover, government initiatives promoting sustainable water management and advancements in desalination technologies also support market growth, positioning Asia Pacific as a crucial hub for water treatment chemicals.

North America Water Treatment Chemicals Market Trends:

The water treatment chemicals market in North America is primarily driven by stringent environmental regulations and the high industrial consumption of water. The need for advanced wastewater treatment technologies, coupled with sustainable solutions, is fueling demand for coagulants and biocides chemicals in the region. With robust municipal infrastructure and increasing investments in industrial water reuse, the market continues to grow. Key industries, including oil and gas, power generation, and food processing, play a significant role in market expansion.

Europe Water Treatment Chemicals Market Trends:

Stricter environmental policies in combination with increased focus on sustainability help shape the market for Europe's water treatment chemicals. The adoption of a circular economy in the region continues to fuel the use of advanced recycling and water treatment technologies. The manufacturing, chemical processing, and power generation sectors are amongst the major market drivers. Improved public awareness concerning water-saving as well as the increased use of eco-friendly chemicals support demand growth in the market over Europe.

Latin America Water Treatment Chemicals Market Trends:

The water treatment chemicals market is growing in Latin America with increasing industrialization and rising attention to improving municipal water infrastructure. The agricultural sector that heavily relies on irrigation water treatment solutions also increases demand. Countries such as Brazil and Mexico are investing in projects including wastewater treatment and desalination to address issues that come with scarcity and pollution. These factors together work to better the growth potential of this market in the region.

Middle East and Africa Water Treatment Chemicals Market Trends:

The Middle East and Africa regions demonstrate a lot of growth prospects in the water treatment chemicals market due to the scarcity of fresh water and its reliance on desalination technologies. Urban and industrial growth in the geographies such as UAE, Saudi Arabia, and South Africa also increases the consumption of treated water. Various governments are heavily investing in infrastructure projects across these regions to improve quality. The use of chemicals to treat water in municipalities and industries is imperative to sustain scarce water resources in this geography.

Top Companies Leading in the Water Treatment Chemicals Industry

Some of the leading water treatment chemicals market companies include BASF SE, Ecolab Inc., Kemira OYJ, Solenis LLC, Akzo Nobel N.V., Baker Hughes Incorporated, Lonza, The DOW Chemical Company, Snf Floerger, and Suez S.A, among others. On 5th November 2024, Solenis acquired BASF's flocculants business for mining applications, enhancing its portfolio to better support mining and mineral processing industries. The acquisition includes renowned product lines such as Magnafloc, Rheomax, Alclar, Alcotac, Jetwet, Aerowet, and Alcotech along with BASF’s customer base and expertise. This move strengthens Solenis' position as a leader in specialty chemicals, focusing on operational efficiency, sustainability, and innovation for the mining sector.

Global Water Treatment Chemicals Market Segmentation Coverage

- On the basis of the type, the market has been categorized into coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, Ph adjusters and softeners, defoaming agents, and others, wherein coagulants and flocculants represent the leading segment. This can be attributed to their critical role in removing impurities and suspended solids. They are widely used in municipal water treatment and industrial applications for improving the clarity of water and for quality standards. Coagulants neutralize particle charges to facilitate aggregation, while flocculants render removal easier through sedimentation. Increasing industrialization, urbanization, and rising awareness of water quality drive demand for them, thus consolidating their dominance in the market.

- Based on the end user, the market is classified into municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper and others, amongst which municipal dominates the market. This can be supported by the growing need for clean drinking water and effective wastewater management. As urbanization and population increase, treated water is in higher demand to ensure public health as well as environmental sustainability by municipalities. Governments worldwide are increasing investment in advanced water treatment facilities and technologies, leading to increased chemical usage. Coagulants, disinfectants, and flocculants are extensively applied in municipal systems, solidifying this segment’s leading position in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 39.67 Billion |

| Market Forecast in 2033 | USD 57.35 Billion |

| Market Growth Rate 2025-2033 | 4.71% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Ecolab Inc., Kemira OYJ, Solenis LLC, Akzo Nobel N.V., Baker Hughes Incorporated, Lonza, The DOW Chemical Company, Snf Floerger, Suez S.A, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Water Treatment Chemicals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)