West Africa Food Services Market Report by Distribution Channel (Online, Offline), End Use (Commercial, Non-Commercial), Retail Type (Eat-In, Take Away), Food Service Type (Full Service Restaurants, Fast-Food Joints, Streets Kiosks/Stalls, Cafes and Bars, and Others), and Region 2025-2033

Market Overview:

The West Africa food services market size reached USD 6.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7% during 2025-2033. The increasingly hectic work schedules of the masses, considerable growth in the travel and tourism sector, and inflating disposable income levels of the consumers represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.4 Billion |

| Market Growth Rate 2025-2033 | 7% |

The Increasingly Hectic Work Schedules of The Masses are Augmenting the Market Growth

The food services market has been experiencing continuous growth. The increasingly hectic lifestyles and work schedules of the masses represent one of the primary drivers resulting in the increasing adoption of food services. The growing work hours resulting in less time to time to prepare meals at home is resulting in a higher probability of individuals opting to eat out or order food for delivery. In addition to this, the shifting lifestyle patterns of West Africans due to the region's rapid urbanization and modernization is further fueling the demand for food services.

The Considerable Growth in the Travel and Tourism Sector is Stimulating the Market Growth

West Africa is a culturally diverse region and is, therefore, a popular tourist destination, which is resulting in an increasing number of tourists supporting local eateries. The rising inclination of tourists towards local cuisines is leading to a considerable increase in demand for food services. Additionally, this growth in tourism has contributed to the development of the hospitality industry, which encompasses hotels, resorts, and lodges that offer local, multicuisine and gourmet dining options to cater to the demands of their guests. As a result, the food service industry in West Africa is facing a positive market outlook, with the establishment of new restaurants and food delivery services to address the increasing demand.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is fragmented due to the presence of a large number of global and regional players. The volume of new entrants is moderate in the food services industry due to low product differentiation and switching cost, the requirement of high capital investment and R&D cost.

What are Food Services?

Food services refer to the provision of food and related services to individuals or groups that encompass a wide range of activities, from menu planning and food preparation, meal delivery services and meal kit providers, to cleaning and maintaining kitchen equipment. Such services may also refer to companies that furnish food and beverage options to other organizations or businesses, which includes vending machine operators and corporate catering services. Food services are often customized to cater to the specific needs and preferences of the consumer, such as inclusion or removal of specific ingredients, dietary restrictions, and cultural preferences. Food services provide customers with the convenience of having meals prepared for them, rather than having to cook for themselves. Some of the advantages of food services are time-efficiency, cost-effectiveness, customizability to suit individual dietary needs, provision of high-quality ingredients, and the availability of a diverse range of cuisine choices.

West Africa Food Services Market Trends:

The market in West Africa is primarily driven by the inflating disposable income levels of the consumers, resulting in a shifting preference towards upscale and diverse dining experiences. In line with this, the rising popularity of global cuisines among individuals, particularly the younger population, is providing an impetus to the market. Moreover, a considerable rise in investments in the restaurant and hospitality sector by public as well as private agencies is creating lucrative growth opportunities in the market. In addition to this, the implementation of favorable initiatives by the governments of the West African countries, including tax incentives and subsidies for the promotion of local cuisine is also creating a positive market outlook. Furthermore, continual technological advancements, such as mobile ordering, contactless payment, and real-time delivery tracking is also acting as a significant growth-inducing factor for the market. Some of the other factors contributing to the market include rising demand for eateries specializing in healthier food options, the emerging trend of veganism resulting in the advent of vegan food service outlets, fierce competition among the key players, and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the West Africa food services market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on distribution channel, end-use, retail type and food service type.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the food services market based on the distribution channel has also been provided in the report. This includes online and offline. According to the report, offline accounted for the largest market share on account of the rapid urbanization in West Africa, resulting in the rising demand for food service establishments where people are increasingly preferring to eat out. Apart from this, significant growth of the tourism and travel industry is driving the demand for more eateries in the region.

End Use Insights:

- Commercial

- Non-Commercial

A detailed breakup and analysis of the food services market based on the end use has also been provided in the report. This includes commercial and non-commercial. According to the report, commercial accounted for the largest market share due to the increasing demand for international cuisine resulting in the growth of multicuisine restaurants and food service centers. Besides this, the increasing popularity of gourmet dishes among young individuals is positively influencing the segment growth.

Retail Type Insights:

- Eat-In

- Take Away

A detailed breakup and analysis of the food services market based on the retail type has also been provided in the report. This includes eat-in and take away. According to the report, eat-in accounted for the largest market share to the growing demand for eat-in food service options as consumers are looking for more upscale and diverse dining experiences. In addition, the increasingly hectic lifestyles of consumers are leading to a higher demand for convenient, healthy, and affordable eat-in options.

Food Service Type Insights:

- Full Service Restaurants

- Fast-Food Joints

- Streets Kiosks/Stalls

- Cafes and Bars

- Others

The report has provided a detailed breakup and analysis of the food services market based on the food service type. This includes full service restaurants, fast-food joints, streets kiosks/stalls, and cafes and bars. According to the report, full service restaurants represented the largest segment due to a considerable increase in business activity and investment in the hospitality sector in the region. Moreover, the shifting consumer preference towards conducting business meetings and negotiations over meals are also fueling the segment growth.

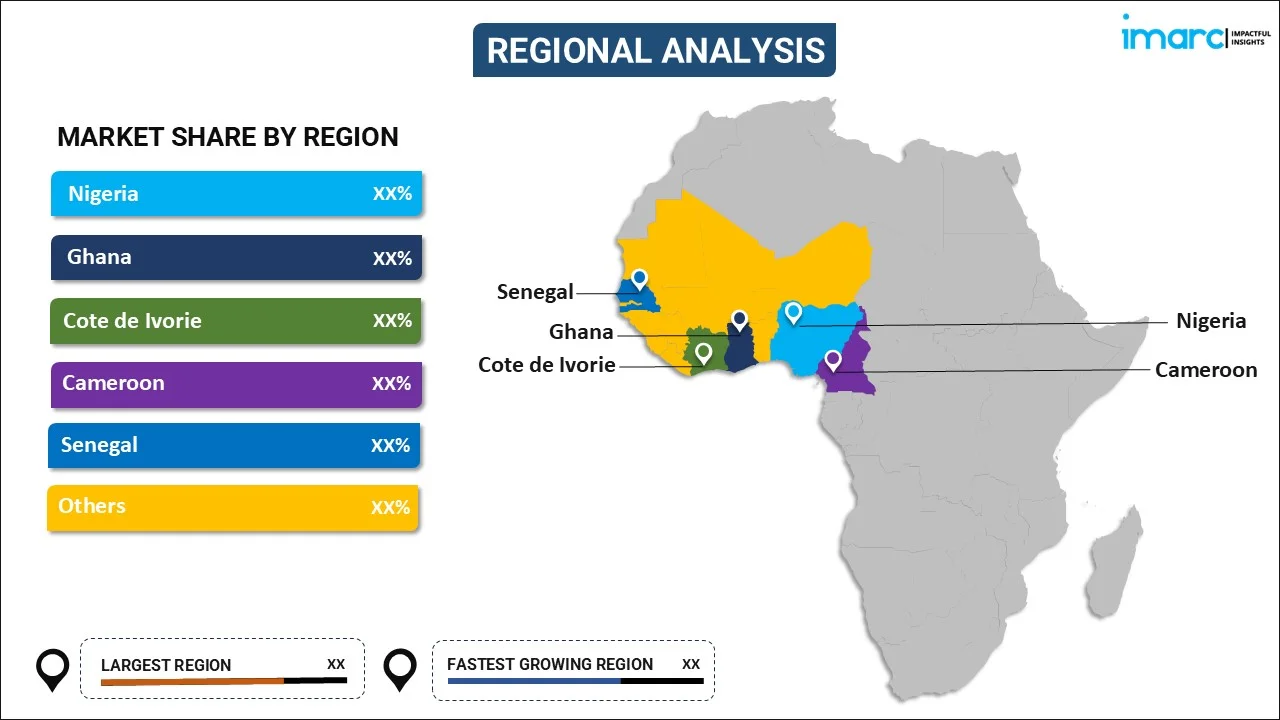

Regional Insights:

- Nigeria

- Ghana

- Cote de Ivorie

- Cameroon

- Senegal

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, and Others.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the West Africa food services market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Distribution Channel, End-Use, Retail Type, Food Service Type, Country |

| Countries Covered | Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the West Africa food services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the West Africa food services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the West Africa food services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The West Africa food services market was valued at USD 6.2 Billion in 2024.

We expect the West Africa food services market to exhibit a CAGR of 7% during 2025-2033.

The introduction of vegan food service outlets, along with the continuous technological advancements, such as mobile ordering, contactless payment, and real-time delivery tracking, are primarily driving the West Africa food services market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for online food delivery services or take away to mitigate the risk of coronavirus transmission, owing to the temporary closure of dine-in facilities across several West African nations.

Based on the distribution channel, the West Africa food services market has been divided into online and offline. Currently, offline exhibits a clear dominance in the market.

Based on the end use, the West Africa food services market can be categorized into commercial and non-commercial, where commercial currently accounts for the majority of the total market share.

Based on the retail type, the West Africa food services market has been segregated into eat-in and take away. Currently, eat-in currently holds the largest market share.

Based on the food service type, the West Africa food services market can be bifurcated into full service restaurants, fast-food joints, streets kiosks/stalls, cafes and bars, and others. Among these, full service restaurants exhibit a clear dominance in the market.

On a regional level, the market has been classified into Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)