Wheatgrass Market Size, Share, Trends and Forecast by Raw Material, Product, Application, and Region, 2025-2033

Wheatgrass Market Size and Share:

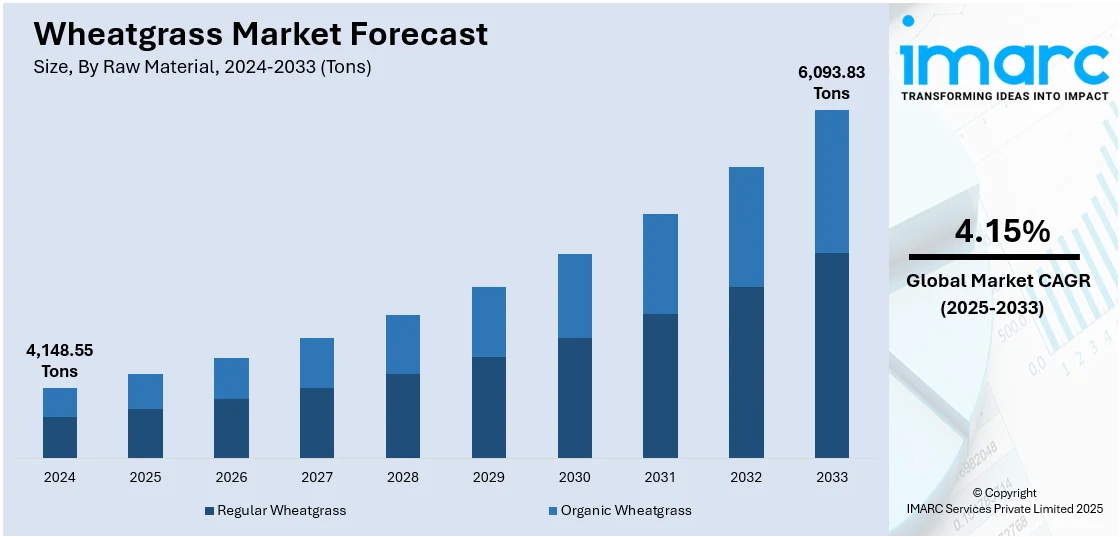

The global wheatgrass market size was valued at 4,148.55 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 6,093.83 Tons by 2033, exhibiting a CAGR of 4.15% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024. The market is witnessing significant growth due to increasing consumer awareness about its health benefits, including detoxification and immune support. Moreover, demand for plant-based supplements, organic products, and their integration into juices and dietary supplements is driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4,148.55 Tons |

|

Market Forecast in 2033

|

6,093.83 Tons |

| Market Growth Rate 2025-2033 | 4.15% |

The wheatgrass market is primarily driven by growing consumer awareness of its health benefits, including its rich nutrient profile, detoxifying properties, and support for immune health. The rise in demand for natural, plant-based supplements has increased Wheatgrass's popularity in health-conscious populations. Additionally, its use in smoothies, juices, and dietary supplements fuels market demand. Increased interest in organic and sustainable food products further accelerates wheatgrass adoption, with consumers seeking natural alternatives for improved wellness and disease prevention. These factors are collectively creating a positive wheatgrass market outlook across the world.

The United States wheatgrass market is primarily driven by rising consumer awareness of its health benefits, particularly its rich content of vitamins, minerals, and antioxidants. As more people adopt health-conscious lifestyles, wheatgrass is gaining popularity as a natural supplement known for detoxification, boosting immunity, and promoting digestion. The increasing demand for plant-based and organic products is another key driver, with wheatgrass being a popular choice among those seeking sustainable, nutrient-dense food alternatives. Additionally, the growth of the wellness and fitness industry, including the use of wheatgrass in smoothies, juices, and dietary supplements, supports its market expansion. The rise in digestive health awareness and detoxification trends also contributes to wheatgrass consumption. As consumer interest in holistic health continues to grow, the United States wheatgrass market is expected to experience continued growth.

Wheatgrass Market Trends:

Health and wellness trends

The prevailing health and wellness trends among the masses represent one of the crucial factors impelling the growth of the market. Consumers are becoming increasingly conscious of their dietary choices and actively seeking natural and nutrient-dense options. Industry analysis shows that most consumers now focus on health when buying fresh food, 84% prioritize wellness, 65% look for natural ingredients, and 55% seek added health benefits beyond basic nutrition. Wheatgrass is packed with vitamins, minerals, and antioxidants, making it a sought-after superfood. Its appeal lies in its potential to enhance overall health, boost energy levels, and support various bodily functions. As people are shifting towards healthier lifestyles, they are incorporating wheatgrass into their diets through fresh juices, smoothies, and dietary supplements. Moreover, wheatgrass aligns with the rising interest in organic and sustainable food options. Its cultivation often involves environment-friendly practices, resonating with consumers who prioritize ethical and eco-conscious choices. This aligns perfectly with the broader health and wellness movement, positioning wheatgrass as a valuable asset in the market.

Rise in vegan and plant-based diets

The increasing consumption of vegan and plant-based diets is supporting the market growth. As more individuals opt for meat-free and environment-friendly dietary choices, wheatgrass is gaining prominence as a plant-based superfood that aligns perfectly with these preferences. According to an industry report, 52.2% of respondents changed their diet in the past two years. Key shifts included cutting back on red meat (29.2%), eating more plant-based meals, and trying alternative proteins (41.8%). Wheatgrass is gluten-free and contains no animal-derived ingredients, making it an ideal addition to vegan diets. Its versatility allows it to be incorporated into a variety of plant-based recipes, including smoothies, salads, and energy bars. This adaptability is enabling wheatgrass to become a staple in the diets of those seeking plant-powered nutrition. Additionally, the ethical and environmental considerations associated with veganism and plant-based diets are spurring the demand for products like wheatgrass, which have a smaller ecological footprint compared to animal agriculture. The ethical appeal of these diets, combined with the health benefits of wheatgrass, is bolstering the market growth.

Growing focus on immunity and detoxification

The rising focus on immunity and detoxification is driving the demand for wheatgrass. A 2024 survey reveals that 37% of immune health supplement users think about their immune health daily, and 39% consider it weekly. Compared to two years ago, 51% are more concerned, and 43% have increased their spending on maintaining strong immune health since the pandemic. Wheatgrass is known for its rich antioxidant content, including vitamins A, C, and E, which can support the defense of the body against harmful free radicals. This antioxidant power is a compelling factor for consumers looking to enhance their immune function. Furthermore, wheatgrass is renowned for its detoxifying properties, primarily attributed to its chlorophyll content. Chlorophyll helps to aid in cleansing the body by promoting the elimination of toxins and impurities. As detox diets and cleanses gain popularity, wheatgrass is becoming a favored ingredient in detoxification regimens.

Growing demand for natural and organic products

Consumer preferences for natural and organic products are positively influencing the market. According to OTA’s 2024 Organic Industry Survey, the organic market reached a record USD 69.7 Billion in sales in 2023, reflecting a 3.4% growth. Wheatgrass is commonly grown using organic farming practices, free from synthetic pesticides and fertilizers. This aligns with the increasing demand for clean, pesticide-free foods. Consumers are seeking wholesome and chemical-free options and are consequently drawn to wheatgrass as a natural and organic choice for their dietary needs. Furthermore, as the awareness about the potential health risks associated with chemical residues in conventional foods grows, more individuals are turning to organic alternatives like wheatgrass to ensure the purity and safety of their nutrition.

Increasing awareness regarding nutrient density

Wheatgrass is becoming popular due to its exceptional nutrient density. Consumers are increasingly conscious of the need to maximize nutrition in their diets. IFIC reports that in 2023, 67% of consumers aimed to increase their protein intake, while 30% prioritized low-sugar options when purchasing food and drinks, up three percentage points from the previous year. Wheatgrass, with its concentrated vitamins, minerals, and enzymes, offers a convenient way to achieve this. It is often referred to as a green powerhouse and is considered one of the most nutrient-dense foods available. This heightened awareness of nutrient density is driving demand for wheatgrass-based products, such as supplements and powders, as individuals seek to optimize their daily nutritional intake.

Research and development (R&D) in wheatgrass applications

Ongoing research and development (R&D) efforts in the field of wheatgrass applications are contributing to the market growth. Scientists and food technologists are exploring innovative ways to incorporate wheatgrass into various products, improve its taste, and enhance its bioavailability. This continuous innovation results in more appealing Wheatgrass-based products that cater to diverse consumer preferences. Additionally, as research uncovers new health benefits and potential therapeutic uses of wheatgrass, it continues to attract attention and investment, further expanding its market potential.

Increasing popularity of wheatgrass liquid and powder formats

The rise in the popularity of both liquid and powder formats of wheatgrass is strengthening the market growth. Wheatgrass liquid is favored for its convenience, as consumers can readily consume it without the need for preparation. Ready-to-drink wheatgrass juices and extracts cater to busy individuals seeking a quick and hassle-free way to incorporate wheatgrass into their daily routines. On the other hand, wheatgrass powder offers versatility, allowing consumers to customize serving sizes and incorporate it into various recipes, including smoothies and baked goods. This dual preference for liquid and powder formats is driving product innovation, with companies developing a range of options to meet diverse consumer needs and preferences.

Wheatgrass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wheatgrass market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on raw material, product, and application.

Analysis by Raw Material:

- Regular Wheatgrass

- Organic Wheatgrass

Organic wheatgrass as the largest raw material in 2024, holding around 64.6% of the market. The organic wheatgrass segment stands out as the largest segment within the market. This growth is driven by consumer preferences for clean, pesticide-free, and environmentally sustainable products. Organic wheatgrass is cultivated without the use of synthetic chemicals, adhering to strict organic farming standards. It appeals to health-conscious consumers who prioritize the purity and quality of their food and dietary supplements.

Analysis by Product:

- Wheatgrass Liquid

- Wheatgrass Powder

Wheatgrass liquid holds the dominant position within the market due to its convenience and ease of consumption. This segment includes ready-to-drink wheatgrass juices and extracts that cater to consumers seeking a quick and hassle-free way to incorporate wheatgrass into their daily routines. The liquid form is particularly popular among busy individuals who value on-the-go nutrition. Its appeal lies in its immediate availability and bioavailability, allowing consumers to benefit from the nutrients of wheatgrass without any preparation.

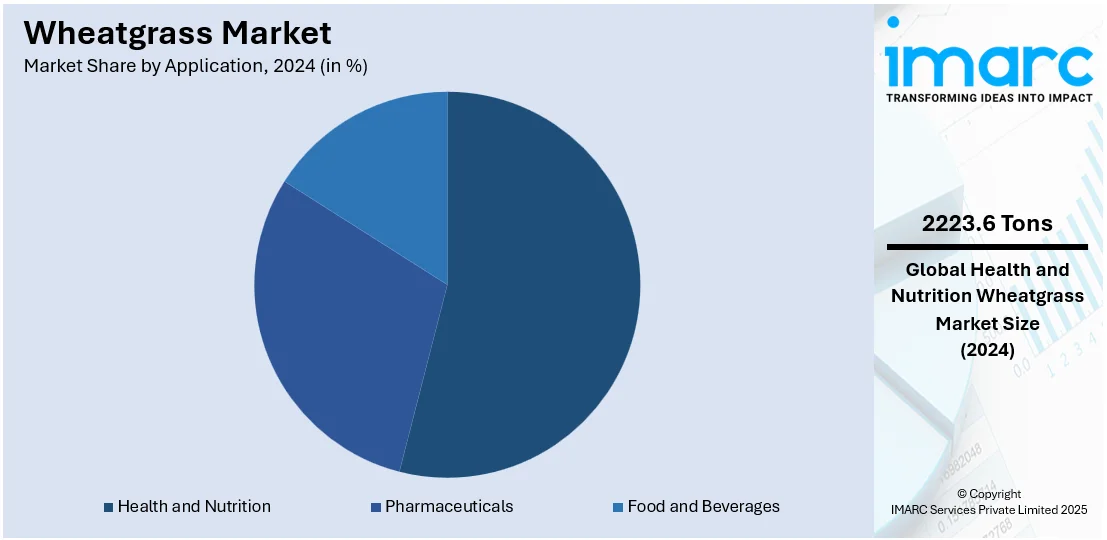

Analysis by Application:

- Health and Nutrition

- Pharmaceuticals

- Food and Beverages

Health and nutrition leads the market with around 53.6% of wheatgrass market share in 2024. Health and nutrition encompass a wide range of products catering to the health-conscious consumer demographic. Wheatgrass is highly regarded for its nutrient-rich composition, making it a popular choice in dietary supplements, superfood powders, and wellness products. Consumers seeking to enhance their overall health, boost immunity, and increase their nutrient intake turn to wheatgrass as a natural and convenient option. Additionally, wheatgrass is often incorporated into detoxification programs and wellness regimens, further solidifying its position within the health and nutrition segment.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 36.9%. The North America wheatgrass market is driven by increasing demand for wheatgrass products. Consumers in the region are increasingly becoming health-conscious and seeking natural, nutrient-dense options, which makes wheatgrass a popular choice. The growing adoption of plant-based diets is also propelling the market growth. Wheatgrass is incorporated into functional food and beverage products, capitalizing on the demand for functional ingredients.

Key Regional Takeaways:

United States Wheatgrass Market Analysis

In 2024, the United States accounted for over 88.10% of the wheatgrass market in North America. The United States wheatgrass market is primarily driven by the rising interest in functional beverages increasing incorporation in juices and smoothies. Between March 2020 and March 2024, U.S. functional beverage sales rose by 54%, reaching USD 9.2 billion, according to an industry report. These beverages now represent roughly 10% of the country’s total non-alcoholic beverage market, reflecting growing consumer demand for drinks offering added health benefits. In line with this, growing awareness of detoxification benefits is encouraging consumers to adopt wheatgrass as a natural cleansing agent. Similarly, the expansion of wellness tourism and retreats augmenting demand for organic wheatgrass in therapeutic settings, is propelling the market. Furthermore, the heightened popularity of fitness influencers and holistic health coaches elevating consumer awareness regarding wheatgrass's nutritional value, is fostering market expansion. The continual advancements in cold-pressing and freeze-drying technologies supporting the development of high-quality wheatgrass products with extended shelf life, are stimulating the market appeal. Likewise, increasing availability of wheatgrass in ready-to-consume formats, including shots and sachets, is also facilitating wheatgrass market demand. Moreover, the rise in chronic fatigue and stress-related health issues contributing to interest in wheatgrass-based revitalization solutions, is impelling the market.

Europe Wheatgrass Market Analysis

The European market is expanding due to growing consumer inclination toward detoxification and natural cleansing solutions. Similarly, the proliferation of organic and plant-based dietary supplements is encouraging higher product uptake. The rising innovative product formulations, such as wheatgrass-infused snacks and beverages, are enhancing market visibility. Furthermore, an increase in fitness consciousness among urban populations contributing to consumption patterns, is driving market growth. According to the European Health & Fitness market report, the memberships increased by 4.7 million, marking a 7.5% rise from 62.9 million in 2022 to 67.6 million in 2024. The industry revenues rose by 14% to a record EUR 31.8 Billion, while the number of fitness clubs increased by 1.4% to nearly 65,000 across Europe. The expanding e-commerce platforms improving accessibility to niche superfood products, including wheatgrass, is strengthening the market demand. Additionally, supportive governmental policies promoting sustainable agriculture are facilitating organic wheatgrass cultivation and stimulating market appeal. The rising number of specialty health stores across Europe, bolstering offline product availability, is expanding the market scope. Besides this, increasing investment in nutraceutical research by European firms enhancing awareness about the clinical benefits of wheatgrass, is impacting the market trends.

Asia Pacific Wheatgrass Market Analysis

The Asia Pacific wheatgrass market is experiencing notable growth attributed to increasing awareness of traditional and herbal remedies. In addition to this, the rising prevalence of lifestyle-related ailments, such as diabetes and obesity, prompting dietary shifts toward nutrient-dense superfoods, is propelling the market growth. A study published in The Lancet revealed that in 2022, India had the highest number of people living with diabetes globally, with 212 million cases, followed by China with 148 million individuals affected. Similarly, the expansion of wellness tourism in countries like Thailand and India, promoting the use in spa and detox programs, is supporting market demand. The rapid urbanization and changing consumer lifestyles driving demand for convenient, health-focused food and beverage options, is bolstering market reach. Furthermore, the growing popularity of social media and wellness influencers is playing a pivotal role in shaping health trends and increasing consumer interest in wheatgrass products. Moreover, favorable government initiatives supporting organic farming improving the availability of high-quality wheatgrass, are providing an impetus to the market.

Latin America Wheatgrass Market Analysis

In Latin America, the market is progressing propelled by growing interest in alternative medicine and natural health remedies. Furthermore, the region’s increasing middle-class population driving demand for premium health and wellness products, is impelling the market. The expansion of health-focused retail chains and organic food markets is improving product visibility and accessibility. According to an industry report, Brazil leads Latin America's organic market and ranks fourth globally in organic farmland, with over 1 million hectares. In 2022, organic produce sales reached BRL 4 Billion, while the number of organic farms grew by 448.63% from 2012 to 2021, totaling to 26,622 farms. Apart from this, rising consumer education on the benefits of antioxidant-rich superfoods is fostering greater acceptance of wheatgrass as a functional dietary addition across urban centers in the region.

Middle East and Africa Wheatgrass Market Analysis

The wheatgrass market in the Middle East and Africa is significantly influenced by rising health consciousness and a growing interest in natural remedies. In accordance with this, the expansion of modern retail infrastructure enhancing product availability across urban centers, is strengthening the market demand. Similarly, increasing government support for sustainable agriculture encouraging the cultivation of organic crops, including wheatgrass, is bolstering development in the market. Furthermore, the heightened influence of global wellness trends and the rising popularity of plant-based diets contributing to the growing acceptance of wheatgrass in health and nutrition regimes, is creating lucrative opportunities in the market. According to a survey, 87% of respondents in the UAE and 81% in Saudi Arabia have experienced plant-based food and beverages.

Competitive Landscape:

The key players in the wheatgrass market are actively engaged in various strategies to maintain and expand their market presence. They are focusing on research and development (R&D) to innovate and introduce new wheatgrass-based products that cater to evolving consumer preferences. This includes creating convenient formats, such as ready-to-drink wheatgrass juices, and incorporating wheatgrass into functional foods and beverages. Additionally, key players are investing in marketing and advertising campaigns to educate consumers about the health benefits of wheatgrass and its versatile applications. Furthermore, some companies are expanding their reach by entering new geographical markets, capitalizing on the global demand for natural and nutritious dietary options. Overall, the industry leaders are committed to staying at the forefront of this growing market through innovation, marketing, and strategic expansion.

The report provides a comprehensive analysis of the competitive landscape in the wheatgrass market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Grove Collaborative acquired 8Greens, known for supplements featuring wheatgrass and other greens. The move expands Grove’s wellness offerings.

- October 2024: The Land Institute launched the Perennial Percent label for foods with at least 1% Kernza, a perennial wheatgrass. The program promotes sustainable agriculture and gradual adoption.

- September 2024: Chilean brand Soy Silvestre transitioned its wheatgrass shots from plastic pots to compostable flexible sachets. Developed with Green Heart Solutions using Futamura’s NatureFlex film, the eco-friendly packaging supports automation, protects through freezing and defrosting, and meets composting standards.

- June 2024: Cambridge Nutraceuticals acquired GP Nutrition. The deal marks Cambridge’s entry into nutricosmetics, adding products with collagen, wheatgrass, and botanical blends to its portfolio.

Wheatgrass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons, Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Regular Wheatgrass, Organic Wheatgrass |

| Products Covered | Wheatgrass Liquid, Wheatgrass Powder |

| Applications Covered | Health and Nutrition, Pharmaceuticals, Food and Beverages |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wheatgrass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wheatgrass market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wheatgrass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wheatgrass market was valued at 4,148.55 Tons in 2024.

IMARC estimates the wheatgrass market to reach 6,093.83 Tons by 2033, exhibiting a CAGR of 4.15% from 2025-2033.

Key factors driving the wheatgrass market include increasing consumer awareness of its health benefits, growing demand for natural and organic products, the rise of plant-based diets, and its popularity as a detoxifying and immunity-boosting supplement. Additionally, the wellness and fitness industry's expansion further fuels market growth.

North America dominates the wheatgrass market, driven by high consumer awareness of its health benefits and a strong demand for natural, organic supplements. The region's increasing focus on wellness, plant-based diets, and fitness trends further supports Wheatgrass's popularity, particularly in the United States.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)