Wood Pulp Market Size, Share, Trends and Forecast by Type, Grade, End Use Industry, and Region, 2026-2034

Wood Pulp Market Size and Share:

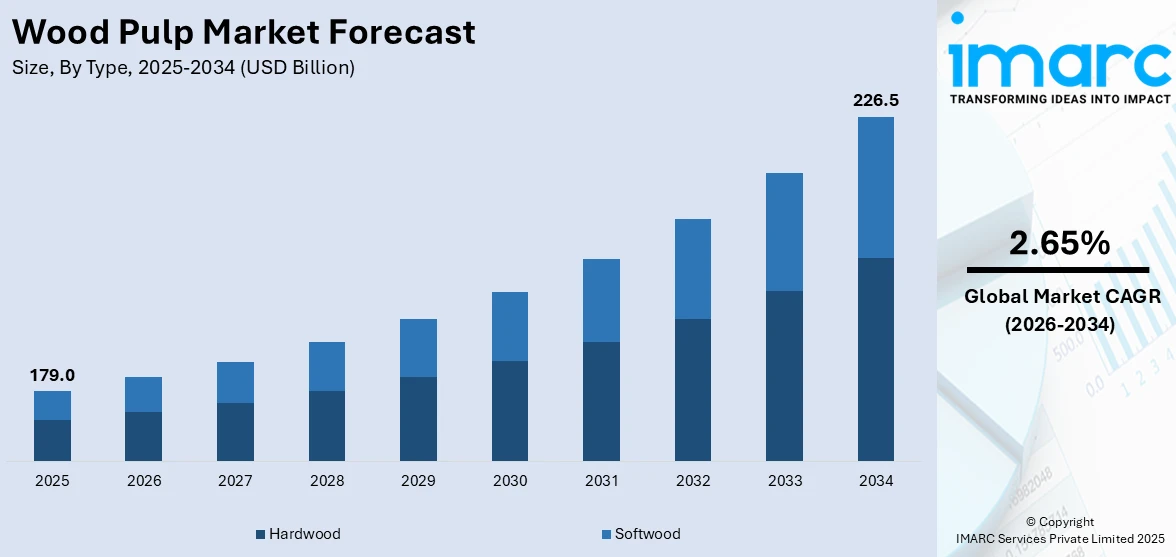

The global wood pulp market size was valued at USD 179.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 226.5 Billion by 2034, exhibiting a CAGR of 2.65% during 2026-2034. Asia-Pacific currently dominates the market and holds the largest market share in 2025. The market is experiencing stable growth driven by the increasing demand for paper products for various purposes, rising preferences for sustainable packaging solutions due to the thriving e-commerce sector, and the burgeoning construction sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 179.0 Billion |

|

Market Forecast in 2034

|

USD 226.5 Billion |

| Market Growth Rate 2026-2034 | 2.65% |

The expansion of the global packaging industry is a major market driver for wood pulp. Packaging serves as a crucial part of branding and consumer appeal. As e-commerce continues to thrive, especially with the shift in shopping habits, there has been a surge in demand for cardboard and paper-based packaging. These packaging materials are often made from wood pulp due to their strength, durability, and sustainability compared to plastic. According to a report by IMARC Group, the e-commerce industry is expected to reach USD 214.5 trillion by 2033, with an astounding growth rate of 25.83% from 2025-2033. Additionally, as per industry estimates, India is anticipated to rank first between 2023 and 2027, among 20 countries in retail e-commerce development, with a CAGR of 14.1%. This surge in e-commerce has encouraged companies to become more environmentally conscious and move away from plastic to reduce their carbon footprint. As a result, wood pulp-based packaging materials such as cardboard and corrugated boxes are increasingly being used in various sectors, including retail, food and beverages (F&B), electronics, and pharmaceuticals.

To get more information on this market Request Sample

The United States is a major market disruptor owing to its increasing population that creates the need for consumer goods, including paper-based products. The country’s population grew by nearly one percent between 2023 and 2024 surpasses 340 million people. This translates to more demand for everyday items like food, hygiene products, and packaging, all of which rely on wood pulp for production. Moreover, the growing improvements in living standards and urbanization are contributing to greater demand for packaged food, personal care products, and educational materials. The expanding middle class in the country is also fueling the demand for more modern consumer products that rely heavily on paper and packaging materials. Just over half of Americans, accounting for 51% of the total population, were considered middle class in the year 2023. As people in these areas continue to increase their purchasing power and change their consumption habits, wood pulp remains a key raw material to meet the growing needs.

Wood Pulp Market Trends

Rising Demand for Paper Products and Education Sector Growth

The global demand for paper products continues to drive wood pulp consumption across multiple regions. Wood pulp, primarily derived from eucalyptus, bamboo, and subabul, is a critical raw material in the production of paper, tissue, board, and specialty papers. In 2021, global production of pulp for paper reached approximately 191.6 million metric tons, reflecting strong demand from educational institutions, publishers, and office supply sectors. In particular, the growing need for textbooks and notebooks in schools and universities—especially in emerging economies—is reinforcing consumption trends. As the demand for printed educational materials increases, so too does the influence on wood pulp market price and supply chain dynamics.

Sustainable Packaging Demand Boosts Wood Pulp Market Growth

Sustainability has become a core consideration for both consumers and manufacturers, with growing emphasis on eco-friendly packaging solutions. The rise of e-commerce, projected by IMARC Group to grow at a CAGR of 27.16% from 2024 to 2032, is contributing to this shift. Consumers increasingly favor biodegradable, recyclable packaging materials, prompting retailers and logistics providers to replace plastic with wood pulp-based alternatives. This change reduces environmental impact, while aligning with global sustainability goals. As adoption increases, so does competition for raw materials, influencing the wood pulp market price and encouraging innovation in pulp-based packaging formats.

Wood Pulp Applications in Construction Materials Drive Industrial Use

Beyond traditional uses, wood pulp is gaining importance in the construction sector, where it serves as a reinforcement material in engineered wood products such as medium-density fiberboard (MDF), chipboards, and oriented strand boards (OSB). These applications enhance structural durability and moisture resistance, contributing to sustainable building practices. The demand for such materials is rising in line with global urbanization and real estate development. In India, for example, residential home sales reached USD 42 billion in FY 2023, with projections indicating the real estate sector will reach USD 1 trillion by 2030. This expanding construction activity adds further upward pressure on the wood pulp market, driven by the increased requirement for raw fiber-based materials.

Regulatory and Market Challenges

The wood pulp industry faces significant external pressures that are reshaping supply and pricing structures. Strict environmental regulations aimed at reducing deforestation and controlling industrial emissions are limiting raw material access and increasing operational costs. Simultaneously, public opposition to unsustainable forestry practices is intensifying, often resulting in legal delays and social resistance to logging activities. Adding to this are the volatile raw material prices, influenced by climate change, geopolitical instability, and unpredictable supply chain disruptions. Competitive pressures are also mounting, with innovations in recycled fibers and alternative materials threatening traditional wood pulp producers. Besides this, technological limitations in pulp processing—such as high energy and water usage—constrain scalability and efficiency. These combined challenges significantly impact wood pulp market outlook and create a complex operating environment for industry stakeholders.

Wood Pulp Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wood pulp market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, grade, and end use industry.

Analysis by Type:

- Hardwood

- Softwood

Hardwood stands as the largest component in 2025. Hardwood trees include oak, birch maple, cherry, mahogany, and walnut. Hardwood is more durable and has higher density as compared to softwood. It is versatile, withstands heavy use, and provides an aesthetic appeal. It is also more resistant to decay than softwood when used for exterior work. The rising employment of hardwood to produce furniture, decks, and flooring is impelling the market growth. The increasing focus on adopting high-quality furniture products that provide enhanced aesthetic appeal to a space is supporting the market growth. The furniture market worldwide is anticipated to generate a revenue of USD 664.9 billion in 2024 as stated by reports.

Analysis by Grade:

- Mechanical

- Chemical

- Semi-Chemical

- Others

Mechanical grade leads the market share in 2025. Mechanical grade wood pulp involves the separation of fibers without the addition of any chemicals. It comprises stone groundwood pulping (SGW), refiner pulping, thermomechanical pulping (TMP), chemithermomechanical pulping (CTMP), and recycled paper pulping. It is produced by mechanically grinding or refining wood chips against a rotating abrasive surface. It retains much of the natural lignin and other components of the wood, resulting in shorter and coarser fibers as compared to chemical pulp. Moreover, it is widely used to produce newsprint, magazine paper, and telephone directories, where brightness is not a major concern. According to reports, the print newspapers and magazines market worldwide is anticipated to witness USD 123.50 billion growth by 2024.

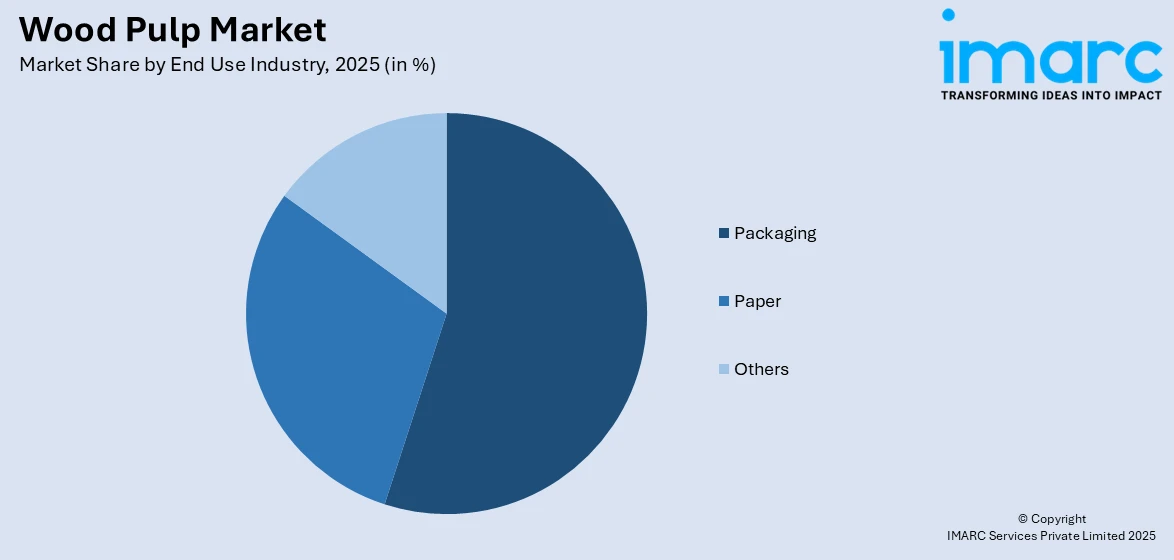

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Packaging

- Food and Beverages

- Pharmaceutical

- Personal Care and Cosmetics

- Automotive

- Others

- Paper

- Newspaper

- Books and Magazines

- Tissues

- Others

- Others

Packaging leads the market share in 2025. The rising utilization of wood pulp in the packaging sector is contributing to the market growth. Wood pulp cardboard boxes and cartons are widely utilized for the packaging of food and beverage (F&B) products, such as cereals, snacks, beverages, and frozen food items. Moreover, wood pulp-based paperboard and cardboard are employed in pharmaceutical sector for packaging medications. These materials offer barrier properties to protect medications from moisture, light, and contamination, that assist in ensuring product integrity and safety. Reports claims that the global cardboard production output is forecasted to increase to USD 254.4 billion by 2033.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific holds the majority of the market share. The rising need for eco-friendly packaging solutions to mitigate carbon footprint in the Asia Pacific is impelling the market growth. The growing environmental concern among individuals is offering a positive market outlook. There is an increase in the utilization of wood pulp for numerous purposes in China. Many countries in Asia Pacific are focusing on meeting the rising wood pulp market demand domestically and globally by investing in paper manufacturing infrastructure. As per reports, China was the world largest importer of wood pulp in 2022, accounting for nearly 37.91% of the total wood pulp imports.

Key Regional Takeaways:

North America Wood Pulp Market Analysis

The North American wood pulp market is growing steadily due to the rising demand for paper products, primarily in packaging, hygiene, and tissue applications. The United States and Canada offer a great market for this product because of their mature paper and pulp industry that have been serving a multitude of sectors such as retailers, food packaging, consumer goods, among many others. Demand for wood pulp is also being fueled by the continuous shift toward sustainable and eco-friendly materials, as these products are now preferred by business and residential consumers, who favor materials that are recyclable and biodegradable. The growth of e-commerce also plays a huge role in this increase in demand for packaging materials, such as corrugated boxes and paper bags, that are made primarily from wood pulp. The advancement in technology in pulp manufacturing, and the commitment to responsible forest management, also contribute to growth in the region. It is expected that the North American market will maintain this growth momentum, considering continued emphasis on sustainability and innovation in production processes.

United States Wood Pulp Market Analysis

The use of wood pulp has been increased due to the high demand for paper products in the United States. For example, growing paper consumption in the US has driven the number of projects demanding higher wood pulp production. As such, the increase of paper mills in 2023 with almost 187 operational facilities has led to high production of wood pulp. The ongoing shift toward sustainable packaging and environmentally friendly alternatives has also intensified the demand for paper and cardboard materials in industries such as those involved in publishing, retails, or packaging. Increased concern about reducing plastic wastes and the need for promoting improved recycling practices also drives the movement toward these alternatives. The growing acceptance of wood pulp has additionally been fostered by the increasing demands arising from e-commerce and the need for product packaging. These boxes, composed of paperboard and corrugated materials, mainly depend on pulp-base material in logistics. The strong movement of consumers to adopt more sustainable options is expected to continue the steady rise in wood pulp use.

Asia Pacific Wood Pulp Market Analysis

Automobiles are increasingly being adopted in the Asia-Pacific region, and this demand is steadily contributing to heightened wood pulp adoption. The automobile sector, according to India Brand Equity Foundation, attracted cumulative equity FDI inflow of USD 35.40 billion from April 2000 to September 2023, boosting the demand for automobiles. This increasing demand leads to the need for lightweight components in interior panels, packaging, and protective wraps. As a result, wood pulp products, such as moulded pulp and paper-based composites, are being used because of their strength, eco-friendliness, and cost-effectiveness. Such products provide a lightweight alternative to traditionally plastic materials, hence reducing emissions and fuel consumption as per regulatory requirements. With a greater emphasis on sustainability, the increasing use of wood pulp in multiple aspects of the automotive industry, such as their application in vehicle production cycle like interiors and packaging is also a contributing factor for the market's growth in the region. Also, the increasing awareness among people of environmental problems are driving producers towards adopting eco-conscious manufacturing of vehicles, thus strengthening the demand for wood pulp in future automotive applications.

Europe Wood Pulp Market Analysis

The continued growth of the food and beverage sector in Europe has greatly impacted the use of wood pulp. For instance, the food and drink wholesaling industry has seen growth in Europe over the years, and it boasts approximately 445K businesses in that sector, indicating robust expansion in the food and beverage market. As ecological considerations are given prominence, the advantages of using wood pulp have pushed food manufacturers to adopt pulp-based materials for their packaging, such as paper cups, cartons, and trays. These are said to be biodegradable, recyclable, and are believed to be a sustainable alternative with regard to plastic packaging. Besides this, increased awareness among the consumers about environmental degradation as a result of plastic waste drives a change to solutions made from pulp. Furthermore, wood pulp also serves other purposes like food preservation using papermakers for filters, absorbent pads, and protective covers for perishables. Stricter regulations and user demand for alternatives is also increasing the adoption of wood pulp through packaging and other food-related applications. The rising preference for sustainability and green practices in food and beverage industries has led to heightened use of wood pulp in packaging solutions.

Latin America Wood Pulp Market Analysis

The growing pharmaceutical sector in Latin America is driving the adoption of wood pulp due to its use in packaging applications. As per the International Trade Administration, healthcare expenditure in Brazil, the largest healthcare market in Latin America, amounts to 9.47% of its GDP, equivalent to USD 161 Billion, thus driving the use of wood pulp in Brazil's pharmaceutical sector. The increasing demand for pharmaceuticals leads to the need for eco-friendly sustainable packaging. Wood pulp has thus become an effective replacement to traditional plastics in some applications whereby medicine cartons, blister packs, and other forms of protective packaging can be replaced with it. Therefore, it further strengthens its renewability and biodegradability with the industry's increased orientation towards sustainability targets as well as reduction impacts of packaging on environmental sustainability. With consumers and regulatory bodies, the movement has increased the attention on the environmental footprint of products. Hence, wood pulp is now taking precedence as a preferred material for pharmaceutical packaging.

Middle East and Africa Wood Pulp Market Analysis

The wood pulp consumption has increased in the construction sector across the Middle East and Africa, as construction spearheads the growth of these regions. Reports indicate that Saudi Arabia's construction sector is booming, with over 5,200 ongoing projects worth USD 819 Billion. This shows a strong growth and investment into infrastructure development. The greater use of wood pulp as a raw material in construction materials like insulation and cement additives because of its sustainability and affordability is another catalyzing factor. Pulp is a significant raw material in manufacturing fiberboard, drywall, and other building materials, all of which possess strength and eco-friendly qualities. As the construction projects in this region becomes more focused on green and sustainable ways of building, adopting renewable materials like wood pulp is proving to be more popular. Furthermore, pulp-based products are also being increasingly adopted as packaging material for construction materials, offering effective and sustainable alternatives to plastic packaging. The expanding construction industry, with its emphasis on eco-friendly materials and practices, is expected to continue driving the growth of wood pulp in the region.

Competitive Landscape:

In order to satisfy rising demand, major market participants are putting a lot of effort into sustainability, technology development, and increasing production capacity. Major companies are spending money on eco-friendly industrial techniques like reducing carbon emissions, boosting the use of recycled fibers, and optimizing water consumption. By implementing cutting-edge technology that enhance pulp quality and lower operating costs, these businesses are also improving their pulp manufacturing processes. As the need for paper-based goods and packaging materials rises as a result of urbanization and population expansion, many companies are increasing their footprint in emerging countries. Additionally, businesses are concentrating on expanding the range of products they provide by adding eco-friendly packaging options that complement the worldwide trend away from plastic. Partnerships with organizations like the Forest Stewardship Council (FSC) that help ensure responsible sourcing of raw materials, is further aligning with consumer preferences for sustainable and ethically produced products.

The report provides a comprehensive analysis of the competitive landscape in the wood pulp market with detailed profiles of all major companies, including:

- APRIL Group (RGE Pte Ltd)

- ARAUCO

- Canfor Corporation

- Metsä Group

- Nippon Paper Industries Co. Ltd

- Oji Holdings Corporation

- Sappi Limited

- Södra, Sonoco Products Company

- Stora Enso Oyj

- Suzano Papel e Celulose

- UPM-Kymmene Oyj

- WestRock Company

Latest News and Developments:

- April 2025: ITC announced it will acquire the pulp and paper business of Aditya Birla Real Estate for up to Rs 3,500 crore ($410 million). This acquisition will add 480,000 metric tons per year to ITC’s paperboards and specialty papers capacity, enhancing its market position.

- April 2025: Nextgreen Global Berhad’s subsidiary, Nextgreen IOI Pulp (NIP), partnered with Hong Kong Paper Sources, a subsidiary of Xiamen C&D Paper & Pulp, to establish Malaysia’s first integrated pulp production facility at Green Technology Park, Pekan, Pahang. With NIP holding 75% equity, the 150,000 MT annual capacity plant will use palm biomass, specifically empty fruit bunches, employing patented PRC-RBMP technology. The RM900 million project, supported by the Malaysian government, aims to boost sustainable pulp production, strengthen China-Malaysia green economy ties, and develop the ECER Special Economic Zone as a green manufacturing hub.

- April 2025: Nippon Paper Industries Co., Ltd. joined the International Sustainable Forestry Coalition (ISFC), a global organization of 17 forestry-related companies managing 16 million hectares of forests across 37 countries. Nippon Paper aims to leverage its expertise in biomass, wood processing, and biochemicals to maximize forest value, strengthen global collaboration, and contribute to building a sustainable society.

- February 2025: Pulpex Limited secured £62 million in Series D funding led by the UK’s National Wealth Fund (£43.5m) and Scottish National Investment Bank (£10m) to build its first commercial-scale fibre-based bottle manufacturing facility near Glasgow. Pulpex’s patented, plastic-free, recyclable bottles made from sustainably sourced wood pulp offer a biodegradable alternative to plastic and glass, reducing carbon impact.

- December 2024: Suzano has inaugurated the world’s largest single-line pulp mill in Brazil, valued at USD 4.3 Billion, located in Ribas do Rio Pardo, Mato Grosso do Sul. With a pulp production capacity of 2.55 million TPA, the new mill boosts Suzano’s total capacity by 20%, reaching 13.5 million TPA. The facility’s unique design, with the smallest structural average radius of the forest base, reduces logistical costs, environmental impact, and greenhouse gas emissions by minimizing transportation distance and fossil fuel use.

- December 2024: AFRY has been awarded an EPCM contract for the Balance of Plant at Arauco’s new greenfield pulp mill in Inocência, Brazil. Arauco, a Chilean forestry group, will invest USD 4.6 Billion to build the world’s largest bleached eucalyptus pulp mill, with a production capacity of 3.5 million tonnes per year. The mill, set to begin operations in 2027, will produce wood pulp used in paper and hygiene products. AFRY's role includes detailed engineering and construction management for various auxiliary facilities, focusing on sustainability and energy efficiency.

Wood Pulp Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardwood, Softwood |

| Grades Covered | Mechanical, Chemical, Semi-Chemical, Others |

| End Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | APRIL Group (RGE Pte Ltd), ARAUCO, Canfor Corporation, Metsä Group, Nippon Paper Industries Co. Ltd, Oji Holdings Corporation, Sappi Limited, Södra, Sonoco Products Company, Stora Enso Oyj, Suzano Papel e Celulose, UPM-Kymmene Oyj, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wood pulp market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wood pulp market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wood pulp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global wood pulp market was valued at USD 179.0 Billion in 2025.

IMARC Group estimates the market to reach USD 226.5 Billion by 2034, exhibiting a CAGR of 2.65% during 2026-2034.

The key factors driving the global wood pulp market include increasing demand for paper and packaging products, growth in the e-commerce sector, sustainability trends favoring eco-friendly materials, rising hygiene product consumption, technological advancements in pulp production, population growth, and government regulations promoting sustainable sourcing and recycling.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global wood pulp market include APRIL Group (RGE Pte Ltd), ARAUCO, Canfor Corporation, Metsä Group, Nippon Paper Industries Co. Ltd, Oji Holdings Corporation, Sappi Limited, Södra, Sonoco Products Company, Stora Enso Oyj, Suzano Papel e Celulose, UPM-Kymmene Oyj, WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)