Yeast Market Report by Form (Dry Yeast, Instant Yeast, Fresh Yeast, and Others), Type (Baker’s Yeast, Brewer’s Yeast, Wine Yeast, Bioethanol Yeast, Feed Yeast, and Others), Application (Food, Feed, and Others), and Region 2026-2034

Yeast Market Overview:

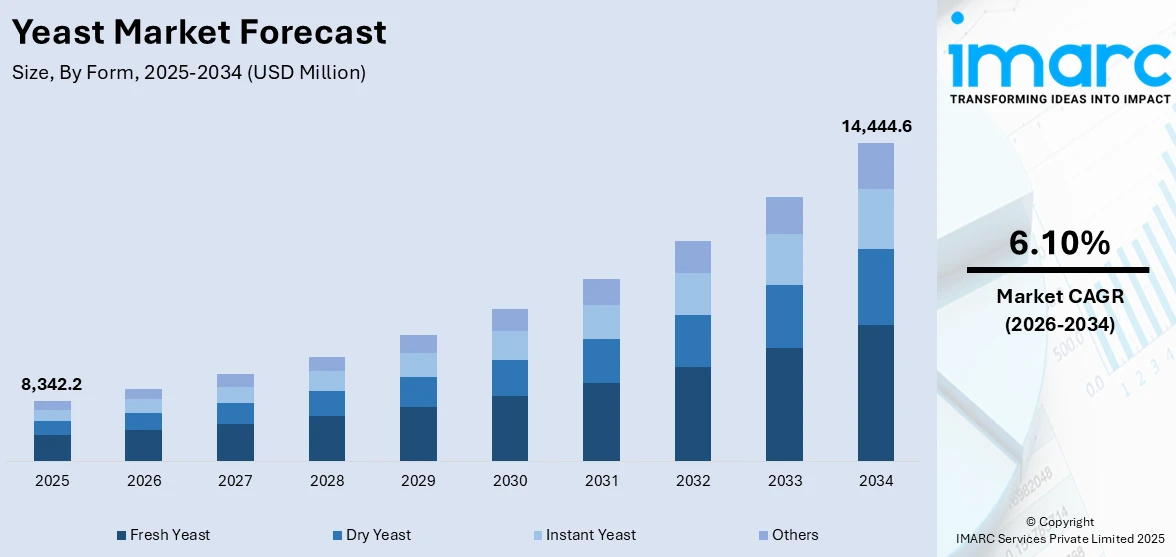

The global yeast market size reached USD 8,342.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,444.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.10% during 2026-2034. The growing demand for bioethanol as a cleaner energy source, rising consumption of baked goods and convenience food products, and innovations and advancements in plant-based food solutions are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8,342.2 Million |

|

Market Forecast in 2034

|

USD 14,444.6 Million |

| Market Growth Rate 2026-2034 | 6.10% |

Yeast Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth because of the rising demand for bakery items and alcoholic drinks among the masses, in which yeast plays a vital role. Moreover, the growing utilization of bioethanol as a biofuel is driving the demand for yeast for its vital role in the fermentation process.

- Key Market Trends: The continuous improvements in fermentation technology and a greater understanding about the nutritional advantages of yeast are supporting the market growth. Furthermore, the increasing demand for natural and clean-labeled yeast products and heightened efforts in research and development (R&D) to enhance yeast strains for diverse industrial uses are impelling the market growth.

- Geographical Trends: Europe leads the market because of its established bakery and brewing industries.

- Competitive Landscape: Some of the major market players in the industry include Associated British Foods Plc, Lesaffre & CIE, Angel Yeast Co., Ltd, Cargill, Incorporated, Chr. Hansen A/S, Alltech Group, Lallemand Inc., Koninklijke DSM N.V., Nutreco N.V., Kerry Group plc, Synergy Flavors, Inc., The Archer Daniels Midland Company, Oriental Yeast Company Limited, Diamond V Mills, Inc. (Diamond V), Pacific Ethanol, Inc. and Leiber GmbH.

- Challenges and Opportunities: Some of the difficulties include fluctuating prices of raw materials and strict regulations concerning food safety and quality. However, opportunities in expanding applications of yeast in non-food industries, such as pharmaceuticals and bioethanol production, are offering new growth avenues for market players.

To get more information on this market Request Sample

Yeast Market Trends:

Growing Demand for Bioethanol

Yeast is vital for the fermentation process to make bioethanol from biomass like corn, sugarcane, and other agricultural feedstocks. The rising emphasis on cleaner energy options to address climate change and decrease dependence on fossil fuels is contributing to the market growth. This is driving the need for specific yeast strains that can effectively convert different feedstocks into bioethanol, enhancing output and cutting production expenses. Furthermore, initiatives and legislation promoting renewable energy usage and reducing greenhouse gas emissions are leading to the adoption of biofuels. In June 2024, BASF transferred its bioenergy enzymes business to Lallemand, with its subsidiaries incorporating the Spartec® product line and related technologies into their Lallemand Biofuels & Distilled Spirits division. This purchase enhances Lallemand's knowledge of bioengineered yeast for ethanol production, underscoring their emphasis on yeast-based fermentation in the biofuels sector. This strategic decision highlights the focus of the industry on utilizing advanced yeast technologies to enhance the effectiveness and output of bioethanol production to address the growing worldwide need for sustainable energy solutions.

Rising Demand for Baked Goods and Convenience Foods

The growing demand for baked goods and convenient food products because of the busier lifestyles of consumers is offering a favorable market outlook. Yeast is essential in the production of a range of baked goods like bread, pastries, and cakes. Innovations in bakery products such as gluten-free and organic options are further driving the demand for yeast. Moreover, the rising popularity of home baking is strengthening the yeast market demand as consumers seeking high-quality yeast products for their homemade bread and pastries. In March 2024, King Arthur Baking Company released Savory Bread Mix Kits, which included yeast along with other ingredients, featuring four different varieties.

Innovation in Plant-Based Food Solutions

Yeast extracts and their derivatives play a vital role in creating plant-based meat alternatives, offering necessary tastes, consistencies, and nutritional compositions. The rising popularity of vegetarian, vegan, and flexitarian diets among consumers is encouraging food manufacturers to include more yeast-based ingredients to improve their products. These advancements involve developing meat substitutes that are more authentic and enhancing the flavor and nutritional value of plant-based products. Additionally, yeast is used in the production of alternative dairy products such as cheese and yogurt, giving consumers more choices and better quality. Advancements in biotechnology and food science enable the development of new yeast strains and fermentation techniques to improve the flavor and utility of plant-based foods. For example, in 2024, Revyve introduced a new egg substitute derived from recycled brewer's yeast to improve plant-based meat, showcasing it at the upcoming IFT First Expo in Chicago (July 14-17). The product replicated the binding and emulsification properties of eggs, with the goal of removing the necessity of additives in plant-based foods.

Yeast Market Segmentation:

IMARC Group provides an analysis of the key yeast market trends in each segment, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on form, type, and application.

Breakup by Form:

- Dry Yeast

- Instant Yeast

- Fresh Yeast

- Others

Fresh yeast accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the form. This includes dry yeast, instant yeast, fresh yeast, and others. According to the report, fresh yeast represented the largest segment.

Fresh yeast accounts for the majority of the market share because it is widely used in baking on account of its excellent leavening properties. Professional bakers and artisan bread makers prefer this type of yeast as it enhances the flavor and texture of baked goods more than other forms of yeast. The demand for fresh yeast remains high due to its consistent performance and the growing consumer shift towards fresh and natural ingredients. Fresh yeast remains the top choice in the market, showcasing its importance in the bakery sector. The yeast market forecast indicates a continuous rise in demand for fresh yeast, driven by its superior qualities and increasing demand in bakery.

Breakup by Type:

- Baker’s Yeast

- Brewer’s Yeast

- Wine Yeast

- Bioethanol Yeast

- Feed Yeast

- Others

Baker’s yeast holds the largest share of the industry

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes baker’s yeast, brewer’s yeast, wine yeast, bioethanol yeast, feed yeast, and others. According to the report, baker’s yeast accounted for the largest market share.

Baker's yeast holds the biggest market owing to its crucial function in the baking. The effectiveness of this yeast makes it essential for producing various baked goods like bread, pastries, and cakes by helping dough rise and creating desirable textures and flavors. The growing consumption of bakery products is driving the demand for baker's yeast. Ongoing innovations and enhancements in yeast strains that improve baking performance, shelf life, and nutritional value are also catalyzing the demand for baker’s yeast. Additionally, nutritional benefits of baker's yeast, including its rich content of vitamins, minerals, and proteins, contribute to its high usage in the food and beverage (F&B) industry. In September 2023, Leiber, a German company known for upcycling brewers' yeast, revealed plans to spend $20 million on constructing its inaugural U.S. facility in Rockingham County, Virginia, leading to the creation of around 35 new jobs. The upcoming facility, set to start production in early 2025, will improve Leiber's processing capabilities and product offerings.

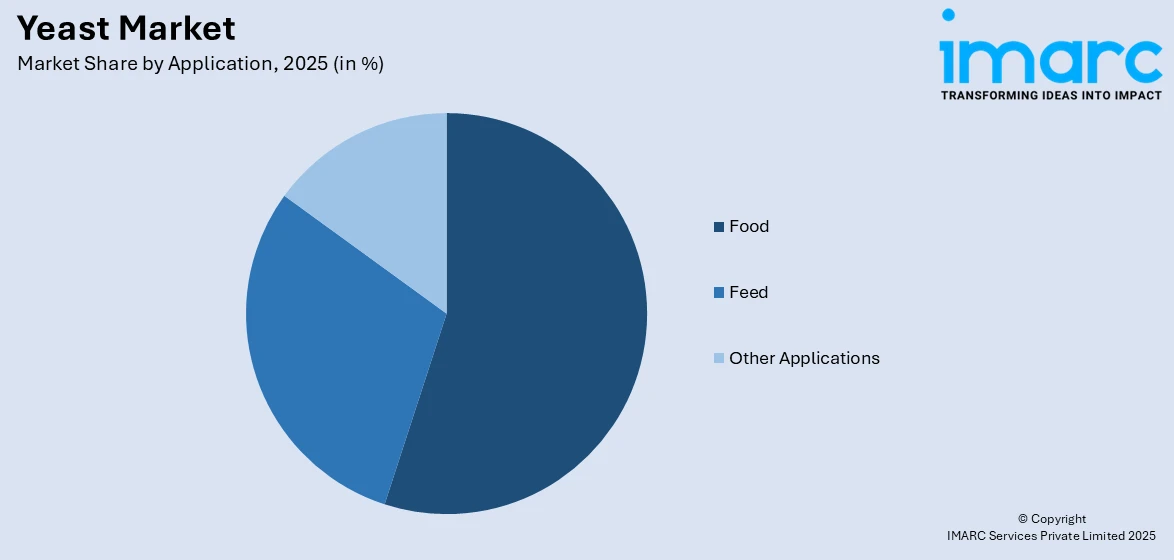

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Food

- Bakery

- Alcoholic Beverages

- Prepared Food

- Others

- Feed

- Other Applications

Food represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes food (bakery, alcoholic beverages, prepared food, and others), feed, and other applications. According to the report, food represented the largest segment.

Food dominates the market as per the yeast market outlook. The main reason for this dominance is the widespread incorporation of yeast in bakery items. Yeast plays a vital role in the fermentation process for bread, pastries, and other baked goods by supplying necessary leavening, taste, and structure. Furthermore, yeast is essential in making alcoholic drinks like beer and wine, as it plays a key role in the fermentation process by turning sugars into alcohol and carbon dioxide. The prepared food sector also relies on yeast for flavor enhancement and nutritional benefits, often incorporating yeast extracts in seasonings, sauces, and ready-to-eat (RTE) meals. The size of the global RTE food market in 2023 was USD 181.5 Billion, as per the IMARC Group.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Europe leads the market, accounting for the largest yeast market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Europe represents the largest regional market for yeast.

Europe holds the biggest market share due to its well-established baking and brewing sectors. The growing demand for top-notch bakery items, including bread, pastries, and specialty baked goods, leads to the widespread use of yeast. Moreover, Europe is a major producer and consumer of alcoholic drinks, especially beer and wine, where yeast is crucial in the fermentation process. The strong focus on natural and organic food ingredients is resulting in higher consumption of organic yeast products. Additionally, improvements in yeast technology and manufacturing techniques to maintain high standards of quality and innovation are bolstering the yeast market growth in the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Associated British Foods Plc, Lesaffre & CIE, Angel Yeast Co., Ltd, Cargill, Incorporated, Chr. Hansen A/S, Alltech Group, Lallemand Inc., Koninklijke DSM N.V., Nutreco N.V., Kerry Group plc, Synergy Flavors, Inc., The Archer Daniels Midland Company, Oriental Yeast Company Limited, Diamond V Mills, Inc. (Diamond V), Pacific Ethanol, Inc, Leiber GmbH etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Major yeast companies are implementing strategies to enhance their market standing and promote expansion. Their focus is on innovation in products by creating new and enhanced yeast strains to fulfill the varied requirements of the food and beverage (F&B) and bioethanol sectors. Enhancing the functional properties of yeast and broadening its applications are top priorities that require investments in research operations. These companies are also seeking strategic acquisitions and partnerships to expand their product portfolios and market presence. Moreover, they are placing importance on sustainable production methods and increasing their footprint in developing markets to take advantage of the growing demand for yeast products. In August 2023, Red Star Yeast launched its 10th fermentation facility in Cedar Rapids, increasing its yeast production capacity, crucial for 40% of North American bread production. This growth reinforced its status as the biggest yeast factory in the world.

Yeast Market News:

- January 2024: Lallemand Inc. announced that its subsidiary Danstar Ferment AG had acquired Swiss biotech firm Evolva AG to strengthen its yeast-based technology and broaden its range of products. The deal, originally worth CHF 20 million, was endorsed by Evolva's investors in 2023.

- January 2024: Argentina approved the sale of four genetically modified yeast strains to enhance ethanol production efficiency and sustainability. This important regulatory achievement supports the country's expanding biofuels sector and is in line with its environmental objectives.

- December 2023: Ohly finished substantial investments in its Hamburg facility to increase production capacity and efficiency for their yeast extracts. These improvements comprised of an advanced drying tower and a fresh fermentation facility, with the goal of improving sustainability and satisfying increasing customer needs.

Yeast Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Dry Yeast, Instant Yeast, Fresh Yeast, Others |

| Types Covered | Baker’s Yeast, Brewer’s Yeast, Wine Yeast, Bioethanol Yeast, Feed Yeast, Others |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Associated British Foods Plc, Lesaffre & CIE, Angel Yeast Co., Ltd, Cargill, Incorporated, Chr. Hansen A/S, Alltech Group, Lallemand Inc., Koninklijke DSM N.V., Nutreco N.V., Kerry Group plc, Synergy Flavors, Inc., The Archer Daniels Midland Company, Oriental Yeast Company Limited, Diamond V Mills, Inc. (Diamond V), Pacific Ethanol, Inc., Leiber GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2020-2034.

- The yeast market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the market and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the yeast industry.

Key Questions Answered in This Report

The global yeast market was valued at USD 8,342.2 Million in 2025.

We expect the global yeast market to exhibit a CAGR of 6.10% during 2026-2034.

The rising usage of yeast in the baking industry, coupled with the growing consumer awareness towards the nutritional benefits of inactivated yeast in dietary supplements, is primarily driving the global yeast market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of yeast.

Based on the form, the global yeast market can be categorized into dry yeast, instant yeast, fresh yeast, and others. Currently, fresh yeast exhibits clear dominance in the market.

Based on the type, the global yeast market has been segmented into baker’s yeast, brewer’s yeast, wine yeast, bioethanol yeast, feed yeast, and others. Among these, baker’s yeast represents the largest market share.

Based on the application, the global yeast market can be bifurcated into food, feed, and other applications. Currently, food accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global yeast market include Associated British Foods Plc, Lesaffre & CIE, Angel Yeast Co., Ltd, Cargill, Incorporated, Chr. Hansen A/S, Alltech Group, Lallemand Inc., Koninklijke DSM N.V., Nutreco N.V., Kerry Group plc, Synergy Flavors, Inc., The Archer Daniels Midland Company, Oriental Yeast Company Limited, Diamond V Mills, Inc. (Diamond V), Pacific Ethanol, Inc., Leiber GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)