Commercial Printing Market Size, Share, Trends and Forecast by Technology, Print Type, Application, and Region, 2025-2033

Commercial Printing Market Size and Share:

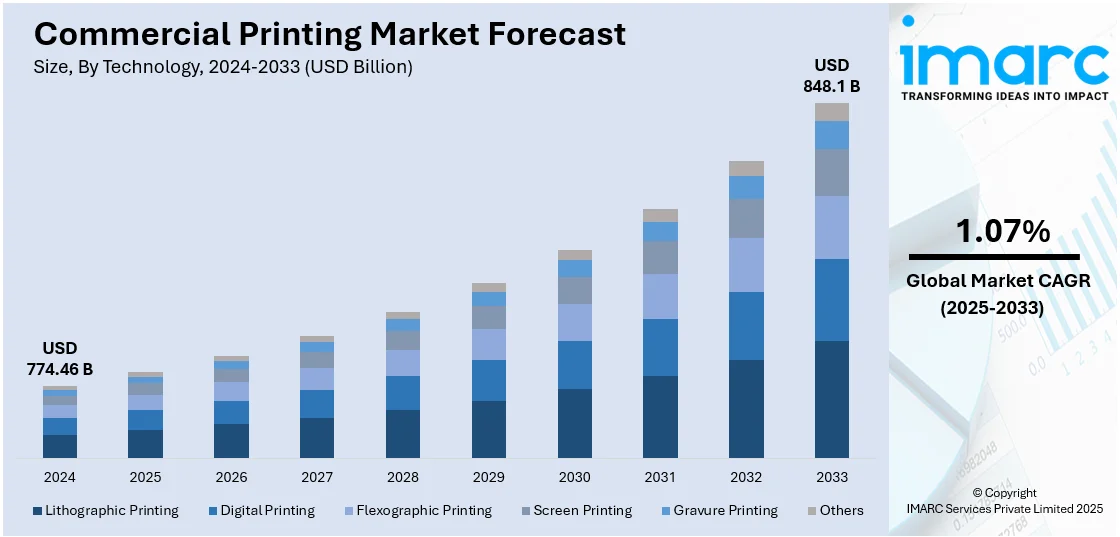

The global commercial printing market size was valued at USD 774.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 848.1 Billion by 2033, exhibiting a CAGR of 1.07% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 37.5% in 2024. The market share in the Asia Pacific region is growing because of its strong manufacturing base, rising demand for packaging, and rapid urbanization. High consumption of printed materials across retail, education, and e-commerce sectors, coupled with cost-effective production and expanding digital print adoption, which is supporting the regional growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 774.46 Billion |

|

Market Forecast in 2033

|

USD 848.1 Billion |

| Market Growth Rate 2025-2033 | 1.07% |

The rising need for packaged consumer products, particularly in areas like food, drinks, pharmaceuticals, and cosmetics, is impelling the market growth. Packaging not only secures the product but also acts as an essential branding element. Labels featuring eye-catching graphics and clear details are essential for meeting regulatory standards and enhancing client interaction, particularly with the growth of e-commerce and retail chains worldwide. In addition to this, contemporary print service providers are incorporating digital tools like automated job scheduling, online proofs, and cloud-based ordering systems to improve efficiency, reduce human mistakes, and enable better communication with clients. Furthermore, the growing user awareness about the environment is encouraging commercial printing companies to embrace eco-friendly methods, such as utilizing recyclable materials, soy or water-soluble inks, and energy-efficient equipment. This change not only lessens environmental impact but also attracts brands that value sustainable supply chains and corporate social responsibility.

To get more information on this market, Request Sample

The United States plays a vital role in the market since manufacturers and retailers depend significantly on premium packaging to distinguish their products. Commercial printers are essential in creating personalized boxes, labels, and flexible packaging for food, drinks, pharmaceuticals, and consumer products to improve branding, compliance, and supply chain requirements. Moreover, printing solutions driven by AI are boosting output quality, facilitating smarter workflows, and increasing user productivity. These advancements enhance quality business printing, optimize tasks, and address the increasing need for smart, efficient, and secure printing solutions. In 2024, HP introduced HP Print AI, the inaugural intelligent printing experience, aimed at making printing easier with functionalities such as Perfect Output for perfect prints and tailored assistance. The technology improved home and office printing by boosting creativity, productivity, and teamwork while maintaining data privacy. Additionally, the Perfect Output function guaranteed top-quality prints suitable for professional applications, including business documents and promotional materials.

Commercial Printing Market Trends:

Technological Advancements and Innovation

The printing industry has witnessed significant innovations in recent years, particularly in the areas of digital printing, automation, and the integration of smart technologies. Digital printing, in particular, is revolutionizing the industry by enabling cost-effective short-run printing, personalization, and quick turnaround times. The advent of high-speed inkjet and laser printing technologies is significantly improving the quality and speed of production, reducing waste and setup costs. These advancements are also influencing large-scale print procurement, such as the U.S. Government Publishing Office's (GPO) program, which awarded USD 469.2 Million in contracts with private-sector printing companies in fiscal year 2024 to meet Federal agencies' printing and publishing needs. Additionally, the advent of automation and workflow management solutions is streamlining production processes, reducing errors, and enhancing efficiency. Furthermore, the integration of augmented reality (AR) and variable data printing (VDP) technologies is enabling businesses to create highly personalized and interactive printed materials. These innovations are expanding the range of applications for commercial printing, including personalized direct mail, packaging, and point-of-purchase displays.

Sustainability and Environmental Concerns

Companies are increasingly seeking environment-friendly printing solutions that reduce their carbon footprint and align with their corporate social responsibility (CSR) initiatives. This shift in demand is prompting commercial printers to adopt eco-friendly practices and invest in sustainable materials and processes. In addition to this, commercial printers are implementing energy-efficient printing technologies and recycling and waste reduction programs to minimize their environmental impact. Various sustainability certifications, such as the Forest Stewardship Council (FSC) and Sustainable Green Printing Partnership (SGP), are gaining prominence, providing assurance to clients that their printed materials are produced with minimal environmental impact. These initiatives are crucial, especially as the UN Environment Programme warns that without urgent waste management action, the global annual cost of waste could almost double to USD 640.3 Billion by 2050. As businesses continue to prioritize sustainability and individuals favor products and services with green credentials, the commercial printing industry is poised to witness growth in demand for eco-friendly printing solutions.

E-commerce and On-Demand Printing

The rise of e-commerce and changing dynamics of retail have a significant impact on the commercial printing industry. E-commerce businesses require packaging, promotional materials, and marketing collateral in varying quantities, often in smaller, customized batches. This is catalyzing the demand for on-demand printing services, which cater to the specific needs of online retailers and businesses with agile supply chains. The global e-commerce market reached USD 26.8 Trillion in 2024, and with projections to hit USD 214.5 Trillion by 2033 at a CAGR of 25.83% (2025-2033), businesses are increasingly seeking on-demand printing services. Furthermore, on-demand printing enables the quick creation of materials, decreasing the necessity for extensive print runs and storage expenses. In addition, it allows for customization, empowering businesses to design distinct, targeted marketing materials and packaging for various products and customer segments. This trend corresponds with the shift towards just-in-time inventory oversight and the growing demand for adaptable, economical printing options.

Commercial Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial printing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, print type, and application.

Analysis by Technology:

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

Lithographic printing stands as the largest component in 2024, holding 40.9% of the market, because of its cost-effectiveness in generating high-volume print runs with uniform quality. It is commonly utilized for books, newspapers, pamphlets, magazines, and packaging as it produces crisp, detailed visuals and accommodates various paper types and finishes. This technology allows for large-scale manufacturing at reduced costs per unit, making it perfect for extended projects. Moreover, progress in plate production and ink compositions is enhancing setup durations and ecological efficiency, further solidifying its market position. Companies favor lithography for tasks that demand precision, color fidelity, and longevity, particularly in fields such as publishing, advertising, and packaging. Its capacity to preserve image quality across extensive batches without sacrificing clarity or alignment provides it an advantage over newer printing techniques in certain applications. The existing infrastructure and trained workforce further support its ongoing leadership in commercial printing activities around the world.

Analysis by Print Type:

- Image

- Painting

- Pattern

- Others

Image leads the market with 65.1% of market share in 2024, because of its extensive use in advertising, packaging, publishing, and business branding. Companies depend largely on visually striking materials, like posters, brochures, banners, product labels, and magazine covers, to capture interest and convey brand identity. Image printing boosts user interaction by providing high-quality visuals, vivid colors, and intricate graphics that improve message recall. As marketing tactics become oriented towards design, the need for striking and expertly printed visuals keeps increasing. Advancements in color calibration, resolution, and substrate compatibility are enhancing the precision and adaptability of image printing on different surfaces. Image print formats, ranging from retail showcases to premium product packaging, are crucial for communicating quality and aesthetic attraction. As industries move towards personalized and creative designs, they are emphasizing image-centric materials to differentiate themselves in competitive markets, thereby strengthening its leading role in the commercial printing sector.

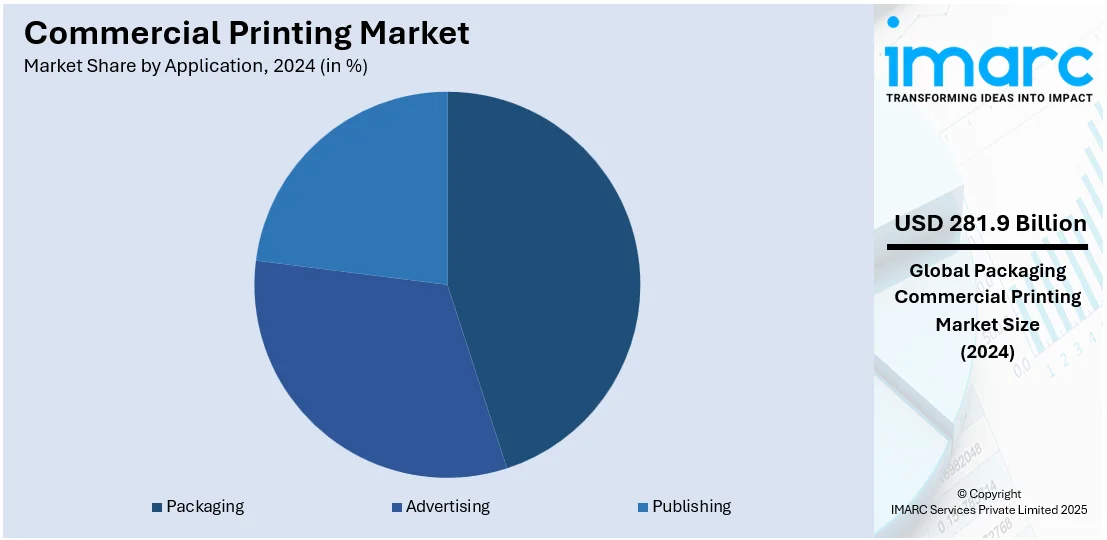

Analysis by Application:

- Packaging

- Advertising

- Publishing

Packaging represents the largest segment, accounting 36.4% of market share in 2024. It leads the market, driven by the increasing need for both branded and functional packaging in sectors such as food and beverage, pharmaceuticals, cosmetics, electronics, and consumer goods. With products vying for visibility on store shelves and online platforms, packaging is emerging as an essential marketing asset, integrating design, information, and functionality. Commercial printers assist with this by providing top-notch printed cartons, labels, wraps, and flexible packaging options. The rise in e-commerce is catalyzing the demand for attractive and sturdy packaging that safeguards products during transit while enhancing brand identity. Regulatory mandates concerning product details and safety labeling also play a role in maintaining consistent demand. Moreover, the transition to eco-friendly and recyclable packaging options is creating novel possibilities for inventive printing solutions.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of 37.5%. The region has become a hub for manufacturing and export-oriented industries. With many global supply chains deeply entrenched in the region, there is a continuous requirement for printed materials such as product packaging, labels, and marketing collateral. This fuels the commercial printing market demand as businesses aim to maintain their competitiveness and brand visibility in the global market. Furthermore, the proliferation of businesses across various sectors, rely heavily on commercial printing to communicate with clients, enhance brand recognition, and promote their products and services. As a result, the commercial printing market in Asia Pacific is experiencing growth, catering to diverse industries including manufacturing, retail, technology. In addition, launch of advanced digital presses with specialized features is accelerating commercial printing growth in the Asia Pacific region. In February 2025, at PrintPack 2025 India, Konica Minolta will unveil its AccurioPress 14010S, featuring white toner capability for high-volume, specialized printing applications. The event will showcase a wide array of digital printing solutions for commercial printing, packaging, and label industries.

Key Regional Takeaways:

United States Commercial Printing Market Analysis

In North America, the market portion held by the United States was 87.60% of the overall total. The United States commercial printing market is experiencing steady growth owing to advancements in digital printing technologies and increasing demand for packaging and labeling solutions. The expansion of e-commerce is significantly contributing to the need for high-quality printed materials, including promotional and packaging prints. Sustainable printing practices, such as the adoption of eco-friendly inks and recyclable substrates, are gaining traction. The integration of automation and AI in printing processes enhances efficiency and cost-effectiveness. Furthermore, customization and variable data printing are driving the market expansion, as businesses seek personalized marketing solutions. The commercial printing industry continues to benefit from technological innovations that improve print quality and turnaround time. Moreover, the shift toward hybrid printing, which combines digital and offset techniques, is offering flexibility and cost efficiency. Growth in sectors such as retail, healthcare, and publishing further support market expansion. Notably, the United States digital printing market size is projected to exhibit a growth rate (CAGR) of 2.90% during 2024-2032, highlighting the increasing adoption of digital technologies in the industry. Investments in advanced printing solutions, including UV and 3D printing, are opening new opportunities for service providers.

Europe Commercial Printing Market Analysis

The Europe commercial printing market is expanding accredited to the growing demand for high-quality packaging, labeling, and marketing materials, with digital and hybrid printing technologies enhancing efficiency and customization. The rise of sustainable printing practices, such as eco-friendly inks and recyclable substrates, is further influencing the industry’s development. According to the European Commission, 40% of plastics used in the EU are in packaging, highlighting the significant role of printed packaging in the region. This growing emphasis on sustainable packaging solutions is driving the adoption of environment-friendly printing technologies. Additionally, the market is witnessing increased demand for print-on-demand services, driven by businesses seeking cost-effective and flexible printing solutions. Advancements in automation and AI are streamlining production processes, reducing waste, and improving turnaround times. The publishing and advertising industries are driving market growth, with digital printing, hybrid printing, and high-resolution technologies expanding the scope of the printing industry.

Asia Pacific Commercial Printing Market Analysis

The Asia Pacific commercial printing market is expanding because of increased demand for packaging, labeling, and marketing materials. Digital technologies like inkjet and laser printing are gaining prominence attributed to efficiency and cost-effectiveness. Automation and AI integration are improving productivity and reducing operational costs. Sustainable practices are also gaining traction, with hybrid printing solutions becoming more popular. The preference for personalized and on-demand printing services supports market growth. Additionally, the adoption of advanced printing techniques, such as 3D and UV printing, is opening new growth opportunities. The growing demand for packaging solutions plays a significant role in driving the commercial printing market demand. According to the India Brand Equity Foundation (IBEF), packaging is currently the fifth-largest sector of the Indian economy and is projected to grow at a compound annual growth rate (CAGR) of 26.7% to reach USD 204.81 Billion by 2025. This expansion in packaging demand directly influences the need for high-quality printing solutions in the region.

Latin America Commercial Printing Market Analysis

The Latin American commercial printing market is expanding attributed to rising demand for packaging, advertising materials, and customized print solutions. Digital technologies like inkjet and laser printing are enhancing efficiency and cost-effectiveness. Hybrid printing solutions are gaining popularity because of flexibility. Sustainable practices and automation in printing processes are influencing market trends. Print-on-demand services are also gaining popularity. Technological advancements, including high-resolution and specialty printing methods, are expanding the industry’s capabilities. Notably, the 3D printing segment is experiencing rapid growth in the region. According to IMARC Group, the Brazil 3D printing market size reached USD 0.62 Billion in 2024 and is projected to grow at a CAGR of 18.10% from 2025 to 2033, reaching USD 2.75 Billion by 2033. This growth highlights the increasing adoption of advanced printing technologies, which are further contributing to the expansion of the commercial printing market.

Middle East and Africa Commercial Printing Market Analysis

The Middle East and Africa commercial printing market is growing owing to increased demand for packaging, advertising materials, and labels. Digital and hybrid printing technologies are improving efficiency, while print-on-demand services offer flexible options. Automation and AI-driven processes are reducing waste, and sustainable practices are gaining traction. A key factor contributing to market expansion is the rapid growth of the e-commerce sector. According to IMARC Group, Saudi Arabia’s e-commerce market size reached USD 222.9 Billion in 2024 and is projected to reach USD 708.7 Billion by 2033, growing at a CAGR of 12.8% during 2025-2033. This surge in online retail is fueling the demand for high-quality printed packaging and labeling solutions, further supporting the commercial printing industry.

Competitive Landscape:

Major market participants are allocating funds toward advanced printing technology and software to maintain their competitiveness. This involves embracing digital printing technology, automation, computer-to-plate (CTP) systems, and software for effective workflow management. These investments enhance print quality, shorten turnaround times, and reduce waste, thereby boosting revenue in the commercial printing market. Numerous commercial printing firms are adopting eco-friendly practices as well. They utilize environmentally safe inks and papers, minimize waste via enhanced printing methods, and acquire certifications to showcase their dedication to sustainability. For example, in 2025 , hubergroup introduced the eco-conscious DYNAMICA Ink Series, an ink free from cobalt and mineral oils intended for high-speed commercial printing. This quick-drying ink provides vivid colors, outstanding gloss, and rapid post-print finishing, all while promoting sustainability with its Cradle-to-Cradle certification. It is designed for large-scale operations, guaranteeing efficiency and uniform print quality. Therefore, eco-friendly practices attract environmentally aware clients while simultaneously lowering operational expenses.

The report provides a comprehensive analysis of the competitive landscape in the commercial printing market with detailed profiles of all major companies, including:

- Acme Printing Co.

- Dai Nippon Printing Co., Ltd.

- Duncan Print Group (Carton Group GmbH)

- Eastman Kodak Company

- Ennis, Inc.

- Quad/Graphics Inc.

- Quebecor Inc.

- R.R. Donnelley & Sons Company

- Taylor Corporation

- WestRock Company

Latest News and Developments:

- October 2025: MGX was thrilled to unveil two innovative products, Unilustre™ Metallized Board and ReadyMAG® Pre-Magnetized Magnet Paper, at the PRINTING United Expo in Orlando, Florida. Both were designed to enable commercial printers and designers with high-performance, ready-to-use substrates that could blend innovation and versatility.

- May 2025: Seiko Epson Corporation introduced three new inkjet printheads to address the growing digital printing market in both commercial and industrial sectors. The products utilized Epson's distinct PrecisionCore technology, offering excellent print quality and enhanced productivity.

- March 2025: Quad/Graphics Inc., a leading commercial printing firm in North America, ventured into the branded solutions sector, providing promotional items, such as corporate gifts and staff uniforms. The action improved its marketing solutions offerings, enabling smooth management of brand-aligned merchandise. Quad sought to streamline marketers' tasks, guaranteeing quality, uniformity, and effectiveness in branded goods initiatives.

- January 2025: At PrintPack 2025, Konica Minolta would introduce its AccurioPress 14010S and showcase a comprehensive range of digital printing solutions aimed at revolutionizing the commercial printing, packaging, and label sectors. The exhibition was set to take place from February 1 to 5, 2025, at the India Expo Centre & Mart, Greater Noida, Delhi NCR. Attendees at PrintPack 2025 would witness live showcases of these innovative printing technologies at the Konica Minolta exhibit.

Commercial Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Lithographic Printing, Digital Printing, Flexographic Printing, Screen Printing, Gravure Printing, Others |

| Print Types Covered | Image, Painting, Pattern, Others |

| Applications Covered | Packaging, Advertising, Publishing |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Acme Printing Co., Dai Nippon Printing Co., Ltd., Duncan Print Group (Carton Group GmbH), Eastman Kodak Company, Ennis, Inc., Quad/Graphics Inc., Quebecor Inc., R.R. Donnelley & Sons Company, Taylor Corporation, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial printing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial printing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial printing market was valued at USD 774.46 Billion in 2024.

The commercial printing market is projected to exhibit a CAGR of 1.07% during 2025-2033, reaching a value of USD 848.1 Billion by 2033.

The commercial printing market is driven by rising demand for packaging, increasing use of digital printing technology, and growth in advertising and publishing industries. Expanding e-commerce and customized printing needs are also supporting the market growth. Additionally, innovations in inkjet and laser printing, along with eco-friendly practices, are shaping industry trends and attracting new business opportunities.

Asia Pacific currently dominates the commercial printing market, accounting for a share of 37.5%. The dominance of the region is because of its large user base and expanding packaging and e-commerce sectors. The region benefits from cost-effective production, technological advancements, and strong demand across advertising, publishing, and labeling applications.

Some of the major players in the commercial printing market include Acme Printing Co., Dai Nippon Printing Co., Ltd., Duncan Print Group (Carton Group GmbH), Eastman Kodak Company, Ennis, Inc., Quad/Graphics Inc., Quebecor Inc., R.R. Donnelley & Sons Company, Taylor Corporation, WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)