Diaper Market in India Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Diaper Market in India Summary:

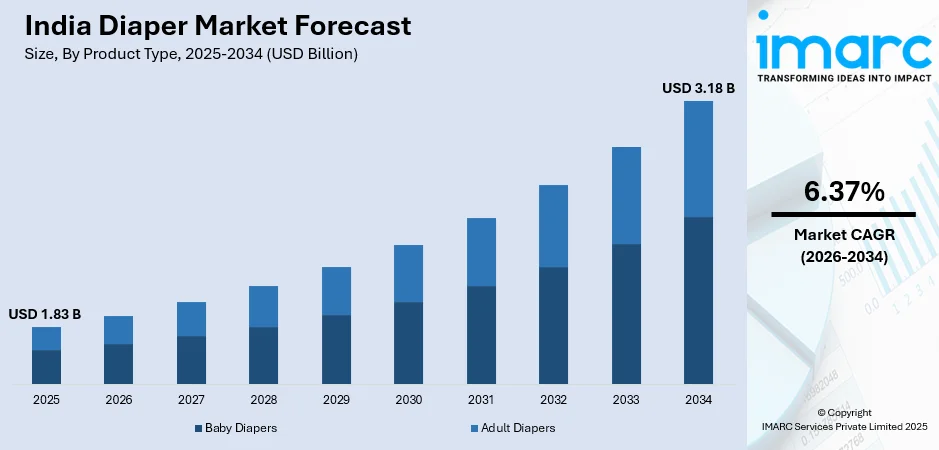

The diaper market in India size was valued at USD 1.83 Billion in 2025 and is projected to reach USD 3.18 Billion by 2034, growing at a compound annual growth rate of 6.37% from 2026-2034.

The Indian market for diapers is growing very aggressively due to mounting focus on child health and hygiene, increasing cases of urinary incontinence and related health disorders due to ill health affecting a large population of older people in their motor abilities, as well as mounting awareness about personal hygiene. India’s diaper market is growing due to rapid urbanization in cities like Delhi, rising disposable incomes, smaller dual-income families, and aggressive marketing campaigns by major brands.

.webp)

To get more information on the market, Request Sample

Key Takeaways and Insights:

- By Product Type: Baby diapers dominate the market with a share of 88.09% in 2025, driven by the country's substantial birth rate, expanding population base, rising household incomes enabling greater expenditure on premium infant care products, and growing awareness among parents regarding infant hygiene and comfort.

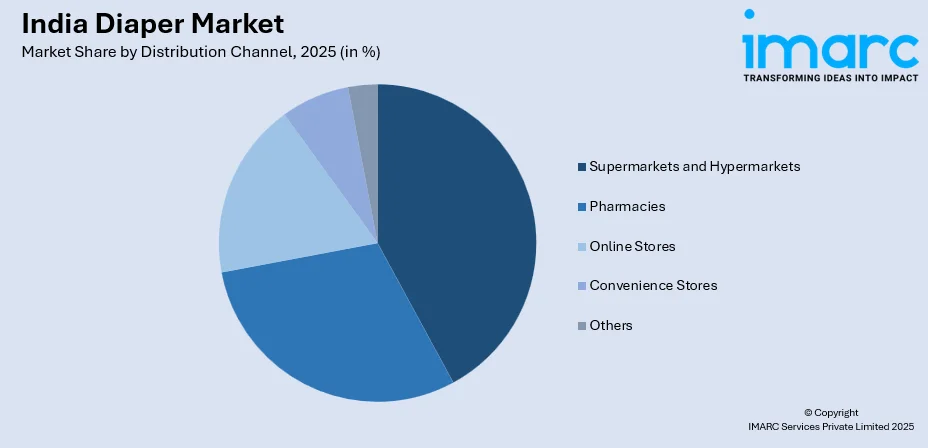

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 42.14% in 2025, attributed to wide product assortments, competitive pricing structures, promotional offers, convenient one-stop shopping experiences, and the expansion of modern retail formats across Indian cities.

- By Region: North India dominates the market with a share of 34% in 2025, supported by high population density, significant urbanization rates, the presence of major metropolitan centers including the National Capital Region, and well-developed retail infrastructure.

- Key Players: The diaper market in India features a competitive landscape with established multinational corporations and domestic manufacturers competing through product innovation, design advancements, strategic pricing, distribution expansion, and targeted marketing campaigns to capture evolving consumer preferences across urban and rural segments. Some of the key players operating in the market include, Himalaya Wellness Company, Kangaroo Health Care, Kimberly-Clark, Luzon Healthcare, Millennium BabyCares Ltd., Nobel Hygiene Private Limited, PAN Healthcare Pvt. Ltd., Procter & Gamble, Romsons Prime Pvt. Ltd., Swara Baby Products Pvt. Ltd., Unicharm Corporation, Uniclan Healthcare Pvt. Ltd., Kamal Health Care Pvt. Ltd., Seni India, and Tataria Hygiene.

To get more information on this market Request Sample

The Indian diaper industry is steadily evolving as consumers place greater importance on hygiene, convenience, and comfort for infants as well as adults managing incontinence. Growing middle class aspirations, increased exposure to global lifestyle trends through digital platforms, and higher workforce participation among women are influencing purchasing decisions and strengthening demand for disposable diaper solutions. This transition aligns with the Government of India’s sustained focus on sanitation and personal hygiene under Swachh Bharat Mission, which continues to promote preventive health practices nationwide. In response, manufacturers are expanding their portfolios to include pant style diapers, tape based options, training pants, and dedicated adult incontinence products designed for different needs and usage scenarios. Rising interest in premium, skin friendly, and environmentally responsible products highlights a shift toward health conscious and sustainable consumption. At the same time, the growth of modern retail and e commerce platforms is improving product availability in tier two and tier three cities, extending access beyond major urban markets.

Diaper Market in India Trends:

Dominance of Pant-Style Diapers and Product Innovation

The Indian diaper market is increasingly shifting toward pant style diapers, which are gaining preference over traditional tape variants due to easier wearability and improved comfort. Reflecting this trend, Romsons Group entered the baby diaper segment in 2025 with its Poochie Play Pants range, offered in both pant and tape formats to address rising demand among Indian parents. Manufacturers are also introducing value focused pant style sub brands to attract entry level consumers in tier two and tier three cities. Continuous innovation in absorption technology, longer dryness duration, and enhanced leak protection is driving product differentiation, while increased investment in research and development is improving comfort and skin friendliness for babies and adults.

Growing Demand for Premium and Eco-Friendly Variants

Indian consumers are increasingly gravitating toward premium and eco-friendly diaper options as parents become more conscious of their babies’ health and environmental impact. For instance, SuperBottoms, a sustainable Indian baby care brand, introduced the country’s first biodegradable disposable diaper liners made from plant based materials to complement cloth diapering, aiming to reduce waste and provide an eco-conscious alternative to conventional disposables. Biodegradable diapers using plant fibers, organic cotton, and chemical free absorbents are gaining popularity by limiting exposure to potentially harmful substances. Tree free technologies and other sustainable innovations mark significant progress in the market. Manufacturers are increasingly focusing on natural, hypoallergenic, and dermatologically tested formulations to meet growing demand for gentle, skin safe products that reduce diaper rash and irritation.

Rising Awareness and Acceptance of Adult Diapers

The adult diaper segment is growing rapidly, driven by a rising elderly population, greater hygiene awareness, and expanding healthcare infrastructure. Homegrown brand Friends Adult Diapers marked its 25‑year presence in India with the nationwide “Azadi Mubarak” initiative, including bike rallies, free health camps, and old‑age home visits to reduce stigma around incontinence and encourage adoption. Media coverage and public health campaigns are normalizing incontinence management, while innovations such as sensor‑enabled smart diapers, premium sustainable packaging, and aloe‑infused skin‑safe variants reflect manufacturers’ focus on comfort, performance, and evolving consumer expectations.

Market Outlook 2026-2034:

The diaper market in India is positioned for sustained growth throughout the forecast period, supported by favorable demographic trends, rising disposable incomes, and evolving consumer lifestyle preferences. Continued urbanization and the expansion of nuclear families where both parents work professionally create strong preference for convenient disposable diapering solutions that minimize laundry requirements and save time. The growing penetration of organized retail and e-commerce platforms will enhance product accessibility across diverse geographic regions and consumer segments. Innovation in product formulations, absorption technologies, and sustainable materials will remain critical for market participants seeking to differentiate their offerings and capture consumer attention. The aging population trend and increasing healthcare awareness will continue driving adult diaper segment growth. The market generated a revenue of USD 1.83 Billion in 2025 and is projected to reach a revenue of USD 3.18 Billion by 2034, growing at a compound annual growth rate of 6.37% from 2026-2034.

Diaper Market in India Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Baby Diapers |

88.09% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

42.14% |

|

Region |

North India |

34% |

Product Type Insights:

- Baby Diapers

- Baby Disposable Diaper

- Baby Training Diaper

- Baby Cloth Diaper

- Baby Swim Pants

- Others

- Adult Diapers

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

The baby diapers dominates with a market share of 88.09% of the total diaper market in India in 2025.

Baby diapers continue to dominate the Indian market, driven by the country’s high birth rate and growing population. In January 2024, Procter & Gamble’s Pampers launched its Premium Care diaper range in India, featuring 360‑degree cottony softness, an anti‑rash blanket, and aloe vera lotion to attract parents seeking health‑ and comfort‑focused, premium options. Rising household incomes allow families to spend more on superior infant care products, while rapid urbanization and the increase of nuclear families with working parents are fueling demand for disposable diapers that save time and reduce laundry.

Modern parents in India show a greater understanding of the need for infant hygiene care through quality diapers that can ensure adequate performance. The current market scenario encompasses a wide array of formats such as disposable diapers, training pants, cloth diapers, as well as swim pants for different stages of development. The key innovation in the current market trend for diapers has been the development of materials for greater skin friendliness, advanced absorption capacities, and wetness indicators for advanced value additions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies

- Online Stores

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

The supermarkets and hypermarkets lead with a share of 42.14% of the total diaper market in India in 2025.

Supermarkets and Hypermarkets: The major distribution channel for buying diapers is supermarkets and hypermarkets, as they get to enjoy the benefits associated with the wider ranges offered, price structures, and the convenience of a single stop option offered by these retailing formats. The organised retail environment allows manufacturers to create significant consumer awareness and attraction through effective use of visual merchandising, display, and demonstration points, among other techniques, by giving an insight into various brands and sizes arranged together during single stop substitution within these encouraging retail formats.

The rise of supermarket and hypermarket chains in Indian cities is adding to the convenience and accessibility of diapers for consumers. Such stores offer a complete range of diaper products ranging from economy to premium brands and extending to baby as well as adult products. The offers and deals offered by some of these stores are not only a marketing tool for the players in the diaper industry but are also tempting enough to attract price-sensitive Indian consumers to try new brands of quality hygiene products.

Regional Insights:

- West and Central India

- South India

- North India

- East and North-East India

North India exhibits a clear dominance with a 34% share of the total diaper market in India in 2025.

North India continues to be the largest regional market for diapers, on the back of high population density, relatively higher rate of urbanization, and the presence of large metropolitan centres, such as the National Capital Region. The region enjoys relatively better disposable incomes in urban areas, better retail infrastructure with modern trade formats, and good consumer awareness pertaining to hygiene and infant care products. The presence of young families, working professionals, and healthcare facilities in northern states leads to huge demand for both baby and adult diaper products.

The region known as North India reveals considerable acceptance of modern retail and online services that improve consumer accessibility to various diaper offerings across various price points and brands. The region's strong cultural traditions related to the welfare, health, and well-being of children make the region support a strong demand for quality infant health products as well. The region also houses manufacturing plants for various products, ensuring an uninterrupted supply and effective distribution networks to support urban and emerging markets.

Market Dynamics:

Growth Drivers:

Why is the Diaper Market in India Growing?

Rising Urbanization and Changing Family Structures

India is experiencing rapid urbanization as millions migrate to cities seeking employment and better living standards. A United Nations report notes that India is the world’s largest contributor to urban population growth, with new urban residents expected between 2025 and 2050, and about 36 % of the population already living in cities in 2025, projected to reach nearly 50 % by mid‑century. This shift concentrates populations in urban centers where nuclear families predominate and both parents often work. Growing female workforce participation and smaller living spaces are driving demand for disposable diapers, which offer convenience, time savings, and efficient infant care, especially in households lacking extended family support.

Increasing Disposable Incomes and Health Awareness

Economic growth and rising employment across sectors have increased household incomes, allowing consumers to spend more on hygiene and infant care products. In May 2025, Neo Asset Management invested approximately ₹170 crore (≈ $20 million) in Indian disposable hygiene company Nobel Hygiene to expand its adult and baby diaper distribution network and strengthen flagship brands, reflecting strong investor confidence in India’s premium diaper market. Indian parents are increasingly willing to pay for quality diapers that ensure comfort, skin health, and protection against rashes. Growing awareness of infant hygiene, coupled with pediatrician recommendations, is driving adoption of branded diapers over traditional alternatives, while the premiumization trend reflects demand for superior materials, enhanced absorption, and skin‑safe formulations.

Expanding Retail Infrastructure and E-commerce Growth

The rapid growth of organized retail, including supermarkets, hypermarkets, and pharmacy chains, has greatly enhanced diaper accessibility and visibility in Indian cities. Modern retail spaces enable product discovery, brand comparison, and promotional engagement, driving consumer awareness and trial. Complementing this, India’s booming e‑commerce sector, valued at USD 129.72 billion in 2025 and projected to reach USD 651.10 billion by 2034, is emerging as a key channel for purchasing diapers. Online platforms offer convenience, competitive pricing, subscription options, and access to a wider range of brands. Combined with digital marketing, influencer partnerships, and targeted campaigns, these channels shape consumer preferences, while the expansion of distribution into tier‑two and tier‑three cities is progressively democratizing access to quality diaper products beyond metropolitan areas.

Market Restraints:

What Challenges the Diaper Market in India is Facing?

Price Sensitivity and Affordability Concerns

The Indian consumer market remains highly price-sensitive, particularly in semi-urban and rural areas where disposable diapers face competition from traditional cloth alternatives that offer lower ongoing costs despite requiring additional laundry effort. The relatively high cost of quality disposable diapers compared to traditional options can limit their penetration among lower-income segments and price-conscious families who prioritize essential expenditures. Manufacturers must carefully balance product quality, features, and pricing to address diverse affordability considerations across the Indian market.

Environmental Concerns and Disposal Challenges

Disposable diapers contribute significantly to environmental pollution due to their non-biodegradable nature and the challenges associated with proper waste disposal in Indian municipalities. Growing environmental awareness among consumers creates scrutiny of conventional diaper products and drives demand for sustainable alternatives. Manufacturers face pressure to develop eco-friendly formulations, biodegradable materials, and recyclable packaging solutions that address environmental concerns while maintaining product performance and affordability standards.

Limited Awareness and Penetration in Rural Markets

Despite overall market growth, diaper adoption remains concentrated in urban and metropolitan areas, with limited penetration in rural markets where traditional cloth diapering practices continue to predominate. Lower awareness about the benefits and availability of disposable diapers, combined with cultural preferences and distribution challenges, constrains market expansion beyond established urban centers. Additionally, the Indian market remains dependent on imports for certain raw materials used in diaper manufacturing, creating supply chain vulnerabilities and cost pressures that impact product pricing and availability.

Competitive Landscape:

The diaper market in India features a competitive landscape with established multinational corporations and prominent domestic manufacturers vying for market leadership across baby and adult diaper segments. Key players compete through diverse product portfolios spanning multiple format types, size variants, and price segments to address heterogeneous consumer preferences. Innovation in product design, absorption technologies, skin-friendly materials, and sustainable formulations serves as primary differentiators among leading competitors. Strategic distribution expansion targeting both urban markets and emerging rural territories enables manufacturers to broaden their consumer reach. The competitive environment is characterized by aggressive marketing campaigns, celebrity endorsements, influencer collaborations, and promotional activities that seek to build brand awareness and drive consumer trial. Manufacturing capacity investments and supply chain optimization efforts support market participants in meeting growing demand while maintaining cost competitiveness.

Some of the key players include:

- Himalaya Wellness Company

- Kangaroo Health Care

- Kimberly-Clark

- Luzon Healthcare

- Millennium BabyCares Ltd.

- Nobel Hygiene Private Limited

- PAN Healthcare Pvt. Ltd.

- Procter & Gamble

- Romsons Prime Pvt. Ltd.

- Swara Baby Products Pvt. Ltd.

- Unicharm Corporation

- Uniclan Healthcare Pvt. Ltd.

- Kamal Health Care Pvt. Ltd.

- Seni India

- Tataria Hygiene

Recent Developments:

- In April 2025, Swara Baby Products Pvt. Ltd. launched India’s first tree-free diaper technology under its Baby Hug Pro brand. The innovation reduces wood-pulp usage from nearly 100% to about 7% without compromising absorption or comfort. Certified by BIS and OEKO-TEX, the diapers target eco-conscious parents seeking sustainable baby care solutions.

India Diaper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Pharmacies, Online Stores, Supermarkets and Hypermarkets, Convenience Stores, Others |

| Regions Covered | West and Central India, South India, North India, East, North-East |

| Companies Covered | Himalaya Wellness Company, Kangaroo Health Care, Kimberly-Clark, Luzon Healthcare, Millennium BabyCares Ltd., Nobel Hygiene Private Limited, PAN Healthcare Pvt. Ltd., Procter & Gamble, Romsons Prime Pvt. Ltd., Swara Baby Products Pvt. Ltd., Unicharm Corporation, Uniclan Healthcare Pvt. Ltd., Kamal Health Care Pvt. Ltd., Seni India, Tataria Hygiene, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The diaper market in India size was valued at USD 1.83 Billion in 2025.

The diaper market in India is expected to grow at a compound annual growth rate of 6.37% from 2026-2034 to reach USD 3.18 Billion by 2034.

Baby diapers dominated the diaper market in India with a share of 88.09%, driven by the country's substantial birth rate, expanding population base, rising household incomes, rapid urbanization, nuclear family proliferation, and growing parental awareness regarding infant hygiene and comfort.

Key factors driving the diaper market in India include rising urbanization and changing family structures, increasing disposable incomes and health awareness among parents, growing participation of women in the workforce, expansion of organized retail and e-commerce channels, innovations in diaper design and absorption technologies, and rising awareness about adult incontinence care solutions.

Major challenges include price sensitivity among consumers particularly in rural and semi-urban areas, environmental concerns regarding non-biodegradable disposable diaper waste, limited awareness and penetration beyond metropolitan markets, competition from traditional cloth diapering practices, and raw material import dependencies that create supply chain vulnerabilities and cost pressures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)