Digital Out-of-home Advertising Market Report by Format Type (Digital Billboards, Video Advertising, Ambient Advertising, and Others), Application (Outdoor, Indoor), End-User (Retail, Recreation, Banking, Transportation, Education, and Others), and Region 2025-2033

Digital Out-of-home Advertising Market Overview:

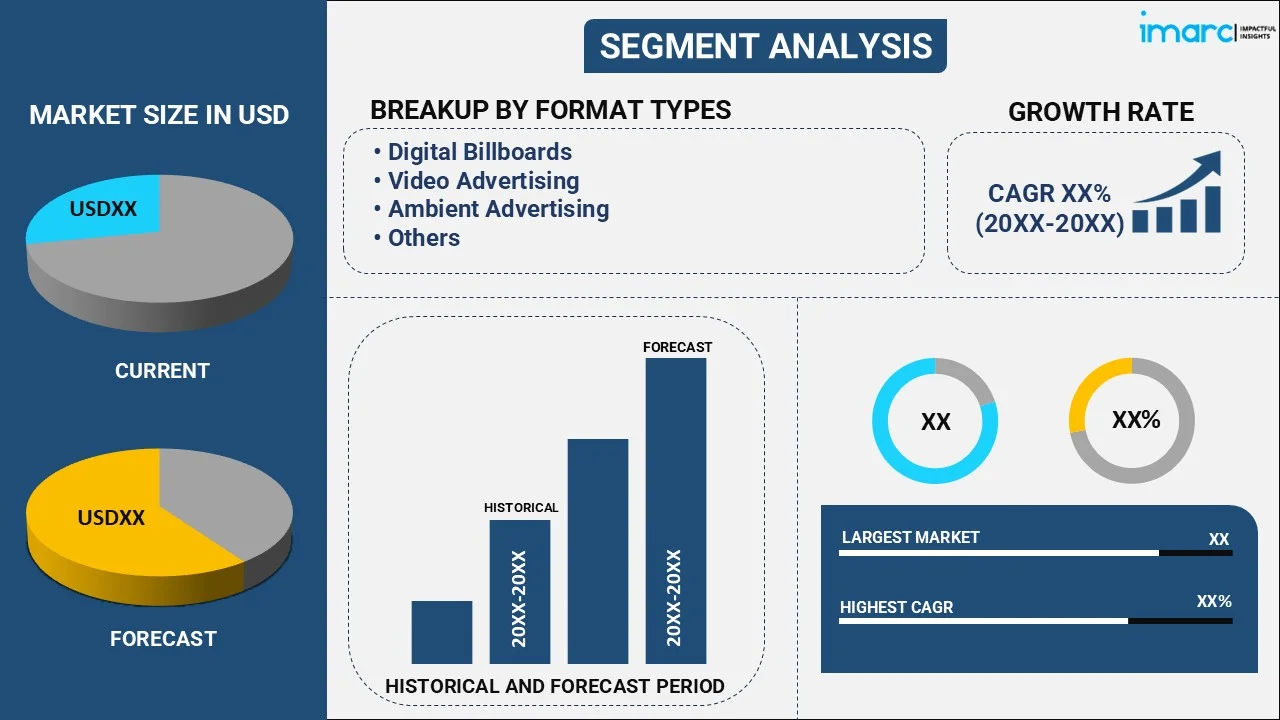

The global digital out-of-home advertising market size reached USD 21.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 54.1 Billion by 2033, exhibiting a growth rate (CAGR) of 10.26% during 2025-2033. The incorporation of cutting-edge technologies, the growing emphasize on personalization and data-driven decision-making, the shifting behavior and expectations of individuals, and the increasing use of digital technology are some of the major drivers of the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.5 Billion |

| Market Forecast in 2033 | USD 54.1 Billion |

| Market Growth Rate 2025-2033 | 10.26% |

Digital Out-of-home Advertising Market Analysis:

- Major Market Drivers: One of the chief market drivers is the rising popularity of programmatic advertising. Moreover, the increasing focus on sustainability and energy efficiency in digital signage solutions is also a growth-inducing factor.

- Key Market Trends: Advancements in data analytics, coupled with the growing demand for personalized and targeted advertising, are influencing the market positively.

- Geographical Trends: Asia Pacific exhibits a clear dominance, accounting for the largest market share owing to rapid urbanization and technological adoption.

- Competitive Landscape: Some of the main market players in the digital out-of-home advertising industry are APG|SGA, Clear Channel Outdoor Holdings Inc., Global Media, JCDecaux, Lamar Advertising Company, oOh!media Limited, Outfront Media Inc., Stroer, among many others.

- Challenges and Opportunities: One of the key challenges hindering the market growth is regulatory constraints. Nonetheless, the continuous evolution of digital technologies, along with the potential for more immersive and personalized advertising experiences, represent digital out-of-home advertising market recent opportunities.

Digital Out-of-home Advertising Market Trends:

Integration of advanced technologies

Data analytics, artificial intelligence (AI), and augmented reality (AR) are benefit in transforming traditional OOH advertising into more interactive and highly targeted campaigns. Additionally, digital screens comprise sensors and cameras that provide real time analysis, which aids advertisers in curating content as per various factors like demographics and user behavior. Furthermore, integration with mobile devices is beneficial in increasing engagement and providing a personalized experience to the audience. On 2 June 2022, Adani Airports Holdings Ltd (AAHL) offered programmatic advertising-enabled digital out-of-home (DOOH) media across its portfolio of airports. Enabling programmatic ad serving at Adani Airports via Lemma would enhance the screens to render dynamic ads, practice audience buying, contextual and real-time ad execution mapped to variables and real-time triggers.

Data-driven decision making

The increasing reliance on data-driven decision-making processes is bolstering the digital out-of-home advertising market growth. Advertisers are investing in advanced analytics to gain insights into the behavior, preferences, and trends of individuals and provide them with customized content. Additionally, programmatic advertising that is powered by data algorithms enables automated, real time buying and placement of ads. QMS, the leading digital outdoor media company, unveiled the campaign-based selling for its world-class City of Sydney Street furniture network on 29 August 2022. 90% of QMS’ new City of Sydney advertising inventory is digital that meet the growing demand for more dynamic and data-led and engaging outdoor advertising. It is also powered by 100% GreenPower energy to minimize carbon footprint.

Changing consumer behavior and expectations

Shifts in consumer behavior and expectations are creating an increasing digital out-of-home advertising demand. People are preferring personalized and relevant content due to increasingly connected world. In addition, industry players are delivering dynamic and contextually relevant messages to fulfil the desire for immersive and memorable experiences. Digital out-of-home (DOOH) provides a versatile platform for brands to engage audiences in meaningful ways, fostering a stronger connection between brands and consumers. On 31 August 2021, Airsqreen launched industry-first advertising platform for digital out-of-home advertising that connects advertisers to screen operators. This is a simple platform that brings a new level of confidence and new revenue potential for the entire industry.

Digital Out-of-home Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with digital out-of-home advertising market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on format type, application, and end-user.

Breakup by Format Type:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

Digital billboards account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the format type. This includes digital billboards, video advertising, ambient advertising, and others. According to the report, digital billboards represented the largest segment.

Digital billboards use cutting-edge technology to present dynamic and eye-catching content to a large audience. Their placement is well-planned to optimize their exposure, which makes them a top option for advertisers looking for high visibility and recognition for their business. Digital billboards are a dynamic medium for outdoor advertising that gives advertisers a powerful tool to catch attention and deliver memorable messages. They can incorporate interactive components and real-time data. Advertisers can promptly alter and personalize their messaging, guaranteeing their pertinence and adaptability to evolving market conditions. On 10 February 2021, Axios announced its partnership with OUTFRONT Media on its ‘MOMENTS by OUTFRONT’ content platform. The new collaboration will feature Axios editorial content on digital billboards and transit displays throughout cities.

Breakup by Application:

- Outdoor

- Indoor

Outdoor holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes outdoor and indoor. According to the report, outdoor accounted for the largest market share.

Outdoor includes a wide range of formats like digital billboards, transit displays, and street furniture. It can reach a massive and diverse audience and offer unparalleled visibility and impact. Besides this, advertisers are investing in digital displays to deliver relevant content that grabs the attention of individuals and enhances their brand awareness, which in turn helps in increasing their revenues. On 30 May 2023, JCDecaux SE, entered into an agreement with Clear Channel Outdoor Holdings, Inc., to enhance its footprint in Italy and Spain and in a rapidly evolving digitalized outdoor advertising.

Breakup by End-User:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

Retail represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes retail, recreation, banking, transportation, education, and others. According to the report, retail represented the largest segment.

The advertising in retail sector aims to enhance the shopping experience of individuals. Retailers are investing in digital displays to display their products, enhance promotions, and improve brand messages in a visually compelling manner. The growth of the segment is driven by the desire to create engaging and immersive shopping environments, ultimately increasing brand awareness, and driving sales. On 21 June 2022, JCDecaux SA collaborated with VIOOH to launch their programmatic digital out-of-home (DOOH) offering for the Brazilian market. This allow JCDecaux to offer effective programmatic digital out-of-home (DOOH) campaigns on its premium screens across Brazil and help brands make meaningful connections with people.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest digital out-of-home advertising market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Asia Pacific represents the largest regional market for digital out-of-home advertising.

Rapid urbanization and technological advancements contribute to the vibrant digital out-of-home (DOOH) landscape in the Asia Pacific region. Key players are investing in digital infrastructure to deploy highly targeted and visually compelling campaigns. The Asia-Pacific market is further fueled by the rising focus on creating a dynamic and evolving ecosystem. On 17 January 2022, Hivestack, a leading independent programmatic digital out-of-home (DOOH) ad tech company launched its full operations in the country ‘Malaysia’. This allows brands, agencies, and omnichannel demand-side platforms (DSPs) in the country to access the Hivestack platform to plan, activate, and measure programmatic digital out-of-home (DOOH) campaigns.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major digital out-of-home advertising companies have also been provided. Some of the major market players in the digital out-of-home advertising industry include APG|SGA, Clear Channel Outdoor Holdings Inc., Global Media, JCDecaux, Lamar Advertising Company, oOh!media Limited, Outfront Media Inc., Stroer.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Top players in the market are driving growth by leveraging innovative technologies and strategic partnerships. They are adopting advanced technologies to deliver highly personalized and contextually relevant content, which benefits in increasing their digital out-of-home advertising market revenue. They are also investing in digital signage technologies, such as interactive displays and augmented reality, to create immersive and memorable experiences. Furthermore, they are forming strategic collaborations with data providers and ad tech companies to enhance the effectiveness of digital out-of-home advertising. For instance, Clear Channel Europe and Broadsign announced an extended partnership to enable media buyers to tap into Clear Channel’s 3000+ digital Out of Home screens in the UK via Clear Channel LaunchPAD on 24 February 2022. Clear Channel’s premium UK Out of Home (OOH) inventory is now available via more than 30 omnichannel and OOH demand-side-platforms (DSPs) integrated with the Broadsign Reach supply-side-platform (SSP).

Digital Out-of-home Advertising Market Recent Developments:

- 13 April 2023: OUTFRONT Media Inc., one of the largest OOH media companies in the U.S. and Canada, shared news of its subsidiary, Outfront Media Canada LP, joining forces with RCC Media Inc. to introduce 39 digital bridge overpass screens and 8 large format digital bulletins across the Greater Toronto Area.

- July 2023: oOh!media introduced an expanded data suite to facilitate audience-driven campaign planning and attribution. Additionally, they inked a long-term OOH partnership with Unpacked by Flybuys, tapping into transactional data.

- 21 June 2023: Clear Channel Netherlands declared a new partnership with Hivestack to offer programmatic digital out-of-home advertising via the Hivestack SSP. This partnership further expands Clear Channel’s programmatic offering in the market as part of Clear Channel LaunchPAD, a pan-European advertising platform offering programmatic, automated, and direct buying channels.

Digital Out-of-home Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End-Users Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | APG|SGA, Clear Channel Outdoor Holdings Inc., Global Media, JCDecaux, Lamar Advertising Company, oOh!media Limited, Outfront Media Inc., Stroer, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital out-of-home advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital out-of-home advertising market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital out-of-home advertising industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global digital out-of-home advertising market was valued at USD 21.5 Billion in 2024.

We expect the global digital out-of-home advertising market to exhibit a CAGR of 10.26% during 2025-2033.

The rising penetration of numerous advanced technologies, such as Near Field Communication (NFC) and Artificial Intelligence (AI), to generate real-time viewership analytics is primarily driving the global digital out-of-home advertising market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of digital and internet-based advertising platforms by several industrial verticals to target specific demographics remotely by using virtual screens, projectors, video content, etc.

Based on the format type, the global digital out-of-home advertising market can be categorized into digital billboards, video advertising, ambient advertising, and others. Currently, digital billboards account for the majority of the global market share.

Based on the application, the global digital out-of-home advertising market has been segregated into outdoor and indoor, where outdoor currently holds the largest market share.

Based on the end-user, the global digital out-of-home advertising market can be bifurcated into retail, recreation, banking, transportation, education, and others. Among these, the retail sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global digital out-of-home advertising market include APG|SGA, Clear Channel Outdoor Holdings Inc., Global Media, JCDecaux, Lamar Advertising Company, oOh!media Limited, Outfront Media Inc., Stroer, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)