Healthcare CRM Market Size, Share, and Trends by Product, Application, Technology, End Use, Region, and Forecast 2025-2033

Healthcare CRM Market Size and Share:

The global healthcare CRM market size was valued at USD 17.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.5 Billion by 2033, exhibiting a CAGR of 10.7% during 2025-2033. North America currently dominates the market, holding a significant market share of over 57% in 2024. The market is experiencing steady growth driven by the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, arthritis, and respiratory issues, increasing focus on improving patient care, and the integration of various advanced technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.5 Billion |

|

Market Forecast in 2033

|

USD 48.5 Billion |

| Market Growth Rate (2025-2033) | 10.7% |

Rapid technological advancements in CRM systems are significantly expanding their capabilities in healthcare. Features such as artificial intelligence (AI), machine learning (ML), predictive analytics, and cloud-based solutions are transforming how patient data is utilized. AI-powered CRMs enable providers to predict patient needs, identify high-risk patients, and offer tailored interventions, thereby enhancing overall care efficiency. On 7th March 2024, Salesforce unveiled its new AI assistant for healthcare, Einstein Copilot. This tool provides responses based on an organization's private healthcare data and can automate tasks such as sending referrals, scheduling appointments, and managing other administrative processes. Salesforce also introduced Assessment Generation and Data Cloud for Health, enabling caregivers to streamline clinical summaries, customize communication, and efficiently create personalized patient assessments. Cloud-based systems ensure data accessibility and scalability while reducing infrastructure costs, making them attractive to both large hospitals and smaller clinics. Furthermore, the integration of wearable devices and the Internet of Things (IoT) into CRM platforms provides real-time health data, empowering providers to make timely and informed decisions. These innovations are improving patient management and are also driving the healthcare industry's digital transformation, contributing to the robust growth of the global healthcare CRM market.

To get more information on this market, Request Sample

The U.S. healthcare market is becoming increasingly competitive, with providers striving to differentiate themselves through superior patient experiences. This dynamic is accelerating the demand for healthcare CRM platforms, which allow organizations to develop targeted marketing campaigns, personalize care interactions, and retain patients. The ability to analyze patient preferences and predict future needs gives providers a competitive edge by fostering loyalty and increasing patient lifetime value. On 23rd September 2024, Unlock Health, a leading tech-enabled growth platform for healthcare systems, hospitals, provider groups, and treatment center facilities based in the U.S., released its advanced suite of Health Risk Assessments (HRA). This innovative HRA suite comprises 19 condition-specific assessments that are aimed at arming healthcare marketing leaders with first-party data to create more customized marketing campaigns, thereby enhancing operational efficiencies and enabling organizational growth. Additionally, mergers and acquisitions among healthcare providers have increased the need for centralized CRM systems to integrate patient data across networks. As patients gain access to more options for care, including retail clinics and telehealth services, providers are leveraging CRM tools to stand out by offering convenience, responsiveness, and seamless care coordination. This growing competition is a significant factor driving the market for CRM solutions tailored to the healthcare sector.

Healthcare CRM Market Trends:

Increasing prevalence of chronic diseases

The growing demand for healthcare CRM on account of the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, arthritis, and respiratory issues, among the masses across the globe is offering a positive market outlook. According to the IDF Diabetes Atlas, 61.3 million people was diagnosed with diabetes in the year 2011 which increased by 12.9 million by the year 2021. Moreover, a healthcare organization has patients with different health issues, and managing the needs of numerous patients is a time-consuming task. Additionally, CRM solutions assist in storing vital information and providing a comprehensive overview of the appointments, medical history, and claims of patients. These solutions strengthen the delivery of healthcare services by improving accounting management processes and operational planning. They also benefit in customizing patient management plans for enhanced ease. Besides this, CRM automation is time-saving as it automates the entire schedule management process. Furthermore, the increasing adoption of cloud-based healthcare solutions to improve patient data security is supporting the market growth. Moreover, CRM offers a hassle-free medical experience by offering a chance to review past reports of a patient.

Rising focus on improving patient care

The increasing demand for healthcare CRM to improve patient care is contributing to the growth of the market. According to the Ministry of Health and Family Welfare, in 2020-2021, 70.06 lakh claims were submitted to the government which increased in 2021-2022 to 1.45 crore. Moreover, CRM systems enhance patient treatment quality by providing more accessible and controlled patient management. They also enable healthcare professionals to access accurate and up-to-date information, leading to more accurate diagnoses and personalized treatment approaches for individuals. They can integrate emergency care, therapy, and diagnosis management, resulting in more effective outcomes and patient satisfaction. In line with this, they aid in minimizing waiting times and generating valuable predictions related to patient stay, retention rates, and real time statistics. They also reduce the need for extensive manual documentation, guidance, and enables hospital staff to access patient information while increasing patient engagement in the treatment process. Apart from this, the rising adoption of CRM for healthcare industry, as it reduces the risks of medical errors due to lower manual intervention, is propelling the growth of the market.

Technological advancements

The integration of advanced technologies, such as AI, ML, data analytics, and predictive analytics, in healthcare CRM is bolstering the growth of the market. ML algorithms provide vital insights from large medical data sets to facilitate improved decision-making and patient outcomes. ML is also used to enhance the security of patient data by securing it from unwanted access and other threats. In line with this, AI can track all kinds of malicious activity, such as potential hacks or suspicious accesses, helping monitor vulnerable activities and relevant leads. AI can also analyze electronic health records (EHRs) to provide doctors and nurses with vital insights, predict diseases, and assist in prescribing the most effective medication. For instance, in 2024, Salesforce launched a new healthcare AI assistant within its customer relationship management system. The company's healthcare-focused AI tool, called Einstein Copilot, is a conversational AI assistant that will provide responses based on a healthcare organization's private data. Besides this, natural language processing (NLP) and AI can be used to speed up the record-keeping process so that healthcare professionals can spend much of their time connecting with their patients rather than completing numerous administrative tasks.

Healthcare CRM Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare CRM market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, technology, end-use, and region.

Analysis by Product:

- Individual

- Referral

- Individual and Referral

Individual and referral leads the market with around 45% of market share in 2024. Various healthcare CRM combine individual and referral to offer comprehensive solutions. They offer enhanced services to patients and optimize different workflows efficiently. They aid in managing patient relationships and improving their referral processes. This approach is usually suitable for larger healthcare organizations. CRM in healthcare industry for individual focuses on direct relationship between healthcare provider and individual patients. Moreover, it assists in improving satisfaction and loyalty among individuals. It supports the concept of patient-centric care and allows hospitals to focus more on patients to meet their needs and expectations, improve service quality (SQ), and build long-term relationships.

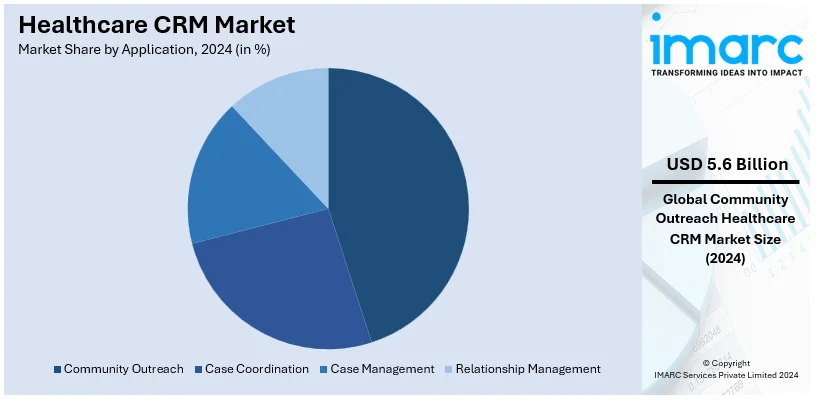

Analysis by Application:

- Community Outreach

- Case Coordination

- Case Management

- Relationship Management

Community outreach leads the market with around 32% of market share in 2024 due to its critical role in fostering patient engagement and improving access to healthcare services. As healthcare providers increasingly focus on preventive care and population health management, community outreach programs become essential for educating communities, promoting health awareness, and connecting underserved populations to necessary resources. Additionally, advancements in CRM technology allow organizations to target specific demographics effectively, track outreach efforts, and analyze outcomes, making community outreach a priority for achieving both public health goals and organizational growth. Its wide-ranging impact on both patient outcomes and healthcare delivery solidifies its leadership in the market.

Analysis by Technology:

- Cloud-based

- Mobile

- Social

- Collaborative

- Predictive

Cloud-based leads the market with around 40% of market share in 2024. Cloud-based CRM system is designed to meet the needs of organizations providing healthcare. It provides robust functionality and customization capabilities and allows organizations to effectively manage patient relationships, services, and operations. It enables users to gain access to powerful analytics tools and automation capabilities that allow them to quickly respond to changing demands in the healthcare industry. These systems also provide an added layer of security by regularly backing up data while ensuring availability in the event of a malicious attack or natural disaster.

Analysis by End Use:

- Payers

- Providers

- Life Science Companies

Payers leads the market with around 48% of market share in 2024. CRM in healthcare allows payers to improve profitability and patient satisfaction. Payers are investing in systems that help them manage information about policy details, payment history, and claims of individual patients. CRM system in healthcare allows providers to facilitate more personalized care for patients. These systems enable providers to streamline several internal operations and manage relationships with other stakeholders. Life science companies encompass biotechnology and pharmaceuticals. CRM is helpful for nurturing and finalizing healthcare provider contracts or agreements with other healthcare organizations. CRM systems are also helpful for maintaining regulatory compliance. These systems enable multiple benefits for life sciences organizations, especially in increasing their revenues.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 57%. This can be attributed to the advanced healthcare infrastructure and widespread adoption of digital technologies. The increasing prevalence of chronic diseases and the growing emphasis on preventive care are creating a need for advanced solutions that improve care coordination and patient outcomes, consolidating North America’s leadership in the market. According to a 2024 report by the CDC, each year, over 944,800 Americans succumb to heart disease or stroke, accounting for more than one-third of all deaths. These conditions also impose a significant economic burden, with healthcare expenditures amounting to $254 Billion annually and an additional $168 Billion lost due to reduced workplace productivity. Projections indicate that the total costs associated with cardiovascular diseases could escalate to approximately $2 Trillion by 2050. These challenges underline the critical role of healthcare CRM systems in driving efficiency and enhancing patient engagement, ensuring the region remains at the forefront of innovation in healthcare delivery. As healthcare needs grow, investments in advanced CRM technologies are expected to further strengthen North America's position in the global market.

The region's robust healthcare systems are continuously integrating CRM solutions to enhance patient engagement, streamline administrative processes, and optimize resource allocation. Regulatory frameworks, such as HIPAA, emphasize the importance of secure and efficient data management, further encouraging the use of CRM platforms. Additionally, North America's strong presence of leading healthcare IT companies fosters innovation, providing organizations with cutting-edge tools tailored to industry needs. The rising demand for personalized care and patient-centric approaches aligns with the capabilities of CRM systems, contributing to their widespread adoption.

Key Regional Takeaways:

United States Healthcare CRM Market Analysis

The United States accounted for 75.0% of the healthcare CRM market in North America. Rapid healthcare digitization, a greater focus on patient interaction, and legal requirements for high-quality care delivery are the main factors propelling the US healthcare CRM industry. With both public and private spending on healthcare included, national health expenditures (NHE) are expected to increase from USD 4.8 Trillion, or USD 14,423 per person, in 2023 to USD 7.7 Trillion, or USD 21,927 per person, in 2032, providers are looking for effective tools, such as CRM systems, to improve patient happiness, streamline operations, and cut costs. In order to handle patient data, coordinate care, and guarantee compliance with laws like HIPAA, the broad adoption of value-based care models has also made the incorporation of sophisticated CRM platforms necessary.

CRM solutions are being used by healthcare businesses to solve issues including fragmented care and the growing need for individualized patient experiences. One of the main drivers of telehealth's growth in 2023 is the importance of CRM systems in managing virtual patient contacts and enhancing communication. The need for CRMs specifically designed for the healthcare industry has also been strengthened by the U.S. government's emphasis on healthcare IT through programs like the HITECH Act and financing for the integration of electronic health records (EHRs). Leading companies, such as Microsoft Dynamics 365 and Salesforce Health Cloud, are always coming up with new ways to provide solutions that work well with EHRs and other medical systems.

Europe Healthcare CRM Market Analysis

Stricter laws, a greater emphasis on patient-centric treatment, and the growing need to effectively control healthcare expenditures are driving the healthcare CRM market in Europe. Healthcare providers have been urged to implement cutting-edge CRM systems for safe data management by the General Data Protection Regulation (GDPR) of the European Union. With strong healthcare systems and government programs to digitize healthcare services, nations like Germany, the UK, and France are leading the way. The need for customized treatment has grown due to the aging population, which makes up more than 20% of Europe's total population. This has further accelerated the development of healthcare CRMs. Effective patient management systems have also become necessary due to the rise in chronic diseases including diabetes and cardiovascular disorders. In addition to lowering administrative burdens and improving patient outcomes, CRM technologies are helping healthcare providers manage cross-border healthcare services within the EU.

Asia Pacific Healthcare CRM Market Analysis

The healthcare CRM market in Asia-Pacific is expanding rapidly as a result of rising telemedicine use, rising investments in healthcare infrastructure, and rising awareness of digital health solutions. The industry is dominated by nations like China, Japan, and India, where healthcare providers are integrating CRM systems to better coordinate care and manage massive amounts of patient data. Government programs like China's healthcare reforms and India's Ayushman Bharat are accelerating the digitization of healthcare facilities and opening doors for the implementation of CRM. The need for CRM systems that can consolidate data from various sources to provide individualized care has also increased due to the increasing use of wearable technology and mobile health apps. Additionally, physicians are being encouraged to invest in patient interaction platforms by the rise in chronic illness prevalence and the trend toward preventative healthcare.

Latin America Healthcare CRM Market Analysis

The increasing demand for operational efficiency, the expanding use of telemedicine, and government initiatives to increase healthcare accessibility are driving the healthcare CRM market in Latin America. Due to the growth of their private healthcare industries, Brazil and Mexico are important markets. Healthcare facilities have been urged to implement CRM systems for improved patient interaction by the region's expanding middle class and rising smartphone usage. Additionally, the need for CRM solutions to efficiently manage patient itineraries has grown as a result of the push for medical tourism in countries like Costa Rica.

Middle East and Africa Healthcare CRM Market Analysis

Growing expenditures in healthcare infrastructure, increased demand for digital health solutions, and the need to improve patient experiences are driving the Middle East and Africa's healthcare CRM industry. With the help of government-led programs like Saudi Arabia's Vision 2030 and the UAE's Smart Dubai, nations like the UAE and Saudi Arabia are spearheading the adoption of healthcare CRMs. These programs seek to enhance service delivery and modernize healthcare systems. CRM solutions now have the chance to simplify patient communication and data management due to the region's growing reliance on telemedicine and mobile health apps.

Competitive Landscape:

Key players are introducing innovative technologies to provide enhanced health and safety to individuals by streamlining various processes. They are engaging in partnerships and collaborations to offer improved healthcare facilities to a wide range of individuals across the globe. In addition, major players are introducing platforms that allow users to schedule and launch virtual appointments that benefit in eliminating physical barriers while enhancing patient convenience and satisfaction. Apart from this, they are integrating advanced technologies, such as AI, the Internet of Things (IoT), data analytics, NLP, and ML. These technologies benefit healthcare providers for improved decision-making regarding the care of patients.

The report provides a comprehensive analysis of the competitive landscape in the healthcare CRM market with detailed profiles of all major companies, including:

- Accenture Plc

- AllScripts Healthcare Solutions Inc

- Amdocs

- Aspect Software Inc

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com inc

- SAP SE

- Siemens Healthineers AG (Siemens AG)

Latest News and Developments:

- October 2025: WE Marketing Médico, a Brazilian HealthTech startup, unveiled the worldwide launch of its AI-oriented invisible CRM solution, designed to address the healthcare sector's significant 90% revenue loss. The system could streamline patient intake and continuous follow-up.

- May 2025: The Maharashtra Public Health Department entered into a 10-year concession agreement with SUMEET SSG BVG Maharashtra EMS to execute the new Maharashtra Emergency Medical Services (MEMS) 108 Ambulance Programme. These vehicles would be equipped with CRM, computer-aided dispatch (CAD), and real-time notifications for patient arrivals.

- April 2025: Tulu Health, a startup in healthtech and fintech, introduced India’s inaugural AI Agent Platform aimed at tackling diverse healthcare requirements. It aimed to assist hospitals and patients by providing modular AI agents that could be utilized via widely used applications like WhatsApp and hospital websites. The AI agents could connect with EHR, CRM, and ERP systems.

- March 2025: Veeva Systems released ‘Veeva CRM Pulse,’ a subscription data service designed to improve HCP engagement metrics in the life sciences sector. The introduction of Veeva CRM Pulse, emphasizing thorough and privacy-compliant HCP access information, enhanced Veeva's market position, highlighting a strategic long-term initiative.

- January 2025: Docfyn unveiled AI-powered marketing suite to transform hospitals and clinics. SEO enhancement, hospital site creation, chatbot integration, CRM systems, and workflow automation comprised its all-encompassing services, aiding hospitals in realizing potential while avoiding excessive strain on assets or personnel.

Healthcare CRM Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Individual, Referral, Individual and Referral |

| Applications Covered | Community Outreach, Case Coordination, Case Management, Relationship Management |

| Technologies Covered | Cloud-Based, Mobile, Social, Collaborative, Predictive |

| End Uses Covered | Payers, Providers, Life Science Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc, AllScripts Healthcare Solutions Inc, Amdocs, Aspect Software Inc, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com inc, SAP SE, Siemens Healthineers AG (Siemens AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare CRM market from 2019-2033.

- The healthcare CRM market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare CRM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Healthcare CRM (Customer Relationship Management) is a software solution tailored for the healthcare industry, enabling providers to manage and optimize patient relationships. It integrates patient data, streamlines operations, personalizes care, and enhances communication, ultimately improving the quality and efficiency of healthcare services.

The healthcare CRM market was valued at USD 17.5 Billion in 2024.

IMARC estimates the global healthcare CRM market to exhibit a CAGR of 10.7% during 2025-2033.

The rising prevalence of chronic diseases, advancements in AI and predictive analytics, increased adoption of cloud-based solutions, and a growing focus on improving patient care and operational efficiency, are primarily driving the global healthcare CRM market.

In 2024, individual and referral represented the largest segment driven by its ability to integrate patient relationships and streamline referral workflows effectively.

Community outreach leads the market owing to its robust functionality for managing patient relationships and operational customization.

The cloud-based segment is the leading technology driven by its enhanced data accessibility, scalability, and cost-effective infrastructure.

The payers segment leads the market, driven by its capacity to improve profitability, streamline policy and claims management, and enhance patient satisfaction.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, with North America currently dominating the global market.

Some of the major players in the global healthcare CRM market include Accenture Plc, AllScripts Healthcare Solutions Inc, Amdocs, Aspect Software Inc, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc, SAP SE, and Siemens Healthineers AG (Siemens AG).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)