How Big Will the Smart Medical Devices Industry be by 2033?

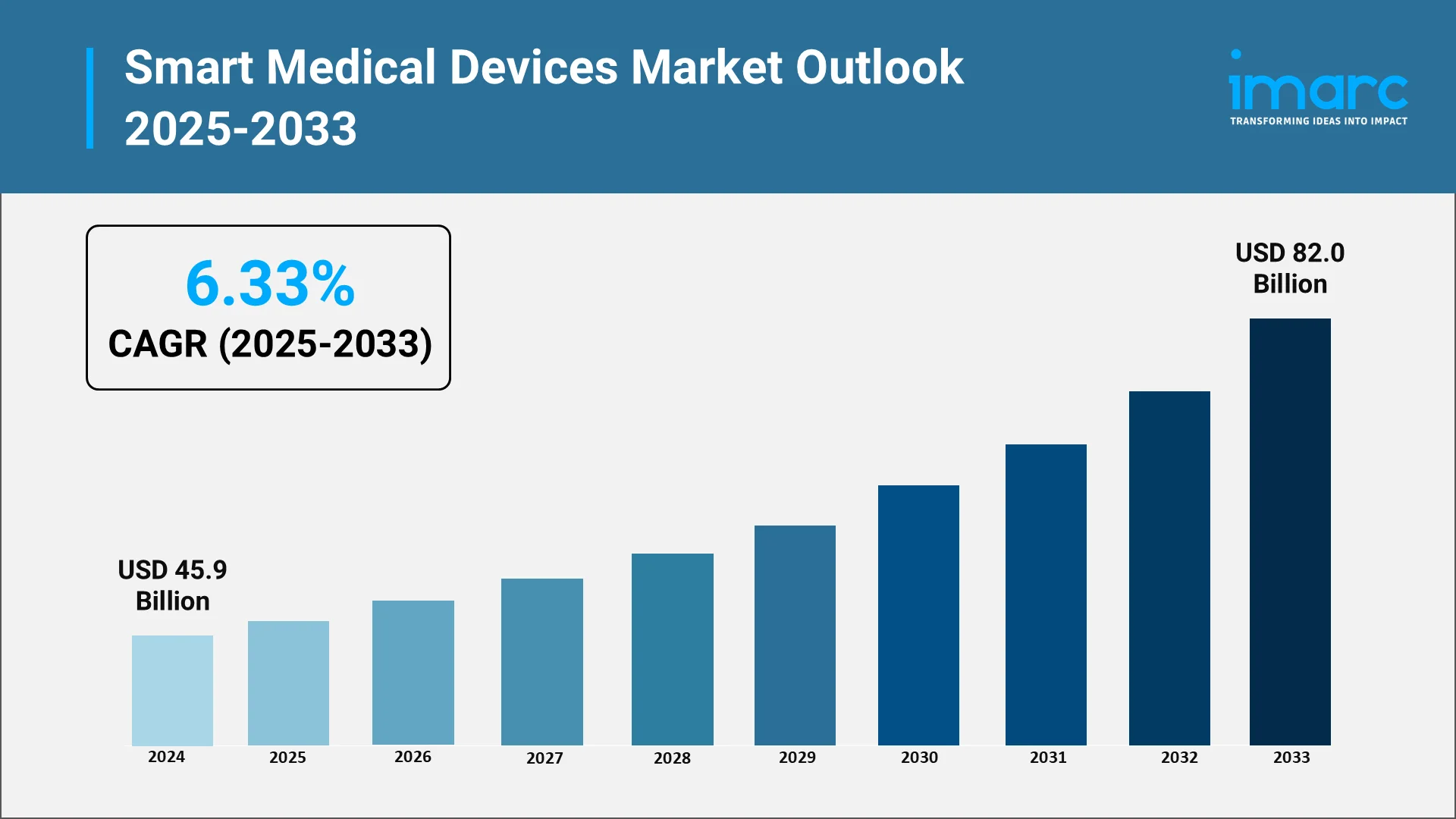

The smart medical devices market is entering a decade defined by connected care, real-time diagnostics, and patient empowerment. Valued at USD 45.9 Billion in 2024, the market is projected to reach USD 82 Billion by 2033, expanding at a compound annual growth rate (CAGR) of 6.33% between 2025 and 2033 by IMARC Group. This steady rise reflects growing confidence in data-driven healthcare systems, integration of IoT in medical environments, and the increasing role of artificial intelligence in clinical decision-making. Devices are evolving from simple trackers to intelligent, self-learning tools that help patients and professionals manage chronic diseases, detect early warning signs, and optimize treatment outcomes.

Explore in-depth findings for this market, Request Sample

What Is the Market Size of Smart Medical Devices?

Steady Growth Backed by Digitization and Preventive Care

The market’s value trajectory points to deepening digitization within global healthcare. Hospitals, home-care settings, and telehealth ecosystems are integrating smart wearables, connected sensors, and remote diagnostic platforms into routine practice. For instance, in December 2024, electronRx announced the launch of purpleDx, a smartphone-based cardiopulmonary assessment app to be showcased at CES 2025 in Las Vegas. The technology enables patients with chronic respiratory diseases, including asthma, COPD, and pulmonary hypertension, to measure digital biomarkers such as heart rate, respiratory rate, and tidal volume from home, allowing clinicians to track lung function remotely. This development strengthens the global smart medical devices market, highlighting how mobile-based diagnostic tools and digital biomarker technologies are expanding remote patient monitoring capabilities worldwide. The growth rate of 6.33% CAGR mirrors how preventive healthcare and patient self-management have gained acceptance across both developed and emerging markets.

Factors Influencing Market Expansion

- Chronic Disease Burden: Diabetes, hypertension, cardiovascular disorders, and respiratory illnesses demand continuous monitoring, boosting adoption of connected sensors and smart monitors.

- Aging Population: Longer life expectancy is increasing the need for devices that ensure independence and early detection of complications.

- Regulatory Support: Governments in the United States, Japan, and the EU are encouraging digital health through reimbursement reforms and approval frameworks for remote monitoring tools.

- Integration with Electronic Health Records (EHR): The ability to link device data with EHR systems enables clinicians to act on real-time information rather than retrospective reports.

These developments together shape a global ecosystem where digital and clinical workflows merge seamlessly, giving patients a larger role in managing their own wellbeing through connected health technology.

Technological Advancements Driving Growth:

From Sensors to Smart Systems

The technological core of this industry lies in the convergence of IoT, AI, and miniaturized electronics. Modern devices go beyond data collection; they analyze trends, predict risks, and deliver actionable feedback to both patients and clinicians. Wearable ECG patches, continuous glucose monitors, and AI-enabled imaging systems exemplify this transformation. As of July 2025, the U.S. Food and Drug Administration (FDA) lists 1,247 authorized AI-enabled medical devices, with 77% of these classified for radiology and 9% for cardiovascular use.

Key Areas of Advancement

- Artificial Intelligence and Predictive Analytics: AI algorithms embedded within smart medical devices detect anomalies and alert care teams automatically.

- Cloud Connectivity: Secure cloud platforms ensure that device data can be accessed, visualized, and analyzed instantly by authorized healthcare providers.

- Power Efficiency: Advances in low-power chips and battery management systems extend device life, improving usability in home-care settings.

- Interoperability Standards: Open protocols like Bluetooth Low Energy and HL7 FHIR support integration across multiple devices and healthcare networks.

- Data Security Enhancements: Encryption and blockchain-based verification safeguard patient information, addressing one of the major concerns in digital health.

These advances underpin the continuing rise of medical IoT devices, where sensors, actuators, and analytical tools collaborate to form an intelligent medical network. In several countries, including the US and Germany, regulatory authorities have updated cybersecurity frameworks to strengthen device resilience, an area likely to gain greater attention as adoption grows.

Increasing Adoption in Healthcare Facilities:

Hospitals Embrace Real-Time Monitoring

Healthcare providers worldwide are embedding smart systems into their workflows to improve outcomes and efficiency. Remote patient monitoring platforms reduce readmissions, while AI-driven analytics support early diagnosis and precision treatment. Hospitals in the US and Europe are deploying connected cardiac monitors and oxygen sensors that automatically upload readings to cloud dashboards, cutting manual intervention.

Drivers Behind Facility Adoption

- Operational Efficiency: Automated monitoring minimizes paperwork and staff workload.

- Outcome-Based Care Models: Insurers and governments are shifting toward reimbursement models that reward measurable patient outcomes, prompting institutions to adopt digital tools.

- Cost Savings: Smart medical devices reduce hospital stays and emergency visits by enabling proactive management of chronic diseases.

- Integration with Telemedicine: During and after the pandemic, telehealth services accelerated adoption of connected devices that maintain continuity of care.

The role of connected health technology in hospital environments goes beyond monitoring—it establishes a feedback loop where physicians can adjust treatment dynamically based on data patterns, not just symptoms. This shift from reactive to proactive healthcare defines the next phase of clinical practice.

Market Segmentation by Device Types and Applications:

Diagnostic and Monitoring Devices

Diagnostic and monitoring products account for the largest revenue share in the market. These include blood glucose and blood pressure monitors, heart rate and oxygen saturation sensors, and portable imaging devices and breath analyzers. Their purpose is early detection and continuous tracking. Modern glucose meters sync automatically with smartphone apps, and smart blood pressure cuffs transmit readings to cloud portals for physician review.

New product introductions, such as Dexcom Inc.’s Stelo over-the-counter continuous glucose monitoring (CGM) sensor, launched in August 2024 in the United States, are expanding accessibility. Priced at up to USD 99 for a two-sensor pack or USD 89 per month via subscription, and approved by the U.S. FDA in March 2024 for adults aged 18 and older not using insulin, Stelo is the first CGM available without prescription, enabling non-diabetic consumers to gain deeper metabolic health insights. Hospitals increasingly rely on these connected devices to support real-time decision-making in both emergency and chronic care settings.

Therapeutic Devices

Therapeutic smart medical devices, such as insulin pumps, ventilators, and hearing aids, use precision algorithms to deliver controlled therapy. For instance, insulin pumps regulate dosage based on continuous glucose monitoring, while AI-enhanced hearing aids adapt automatically to environmental noise levels. These innovations enhance patient comfort, safety, and treatment accuracy through real-time data-driven adjustments.

For instance, in February 2025, Tandem Diabetes Care Inc. received U.S. FDA clearance for its Control-IQ+ automated insulin delivery (AID) technology for adults with type 2 diabetes. Integrated into the t:slim X2 insulin pump, the upgraded algorithm adjusts insulin dosing more precisely and supports broader weight and insulin ranges. After successful clinical trials involving over 300 participants, the system will be launched in March 2025, marking a major milestone in expanding automated insulin delivery to type 2 diabetes management within the global smart medical devices market.

Applications Across Conditions

- Oncology: Imaging scanners, radiation dosing systems, and smart biopsy tools improve diagnostic accuracy.

- Diabetes: Continuous glucose monitoring and automated insulin delivery enhance self-management.

- Cardiovascular Disorders: Implantable and wearable ECG systems detect arrhythmias and predict cardiac events.

- Infectious Diseases: Portable diagnostic kits assist in early detection and containment efforts.

- Autoimmune and Respiratory Conditions: Smart inhalers and connected nebulizers help maintain medication adherence.

These devices collectively form the foundation of healthcare device innovations that redefine how medicine is delivered, from hospitals to homes.

Regional Market Forecasts and Growth Drivers:

North America: The Established Leader

North America maintains the largest share due to its advanced medical infrastructure, strong insurance networks, and rapid regulatory approvals. The United States FDA has streamlined pathways for digital and AI-enabled devices, fostering a favorable environment for innovation. High prevalence of chronic diseases and strong R&D investment from companies like Abbott and Medtronic sustain market dominance.

Europe: Consistent Adoption Through Policy Support

Europe benefits from unified standards under the EU Medical Device Regulation (MDR) and substantial funding for e-health. Countries like Germany, France, and the UK promote reimbursement for digital therapeutics, boosting uptake among healthcare providers. Data protection laws such as GDPR strengthen patient confidence in using connected medical systems.

Asia-Pacific: The Fastest-Growing Frontier

Asia-Pacific is poised for rapid expansion, driven by rising healthcare expenditure, expanding middle-class populations, and increased smartphone penetration. China, Japan, India, and South Korea are focusing on integrating IoT into healthcare infrastructure. India’s National Digital Health Mission, for instance, supports interoperability among medical devices and electronic health records. As disposable incomes rise, home-based monitoring tools are seeing greater demand.

Latin America and the Middle East & Africa

Both regions are progressing gradually, encouraged by government investments in healthcare modernization and public–private partnerships. In Brazil and Mexico, telehealth platforms are enabling rural access to diagnostics. Gulf Cooperation Council (GCC) countries are introducing smart hospital projects that embed IoT devices within their infrastructure—an area where recent news from Saudi Arabia’s Ministry of Health highlighted national efforts to digitize healthcare services by 2030.

Major Industry Players and Competitive Landscape:

Key Companies Shaping the Market

The competitive ecosystem includes technology leaders, pharmaceutical companies, and specialized device manufacturers, such as Abbott Laboratories, Apple Inc., Dexcom, Inc., Fitbit, Inc. (Google LLC), Garmin Ltd., Koninklijke Philips N.V., Medtronic plc, Novo Nordisk A/S, OMRON Healthcare, Inc., Sotera, Inc., VitalConnect, and West Pharmaceutical Services, Inc. Some of the recent developments in the market include:

- In August 2025, Abbott India Ltd launched the FreeStyle Libre® 2 Plus continuous glucose monitoring system, providing real-time glucose readings every minute and customizable alarms directly on smartphones. Designed for India’s 101 million people living with diabetes, the device allows users and caregivers to track glucose levels without fingersticks, helping reduce hospital visits by up to 66% and lowering cardiovascular complication risks by 78% in Type 1 diabetes. This launch strengthens connected health innovation and remote diabetes management through continuous, data-driven monitoring technology.

- In September 2025, Apple Inc. introduced the Apple Watch Series 11, featuring hypertension notifications, a sleep score system, 5G connectivity, and up to 24 hours of battery life. Using optical heart sensors and machine learning trained on over 100,000 participants, the watch can detect early signs of chronic high blood pressure. This launch reinforces wearable health technology through real-time monitoring, clinical-grade data accuracy, and expanded global accessibility across 150 countries.

- In April 2025, Dexcom Inc. received U.S. FDA clearance for its Dexcom G7 15 Day Continuous Glucose Monitoring (CGM) System, designed for adults aged 18 and above with diabetes. The device offers a 15-day wear duration, the longest yet in Dexcom’s lineup, and delivers an 8% mean absolute relative difference (MARD), improving accuracy while reducing hyper- and hypoglycemia incidents.

Strategies for Market Leadership

- R&D Investment: Companies allocate significant budgets to integrate AI and ML for predictive analytics and better diagnostic precision.

- Partnerships and Collaborations: Cross-sector alliances between tech firms and healthcare providers accelerate product development.

- Regional Expansion: Firms extend operations into Asia-Pacific and Latin America to tap emerging opportunities.

- Product Miniaturization: Compact, user-friendly designs drive home-care adoption.

- Regulatory Compliance: Continuous adaptation to evolving data privacy and cybersecurity standards.

This competitive landscape underscores how technology and healthcare expertise intersect to build the next generation of digital therapeutics.

Looking Ahead: A Connected Future for Medicine

The smart medical device industry is shifting the focus of healthcare from treatment to prevention, from hospitals to homes, and from episodic visits to continuous monitoring. As the market grows toward USD 82 Billion by 2033, innovation will hinge on three critical directions:

- Interoperable Ecosystems: Seamless communication among devices, EHR systems, and cloud platforms will determine scalability.

- Ethical Data Use and Security: Balancing privacy with analytics remains vital for trust.

- AI-Assisted Personalization: Tailoring treatment plans through real-time insights will become standard practice.

Governments and private players alike are investing heavily in digital health infrastructure to sustain this momentum. In July 2025, Royal Philips announced strategic partnerships with Dräger, Hamilton Medical, Getinge, and B. Braun Melsungen AG to enhance hospital interoperability and create a “smart healing environment” using Service-Oriented Device Connectivity (SDC) standards. The collaboration enables seamless communication among medical devices, supporting consolidated alarm management, faster clinician response times, and reduced noise in patient rooms. This initiative strengthens the global smart medical devices market by advancing connected hospital ecosystems that improve patient safety, operational efficiency, and real-time monitoring across multi-vendor platforms.

Reasons to choose IMARC for analyzing the Smart Medical Devices Market:

- Proven Sector Expertise: IMARC has a deep understanding of digital health, IoT integration, and medical device regulation, allowing for accurate and context-driven market evaluations.

- Reliable Data Sources: All projections and insights are based on verified inputs from government agencies, regulatory filings, and leading corporate disclosures—never speculative or unverified data.

- Customized Market Insights: IMARC tailors its studies to client needs, delivering regional breakdowns, product-level segmentation, and competitor benchmarking that align with specific strategic goals.

- Strong Analytical Framework: Each report applies quantitative modeling supported by qualitative analysis, providing a balanced perspective on growth drivers, restraints, and opportunities.

- Global Research Network: IMARC’s global team tracks market developments across North America, Europe, Asia-Pacific, and emerging regions to capture both macro and micro trends.

- Commitment to Professional Integrity: The firm maintains transparency and objectivity in its methodology, ensuring every forecast and interpretation is defensible and data-backed.

IMARC’s professionalism, depth of knowledge, and commitment to accuracy make it a dependable partner for businesses, investors, and policymakers seeking a clear view of the Smart Medical Devices Market and its trajectory toward 2033.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)