How Online Grocery Market is Driving the Next Wave of Retail Innovation?

.webp)

Market Overview: Tech-Driven Growth Transforms Online Grocery

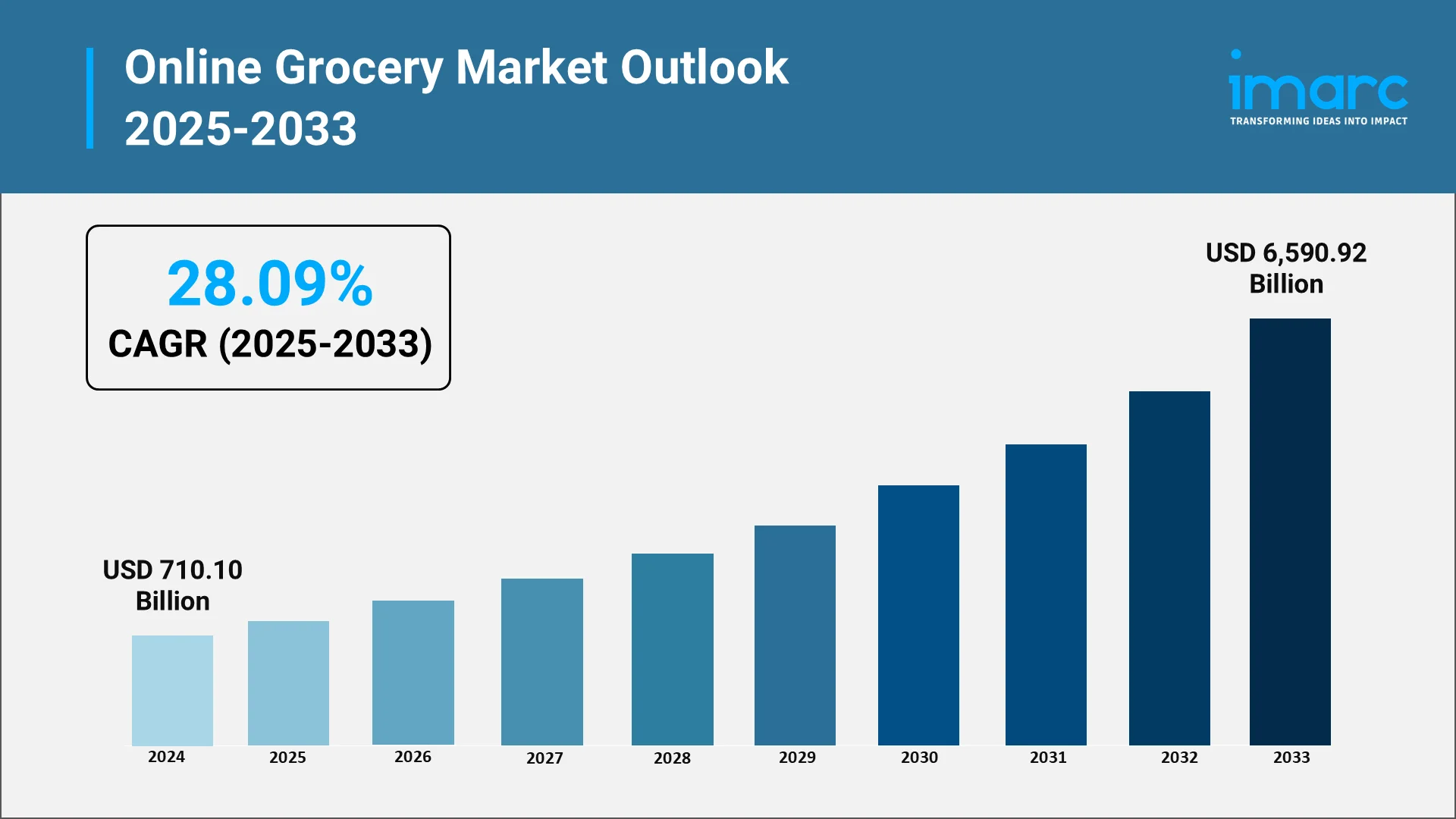

The global online grocery market has rapidly evolved from a convenience service to a mainstream retail segment, reshaping how consumers shop for everyday essentials. According to the IMARC group report, the market reached a value of USD 710.10 Billion in 2024 and is projected to witness consistent expansion. Factors such as increased internet penetration, widespread smartphone use, and changing consumer habits are accelerating digital grocery adoption. Market players are also enhancing their e-commerce presence, with seamless interfaces and smart delivery models boosting user retention. As economies mature and technology integrates deeper into retail ecosystems, the online grocery market growth is expected to stay strong, driven by evolving urban lifestyles and technological innovation.

Explore in-depth findings for this market, Request Sample

Redefining the Retail Experience: How Consumers Are Driving Online Grocery Innovations

Consumer behavior has shifted significantly, shaped by the rise of digital convenience and lasting changes in retail following the pandemic. According to an industry survey conducted in the United States in 2024, the primary reasons consumers purchase groceries online are to save time (77%), reduce impulse purchases (41%), and facilitate the comparison of products and prices (38%). In response, retailers are increasingly leveraging advanced technologies to meet consumer preferences in real time, driving a market focused on data, efficiency, and customer satisfaction. Moreover, the evolution of online grocery shopping extends beyond convenience. Emerging online grocery market trends point toward a greater emphasis on value-based purchasing and ethical consumption. Retailers that offer organic, locally sourced, or environmentally responsible products are resonating with a growing segment of conscientious consumers. The market is no longer just about availability, but also about the ability to deliver curated, purpose-driven shopping experiences that reflect the values of today’s shoppers.

Supply Chain Revolution: Online Grocery as a Catalyst for Economic and Logistical Efficiency

Online grocery platforms are playing an increasingly important role in optimizing the food and retail supply chain. By leveraging tools such as inventory management systems and predictive analytics, e-grocers are improving operational flexibility, minimizing waste, and enabling seamless coordination among farmers, suppliers, and last-mile delivery providers, resulting in faster turnarounds and fresher products. This logistical efficiency supports services like same-day delivery, which enhances the market outlook. Notably, in March 2025, Uber Eats partnered with FreshDirect to offer grocery delivery across New York City via the Uber Eats and Uber apps. The collaboration enables same-day and on-demand delivery, significantly expanding FreshDirect’s customer reach through Uber’s established urban logistics network. Such strategic alliances highlight the sector’s transition toward integrated, technology-driven service models aimed at enhancing convenience and scale. Furthermore, online grocery market research reveals that companies that prioritize localized sourcing and efficient distribution are gaining a competitive edge by reducing carbon emissions while maintaining profitability. These advancements also contribute to macroeconomic growth by creating jobs and supporting digital entrepreneurship.

Key Industry Trends Reshaping the Online Grocery Landscape:

Need for Speed: Rise of Ultra-Fast Delivery Services

A significant shift in the online grocery market is the emergence of ultra-fast delivery services, which promise order fulfillment in under 30 minutes. This model addresses growing consumer demand for speed and convenience, particularly in urban areas. A recent survey revealed that 31% of Indian consumers rely on quick commerce platforms for their primary grocery needs. To meet these expectations, both startups and major retailers are investing in micro-fulfillment centers and hyperlocal logistics. In July 2025, Amazon expanded its “Now” quick-commerce service in Delhi, launching a 10-minute delivery offering for groceries and daily essentials. This service is supported by real-time inventory tracking and dynamic routing algorithms, designed to reduce delays and improve operational efficiency. As competition intensifies, companies capable of maintaining delivery speed without compromising on cost or quality are gaining greater market share and influencing the evolution of convenience-driven retail models.

Smarter Carts: Integration of AI and Machine Learning for Personalized Shopping

Artificial intelligence (AI) and machine learning (ML) have become integral to the online grocery ecosystem, shaping how consumers interact with digital platforms. These technologies support features such as personalized product recommendations, automated reordering, and AI-powered chatbots, all of which enhance the shopping experience and increase average basket size. One of the recent developments is that in April 2025, South Korea’s Lotte launched Lotte Mart Zetta, a new grocery app built on the Ocado Smart Platform (OSP). The platform integrates AI-driven features such as Ocado’s “smart cart” to offer personalized recommendations and streamline the user journey, reinforcing the market’s shift toward intelligent automation. In addition, voice assistants and predictive analytics further contribute by improving customer support, forecasting demand, optimizing inventory, and reducing spoilage. Moreover, consumers value the ability to compare products and prices easily, an experience that AI significantly improves by tailoring options to individual preferences. Besides, early adopters of AI benefit from higher conversion rates and increased customer retention, strengthening digital engagement.

Basket on Repeat: Expansion of Subscription-Based Grocery Models

The rising adoption of subscription-based grocery models is transforming consumer shopping patterns by offering convenience, consistency, and time savings. These models allow customers to schedule regular deliveries of essential items such as milk, eggs, and fresh produce, reducing friction in routine purchases. A 2024 industry study surveying over 67,000 consumers across 11 countries revealed that 15% of consumers use online grocery subscriptions weekly. Subscription-based usage is significantly higher among younger demographics, with 28% of Gen Z and 25% of millennials engaging with these services. These trends underscore a generational shift in shopping behavior, with younger consumers driving digital adoption. Subscription models offer consistent pricing, auto-renewals, and personalization, which not only simplify meal planning but also build brand loyalty. For retailers, they generate stable revenue streams and enable delivery route optimization, contributing to cost efficiency and long-term market growth.

From Farm to Screen: Growth of Direct-to-Consumer Farm-to-Table Platforms

Direct-to-consumer (D2C) farm-to-table grocery platforms are revolutionizing the food supply chain by connecting producers directly with consumers. These platforms focus on delivering fresh, locally sourced produce, eliminating the need for traditional intermediaries. This model is valued by consumers for its transparency, freshness, and traceability, offering greater assurance about product origins. Moreover, D2C platforms provide farmers with higher profit margins and reduce inefficiencies within the supply chain. In addition to perishable items, these platforms are expanding their offerings to include specialty foods, organic products, and gourmet kits, catering to niche markets. With sustainability and quality becoming increasingly important, D2C channels are tapping into a growing segment of health-conscious and environmentally aware consumers. Notably, in July 2025, Navore Market launched San Diego County’s first online marketplace, connecting local consumers directly to regional farmers and food producers. This initiative not only enhances access to local food but also strengthens the regional economy, promoting sustainable agricultural practices.

Greener Carts: Adoption of Sustainable and Eco-Friendly Packaging Solutions

Sustainability has emerged as a key competitive factor in the online grocery market, influencing both consumer behavior and corporate strategy. Industry reports from 2024 indicate that over 80% of consumers are willing to pay more for sustainably produced or sourced goods, highlighting the increasing importance of environmental responsibility in purchasing decisions. On average, certain consumers are willing to spend approximately 9.7% more on products that adhere to defined environmental criteria, including those that are locally sourced, manufactured using recycled or sustainable materials, or produced with reduced carbon emissions. In response, retailers are adopting sustainable packaging solutions, including compostable bags, reusable containers, and recycled materials, to reduce plastic waste and enhance brand perception. These practices not only meet rising consumer expectations but also address growing regulatory pressures tied to ESG commitments. Companies introducing circular packaging systems and returnable delivery kits are experiencing higher customer engagement and trust, reinforcing sustainability as a driver of long-term market competitiveness.

Digital Grocery Decoded: Online Grocery Segmentation

Staples Set the Standard in Grocery Carts

- Staples and cooking essentials like grains, edible oils, spices, and fresh produce account for 28.9% of the market share in 2024.

- These foundational items are purchased regularly and across all income brackets, making them essential drivers of repeat business and platform engagement.

- Their consistent demand ensures steady transaction volumes, helping retailers optimize inventory and streamline logistics while catering to core household needs.

Marketplace Model Commands Digital Shelf Space

- The pure marketplace model remains the dominant force in the online grocery business landscape, connecting multiple sellers to consumers via a unified digital platform.

- This model thrives on product diversity, competitive pricing, and operational scalability—offering flexibility to vendors and choice to shoppers.

- Its decentralized nature also enables platforms to expand into new geographies with minimal inventory risk, fueling online grocery market share gains in both urban and semi-urban areas.

Web and App Platforms Shape the User Journey

- Web-Based Platforms: Web interfaces appeal to users seeking detailed product views, price comparisons, and a broader navigational experience—often favored in home and workplace settings.

- App-Based Platforms: Mobile applications drive the majority of real-time purchases through personalized notifications, location-based services, and user-friendly interfaces optimized for handheld convenience.

- Together, they enable seamless access to digital grocery aisles, reinforcing platform loyalty and contributing to sustained market growth.

Subscription Shopping Builds Lasting Loyalty

- Subscription-based grocery models are rapidly gaining popularity among busy households and working professionals who prioritize convenience and time savings.

- These services automate replenishment of frequently used products, reduce the cognitive load of repeated purchases, and enable predictable delivery schedules.

- In turn, platforms benefit from improved customer retention, optimized route planning, and reduced churn—making subscriptions a strategic pillar in the future of online retail.

Around the World in 5 Carts: Regional Trends in Online Grocery Landscape

Quick Commerce Capital: APAC Sets the Pace

Asia Pacific currently dominates the market, holding a market share of over 58.3% in 2024, driven by its large consumer base, increasing digital literacy, and the expanding middle class. Countries such as China, India, and South Korea are experiencing significant growth in the adoption of grocery apps and digital payment technologies, including UPI and mobile wallets. India is emerging as a key market within the region, supported by rising smartphone penetration and an anticipated 55.3% internet penetration rate by 2025, coupled with growing demand for quick commerce services. This rapid digital adoption positions the Asia Pacific as the largest online grocery market globally, attracting considerable attention from e-commerce giants, regional startups, and international investors.

One such example is KIKO Live, which launched its ONDC Buyer app in January 2025. Designed to transform the online shopping experience, the app offers features such as grocery list search, nearby store suggestions, and quick commerce services. It facilitates faster and more efficient deliveries from local stores, initially focusing on areas like Delhi, with plans for expansion into additional cities. KIKO Live aims to partner with 10,000 stores by 2025, helping small retailers enhance their home delivery capabilities. This development reflects the broader trend of digital transformation in the region and underscores the growing importance of quick commerce in shaping the future of online grocery retail.

Convenience First: Online Grocery Gains Ground

In North America, the market is experiencing steady growth, driven by shifting consumer preferences toward convenience, time-saving, and digital-first experiences. The United States remains the dominant contributor. As per industry reports, in June 2025, online grocery sales in the US experienced a year-over-year growth of USD 2.1 Billion, compared to a USD 2.4 Billion increase in February, which marked the largest growth to date. Canada is also witnessing increased traction, supported by growing internet penetration and digital payment adoption. The market is further influenced by consumer demand for organic, fresh, and locally sourced products, fostering innovation across fulfillment and logistics systems.

Smart Carts and Sustainability: Europe’s E-Grocery Shift

Europe’s market is evolving rapidly, supported by high internet connectivity, aging populations, and strong adoption of e-commerce platforms. Countries like the UK, Germany, France, and the Netherlands lead in online grocery penetration. Consumer demand for sustainability, eco-friendly packaging, and traceable sourcing is shaping retail strategies. Quick commerce and dark store models are emerging across urban centers, particularly in response to busy lifestyles and rising single-person households. For instance, in September 2024, Co-op partnered with Deliveroo Express, using its white-label solution to enable rapid fulfillment across hundreds of convenience stores. This integration allows Co-op customers to order online and receive groceries within 60 minutes, utilizing Deliveroo’s logistics and rider network across 1,400 locations, boosting Co-op’s quick-commerce capabilities.

Fast, Fresh, and Growing: Latin America’s E-Grocery Momentum

The online grocery market in Latin America is growing steadily, with Brazil and Mexico leading the expansion. Factors such as a young population, increased smartphone usage, improved digital infrastructure, and greater familiarity with online shopping are driving e-grocery adoption. According to industry reports, the region has over 165 Million individuals aged 15 to 29, making up around 27% of the total population. While traditional retail remains dominant, urban millennials and young families are fueling digital transformation. Local and regional players are partnering with fintech solutions to ensure secure transactions. Despite logistical challenges like last-mile delivery, the rising middle class and improved internet access offer significant long-term market potential.

Groceries Go Digital: MEA Embraces E-Trolleys

The market in the Middle East and Africa is gaining momentum, led by the UAE, Saudi Arabia, and South Africa. Rapid urbanization, a growing young population, and high smartphone penetration are encouraging digital grocery adoption. Moreover, government initiatives to promote digital economies and smart cities are supporting market growth. Consumers are increasingly opting for online platforms due to convenience, availability of imported products, and improved delivery networks. Notably, in April 2025, Egypt-based quick-commerce startup Rabbit officially launched operations in Saudi Arabia, establishing its regional headquarters in Riyadh. Rabbit is targeting 20 Million deliveries by 2026, offering ultra-fast delivery within 20 minutes, powered by AI-driven recommendations and hyperlocal logistics. E-grocery apps are integrating local payment systems and multilingual interfaces to cater to diverse audiences.

Online Grocery’s Next Chapter: Growth Catalysts and Strategic Outlook (2025–2033)

The global online grocery market is expected to reach USD 6,590.92 Billion by 2033, expanding at a CAGR of 28.09% during 2025-2033. The following key drivers are shaping the landscape:

- Urbanization and Dual-Income Growth: Accelerated urban development and the rise of dual-income households are increasing demand for convenient and time-saving grocery solutions.

- Digital Lifestyle Adoption: Greater smartphone usage and mobile app penetration are shifting consumer habits toward digital grocery platforms.

- Logistics Optimization and Last-Mile Innovation: Investments in micro-fulfillment centers, AI-driven logistics, and cold-chain infrastructure are boosting delivery efficiency.

- Sustainability and Consumer Expectations: Demand for eco-friendly packaging and ethically sourced products is influencing platform strategies and consumer loyalty.

- Policy and Regulatory Support: National digital economy strategies and retail innovation policies are providing an enabling environment for sector growth.

IMARC’s Vision: Powering the Digital Grocery Revolution with Strategic Foresight

IMARC Group empowers stakeholders in the online grocery ecosystem with deep, data-driven intelligence tailored for sustainable growth and competitive advantage. As the market evolves toward personalized, faster, and more sustainable solutions, our research helps clients anticipate changes, unlock opportunities, and align with emerging consumer behaviors.

How IMARC Adds Strategic Value:

- Decoding Market Dynamics: Identifying key consumer, retail, and tech trends shaping online grocery adoption.

- Innovation Tracking: Monitoring advancements in AI, logistics tech, and business models like subscriptions and D2C.

- Regulatory and Policy Advisory: Navigating the complexities of food safety, e-commerce, and sustainability regulations across regions.

- Tailored Strategy Development: Designing market-entry and expansion strategies based on platform preferences, product types, and regional shifts.

- Accurate Forecasting: Equipping clients with long-term demand projections and actionable insights to plan.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)