Top Factors Driving Growth in the UAE Cold Chain Logistics Market

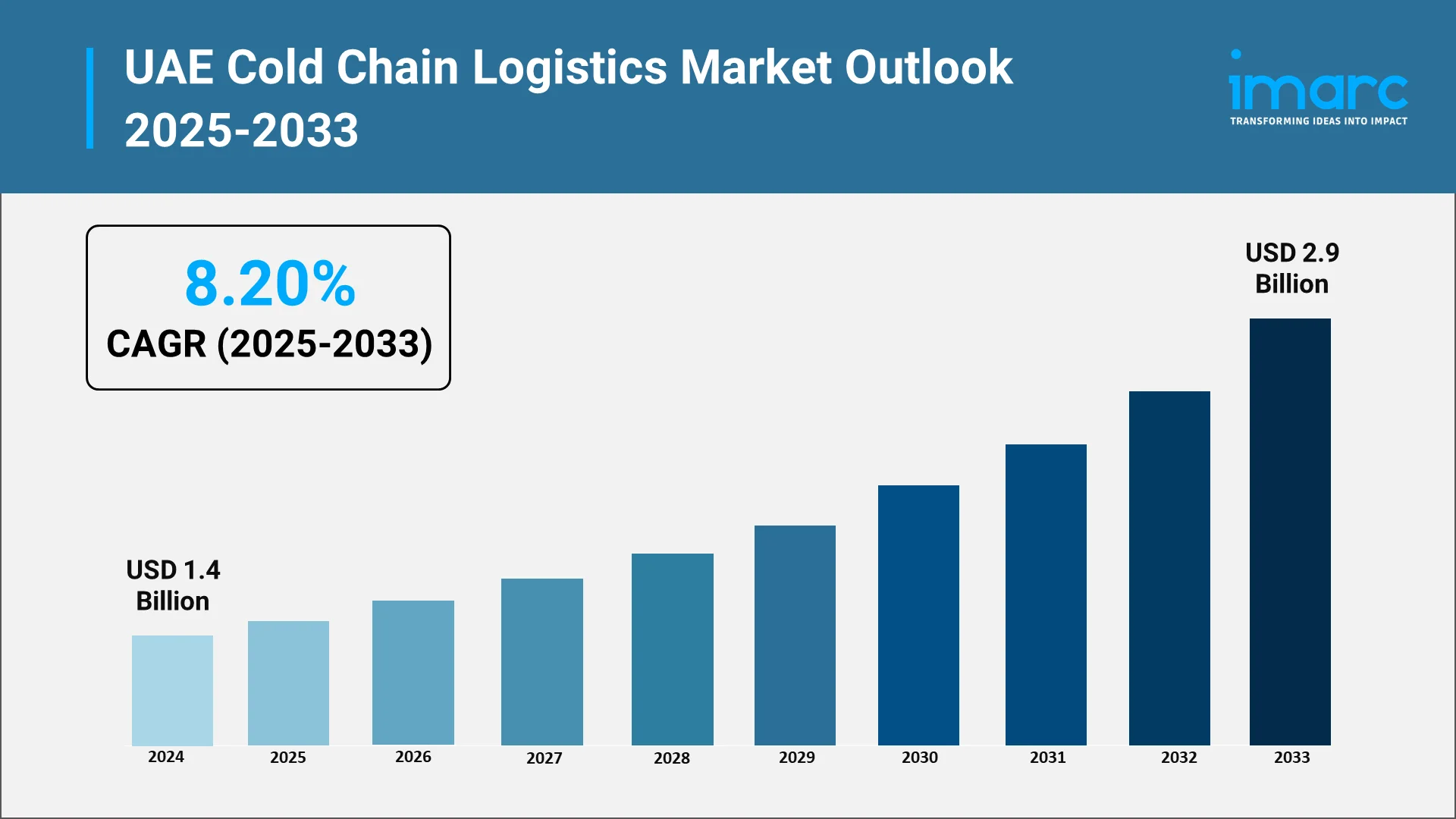

The UAE cold chain logistics market has emerged as a critical component of the nation's broader economic diversification strategy. As the country positions itself as a leading regional hub for trade, commerce, and healthcare, the demand for sophisticated temperature-controlled supply chain solutions continues to intensify. The UAE cold chain logistics market size reached USD 1.4 Billion in 2024 as per IMARC Group and it reflects the growing importance of maintaining product integrity across pharmaceuticals, perishable foods, and biotechnology products throughout their journey.

The transformation of Dubai and Abu Dhabi into global logistics hubs has created unprecedented opportunities for cold chain service providers. The market trends indicate a shift toward more integrated, technology-driven solutions that offer end-to-end visibility and control.

Understanding the forces shaping this dynamic sector provides valuable insights for stakeholders seeking to capitalize on emerging opportunities. From pharmaceutical companies requiring stringent temperature controls to food retailers expanding their online presence, the ecosystem supporting the UAE cold chain logistics market share encompasses diverse industries. This comprehensive analysis explores the key drivers propelling market expansion and the strategic considerations that will define the industry's trajectory.

Explore in-depth findings for this market, Request Sample

Rising Demand for Temperature-Sensitive Pharmaceuticals and Vaccines:

The healthcare sector's evolution has fundamentally reshaped the UAE cold chain logistics market analysis landscape. Modern biopharmaceuticals, including advanced biologics and gene therapies, require precise temperature maintenance throughout storage and distribution. These sophisticated medications represent the cutting edge of medical science, offering breakthrough treatments for conditions that were previously difficult to manage.

The UAE's role as a regional healthcare hub has amplified the importance of reliable cold chain infrastructure. Hospitals, clinics, and pharmacies across the Emirates depend on consistent access to temperature-sensitive medications that lose efficacy when exposed to temperature fluctuations. Cold chain logistics providers must therefore implement rigorous protocols to ensure pharmaceutical products maintain their therapeutic properties from manufacturer to patient.

Recent global health developments have underscored the critical importance of robust cold chain networks. The distribution of temperature-sensitive vaccines requires specialized storage facilities, refrigerated transport vehicles, and trained personnel who understand the complexities of handling biological products. This heightened awareness has accelerated investments in cold chain capabilities across the UAE, with both public and private sectors recognizing the strategic importance of pharmaceutical security.

The pharmaceutical cold chain extends beyond vaccines to encompass a wide range of biological products, insulin formulations, and diagnostic materials. Healthcare providers increasingly demand validated transportation solutions with continuous temperature monitoring and rapid response protocols. These requirements have pushed cold chain logistics companies to adopt more sophisticated approaches to quality assurance and risk management, elevating industry standards across the board.

Expansion of the E-Commerce and Online Grocery Sector:

Digital transformation has revolutionized consumer behavior throughout the UAE, with online shopping becoming increasingly prevalent across all demographic segments. According to the International Trade Administration, the UAE leads the Gulf Cooperation Council (GCC) in e-commerce with a total of $3.9 billion in sales in 2020, or 10% of all retail sales. With nearly all UAE citizens having easy approach to the internet connection and smart devices, the Dubai Chamber of Commerce and Industry foresees that E-Commerce will bring in $8 Billion by 2025. The convenience of home delivery combined with expanding product selection has driven remarkable growth in e-commerce platforms. This shift has created substantial demand for temperature-controlled delivery solutions, particularly for fresh produce, frozen foods, and prepared meals that require careful handling.

Online grocery platforms have emerged as major consumers of cold chain logistics services. These digital marketplaces promise consumers the same quality and freshness available in physical stores, creating complex logistical challenges. Maintaining the cold chain during last-mile delivery, especially in the UAE's extreme climate conditions, requires specialized vehicles, insulated packaging, and precise timing to ensure products reach customers in optimal condition.

The competitive landscape among e-commerce platforms has intensified focus on delivery speed and product quality. Same-day and next-day delivery options have become standard offerings, compressing timeframes for cold chain operations. UAE cold chain logistics market participants must balance speed with temperature control, investing in distributed warehouse networks and advanced route optimization technology to meet customer expectations.

Consumer expectations continue to evolve, with shoppers demanding greater transparency regarding product handling and storage conditions. Some platforms now offer temperature tracking features that allow customers to verify their purchases remained within acceptable temperature ranges throughout delivery. This transparency trend reinforces the importance of reliable cold chain infrastructure and pushes providers to implement more robust monitoring systems.

Increasing Investments in Advanced Refrigeration and Monitoring Technologies:

Technological innovation has transformed the capabilities and efficiency of modern cold chain operations. Advanced refrigeration systems now offer unprecedented precision in temperature control, utilizing smart sensors and automated adjustment mechanisms to maintain optimal conditions. These systems can respond to environmental changes in real-time, ensuring product integrity even during unexpected circumstances.

The integration of Internet of Things (IoT) technology has revolutionized cold chain monitoring and management. Connected sensors throughout the supply chain provide continuous data streams on temperature, humidity, and other critical parameters. This real-time visibility enables logistics providers to identify and address potential issues before they compromise product quality, significantly reducing waste and improving operational reliability.

Blockchain technology is gaining traction as a tool for enhancing cold chain transparency and accountability. By creating immutable records of temperature data and handling procedures, blockchain systems provide verifiable proof that products remained within acceptable parameters throughout their journey. This capability proves particularly valuable for high-value pharmaceuticals and specialty foods where regulatory compliance and quality assurance are paramount.

Artificial intelligence and machine learning algorithms are increasingly deployed to optimize cold chain operations. These technologies analyze historical data to predict demand patterns, identify potential bottlenecks, and recommend optimal routing strategies. Predictive maintenance capabilities help prevent equipment failures before they occur, minimizing disruptions and ensuring consistent service quality throughout the UAE cold chain logistics network.

Growth of the Food and Beverage Export Industry:

The UAE's strategic geographic position between East and West has established it as a natural transshipment hub for international food trade. The country's modern port facilities and free trade zones facilitate the efficient movement of perishable goods between continents. This positioning has attracted food exporters seeking reliable cold chain infrastructure to support their regional and global distribution strategies.

Growing affluence across the Middle East and North Africa region has increased demand for premium food products, including imported fruits, seafood, and specialty ingredients. UAE-based cold chain facilities serve as staging points for distributing these products throughout neighboring markets. The ability to consolidate shipments and redistribute products efficiently makes the Emirates an attractive base for food trading operations.

The country's food processing sector has expanded significantly, with facilities producing value-added products for domestic consumption and export. These operations require sophisticated cold chain support from raw material receiving through finished product distribution. Temperature-controlled logistics providers must accommodate varying requirements across different food categories, from frozen seafood to fresh produce to dairy products.

Export-focused food businesses leverage the UAE's extensive air cargo infrastructure to reach distant markets quickly. Dubai International Airport and other major aviation hubs offer comprehensive cold chain handling services for perishable exports. The speed advantage of air freight combined with reliable temperature control makes the UAE an ideal gateway for time-sensitive food products destined for Asian, European, and African markets.

Government Initiatives to Enhance Logistics Infrastructure and Supply Chain Efficiency:

The UAE government has demonstrated strong commitment to developing world-class logistics infrastructure as part of its economic diversification strategy. Major investments in port expansion, airport development, and road networks create the physical foundation for efficient cold chain operations. These infrastructure projects consider the specific requirements of temperature-controlled cargo, incorporating specialized facilities and handling equipment. For example, the Dubai Commercial Transport Strategy 2030 was approved in May 2024 with the goal of increasing and doubling the commercial transport and logistics sector's economic contribution to around AED 16.8 Billion. It also focuses on increasing the adoption of technology in infrastructure by 75%.

Regulatory frameworks governing cold chain operations continue to evolve, establishing clear standards for facility design, equipment specifications, and operational procedures. These regulations align with international best practices, facilitating trade by ensuring UAE-based operations meet global quality expectations. Consistent regulatory enforcement builds confidence among international partners regarding the reliability of UAE cold chain services.

Free trade zones throughout the Emirates offer attractive incentives for logistics companies and food traders. These zones provide streamlined customs procedures, tax benefits, and modern facilities designed to support cold chain operations. The concentration of related businesses within free zones creates synergies that enhance overall supply chain efficiency and reduce transaction costs for all participants.

Strategic initiatives aimed at positioning the UAE as a food security hub for the region have accelerated cold chain development. National strategies emphasize the importance of reliable food storage and distribution capabilities to ensure consistent supply during potential disruptions. These priorities have driven public and private investment in cold storage capacity and advanced logistics technology throughout the country.

Opportunities and Challenges in the UAE Cold Chain Logistics Industry:

The expanding UAE cold chain logistics market size 2025 presents significant opportunities for service providers and technology vendors. Healthcare sector growth creates sustained demand for pharmaceutical cold chain services, while e-commerce expansion drives requirements for last-mile refrigerated delivery. Companies that can deliver integrated solutions addressing multiple industry segments are well-positioned to capture market share.

Sustainability concerns are reshaping cold chain operations, with increasing focus on energy efficiency and environmental impact. Opportunities exist for providers that can demonstrate lower carbon footprints through renewable energy utilization, efficient refrigeration systems, and optimized routing. Meeting sustainability expectations while maintaining service quality represents both a challenge and a competitive differentiator.

However, the sector faces notable challenges that require careful navigation. The UAE's extreme climate conditions place extraordinary demands on refrigeration equipment and increase operational costs. Maintaining temperature control during outdoor handling and last-mile delivery requires specialized solutions that add complexity and expense to operations. Energy consumption for cooling represents a significant cost factor that affects profitability and environmental performance.

Skilled workforce development remains an ongoing challenge for the industry. Cold chain operations require personnel with specialized knowledge of temperature management, quality control procedures, and regulatory compliance. Training programs and professional development initiatives are essential to build the human capital necessary for sector growth. Competition for qualified professionals can drive up labor costs and affect service consistency.

Future Outlook for the UAE Cold Chain Logistics Industry:

The trajectory of the UAE cold chain logistics market trends points toward continued expansion driven by healthcare innovation, e-commerce growth, and regional trade development. Emerging technologies will enable more efficient and reliable operations, while regulatory evolution will establish higher standards that benefit consumers and businesses alike. The convergence of digital transformation and physical infrastructure development creates a powerful foundation for sustained growth.

Integration of cold chain logistics with broader supply chain management systems will become increasingly important. Seamless data flow between different supply chain participants enables more efficient coordination and reduces the risk of quality failures. Platform-based business models that connect multiple service providers through digital interfaces may emerge as alternatives to traditional vertical integration approaches.

Climate adaptation strategies will become central to cold chain planning and operations. As sustainability considerations gain prominence, the industry must develop innovative approaches to reduce environmental impact while maintaining service quality. Investments in renewable energy, electric vehicle fleets, and energy-efficient facilities will likely accelerate as companies respond to regulatory requirements and market expectations.

The development of specialized cold chain capabilities for emerging product categories will create new market segments. As biotechnology advances and novel therapeutic approaches reach commercialization, logistics providers must develop expertise in handling products with unique requirements. This specialization will likely lead to greater segmentation within the cold chain market, with providers focusing on specific industries or product types where they can deliver superior value.

Choose IMARC Group for Unmatched Market Intelligence and Strategic Insights:

IMARC Group empowers organizations with comprehensive market research illuminating opportunities within the UAE cold chain logistics sector. Our data-driven reports provide deep analysis of market dynamics, competitive landscapes, technological innovations, and regulatory developments shaping this industry. We deliver strategic forecasting helping clients anticipate trends in temperature-controlled logistics, from pharmaceutical distribution to e-commerce fulfillment across regional markets.

Our competitive benchmarking evaluates service provider capabilities and technology adoption patterns defining market leadership. We offer policy and infrastructure advisory to navigate regulatory frameworks and compliance requirements. Our custom research and consulting provide tailored insights aligned with your organizational objectives, whether expanding operations, investing in infrastructure, or developing innovative offerings. Partner with IMARC Group to gain clarity needed to succeed in this dynamic market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)