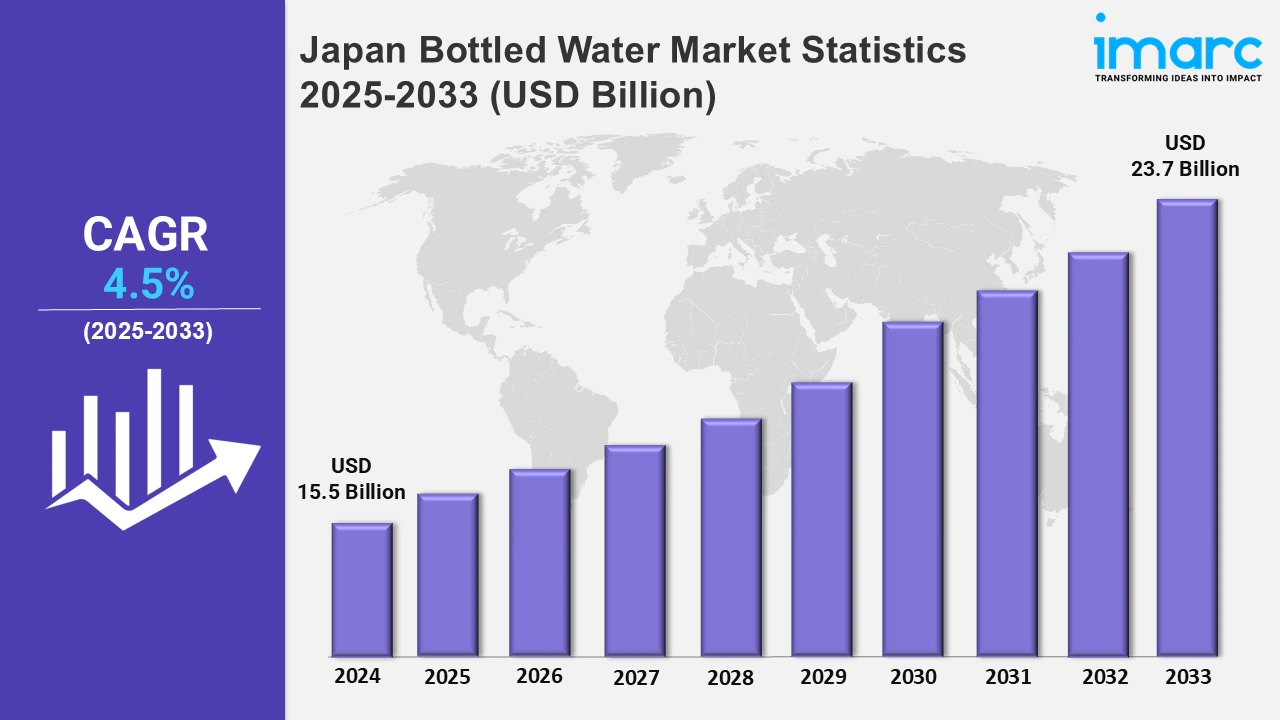

Japan Bottled Water Market Expected to Reach USD 23.7 Billion by 2033 - IMARC Group

Japan Bottled Water Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan bottled water market size was valued at USD 15.5 Billion in 2024, and it is expected to reach USD 23.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% from 2025 to 2033.

To get more information on this market, Request Sample

Japan's bottled water market is thriving, fueled by a growing tourism sector. For instance, as of May 2024, Japan hosted over 3 million international tourists each month, with the country expected to attract 60 million visitors by 2025. This surge is escalating the demand for high-quality, pure, and distinctly flavored bottled water. Renowned for safety and unique regional varieties, Japanese bottled water appeals to both domestic and international tourists. This trend underscores the role of tourism in shaping consumer preferences and boosting the market growth.

Additionally, the bottled water market in Japan is embracing eco-conscious innovations by incorporating sustainable materials to reduce environmental impact. These advancements prioritize renewable resources and lower carbon footprints, reflecting growing consumer demand for environmentally friendly solutions. For instance, in November 2024, Neste, Indorama Ventures, ENEOS, Mitsubishi Corporation, Suntory, and Iwatani unveiled a bio-PET bottle, which is made from used cooking oil to reduce CO2 emissions. The ISCC+-certified variants represent a significant step towards sustainable packaging. Besides this, various brands across Japan are introducing unique offerings, such as functional waters infused with vitamins, minerals, and electrolytes, to cater to health-focused consumers. Flavored and sparkling waters are gaining traction as appealing alternatives to beverages with high sugar content. Advanced filtration and mineral-enhancement technologies are creating premium water products that command higher consumer interest.

Japan Bottled Water Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The rising awareness regarding the benefits of hydration and the health risks associated with consuming beverages with high sugar levels is driving individuals across these regions towards bottled water.

Kanto Region Bottled Water Market Trends:

The Kanto region focuses on the growing demand for mineral-rich and functional water products, owing to the increasing health consciousness among people. Tokyo is the leader in this trend. Various brands across the region, like Suntory’s Iyemon Tokucha, are popular. Many convenience stores and online shops are growing to meet demand.

Kinki Region Bottled Water Market Trends:

The growing tourism in cities like Osaka is driving the market growth in the Kinki region. Kyoto is known for its cultural heritage. Besides this, seasonal festivals and tea ceremonies make spring water more popular. Regional branding is important, thereby emphasizing the pure origins and cultural relevance of bottled water in this area.

Central/Chubu Region Bottled Water Market Trends:

The Central/Chubu region, which includes Mount Fuji, focuses on natural purity in the bottled water business. Products like Fujisan natural water, which comes directly from Mount Fuji's aquifers, are popular due to its health benefits. Besides this, the region also benefits from its proximity to freshwater supplies, which allows local producers to compete with big brands.

Kyushu-Okinawa Region Bottled Water Market Trends:

In the Kyushu-Okinawa region, functional bottled water with added minerals or electrolytes is popular due to the area's warm climate. Ryukyu spring water incorporates minerals that cater to active lifestyles and tourism-driven hydration needs. Moreover, the region’s tourism industry, particularly in Okinawa, promotes bottled water as an essential commodity for visitors, contributing to the market expansion.

Tohoku Region Bottled Water Market Trends:

In the Tohoku region, disaster preparedness has a significant impact on bottled water demand. The region's history of earthquakes has raised awareness of emergency supplies. Governments and citizens across Tohoku value brands like Aquarius and Evian, which are advertised for their extended shelf life and consistent quality. Moreover, bulk purchases of preparedness kits are also becoming common in this region.

Chugoku Region Bottled Water Market Trends:

The Chugoku region, which includes Hiroshima, is showing an increased interest in functional bottled water. Products with additional benefits, such as Pocari sweat ion water for hydration during hot summers, are extremely popular. This trend is further supported by the region's active lifestyle and sports culture.

Hokkaido Region Bottled Water Market Trends:

Hokkaido is known for its nature. Bottled water sales in the region promote purity and cold-origin marketing. Products like Hokkaido Taisetsuzan natural mineral water come from a spring at the foot of Mount Asahidake. The emphasis of locals on outdoor activities also fuels the demand for easy hydration solutions that complement Hokkaido's eco-tourism appeal.

Shikoku Region Bottled Water Market Trends:

Small-scale bottled water makers in the Shikoku region take advantage of the uniqueness of local springs like those in Tokushima and Kochi. These brands cater to niche consumers who value handcrafted quality and minimal processing. Naruto Spring Water is known for its unique mineral content and compatibility with traditional Japanese aesthetics, drawing both regional and domestic tourists.

Top Companies Leading in the Japan Bottled Water Industry

The market research study generally includes a detailed analysis of the competitive landscape. In January 2023, Emma Japan launched the Emma Bottle, a functional bottle using deep-sea sand energy and far-infrared vibrations to produce antioxidant-rich water for aging care. It aids in minimizing cell oxidation and refining water molecules.

Japan Bottled Water Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into still, carbonated, flavored, and mineral. Still water provides pure and non-carbonated hydration, which is ideal for daily use. Carbonated water offers refreshing effervescence, enjoyed alone or in drinks. Moreover, flavored water combines hydration with taste using fruit or herbal infusions. Besides this, mineral water sourced from springs delivers various health benefits. Each of these product types caters to distinct preferences and occasions.

- Based on the distribution channel, the market has been bifurcated into supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others. Supermarkets and hypermarkets offer numerous bottled water brands at competitive prices, which appeals to bulk buyers. Convenience stores provide easy access for single purchases, ideal for on-the-go consumption. Direct sales focus on personalized delivery services, targeting health-conscious customers. On-trade channels, such as restaurants and cafes, emphasize premium bottled water for dining experiences.

- On the basis of the packaging type, the market has been bifurcated into PET bottles, metal cans, and others. PET bottles are popular for their lightweight and convenient design, making them ideal for everyday use. Moreover, metal cans offer eco-friendly benefits and maintain water freshness, appealing to environmentally conscious consumers and those seeking a premium drinking experience.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.7 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Bottled Water Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)