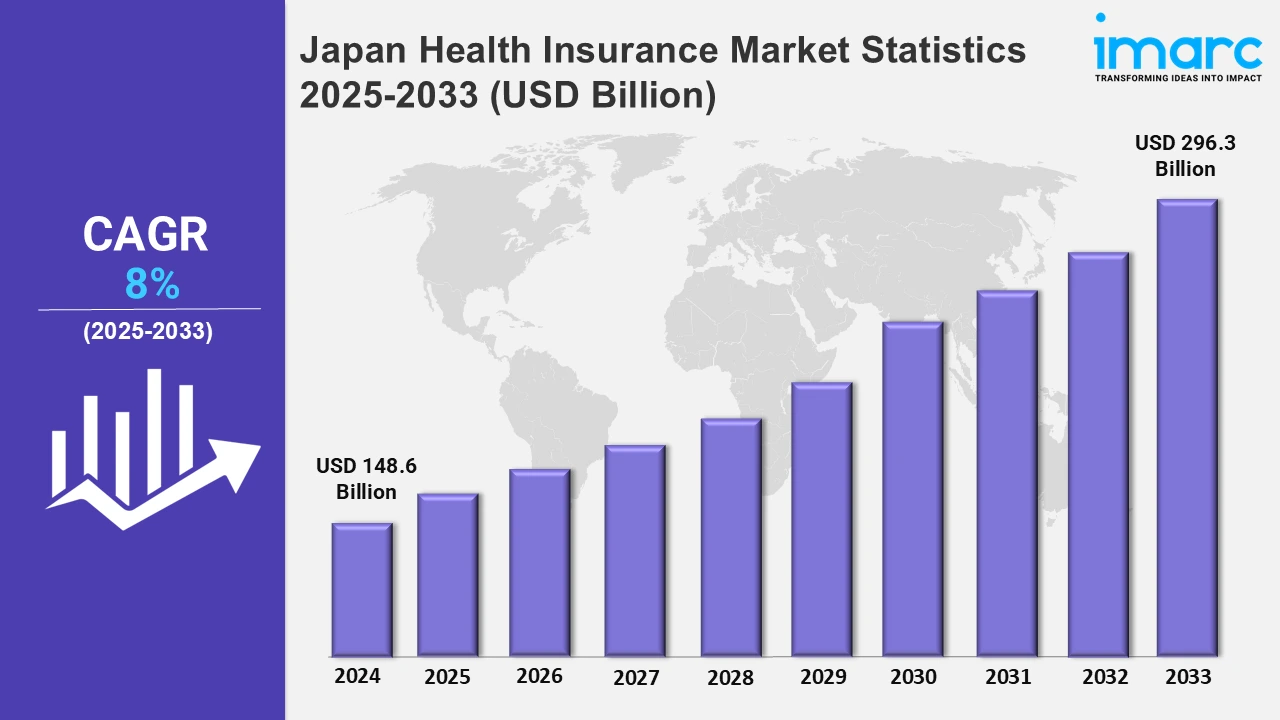

Japan Health Insurance Market Expected to Reach USD 296.3 Billion by 2033 - IMARC Group

Japan Health Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan health insurance market size was valued at USD 148.6 Billion in 2024, and it is expected to reach USD 296.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8% from 2025 to 2033.

To get more information on this market, Request Sample

Japan's health insurance market is prioritizing enhanced accessibility and user support. These initiatives streamline provider navigation, appointment scheduling, direct billing, and reimbursement, addressing challenges for international participants and promoting seamless healthcare access. In January 2025, the Department of Defense introduced a 24/7 bilingual call center to support civilian employees with health insurance navigation in Japan, including provider selection, appointments, direct billing, and reimbursement assistance.

Additionally, the health insurance market in Japan is addressing the growing healthcare needs of international tourists with specialized travel medical products. These solutions provide extensive emergency medical coverage, including evacuation services, private hospital access, and necessary treatments. Digital tools, such as safety apps, enhance convenience by offering real-time updates, emergency contacts, and useful resources. This approach reflects a focus on delivering comprehensive healthcare support to meet the demands of the rising tourism industry in the country. For instance, in November 2024, travel insurer WorldTrips launched Atlas JapanSecure, a new medical coverage product for travelers visiting Japan. It offers emergency medical evacuation coverage up to US$1 Million, treatment for eligible illnesses or injuries with private hospital room access, and the Tokio Marine safety app, which provides emergency contacts, real-time updates, and other essential resources, thereby driving the market expansion.

Japan Health Insurance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growing awareness towards lifestyle diseases and the importance of preventive healthcare is elevating the market in Japan.

Kanto Region Health Insurance Market Trends:

In the Kanto region, which includes Tokyo, there is a considerable push to integrate digital health solutions into insurance products. Various companies across the region, like Nippon Life Insurance, have created mobile applications that enable policyholders to access telemedicine services and manage claims online, thereby increasing customer satisfaction.

Kinki Region Health Insurance Market Trends:

The Kinki region, which includes Osaka, has seen an increase in corporate wellness efforts integrated into health insurance coverage. For example, various companies, like Dai-ichi Life Insurance, work with regional companies to provide wellness programs that encourage healthy employee behaviors, such as frequent health check-ups, with the goal of lowering overall healthcare expenses.

Central/Chubu Region Health Insurance Market Trends:

Central/Chubu, which is the center of numerous small and medium-sized firms, is experiencing an increase in demand for personalized health insurance solutions. Moreover, numerous companies across this region, like Tokio Marine & Nichido Fire Insurance Co., offer customizable group health insurance plans that are tailored to the demands and budgets of SMEs, assuring comprehensive coverage for their employees.

Kyushu-Okinawa Region Health Insurance Market Trends:

The Kyushu-Okinawa region prioritizes preventive healthcare in insurance programs. Sompo Japan Insurance provides plans that include frequent health screenings and preventive measures, with the goal of detecting health conditions early and encouraging policyholders to live healthy lives.

Tohoku Region Health Insurance Market Trends:

The Tohoku region, known for its aging demographic, is seeing insurers cater to senior citizens with tailored policies. Meiji Yasuda Life Insurance offers long-term care alternatives, home nursing coverage, and assistance with chronic diseases. These offers address the special healthcare needs of elderly citizens, ensuring they have access to quality treatment while reducing financial pressures.

Chugoku Region Health Insurance Market Trends:

In the Chugoku region, insurers are actively working with community organizations to raise health awareness. Sumitomo Life Insurance partners with community organizations to provide programs on health and disease prevention. This customized strategy promotes healthier lifestyles and increases the insurer's relationships with regional communities.

Hokkaido Region Health Insurance Market Trends:

The growing focus on enhancing data portability for healthcare information is driving the market growth in Hokkaido. Initiatives aim to improve access to electronic and personal health records, thereby ensuring seamless information sharing and better patient-centered care across the region. For instance, in April 2023, Fujitsu and Sapporo Medical University formed a strategic partnership aimed at enabling data portability for patients’ healthcare information, including electronic health records.

Shikoku Region Health Insurance Market Trends:

The market in the Shikoku region is growing due to efforts to improve rural healthcare and use digital tools. For example, Tokushima Prefecture started telemedicine services to link rural areas with urban hospitals. This helps provide better care and reduces gaps in healthcare access. Government programs support these changes, which encourage new ideas in health insurance and make managing patient care easier.

Top Companies Leading in the Japan Health Insurance Industry

The market involves the launch of several launches by key players. For instance, in January 2025, Japan implemented the Myna insurance card to simplify healthcare processes. Furthermore, Dai-ichi Life Insurance Company across Japan, in February 2024, invested ¥10 Billion to enhance its digital insurance services that aid in enhancing customer experiences. Apart from this, in May 2023, Nippon Life Insurance Company partnered with H2O.ai to elevate its health insurance business via novel machine learning technologies.

Japan Health Insurance Market Segmentation Coverage

- On the basis of the provider, the market has been bifurcated into private providers and public providers. Public options, including national health insurance and employees' health insurance, ensure affordable coverage for most citizens. Moreover, private providers offer supplemental plans and cover advanced treatments, specialized care, international healthcare needs, etc., enhancing accessibility and catering to diverse healthcare demands across the population.

- Based on the type, the market has been bifurcated into life-time coverage and term insurance. Life-time coverage provides long-term security, ensuring continuous healthcare support, especially for aging populations. Moreover, term insurance offers short-term coverage for specific periods or events, catering to temporary healthcare needs and providing flexibility for individuals seeking focused or limited-time protection.

- On the basis of the plan type, the market has been bifurcated into medical insurance, critical illness insurance, family floater health insurance, and others. Medical insurance covers general healthcare expenses, including hospitalizations and treatments. Moreover, critical illness insurance provides financial support for serious conditions like cancer or heart disease. Besides this, family floater plans encompass coverage for several family members under one policy, offering both convenience and cost savings.

- Based on the demographics, the market has been bifurcated into minor, adults, and senior citizens. Minors benefit from government-supported pediatric care. Moreover, adults typically seek comprehensive plans for general health needs and critical illness coverage. Besides this, senior citizens prioritize long-term care and age-specific coverage, addressing chronic conditions and healthcare services needed in later life.

- On the basis of the provider type, the market has been bifurcated into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider and organizations (EPOs). Provider organizations (PPOs) offer the option to choose healthcare providers without requiring referrals. Moreover, point-of-service (POS) plans combine PPO flexibility with coordinated care. Besides this, health maintenance organizations (HMOs) focus on cost-efficient and network-based care. Apart from this, exclusive provider organizations (EPOs) ensure lower costs through restricted network options.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 148.6 Billion |

| Market Forecast in 2033 | USD 296.3 Billion |

| Market Growth Rate 2025-2033 | 8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Health Insurance Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)