Open Source Intelligence Market Size, Share, Trends and Forecast by Source Type, Technique, End User, and Region, 2026-2034

Open Source Intelligence Market Size and Share:

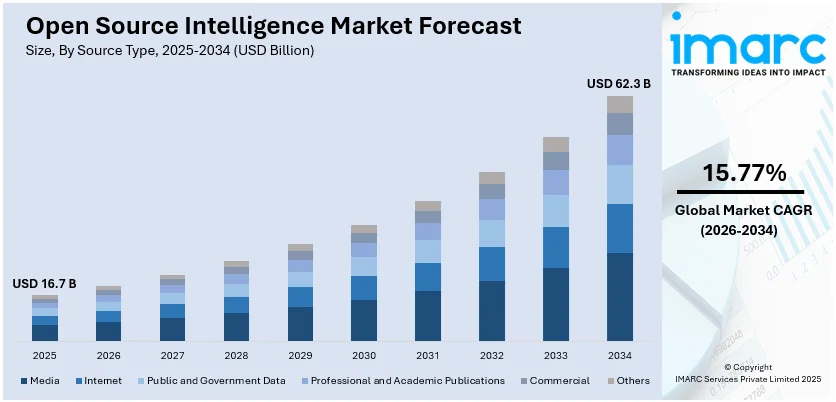

The global open source intelligence market size was valued at USD 16.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 62.3 Billion by 2034, exhibiting a CAGR of 15.77% from 2026-2034. North America currently dominates the market, holding the largest market share. This is due to an increasing number of cyber security threats, significant expansion of e-commerce and online platforms channels, and the implementation of AI security solutions to enrich decision-making processes and address risks within the evolving digital environment.

Market Size & Forecasts:

- Open source intelligence market was valued at USD 16.7 Billion in 2025.

- The market is projected to reach USD 62.3 Billion by 2034, at a CAGR of 15.77% from 2026-2034.

Dominant Segments:

- Source Type: Media dominates the open source intelligence market, accounting for 31.0% of the share, due to its vast, real-time coverage, accessibility, and ability to capture global events quickly.

- Technique: With a commanding 32.0% share, security analytics lead the market, owing to its ability to detect threats, analyze patterns, and provide real-time, actionable insights.

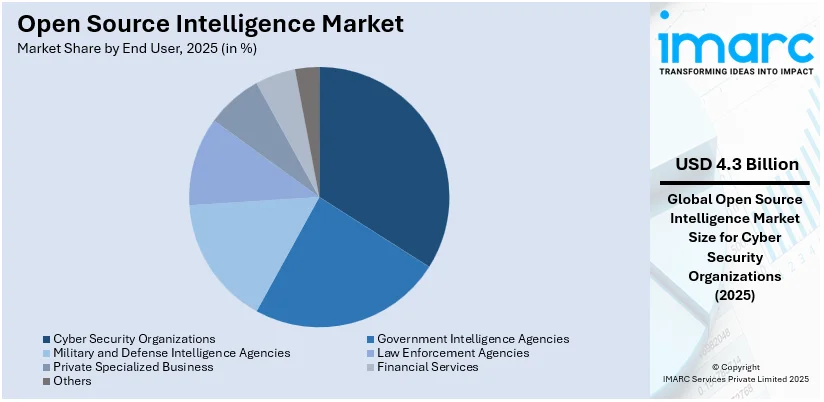

- End User: Cyber security organizations hold the biggest market share, accounting 29.8% in 2025. The dominance of the segment is attributed to their need for threat detection, risk assessment, and proactive defense against cyber-attacks.

- Region: North America leads the market, holding a dominant 36.0 % share. This regional advantage is driven by advanced technology infrastructure, strong cybersecurity initiatives, and a high demand for intelligence services.

Key Players:

- The leading companies in the open source intelligence market include Cellebrite (Sun Corporation), Dassault Systèmes, Expert.AI, Hensoldt AG, Hyland Software Inc., IPS S.p.A., Maltego Technologies GmbH, OffSec Services Limited, Palantir Technologies Inc., Recorded Future Inc., and Thales Group.

Key Drivers of Market Growth:

- Increasing Cybersecurity Threats: The rise in cyberattacks is catalyzing the demand for OSINT tools to detect and mitigate risks. As traditional security measures become less effective, AI-driven solutions are enhancing threat detection and real-time responses to emerging threats.

- Technological Advancements: The rapid expansion of digital platforms is increasing online data, providing vast opportunities for OSINT tools to analyze this information. Advanced algorithms and AI help organizations extract valuable insights, improving decision-making and threat detection.

- Social Media Data Expansion: The rise in social media users is significantly expanding publicly available data, creating a wealth of insights for OSINT tools. These tools analyze content from various platforms, enabling organizations to improve security and make informed decisions.

- Government Reliance on OSINT: Governments are increasingly relying on OSINT to monitor threats and enhance decision-making, helping to identify emerging risks and track geopolitical events. This proactive approach allows for faster threat detection and more effective security measures.

- E-Commerce Growth and Security: The rapid expansion of e-commerce is transforming shopping into a more accessible and convenient experience for buyers, while also increasing the volume of digital transactions. As these transactions grow in complexity, businesses are turning to AI-driven security solutions to protect sensitive data and prevent fraud, thus driving the demand for OSINT tools that can analyze and detect threats in real-time.

Future Outlook:

- Strong Growth Outlook: The open source intelligence market is experiencing robust growth due to increasing demand for real-time data, rising cybersecurity threats, and the need for enhanced decision-making.

- Market Evolution: The open source intelligence market is evolving rapidly with advancements in artificial intelligence (AI), machine learning (ML), and automation, enabling more efficient data collection, analysis, and actionable insights.

The increasing cybersecurity threat intelligence requirements for organizations, governments, and law enforcement agencies with their growing interests and uses in OSINT for early detection of security threats is propelling the market. OSINT tools gather publicly available data from social media platforms, websites, forums, and news outlets to provide insights into cyber threats, hacker activities, and emerging trends. Besides, the product usage in combatting threats, whether in terms of threat detection or situational awareness, or even real-time decision making, as it becomes more sophisticated and frequent represents another major growth-inducing factor. This further causes an increase in the OSINT requirements for most sectors, such as government, defence, finance, and even the private sector.

To get more information on this market Request Sample

The United States has emerged as a key region for open source intelligence market. This is due to the growing reliance on OSINT by government agencies and law enforcement for criminal investigations and public safety. Agencies such as the FBI, CIA, and local police departments use OSINT tools to gather intelligence from publicly accessible data sources, including social media, websites, and public records, for criminal profiling, tracking suspects, and solving cases. OSINT aids in identifying trends related to organized crime, terrorism, and trafficking, as well as providing insights into the behavior of criminal networks. With the increase in online criminal activity and the availability of vast amounts of open data, law enforcement agencies are leveraging OSINT technologies to enhance investigation efficiency and make more informed decisions. This adoption of OSINT technologies for criminal investigations and public safety is fueling the market's growth within the United States.

Open Source Intelligence Market Trends:

Government Utilization for National Security

The growing reliance of governments on open source intelligence to monitor and assess potential threats to national security is contributing to the market. Governments leverage open source intelligence tools to collect and analyze publicly available data from diverse sources, including news outlets, social media, public records and forums. This information helps in identifying emerging threats, monitoring extremist activities, and tracking geopolitical developments. The ability to gather actionable insights in real-time enhances decision-making processes in critical situations, such as counter-terrorism operations and disaster response. With increasing cybersecurity challenges and the complexity of global threats, open source intelligence enables proactive threat detection and mitigation without reliance solely on classified intelligence. In 2024, Fivecast launched its Discovery solution integrated into the Fivecast ONYX platform to address global intelligence challenges. This innovation enables faster and more efficient data discovery, aiding analysts in uncovering insights across vast open-source data. It enhances the efficiency of intelligence investigations in sectors like national security, corporate security, and financial crime.

Expansion of e-commerce and online retail

The exponential growth of e-commerce and online retail has completely revolutionized the way we shop and transact as customers and retail businesses. Although e-commerce makes it easy for customers to shop from the comfort of their homes, digital transactions have increased significantly. The global e-commerce market size increased to USD 21.1 Trillion in 2023. The market is expected to increase further to USD 183.8 Trillion by 2032, according to IMARC GROUP, and the market compound annual growth rate from 2024 to 2032 is projected at 27.16%. Moreover, the increasing volumes and complexity of transactions have compelled players in the retail industry to adopt artificial intelligence-based AI security solutions to protect their digital assets. These solutions use AI algorithms to learn from and identify unusual patterns, identify fraud, and prevent unauthorized access in real-time, thus contributing to the open source intelligence market revenue.

Open Source Intelligence Market Growth Drivers:

Rising Cybersecurity Threats

The rise in cyberattacks and data compromises has highlighted the necessity for enhanced security measures, increasing the demand for open-source intelligence (OSINT) tools to actively detect and mitigate potential risks. Conventional security solutions, such as firewalls and antivirus programs, are becoming less effective at protecting against advanced cyber strategies. The Cloud Security Alliance reports that 63% of security experts see the potential of AI in boosting security initiatives, especially in advancing threat detection and response. AI-driven systems, such as those utilizing ML, constantly adjust to evolving threats, independently reacting in real-time to new risks. This move towards AI-based security is encouraging organizations in various sectors to invest in advanced technologies that can protect vital infrastructure and digital assets. As a result, the need for OSINT tools is increasing, as they offer crucial information on possible vulnerabilities and improve overall security protocols.

Technological Advancements

The rapid growth of digital platforms and the internet is significantly increasing the volume of online data, encompassing social media, blogs, news sites, and forums, generating immense potential for OSINT tools to evaluate and derive useful intelligence. OSINT solutions are utilizing advanced algorithms, data mining methods, and AI to navigate this vast amount of data, offering businesses and security entities valuable insights. The advancement of data analytics and ML improves the capability to handle and interpret large volumes of information instantaneously, enabling organizations to swiftly recognize trends, patterns, and anomalies. These technological advancements facilitate more precise decision-making, enhance risk management approaches, and assist organizations in staying ahead of new threats, playing a crucial role in the growth of the market. For example, in 2025, Bengaluru Police announced plans to launch an AI-powered social media monitoring platform to detect misleading, communal, or threatening content online. The platform will include OSINT tools to analyze digital footprints and generate actionable intelligence reports. It aims to enhance real-time monitoring, sentiment analysis, and influencer tracking for better law enforcement.

Growing Number of Social Media Users

The increasing variety of digital platforms, especially social media, is greatly enhancing the availability of publicly accessible data, driving the expansion of the OSINT market. With rising individual activity on these platforms, substantial quantities of user-created content emerge, providing essential insights for different purposes. For example, Press Information Bureau (PIB) reports that the quantity of internet subscribers in the nation increased from 251.59 million in March 2014 to 954.40 million in March 2024, reflecting a compounded annual growth rate (CAGR) of 14.26%. OSINT tools currently examine information from social networks, discussion boards, and various online platforms for security, marketing, and competitive intelligence. These tools, fueled by sophisticated analytics, can analyze vast datasets instantaneously, reveal patterns, and detect new threats, allowing organizations to make knowledgeable choices and improve security measures, which boosts the demand for OSINT solutions.

Open Source Intelligence Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global open source intelligence market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on source type, technique, and end user.

Analysis by Source Type:

- Media

- Internet

- Public and Government Data

- Professional and Academic Publications

- Commercial

- Others

Media holds the biggest open source intelligence market share. The media sector includes television, radio, newspapers, magazines, and digitally hosted news channels. The extensive given channels provide invaluable information on public discourse, popular trends, and social dynamics. Researchers rely on virtually limitless channels as sources of real-time consumer statistics, market dynamics, and public reaction. The availability of platforms that differ from massive and particular channels enables a general understanding of the market condition. Besides this, the media sector is easy to access, updated every minute, and generally covers all the happenings in the world hence the most reliable of all sources.

Analysis by Technique:

- Text Analytics

- Video Analytics

- Social Media Analytics

- Geospatial Analytics

- Security Analytics

- Others

Security analytics leads the market. Security analytics is the largest market due to the need to protect digital assets and information that broadens our connected world. It is responsible for collecting, analyzing, and interpreting security data to identify potential threats, vulnerabilities, and breaches. It is a combination of machine learning, statistical analysis, and pattern recognition used to provide real-time monitoring, threat detection, and incident response. Besides this, the rising demand for security analytics responds to the growing complexity of cyber threats and IT environments. For instance, in November 2023, Brightside AI, a Software as a Service platform focused on supporting teams in their fight against genAI-powered social-engineering cyberattacks, is proud to announce the successful completion of a USD1M deal with Social Links, a tech investor solely focused on creating OSINT infrastructure. The latter is represented by an OSINT platform that unites more than 500 open sources of information and drastically accelerates an organization’s work with other people’s data, done in the open data framework. As part of the deal, Brightside will gain extended access to the Social Links platform for the next five years to optimize the artificial intelligence powered LLM models based on human data search engines for effective use of real-world examples.

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Government Intelligence Agencies

- Military and Defense Intelligence Agencies

- Cyber Security Organizations

- Law Enforcement Agencies

- Private Specialized Business

- Financial Services

- Others

Cyber security organizations lead the market. Cyber security organizations are protecting digital infrastructure, networks, and data from online threats and attacks. It is highly visible due to the increase in the number and multiplicity of cyber threats, necessitating greater security protections and constant vigilance. Moreover, cyber security organizations attempt to detect exposures, prevent violations, and mitigate exposure using various technologies and approaches, including threat intelligence, security analytics, and intrusion detection systems. Besides this, in November 2021, NICE Actimize, a NICE business, unveiled its IFM-X Dark Web Intelligence solution, which delivers broad coverage of the Dark and Deep Web, malware networks, private messaging platforms, and clandestine fraudster infrastructure and communities, aiding FSOs in combating the widespread challenges of identifying active fraud and account takeover (ATO) threats. As the amount of data positioned on the Dark Web continues to surge, financial service organizations (FSOs) simultaneously experience more complex fraud that is harder to detect and prevent. Currently, cyber security is a top issue for all aspects of the economy due to the increasing use of digital technology, which is driving the open-source intelligence market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest open source intelligence market share. North America, is known for its very advanced technological ecosystem, strong economic growth pace, and a deep commitment to innovation. It covers mainly the United States and Canada and is a leader across a broad spectrum of industries, including technology, finance, healthcare, and consumer goods. North America’s economy is characterized by the high buying power of consumers and the quick assimilation of new technologies, which makes it a very attractive market for digital services, advanced analytics, and cybersecurity. For instance, on February 15, 2024, Leidos, a FORTUNE 500 science and technology leader with a significant footprint, is pleased to announce the firm was awarded a new task order contract by the United States Defense Intelligence Agency’s (DIA) Science & Technology (S&T) Directorate. Leidos will design and implement a Tasking, Collection, Processing, Exploitation, and Dissemination (TCPED) system for the DIA’s Open Source Intelligence Integration Center (OSIC) based on this agreement. Thus, the shifting expectations of diverse, wealthy, and very digitally-savvy clients offer steady growth and a lot of opportunities to companies of various industries, which is positively influencing the open source intelligence market outlook.

Key Regional Takeaways:

United States Open Source Intelligence Market Analysis

The United States open source intelligence market is driven by several key factors that are propelling its growth and adoption across various industries. There is a rise in the need for proactive monitoring and intelligence gathering due to higher cases of cyber threats. As per the IT Governance, there are around 4,186,879,104 number of data breaches by April 2024 in US. Open source intelligence tools help organizations identify potential vulnerabilities and threats by tracking information from publicly available sources, such as social media, websites, and online forums. These tools are vital in identifying cyberattacks in their early stages, allowing for quicker responses to mitigate damage and protect sensitive data. Besides this, the massive growth in social media platforms, blogs, and online content provides an abundance of publicly available data. This data is often mined for intelligence, including tracking sentiment, monitoring geopolitical developments, and identifying security risks. Moreover, governing agencies in the US are increasingly turning to open-source information to complement classified data. Local and federal law enforcement agencies are using open source intelligence for criminal investigations, countering terrorism, tracking illegal activities, and identifying suspects using publicly available information from online platforms. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) allow for the automated collection and analysis of large volumes of open-source data. Open source intelligence tools powered by these technologies can process and analyze vast amounts of unstructured data like text, images, and videos to extract meaningful insights.

Asia Pacific Open Source Intelligence Market Analysis

The increasing frequency of cyber threats in countries like China, India, Japan, and South Korea are prompting governing agencies, corporations, and cybersecurity agencies to invest heavily in open source intelligence solutions for proactive threat detection, risk management, and national security. These solutions allow quick identification of cyberattacks, vulnerabilities, and emerging threats by scanning publicly available digital sources like social media, blogs, and forums. In addition, the rapid digitalization and high internet usage across the region are creating vast amounts of publicly accessible data. This includes information from social media platforms, e-commerce websites, and online news outlets, which are rich sources for intelligence gathering. According to reports, there were about 751.5 Million internet users in India at the start of 2024. Besides this, the Asia Pacific region is facing geopolitical tensions, particularly in areas like the South China Sea and the Korean Peninsula. Open source intelligence is crucial for monitoring military activities, political unrest, and terrorism, helping organizations stay ahead of potential security threats. Furthermore, technological advancements in AI, ML, and big data analytics are also accelerating the adoption of open source intelligence. These innovative technologies allow organizations to automate data collection, perform real time analysis, and generate actionable insights from vast and unstructured datasets. Additionally, the growing focus on legal and regulatory compliance, particularly regarding data privacy and security, is catalyzing the demand for open source intelligence.

Europe Open Source Intelligence Market Analysis

The Europe open source intelligence market is experiencing rapid growth on account of several key trends. One of the most significant trends is the increasing reliance on open source intelligence for cybersecurity. As cyber threats evolve, governing agencies and private organizations in the region are increasingly using open source intelligence tools to detect and mitigate cyber risks. The heightened awareness among individuals about cyberattacks and data breaches is catalyzing the demand for proactive intelligence gathering from publicly available online sources. Another prominent trend is the integration of advanced technologies in these tools to enable organizations to process large volumes of unstructured data from diverse sources, such as social media, news outlets, and online forums, in real time. The ability to use AI to identify patterns, trends, and emerging threats is improving the accuracy and speed of open source intelligence analysis. Additionally, big data analytics is playing an increasing role in extracting actionable insights from massive datasets, enhancing decision-making processes in sectors like law enforcement, national security, and corporate intelligence. As per the Centre for the Promotion of Imports from developing countries (CBI), the European big data market is expected to experience a CAGR of 7.7% from 2023 to 2029. Furthermore, the implementation of the EU’s General Data Protection Regulation (GDPR) and other privacy laws is pushing organizations to adopt open source intelligence tools that are both compliant and secure.

Latin America Open Source Intelligence Market Analysis

Rising security concerns in various sectors in the region is contributing to the market growth. Open source intelligence tools help governing, law enforcement, and security agencies in monitoring threats and tracking criminal activity through publicly available data from social media, forums, and news outlets. In line with this, cybersecurity threats are rising across the region, which is encouraging the adoption of open-source intelligence solutions to detect and mitigate risks. According to reports, cyberattack statistics in Brazil in the second quarter of this year registered a 67% increase in which organizations were attacked 2,754 times per week. Apart from this, with the growing digital footprint, open source intelligence solutions aid in identifying cyberattacks, online fraud, and data breaches.

Middle East and Africa Open Source Intelligence Market Analysis

The open source intelligence market in the Middle East and Africa (MEA) is driven by several key factors. Security and geopolitical instability in the region, including threats from terrorism, civil unrest, and military conflicts, are bolstering the market growth. Governing and security agencies are rapidly using open source intelligence solutions to monitor social media, news outlets, and online forums for early warning signals and to track emerging threats. Additionally, economic diversification and digital transformation in countries like the United Arab Emirates (UAE), Saudi Arabia, and South Africa are catalyzing the demand for open source intelligence in business intelligence, market analysis, and competitive research. The Middle East digital transformation market size is projected to exhibit a CAGR of 16.00% during 2024-2032, as reprted by the IMARC Group.

Competitive Landscape:

Key players in the open source intelligence (OSINT) market are heavily investing in integrating artificial intelligence (AI) and machine learning (ML) technologies into their platforms. These technologies enable enhanced data analysis, pattern recognition, and predictive insights, providing users with more precise and actionable intelligence. Companies are developing AI-driven solutions that can process vast amounts of unstructured data from diverse sources such as social media, public records, and news platforms. By offering cutting-edge capabilities, these players position themselves as leaders in the rapidly evolving OSINT landscape. Market leaders are forming strategic partnerships and pursuing acquisitions to expand their capabilities and market reach. Collaborations with cybersecurity firms, government agencies, and private enterprises help companies enhance their service offerings and tap into new customer segments. For instance, partnerships with cloud service providers enable the delivery of scalable and secure OSINT solutions. Acquiring smaller, niche firms specializing in specific OSINT domains allows key players to integrate innovative technologies and expand their expertise.

The report provides a comprehensive analysis of the competitive landscape in the open source intelligence market with detailed profiles of all major companies, including:

- Cellebrite (Sun Corporation)

- Dassault Systèmes

- Expert.AI

- Hensoldt AG

- Hyland Software Inc.

- IPS S.p.A.

- Maltego Technologies GmbH

- OffSec Services Limited

- Palantir Technologies Inc.

- Recorded Future Inc.

- Thales Group

Latest News and Developments:

- January 2025: The Coalition for Health AI (CHAI) launched an open-source Applied Model Card on GitHub, designed as a "nutrition label" for healthcare AI. This initiative aims to increase transparency, trust, and accountability by providing detailed information on AI model training, performance, fairness, and bias. The model card is intended to streamline AI procurement processes and ensure informed decisions in healthcare AI use.

- January 2025: Chinese AI start-up MiniMax released a series of open-source models, including foundational and multimodal models, to compete with top AI offerings from US companies. These models, including the MiniMax-01 large language model, were shown to match leading AI systems in performance tests. The release intensifies the race among Chinese tech firms to offer cost-effective, advanced AI systems.

- October 2024: IndiaAI and Meta announced the creation of the Center for Generative AI, Srijan at IIT Jodhpur and the "YuvAi Initiative for Skilling and Capacity Building" in collaboration with AICTE. These initiatives aim to advance open-source AI, empower 100,000 youth with generative AI skills, and foster innovation across sectors like healthcare, education, and agriculture. This partnership supports India’s AI mission for technological sovereignty and inclusive growth.

- September 2024: Alibaba expanded its AI offerings by releasing over 100 open-source models and text-to-video technology, focusing on digital commerce. This move aims to democratize access to AI, especially benefiting SMBs by lowering barriers to advanced tools for eCommerce and digital marketing. The strategy also includes boosting Alibaba's cloud services through increased AI adoption.

- September 2024: IBM and NASA released an open-source AI model for weather and climate applications. This foundation model, developed with contributions from Oak Ridge National Laboratory, offers flexible solutions for improved weather forecasting, climate projections, and severe weather prediction. It aims to democratize AI in climate science, benefiting developers, scientists, and businesses globally.

- July 2024: Meta launched its open-source AI model, Llama 3.1 405B, claiming it to be competitive with models from OpenAI and Anthropic. The model is available for free, allowing developers to fully customize it without intermediaries, enabling broad access to generative AI. Meta's move aligns with its belief in open-source AI as essential for promoting safety, accessibility, and avoiding monopolistic control.

- November 2024: Altia launched an advanced new product designed to revolutionize how open-source intelligence can be tracked and managed as part of an investigation. OSINT Investigator, the innovative module, allows investigation and risk teams to modernize the operations and manage increasing data volumes and backlogs.

- October 2024: Fivecast, an Australian OSINT software company, has introduced a new solution called Discovery within its Fivecast ONYX platform to address increasing global threats. This solution enhances intelligence gathering for government and corporate analysts by automating processes like digital footprinting and identity resolution. CEO Dr. Brenton Cooper emphasized its ability to provide broad searches and deep data collection, improving efficiency in national security and corporate sectors. Fivecast, a member of Australia’s Defense Industry Security Program, has received various accolades and funding to expand its services in key markets.

- March 2024: ShadowDragon, a provider of ethical OSINT, datasets, and APIs, announced its partnership with Vestigo Consulting and Collaboraite, both part of the Investigo Group. With the help of this partnership, shared clients can access ShadowDragon OSINT investigative tools securely from within the Collaboraite platform.

Open Source Intelligence Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Source Types Covered | Media, Internet, Public and Government Data, Professional and Academic Publications, Commercial, Others |

| Techniques Covered | Text Analytics, Video Analytics, Social Media Analytics, Geospatial Analytics, Security Analytics, Others |

| End Users Covered | Government Intelligence Agencies, Military and Defense Intelligence Agencies, Cyber Security Organizations, Law Enforcement Agencies, Private Specialized Business, Financial Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cellebrite (Sun Corporation), Dassault Systèmes, Expert.AI, Hensoldt AG, Hyland Software Inc., IPS S.p.A., Maltego Technologies GmbH, OffSec Services Limited, Palantir Technologies Inc., Recorded Future Inc., Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the open source intelligence market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global open source intelligence market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the open source intelligence industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global open source intelligence market was valued at USD 16.7 Billion in 2025.

IMARC estimates the global open source intelligence market to exhibit a CAGR of 15.77% during 2026-2034.

The market for open source intelligence is driven by an increasing number of cyber security threats, significant expansion of e-commerce and online platforms channels, and the implementation of AI security solutions to enrich decision-making processes and address risks within the evolving digital environment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global open source intelligence market include Cellebrite (Sun Corporation), Dassault Systèmes, Expert.AI, Hensoldt AG, Hyland Software Inc., IPS S.p.A., Maltego Technologies GmbH, OffSec Services Limited, Palantir Technologies Inc., Recorded Future Inc., Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)