Orthopedic Implants Market Size, Share, Trends and Forecast by Product, Type, Biomaterial, End User, and Region, 2025-2033

Orthopedic Implants Market Size and Share:

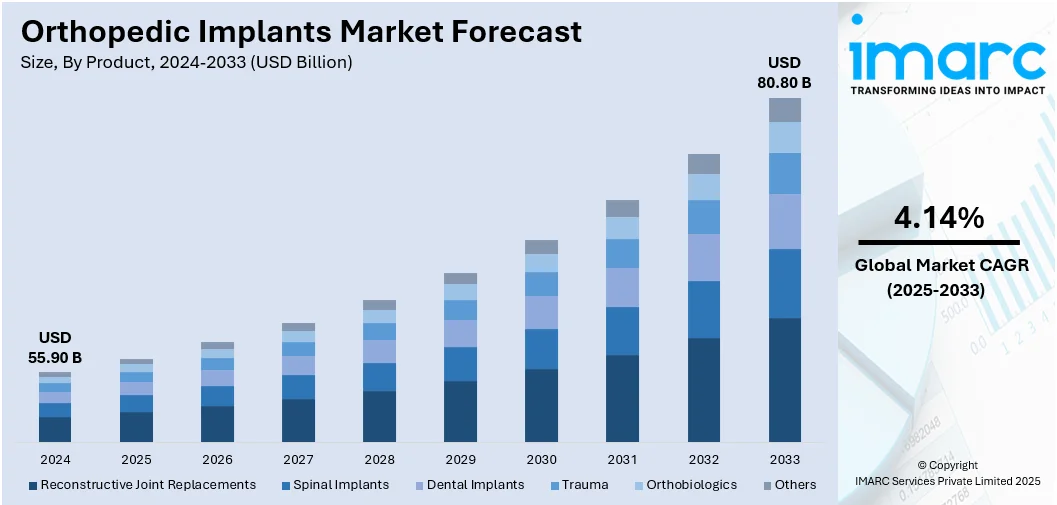

The global orthopedic implants market size was valued at USD 55.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 80.80 Billion by 2033, exhibiting a CAGR of 4.14% from 2025-2033. North America currently dominates the market, holding a market share of 45.7% in 2024. The dominance of the region is attributed to its advanced healthcare infrastructure, strong medical device industry, and high adoption of cutting-edge technologies. A well-established reimbursement system, coupled with an increasing elderly population and rising awareness about orthopedic treatments, further expands the orthopedic implants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 55.90 Billion |

| Market Forecast in 2033 | USD 80.80 Billion |

| Market Growth Rate 2025-2033 | 4.14% |

The increasing incidence of musculoskeletal disorders like arthritis, osteoporosis, and joint deformities is a critical factor contributing to the market growth. These conditions, which are often chronic, lead to a higher need for corrective surgeries, thereby catalyzing the demand for different orthopedic implants to enhance patient mobility and lifestyle quality. Moreover, the growing awareness about orthopedic health and the availability of surgical options, particularly through online platforms and media, is empowering patients to seek treatments earlier. Besides this, advancements in technology related to the design, materials, and manufacturing of orthopedic implants are greatly enhancing their functionality, longevity, and biocompatibility. These advancements are improving the efficacy and durability of implants, resulting in higher patient satisfaction and promoting greater acceptance of surgical procedures.

To get more information on this market, Request Sample

The United States constitutes a vital segment of the market, driven by a well-established healthcare system that enables access to cutting-edge orthopedic therapies. Modern facilities, expert professionals, and advanced technology guarantee that orthopedic implants are readily accessible, facilitating procedures for patients. Moreover, the integration of advanced technologies, such as augmented reality (AR) in orthopedic procedures, is by improving surgical accuracy and effectiveness. These advancements enhance patient results, decrease complications, and reduce expenses, while also lessening environmental effects, making them more appealing to both patients and professionals. In 2025, Pixee Medical announced the US launch of its AR surgical system, Knee+ NexSight, at the AAOS Annual Meeting. The system offers real-time navigation for total knee arthroplasty (TKA) with no need for physical disposables, reducing cost and environmental impact.

Orthopedic Implants Market Trends:

Increasing aging population

The rising geriatric population, which more prone to age-related joint issues, is a crucial factor bolstering the orthopedic implants market growth. The World Health Organization (WHO) projects that the global population aged 60 and above will reach 2.1 billion by 2050, indicating a continuous need for orthopedic solutions. As people age, bones weaken and joints deteriorate, resulting in an increased demand for medical interventions like hip, knee, and spinal implants. Older adults frequently encounter mobility challenges and persistent pain, making them suitable candidates for orthopedic procedures. With growing life expectancy, a greater number of individuals live longer with conditions that necessitate surgical intervention and assistance from implants. The need for joint replacement and bone fixation devices is increasing consistently alongside the growing elderly population. Moreover, older individuals are becoming more mindful about their health and are looking for options that enhance their quality of life and autonomy. This growing need for surgical procedures and recovery of mobility is catalyzing the demand for dependable and efficient orthopedic implants.

Rising cases of obesity

The increasing prevalence of obesity is driving the demand for orthopedic implants because of higher incidences of joint degeneration and mobility issues. According to industry reports, the count of adults experiencing obesity is projected to rise to 1.53 billion by 2035. Excess body weight puts more stress on weight-bearing joints like the knees, hips, and spine, leading to faster wear and tear. People with obesity face an increased risk of health issues, including osteoarthritis, joint deterioration, and lower back pain, leading to a necessity for implants. With the progression of these issues, the need for joint replacement surgeries involving orthopedic implants is growing. Obesity raises the risk of fractures because of inadequate bone health and problems with mobility. As obesity-related joint issues impact more individuals, the demand for personalized, long-lasting, and robust implants is rising.

Growing medical tourism activities

Rising medical tourism initiatives are offering a favorable orthopedic implants market outlook as more international patients seek affordable, high-quality orthopedic treatments. According to the IMARC Group, the worldwide medical tourism market value reached USD 144.5 Billion in 2024. Numerous individuals visit countries where orthopedic operations, including joint replacements and spinal surgeries, can be obtained at reduced prices while maintaining high quality. These nations frequently feature advanced medical facilities, proficient surgeons, and availability of contemporary orthopedic implants, rendering them appealing locations for care. Individuals from areas with lengthy wait times or costly healthcare systems opt for having surgeries overseas. With the rise of medical tourism, the need for orthopedic surgeries is growing, resulting in a greater demand for implants. Medical tourism centers housing hospitals maintain an extensive selection of implants to accommodate diverse patient needs, promoting consistent production and availability. This transnational patient flow is positively influencing the market and fostering innovations, competitive pricing, and enhanced service quality to draw international patients in search of effective orthopedic therapies.

Orthopedic Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global orthopedic implants market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, type, biomaterial, and end user.

Analysis by Product:

- Reconstructive Joint Replacements

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

- Spinal Implants

- Spinal Fusion Implants

- Vertebral Compression Fracture (VCF) Devices

- Motion Preservation Devices/Non-Fusion Devices

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Trauma

- Orthobiologics

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation Products

- Synthetic Bone Substitutes

- Others

- Others

Reconstructive joint replacements (knee replacement implants, hip replacement implants, and extremities) lead the market, as they can greatly enhance mobility and alleviate pain in individuals experiencing serious joint degeneration or injuries. These techniques, chiefly focused on rehabilitating weight-bearing joints like the hip and knee, significantly improve the quality of life of patients. The growing elderly population, which is more susceptible to joint issues, is catalyzing the demand for reconstructive joint replacements. Moreover, progress in implant materials and surgical methods is enhancing the durability, lifespan, and overall success rates of these operations. The rising use of minimally invasive techniques is lowering recovery durations and surgical complications. Furthermore, reconstructive joint replacements gain advantages from robust reimbursement policies, allowing them to be available to a broader patient population. These elements together establish reconstructive joint replacements as the leading product segment in the market.

Analysis by Type:

- Knee

- Hip

- Wrist and Shoulder

- Dental

- Spine

- Ankle

- Others

Knee represents the largest segment attributed to the high incidence of knee disorders like osteoarthritis among the elderly population. The knee joint is among the most frequently substituted joints due to its vital role in movement and overall quality of life. With the world's population getting older, the need for knee implants is increasing, propelled by the necessity for efficient solutions to ease pain and regain functionality. Furthermore, progress in implant technology, with better materials and design, is greatly improving the performance and durability of knee implants, resulting in greater reliability and effectiveness. The advancement of minimally invasive surgical methods is further contributing to the growth of the knee implant segment by shortening recovery durations and enhancing patient results. The growing knowledge about knee replacement choices, along with advantageous reimbursement policies, is positively influencing the market.

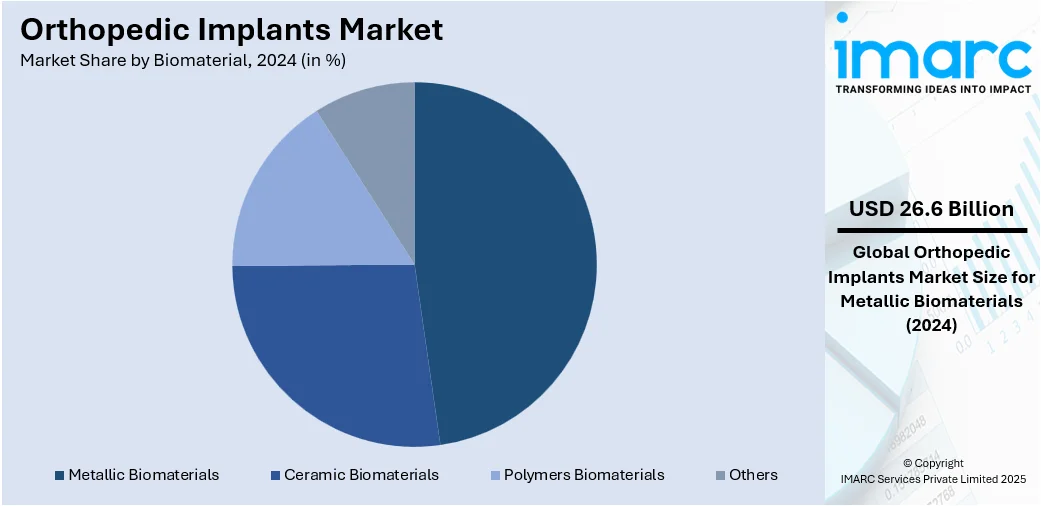

Analysis by Biomaterial:

- Metallic Biomaterials

- Stainless Steel

- Titanium alloy

- Cobalt alloy

- Others

- Ceramic Biomaterials

- Polymers Biomaterials

- Others

Metallic biomaterials (stainless steel, titanium alloy, cobalt alloy, and others) hold the biggest market share of 47.5%, because of their exceptional strength, longevity, and biocompatibility, making them ideal for load-bearing applications. These substances, mainly alloys like titanium and stainless steel, exhibit excellent resistance to corrosion and wear, guaranteeing the durability of orthopedic implants. Their mechanical characteristics are ideal for enduring stresses and strains of human motion, making them critical for joint replacements and various orthopedic surgeries. Moreover, metallic biomaterials can be readily sterilized and have proven long-term performance histories, aiding in their extensive use. Their adaptability in production methods, including casting, forging, and 3D printing, enables personalization and accuracy in implant creation, improving surgical results. Moreover, ongoing developments in metallic alloys, including enhancements in fatigue resistance and osseointegration, are supporting their market leadership, establishing them as the favored option for orthopedic applications.

Analysis by End User:

- Hospitals

- Orthopedic Clinic

- Ambulatory Surgical Centers

- Others

Hospitals are crucial segment in the market because of their extensive facilities and the existence of specialized orthopedic units. Equipped with state-of-the-art medical devices and expert personnel, hospitals provide a variety of orthopedic treatments, including joint replacements and trauma operations. Moreover, hospitals gain from solid partnerships with insurance firms, guaranteeing broader patient access.

Orthopedic clinic is becoming more popular due to their targeted emphasis on musculoskeletal disorders. This segment provides tailored care with a focus on non-invasive therapies and recovery. Its capacity to deliver customized treatment plans and the accessibility of specialized services for patients in need of focused orthopedic care make it a desirable choice.

Ambulatory surgical centers are gaining prominence in the market because of their cost-effectiveness and capacity to conduct minimally invasive procedures. These facilities provide outpatient treatments, minimizing hospitalizations and enabling patients to recover more quickly. The rising need for cost-effective, minimally invasive choices is resulting in a higher inclination towards ambulatory surgical centers.

Others include a range of unconventional environments, such as rehabilitation centers, research facilities, and home health services. These segments are growing owing to a rising need for post-surgery care, rehabilitation, and advanced treatments. The growing prevalence of home healthcare and outpatient rehabilitation programs is broadening the availability of orthopedic implant services, offering patients greater flexibility in recovery and enhancing overall results.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with 45.7%, owing to its highly developed healthcare infrastructure, which supports the integration of cutting-edge medical technologies and offers access to top-tier facilities. The area enjoys a strong regulatory framework, guaranteeing elevated levels of safety and effectiveness for orthopedic implants. A growing elderly population, along with a rising incidence of musculoskeletal conditions, is driving the need for joint replacement procedures. The area features a well-established reimbursement system, increasing accessibility of orthopedic procedures for patients. Additionally, North America hosts numerous top orthopedic implant producers, promoting ongoing innovation and bolstering market growth. In 2025, Nanochon received Health Canada approval to begin its first-in-human trial of a 3D printed orthopedic knee implant called Chondrograft. The implant aims to regenerate cartilage and reduce recovery time for patients with joint damage.

Key Regional Takeaways:

United States Orthopedic Implants Market Analysis

The orthopedic implants market in the United States is witnessing growth, accounting 87.60% market share, supported by the growing occurrence of sports injuries and a heightened preference for minimally invasive surgical techniques. Recent data indicates that around 8.6 million injuries related to sports and recreation happen each year in the United States, which is driving the need for orthopedic implants and reconstructive treatments. The rising awareness about advanced orthopedic treatment and enhanced patient results is promoting the early use of implant technologies. In addition, significant healthcare spending and the availability of advanced surgical facilities are contributing to higher need for orthopedic procedures. The growing elderly demographic, emphasizing the importance of active living, is also catalyzing the demand for implants that prioritize long-term resilience and adaptability. Moreover, incorporating digital tools in preoperative planning and postoperative monitoring boosts procedural efficiency and accelerates recovery times. Beneficial reimbursement structures and ongoing advancements in biocompatible materials are further supporting the orthopedic implants market growth. Technological convergence, including the integration of smart sensors in implants, is becoming more popular, facilitating customized treatment plans. Through sustained investments in orthopedic research and an increasing focus on patient-centered care, the United States continues to be a major force in innovation and advancement within the worldwide orthopedic implants industry.

Europe Orthopedic Implants Market Analysis

In Europe, the market for orthopedic implants is growing due to increased demand for reconstructive surgeries and the rise in musculoskeletal issues linked to lifestyle. NHS England emphasizes that more than 20 million people in the UK, close to one-third of the population, experience musculoskeletal (MSK) disorders, suggesting a significant demand for orthopedic treatments. A move towards outpatient surgical services, bolstered by improved procedural efficiency and cost management tactics, is resulting in higher adoption rates of orthopedic implant. The area is experiencing a rise in the adoption of advanced imaging and robotic-assisted technologies, enhancing the accuracy of implant placements and increasing patient trust in surgical results. Moreover, the focus on clinical results and post-surgery mobility is leading to the creation of more ergonomic and patient-friendly implant designs. The elderly population in the area is pursuing advanced joint and spinal treatments, driving the need for cutting-edge orthopedic solutions.

Asia Pacific Orthopedic Implants Market Analysis

The orthopedic implants market in the Asia Pacific region is growing because of enhanced healthcare access and the rising use of advanced surgical methods. According to the India Brand Equity Foundation (IBEF), the Indian medical technology industry is expected to attain USD 50 Billion by 2030, illustrating the area's overall progress in healthcare innovation and infrastructure enhancement. Urban development and shifts in job roles are resulting in an increase in orthopedic ailments associated with repetitive stress and mobility challenges, catalyzing the demand for implants. Patients are prioritizing quality-of-life enhancements following surgery, driving the need for advanced implant options that offer quicker recovery advantages. Local manufacturing capabilities are enhancing, allowing faster and cheaper access to orthopedic devices. Government programs and improvements in hospital facilities are boosting orthopedic treatments, while an increasing younger population with trauma injuries requires swift care, making the area a rapidly growing market for orthopedic implants.

Latin America Orthopedic Implants Market Analysis

The Latin American orthopedic implants market is growing, driven by increased awareness about musculoskeletal health and broader access to elective surgical treatments. Reports indicate that 26.1% of adults in Brazil experience chronic musculoskeletal disorders (MSKDs), substantially increasing the need for orthopedic implants throughout the area. Greater investment in local healthcare infrastructure is allowing a larger population to access orthopedic procedures, especially in urban areas. The growing emphasis on patient recovery and post-operative care is driving the need for implants that provide improved stability and mobility. Furthermore, the progressive enhancement of hospital systems and the rising number of skilled orthopedic professionals are boosting procedural results and fostering patient participation. These elements, along with evolving lifestyles and an increase in trauma-related injuries, are offering a favorable orthopedic implants market outlook.

Middle East and Africa Orthopedic Implants Market Analysis

The orthopedic implants market in the Middle East and Africa is experiencing consistent growth, bolstered by an increasing focus on specialized medical treatment and surgical innovations. A report indicates that Saudi Arabia's healthcare system is experiencing significant privatization under Vision 2030, with more than 290 hospitals and 2,300 health facilities moving to private management. By 2030, participation from the private sector is anticipated to increase from 25% to 35%, generating new capital inflows and enhancing operational efficiency. This change is expected to improve access to contemporary orthopedic services and treatments involving implants. Health awareness, enhanced diagnostic technologies, medical travel, and funding for advanced healthcare facilities are promoting early interventions, increasing implant use, and improving treatment accessibility and patient engagement.

Competitive Landscape:

Major companies in the industry are concentrating on broadening their product ranges by dedicating resources to research and development (R&D) to improve implant materials and designs. They are progressively utilizing advanced technologies like 3D printing and robotics to enhance the accuracy and results of surgical procedures. For example, in 2024, Sparsh Hospitals launched an on-site 3D printing lab in India to advance orthopedic and personalized medical care. The facility provided custom implants, prosthetics, and anatomical models, enabling surgeons to plan orthopedic surgeries with greater precision. Besides this, leading companies are establishing strategic alliances and collaborations with healthcare providers to enhance their market position. Moreover, they are concentrating on broadening their presence in developing markets by providing cost-effective, top-notch implants. As per the orthopedic implants market forecast, there is a continued emphasis on regulatory compliance and improving post-surgery recovery processes, which is expected to facilitate the development of innovative implants with enhanced durability and biocompatibility.

The report provides a comprehensive analysis of the competitive landscape in the orthopedic implants market with detailed profiles of all major companies, including:

- Arthrex Inc.

- Auxein

- B. Braun SE

- CONMED Corporation

- Enovis Corporation

- Exactech, Inc.

- Globus Medical

- Medical Devices Business Services, Inc. (Johnson & Johnson)

- Narang Medical Limited

- Smith & Nephew plc

- Stryker Corporation

- The Orthopaedic Implant Company

- United Orthopedic Corporation

Latest News and Developments:

- May 2025: Croom Medical launched the TALOS platform for 3D printing tantalum implants using laser-powder-bed fusion. Developed with Global Advanced Metals, TALOS enables precise control of implant properties, high porosity, and titanium-tantalum hybrid printing. It supported sustainability via closed-loop tantalum recycling and expanded use in medical, energy, and industrial applications.

- May 2025: Durham-based restor3d raised $38M to accelerate its 3D-printed orthopedic implant innovations. The capital supported the launch of four products, including personalized knee, hip, shoulder, and ankle systems. With FDA clearances and AI-driven design, the firm aims to scale personalized care and approach profitability while expanding its market share.

- April 2025: MicroPort Orthopedics launched its Evolution® Medial-Pivot Knee in India, offering superior flexion stability and anatomical motion. With over 1 million global cases and 98.8% survivorship in 17 years, the design replicated natural knee movement. The company also provided surgical training via its Joint Academy platform across Indian cities.

- January 2025: Group FH ORTHO launched the JARVIS round baseplate for reverse shoulder prostheses in the U.S., following FDA approval in late 2024. Designed for glenoid reconstruction, it offers multiple lateralisation and distalization options, adaptive glenospheres, and compatibility with existing humeral stems. The system enhanced surgical precision and patient fit.

Orthopedic Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered | Knee, Hip, Wrist and Shoulder, Dental, Spine, Ankle, Others |

| Biomaterials Covered |

|

| End Users Covered | Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arthrex Inc., Auxein, B. Braun SE, CONMED Corporation, Enovis Corporation, Exactech, Inc., Globus Medical, Medical Devices Business Services, Inc. (Johnson & Johnson), Narang Medical Limited, Smith & Nephew plc, Stryker Corporation, The Orthopaedic Implant Company, United Orthopedic Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the orthopedic implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global orthopedic implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the orthopedic implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The orthopedic implants market was valued at USD 55.90 Billion in 2024.

The orthopedic implants market is projected to exhibit a CAGR of 4.14% during 2025-2033, reaching a value of USD 80.80 Billion by 2033.

The orthopedic implants market is driven by an aging population, the growing incidences of musculoskeletal disorders, and advances in implant materials and technology. Increased awareness about minimally invasive procedures, improved healthcare infrastructure, and rising demand for joint replacement surgeries further contribute to the market growth. Additionally, the growing healthcare expenditure and favorable reimbursement policies are positively influencing the market.

North America currently dominates the orthopedic implants market, holding a share of 45.7%, owing to its advanced healthcare infrastructure, strong medical device industry, and high adoption of cutting-edge technologies. A well-established reimbursement system, coupled with a growing elderly population and increasing awareness about orthopedic treatments, further support the market dominance in the region.

Some of the major players in the orthopedic implants market include Arthrex Inc., Auxein, B. Braun SE, CONMED Corporation, Enovis Corporation, Exactech, Inc., Globus Medical, Medical Devices Business Services, Inc. (Johnson & Johnson), Narang Medical Limited, Smith & Nephew plc, Stryker Corporation, The Orthopaedic Implant Company, United Orthopedic Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)