United States Industrial Gases Market Expected to Reach USD 40.8 Billion by 2033 - IMARC Group

United States Industrial Gases Market Statistics, Outlook and Regional Analysis 2025-2033

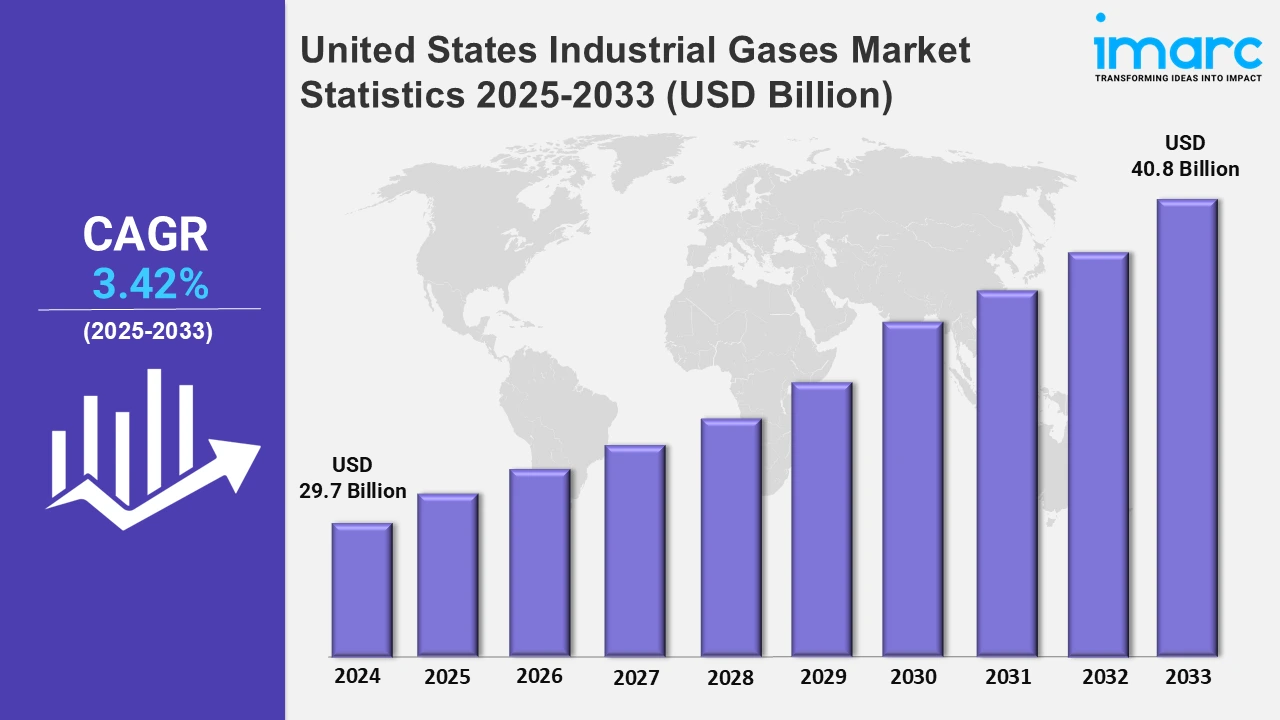

The United States industrial gases market size was valued at USD 29.7 Billion in 2024, and it is expected to reach USD 40.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% from 2025 to 2033.

To get more information on this market, Request Sample

The growing requirement for high-purity industrial gases is driving considerable expenditures in the manufacturing of semiconductors. Expansion efforts are centered on improving supply chains and infrastructure to enable advanced chip production, as well as assuring a consistent and efficient supply of critical gases to fuel the industry's fast technical breakthroughs. For example, in June 2024, Air Liquide secured a major agreement to bolster the US semiconductor industry with an investment exceeding USD 250 Million. This funding is directed toward strengthening the availability of key industrial gases necessary for semiconductor production.

Moreover, a rising focus on low-carbon solutions is fueling demand for clean hydrogen and nitrogen in industrial applications. Expanding partnerships are strengthening the supply chain for sustainable chemical manufacturing, assisting with the shift to environmentally friendly processes, and improving the infrastructure for large-scale blue ammonia and hydrogen-based energy projects. For instance, in February 2024, OCI and Linde formed a partnership wherein Linde supplies clean hydrogen and nitrogen to OCI’s blue ammonia facility, that is under-development in Beaumont, Texas. Furthermore, the United States industrial gases market is rapidly expanding, driven by rising demand from industries such as healthcare, industry, and renewable energy. Companies are prioritizing investments in cutting-edge technologies such as hydrogen generation, carbon capture, and AI-powered process optimization to improve efficiency and sustainability. The move to green hydrogen and low-carbon solutions is accelerating market growth, in compliance with federal decarbonization plans. For example, Air Products and Chemicals, Inc., an industry leader, has been acknowledged for its outstanding performance and institutional support. The company's stock hit an all-time high in December and is on track to achieve another high, demonstrating its strong market position. It specializes in industrial and specialized gases, with a strong emphasis on the renewable energy sector. Analysts estimate that the company's revenue will rise, citing strategic investments and global development activities. These advances highlight the industry's fast growth, which is driven by technological breakthroughs, favorable market circumstances, and a dedication to sustainability.

United States Industrial Gases Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. Advancements in technology for producing, storing, and distributing industrial gases in various regions of the US are significantly driving the growth of the market.

Northeast Industrial Gases Market Trends:

Healthcare and biotechnology are the driving forces behind the industrial gases industry in the Northeast. Praxair, currently a part of Linde, provides oxygen, nitrogen, and other gases to healthcare institutions around the region. In Massachusetts, biotech hubs like Cambridge rely on gases for laboratory and pharmaceutical manufacturing processes. Furthermore, the region's hospitals and medical research facilities rely substantially on nitrogen for cryopreservation and oxygen for patient care, resulting in a continual high demand for industrial gases.

Midwest Industrial Gases Market Trends:

The automotive and steel manufacturing sectors influence the market in the Midwest. For example, Air Products supplies gases to major automotive manufacturers and steel mills in cities like Detroit and Pittsburgh. The steel sector, notably in Ohio and Pennsylvania, employs oxygen in blast furnaces, but nitrogen is essential in vehicle manufacturing for components and welding. With the growing need for greener technologies, hydrogen is experiencing an increase in steel manufacturing, particularly in decarbonization programs.

South Industrial Gases Market Trends:

The petrochemical and energy sectors in the South, particularly along the Gulf Coast, are important sources of industrial gases. Linde has extensive operations in Texas and Louisiana that deliver hydrogen, oxygen, and carbon dioxide to refineries and chemical plants. The region is a natural gas processing hub, with gases such as hydrogen utilized in refining and carbon dioxide used in improved oil recovery programs. Moreover, advances in carbon capture technology are on the rise, fueled by government incentives and environmental aims.

West Industrial Gases Market Trends:

The electronics and clean energy industries are critical to the industrial gases industry in the West. California, notably Silicon Valley, depends on gases such as nitrogen, argon, and helium for semiconductor production. Companies such as Air Liquide offer critical gases to these high-tech sectors. Furthermore, the region is at the forefront of the clean energy transition, with rising demand for hydrogen for fuel cells and storage solutions, particularly as California pushes for renewable energy adoption and hydrogen infrastructure development.

Top Companies Leading in the United States Industrial Gases Industry

Some of the leading United States industrial gases market companies have been mentioned in the report. Major key players are focusing on strategic business growth to support market requirements. For example, in May 2024, Linde expanded its La Porte facility's capacity, doubling output to meet growing industrial gas demand across the US Gulf Coast, bolstering supply to manufacturing, healthcare, and energy industries.

United States Industrial Gases Market Segmentation Coverage

- Based on the type, the market has been segmented into nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others, wherein nitrogen represents the most preferred segment. Nitrogen is primarily used in ammonia production, food preservation, chemical manufacturing, and electronics industries.

- Based on the application, the market is categorized into manufacturing, metallurgy, energy, chemicals, healthcare, and others, amongst which manufacturing dominates the market. This is because the most common industrial gases, such as oxygen, nitrogen, and argon, are widely employed in manufacturing industries.

- Based on the supply mode, the market has been divided into packaged, bulk, and on-site. Among these, packaged exhibits a clear dominance in the market due to its large infrastructure, diverse product portfolio, and strategic market positioning.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 29.7 Billion |

| Market Forecast in 2033 | USD 40.8 Billion |

| Market Growth Rate 2025-2033 | 3.42% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Industrial Gases Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)