West Africa Alcoholic Beverages Market Report by Product Type (Beer, Spirits, Wine, and Others), Packaging Type (Glass Bottles, Tins, Plastic Bottles, and Others), Distribution Channel (Open Markets, Supermarkets/Hypermarkets, Hotels/Restaurants/Bars, Specialty Stores, and Others), and Region 2025-2033

Market Overview:

The West Africa alcoholic beverages market size reached USD 13.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The rising consumption of alcoholic beverages among the masses, the rising popularity of socializing among individuals, and the introduction of mixed and flavored alcoholic beverages represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.9 Billion |

| Market Forecast in 2033 | USD 22.9 Billion |

| Market Growth Rate 2025-2033 | 5.42% |

The Rising Middle-Class Population is Augmenting the Market Growth

Africa, the second-largest continent in the world, is emerging as one of the fastest-growing economies globally. The region's economy has been on an upward trajectory, with several West African countries exhibiting impressive annual GDP growth rates. This growth rate is much higher than that of many other developing countries worldwide. As a result, the middle-class population in the region is growing, with consumers having more disposable income levels. Thus, increasing purchasing power causes a shift in spending patterns, with media and other influencing factors playing a significant role in shaping consumer behavior. As consumers in the region continue to enjoy higher levels of disposable income, their preferences have shifted towards non-essential and recreational products. This trend is benefiting the overall alcoholic beverages industry and can be attributed to the rising demand for leisure and recreational activities among the middle-class population in West Africa.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is concentrated with only three major players operating in the market due to a moderate growth rate. The volume of new entrants is moderate in the West Africa alcoholic beverages industry due to high brand development and marketing cost.

What are Alcoholic Beverages?

Alcoholic beverages are a type of drink that contains ethyl alcohol, also known as ethanol, as the main active ingredient. They are manufactured through a process called fermentation, in which yeast or bacteria convert sugars into alcohol and carbon dioxide. The level of alcohol in the drink may vary depending on the type of beverage and the fermentation process used. Additionally, they are consumed globally for a variety of reasons, including socializing, celebration, relaxation, and as a way to enhance the flavor of food. One of the most consumed alcoholic beverages includes beer and wine, which is a type of fermented drink prepared from barley, wheat, or rye. It generally has a lower alcohol content compared to other alcoholic beverages and comes in a wide range of flavors and styles. Another type of alcoholic beverage is wine, which is produced from fermented grapes and can have a variety of flavors and alcohol levels, depending on the type of grape and fermentation process used. On the other hand vodka, whiskey, gin, and rum, are distilled alcoholic beverages that have a much higher alcohol content.

COVID-19 Impact:

The COVID-19 pandemic had a significant impact on the alcoholic beverages industry in West Africa. With the implementation of lockdowns and social distancing measures across the region, there has been a temporary closure of bars, nightclubs, and other social venues, leading to a sharp decline in the consumption of alcoholic beverages. This decline in demand led to a significant reduction in sales for many companies operating in the alcoholic beverages industry. The COVID-19 pandemic also affected the production and distribution of alcoholic beverages in West Africa due to the closure of borders and restrictions on the movement of goods, which makes it difficult for companies to access raw materials and transport their products to their intended destinations. As a result, many companies had to scale back their production or temporarily shut down their operations.

West Africa Alcoholic Beverages Market Trends:

The increasing consumption of alcoholic beverages among the masses majorly drives the market in West Africa. This can be supported by the growing demand for certain types of alcoholic beverages, such as craft beer, premium wine, and high-end spirits, due to the changing consumer preferences for unique and high-quality products. In addition, the rising popularity of socializing and attending mid-week and weekend parties among young adults and working professionals is positively influencing the market. With the shifting trend towards urbanization is resulting in the introduction of premium beverages that are associated with sophistication, is providing a boost to the sales of alcoholic beverages across the region. In addition, the growing preference for experimenting with a range of flavored alcohols and mixed beverages is also driving the market. Furthermore, continual technological advancements, such as the emergence of automation, data analytics, and e-commerce, are creating a positive market outlook for leading companies to determine the market trend and enhance production and distribution efficiency, are significantly supporting the demand. Some of the other factors driving the market include rapid urbanization and inflating disposable income levels of the masses.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the West Africa alcoholic beverages market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type, packaging type and distribution channel.

Product Type Insights:

- Beer

- Spirits

- Wine

- Others

The report has provided a detailed breakup and analysis of the West Africa alcoholic beverages market based on the product type. This includes beer, spirits, wine, and others. According to the report, beer represented the largest segment due to the changing consumer preferences. As consumers become more health conscious, they are opting for low or no-alcohol beer options, which is acting as another growth-inducing factor. Additionally, craft beer is emerging as a significant trend among the masses due to its unique and authentic flavors. Another driver is the increasing demand for premium beer options. As disposable incomes rise, consumers are willing to spend more on high-quality beers. This trend has also led to an increase in the popularity of imported beer options, as consumers prefer exotic tastes from different parts of the world.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

A detailed breakup and analysis of the West Africa alcoholic beverages market based on the packaging type has also been provided in the report. This includes glass bottles, tins, plastic bottles, and others. According to the report, glass bottles accounted for the largest market share due to the growing trend toward premiumization in the alcoholic beverages industry. Consumers are willing to pay more for high-quality, premium products, and glass bottles help to convey this premium image, which is driving the demand. Moreover, an enhanced focus on sustainability is positively influencing the glass bottles segment.

Distribution Channel Insights:

- Open Markets

- Supermarkets/Hypermarkets

- Hotels/Restaurants/Bars

- Specialty Stores

- Others

The report has provided a detailed breakup and analysis of the West Africa alcoholic beverages market based on the distribution channel. This includes open markets, supermarkets/hypermarkets, hotels/restaurants/bars, specialty stores, and others. According to the report, open markets represented the largest segment due to the easy availably of premium and craft beverages via open markets. Along with this, the emergence of small, independent producers who offer unique and innovative products that cater to the demand for craft beverages. Moreover, the growth of e-commerce and online sales platforms, have made it easier for consumers to access and purchase alcoholic beverages, propelling the market.

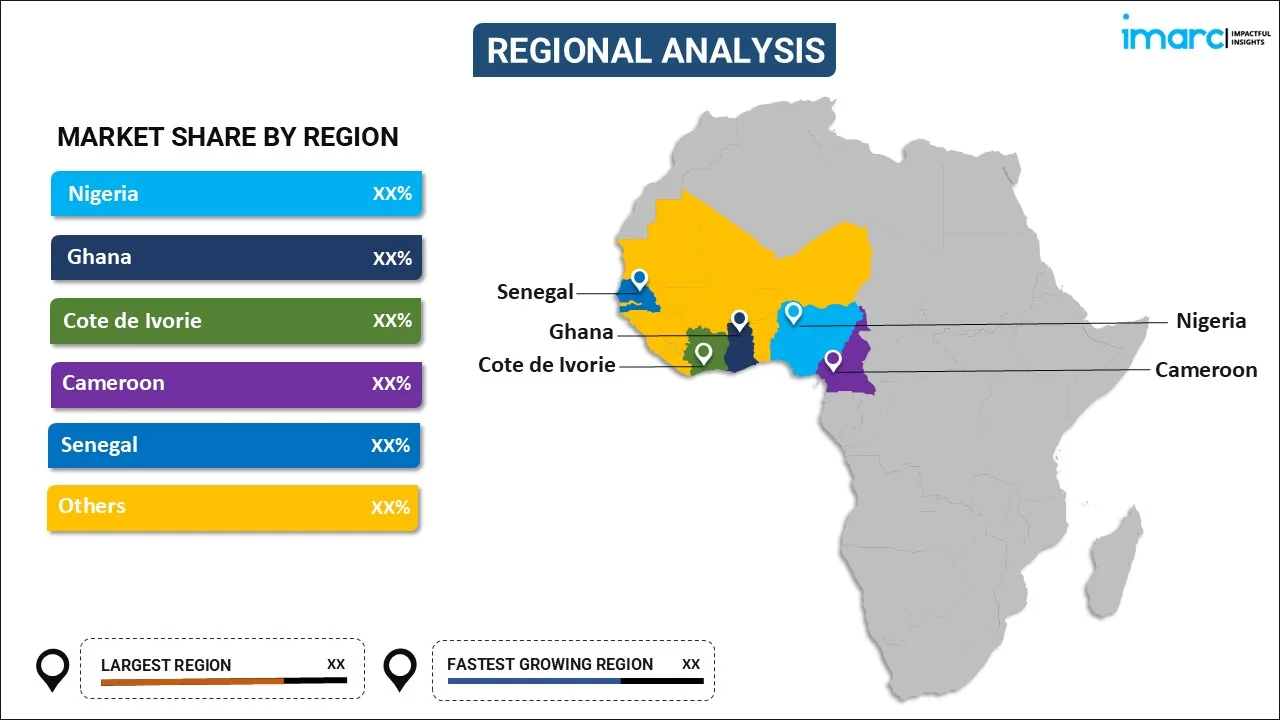

Regional Insights:

- Nigeria

- Ghana

- Cote de Ivorie

- Cameroon

- Senegal

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, and Others.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the West Africa alcoholic beverages market. Some of the companies covered in the report include:

- Diageo Plc

- Heineken International B.V.

- Anheuser-Busch InBev

- Castel Group

- Kasapreko Company Ltd

- Tambour Original

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Hectoliters |

| Segment Coverage | Product Type, Packaging Type, Distribution Channel, Country |

| Countries Covered | Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, Others |

| Companies Covered | Diageo Plc, Heineken International B.V., Anheuser-Busch InBev, Castel Group, Kasapreko Company Ltd, and Tambour Original |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the West Africa alcoholic beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the West Africa alcoholic beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the West Africa alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The West Africa alcoholic beverages market was valued at USD 13.9 Billion in 2024.

We expect the West Africa alcoholic beverages market to exhibit a CAGR of 5.42% during 2025-2033.

The elevating levels of globalization, growing trend of socializing, and increasing number of breweries and wineries, are primarily driving the West Africa alcoholic beverages market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of alcoholic beverages across the region.

Based on the product type, the West Africa alcoholic beverages market can be segmented into beer, spirits, wine, and others. Currently, beer holds the majority of the total market share.

Based on the packaging type, the West Africa alcoholic beverages market has been segregated into glass bottles, tins, plastic bottles, and others. Among these, glass bottles currently exhibit a clear dominance in the market.

Based on the distribution channel, the West Africa alcoholic beverages market can be categorized into open markets, supermarkets/hypermarkets, hotels/ restaurants/bars, specialty stores, and others. Currently, open markets account for the largest market share.

On a regional level, the market has been classified into Nigeria, Ghana, Cote de Ivorie, Cameroon, Senegal, and others.

Some of the major players in the West Africa alcoholic beverages market include Diageo Plc, Heineken International B.V., Anheuser-Busch InBev, Castel Group, Kasapreko Company Ltd, and Tambour Original.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)