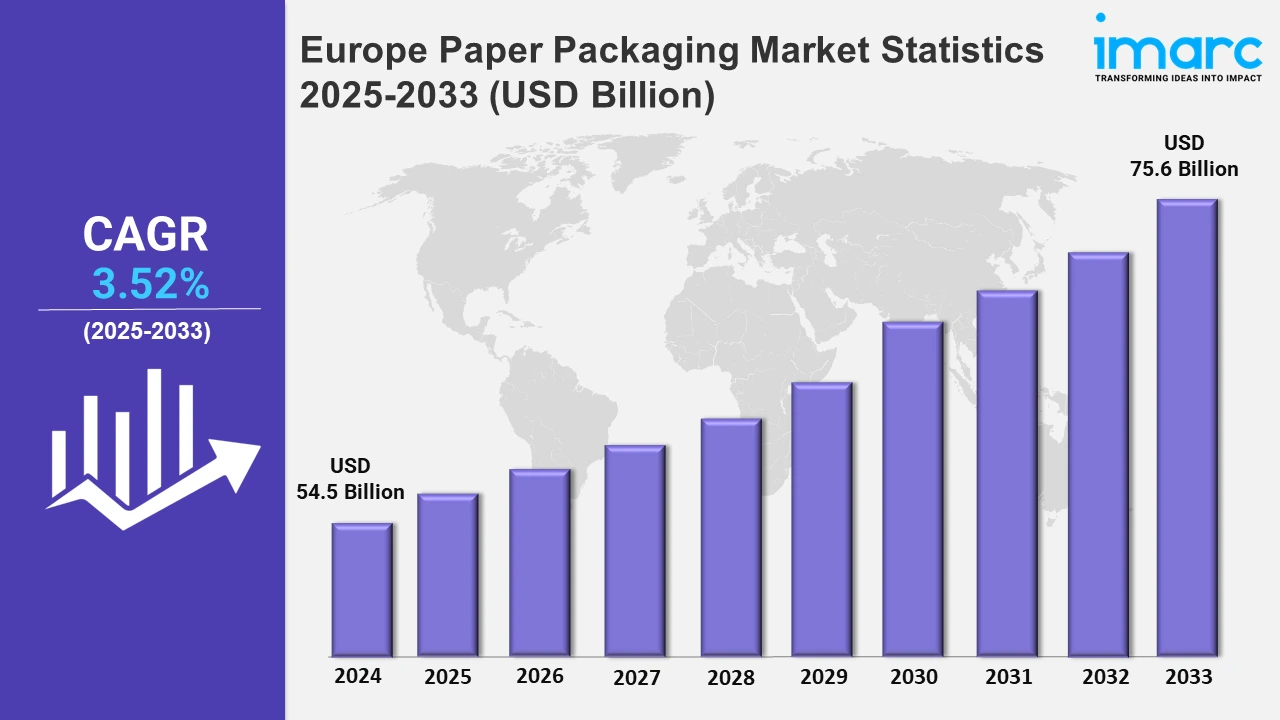

Europe Paper Packaging Market Expected to Reach USD 75.6 Billion by 2033 - IMARC Group

Europe Paper Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

The Europe paper packaging market size was valued at USD 54.5 Billion in 2024, and it is expected to reach USD 75.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.52% from 2025 to 2033.

To get more information on this market, Request Sample

The widespread focus on sustainability and regulatory compliance impels rising advancements in the paper packaging industries in Europe. Companies are facing pressure to adopt creative solutions that meet functional and environmental requirements as consumers are extensively focusing on eco-friendly alternatives. Besides this, the growing awareness towards plastic's negative environmental consequences is encouraging firms to spend money on research and development activities to introduce high-performing and environmentally friendly packaging options, thereby driving up demand for renewable packaging solutions. Aligned with this trend, Parkside presented its Recoflex line of paper-based, recyclable, and flexible packaging solutions in April 2024, a significant milestone in the development of sustainable packaging solutions. This range includes freezer-proof paper, translucent barrier paper for food applications, and flow-wrap solutions designed for ambient products. Recoflex demonstrates how advanced barrier properties can align with sustainability goals without compromising on functionality.

In accordance with this, All4Labels unveiled STARPACK in November 2024, an FSC-certified and renewable paper bundling container that uses 80% usage of plastic packaging. This solution, which targets sectors including F&B and healthcare, underscores the rising demand for replacements that provide performance coupled with environmental friendliness. Notably, STARPACK earned the Liderpack Award, reflecting its innovative approach and alignment with market trends. Overall, in the paper packaging industries in Europe, several factors contribute to the market growth. Businesses are creating paper-based solutions to fulfill the various requirements of sectors like retail, healthcare, F&B, etc. Further, innovations that promote sustainability targets are being driven by the shift toward packaging that is recyclable and lightweight.

Europe Paper Packaging Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which Germany, France, the United Kingdom, Italy, Spain, and others. According to the report, Germany is leading the majority of the market share, driven by robust environmental regulations, cutting-edge manufacturing infrastructure, sustainability adherence, etc.

Germany Paper Packaging Market Trends:

Germany is leading the overall market due to its highly qualified workforce and substantial expenditures in innovations and research. Along with this, its environmentally friendly packaging solutions control a large portion of the market. Germany further solidified its position with projects like Mondi's FlexStudios, which started in November 2024. This 2,300 m² facility, which includes testing labs, pilot lines, and collaborative areas to spur creativity, acts as a center for the development of sustainable and flexible packaging in the country. Additionally, the elevating adoption of green technologies and the rising focus on reducing waste confirm its continued leadership in this sector.

France Paper Packaging Market Trends:

Industry players across France emphasize premium and luxury paper packaging, driven by its strong cosmetics and wine industries. The nation prioritizes eco-friendly solutions, such as biodegradable and recyclable paper materials, aligning with strict EU regulations. For instance, the usage of FSC-certified paper packaging for L'Oréal's goods showcases France's innovative approach. Moreover, strong market growth is ensured by the country's emphasis on sustainability and superior aesthetics, especially in areas like gastronomy and beauty.

United Kingdom Paper Packaging Market Trends:

The United Kingdom is advancing in corrugated paper packaging, favored for the e-commerce and retail sectors. Leading companies like DS Smith innovate with lightweight yet durable materials to reduce carbon footprints. The UK’s emphasis on circular economy principles, including government policies supporting recycling, propels the market growth. For example, Amazon’s shift to paper-based mailers in the United Kingdom exemplifies the market’s transition toward sustainable and consumer-friendly packaging solutions.

Italy Paper Packaging Market Trends:

Italy is renowned for its artistic paper packaging, driven by its fashion and food industries. The country focuses on using recycled materials for creative and functional designs. Ferrero Rocher, for instance, uses paper-based trays in accordance with environmentally friendly standards. Furthermore, Italy is a pioneer in paper packaging for luxury and premium markets because of its long history of design and craftsmanship combined with sustainability.

Spain Paper Packaging Market Trends:

Spain's paper packaging market thrives on innovations for the agricultural sector, with a focus on fresh produce packaging. The country adopts compostable paper trays to support its extensive fruit export market. For example, companies in Valencia use recyclable paper cartons for citrus fruits. Spain’s commitment to minimizing plastic use in agriculture positions it as a key player in environmentally friendly packaging solutions for food.

Other Countries Paper Packaging Market Trends:

In other countries such as Sweden, Denmark, Norway, etc., the market focuses on renewable materials from sustainably managed forests. Concurrently, companies like BillerudKorsnas lead with innovative solutions, including paper-based alternatives to plastic in food packaging. Governments support sustainable forestry, enhancing paper production. For example, Swedish companies lead the region in environmentally responsible practices by using recyclable paper cartons for dairy goods, which promotes the expansion of paper packaging in Northern Europe.

Top Companies Leading in the Europe Paper Packaging Industry

Key companies in the Europe paper packaging sector are prioritizing innovation and eco-friendly practices. As such, the adoption of automation in manufacturing is boosting efficiency and reducing costs, enabling these companies to remain competitive in pricing. In February 2024, Smurfit Kappa invested €54 Million to expand its Bag-in-Box facility in Ibi, Spain. The upgrade included advanced equipment to boost production, supporting rising demand for sustainable packaging with features like reduced plastic use and extended shelf life for products.

Europe Paper Packaging Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others, wherein folding boxes and cases represent the most preferred segment. This segment capitalizes on improvements in packaging technology that increase the strength and durability of folding boxes, thereby making them versatile for packaging various items.

- Based on the grade, the market is categorized into solid bleached, coated recycled, uncoated recycled, and others. Currently, uncoated recycled exhibits a clear dominance in the market. Uncoated recycled paper in packaging is eco-friendly, offering durability and versatility and it is majorly used for boxes, bags, wrapping, etc., to reduce environmental impact.

- On the basis of the packaging level, the market has been divided into primary packaging, secondary packaging, and tertiary packaging. Among these, primary packaging exhibits a clear dominance in the market. Primary paper packaging protects products directly, ensuring safety and freshness. It is commonly used for food, beverages, and personal care items, emphasizing sustainability and convenience.

- Based on the end use industry, the market is bifurcated into food, beverages, personal care and home care, healthcare, and others, wherein food dominates the market. Paper-based food packaging is designed for safety and freshness, thereby incorporating grease-resistant coatings and recyclability.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 54.5 Billion |

| Market Forecast in 2033 | USD 75.6 Billion |

| Market Growth Rate 2025-2033 | 3.52% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End Use Industries Covered | Food, Beverages, Personal Care and Home Care, Healthcare, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Paper Packaging Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)