India Pulses Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2026-2034

India Pulses Market Summary:

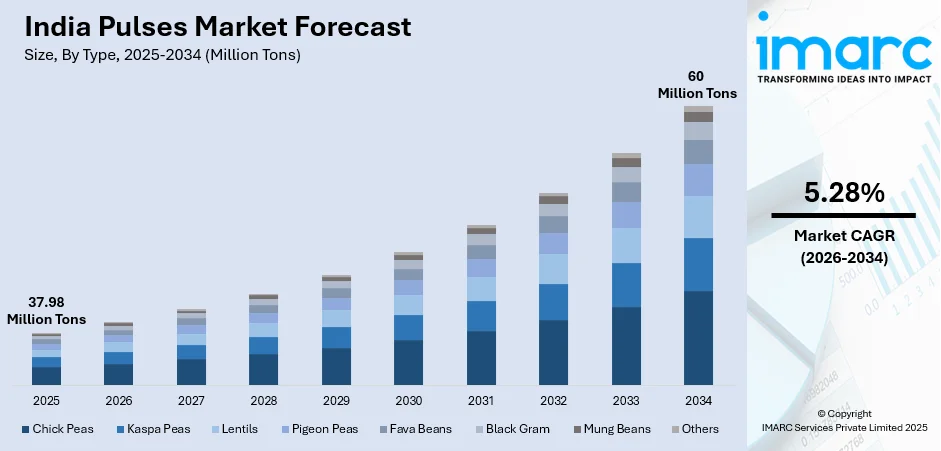

The India pulses market size reached 37.98 Million Tons in 2025 and is projected to reach 60 Million Tons by 2034, growing at a compound annual growth rate of 5.28% from 2026-2034.

The country's sizable vegetarian population, which mostly depends on pulses as a source of protein, is the main reason why the Indian pulses industry is expanding. Demand for nutrient-rich legumes that provide dietary fiber, minerals, and vital amino acids is rising as consumers become more health conscious. Market prospects are broadening across a variety of consumer groups due to the growing uses in food processing and ready-to-eat (RTE) product compositions.

Key Takeaways and Insights:

-

By Type: Lentils dominate the market with a share of 26% in 2025, owing to widespread culinary applications across Indian households, nutritional superiority as a complete protein source, and strong government support through enhanced procurement mechanisms driving cultivation expansion.

-

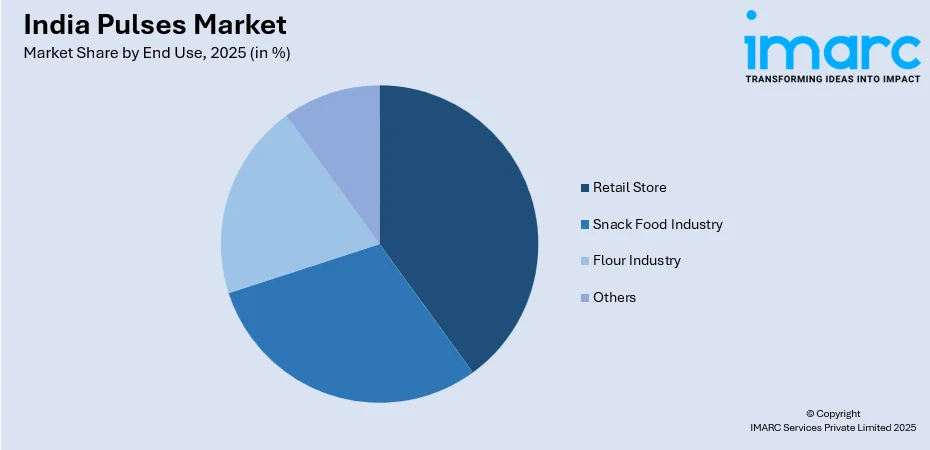

By End Use: Retail store leads the market with a share of 39% in 2025. This dominance is driven by extensive distribution networks reaching urban and rural consumers, consumer preference for quality-assured packaged pulses, and organized retail expansion strengthening accessibility.

-

By Region: North India represents the largest region with 29% share in 2025, driven by favorable agro-climatic conditions supporting diverse pulse cultivation, strong agricultural infrastructure, and concentration of major pulse-producing states contributing significantly to national output.

-

Key Players: Key players drive the India pulses market by expanding product portfolios, investing in processing infrastructure, and strengthening supply chain networks. Their focus on quality assurance, traceability systems, and diverse packaging formats enhances market penetration while partnerships with agricultural cooperatives ensure consistent sourcing across diverse pulse varieties.

To get more information on this market Request Sample

The India pulses market represents a cornerstone of the nation's agricultural economy and food security framework, serving as the primary protein source for millions of vegetarian households. The market demonstrates robust fundamentals supported by consistent domestic demand, expanding food processing applications, and favorable government policies aimed at achieving production self-sufficiency. According to the Ministry of Consumer Affairs, India was poised to be the largest global producer of lentils (masoor) in the 2023-24 crop year due to increased acreage. The nation's lentil output was projected to reach a record 1.6 Million Tons in the 2023-24 rabi season due to rising acreage, reflecting successful cultivation expansion initiatives. The integration of pulses into modern retail formats, RTE products, and plant-based protein formulations is creating diversified growth avenues. Strategic procurement mechanisms, enhanced minimum support price (MSP), and investment in processing infrastructure are collectively strengthening the value chain from farm to consumer, ensuring sustained market expansion throughout the forecast period.

India Pulses Market Trends:

Rising Preference for Organic and Premium Pulses

In India, the growing consumer awareness regarding food adulteration and chemical residues is driving the demand for organic, preservative-free pulse variants across urban markets. Health-conscious consumers are increasingly seeking certified organic pulses that guarantee purity and nutritional integrity. This shift is encouraging farmers and processors to adopt organic cultivation practices and obtain relevant certifications, creating a premium segment that commands higher price realization and fosters sustainable agricultural practices across the country.

Integration into Plant-Based Protein Products

Pulses are gaining prominence as key ingredients in plant-based protein formulations targeting health-conscious and wellness-oriented consumers. As per IMARC Group, the India health and wellness market size reached USD 156.0 Billion in 2024. Food manufacturers are leveraging pulse-derived proteins in developing meat alternatives, protein-enriched snacks, and functional food products. This trend aligns with growing vegan and flexitarian dietary preferences, positioning pulses as versatile ingredients capable of meeting evolving nutritional demands while supporting sustainable food production systems.

Expansion of Value-Added Processing Capabilities

The market is witnessing significant investments in pulse processing infrastructure, including cleaning, grading, and packaging facilities. Value-added products, such as ready-to-cook dal mixes, pulse-based flours, and instant meal preparations, are expanding market opportunities beyond traditional consumption patterns. Processing modernization enhances product shelf life, reduces wastage, and enables manufacturers to capture higher margins while meeting urban consumer convenience expectations. Additionally, improved processing capacity strengthens supply chain efficiency and supports consistent quality for domestic and export markets. As per customs data, India shipped 729 Thousand Metric Tons of pulses from January to December 2024, exceeding the 688 Thousand Metric Tons exported in the same timeframe in 2023.

Market Outlook 2026-2034:

The India pulses market outlook remains positive, supported by structural demand drivers and strategic policy interventions targeting production self-sufficiency. Growing population, rising disposable incomes, and increasing health awareness are expected to sustain robust consumption growth. The market size was estimated at 37.98 Million Tons in 2025 and is expected to reach 60 Million Tons by 2034, reflecting a compound annual growth rate of 5.28% over the forecast period 2026-2034. Government initiatives focusing on area expansion, productivity enhancement, and processing infrastructure development will strengthen supply-side fundamentals, supporting sustainable market growth.

India Pulses Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Lentils |

26% |

|

End Use |

Retail Store |

39% |

|

Region |

North India |

29% |

Type Insights:

- Chick Peas

- Kaspa Peas

- Lentils

- Pigeon Peas

- Fava Beans

- Black Gram

- Mung Beans

- Others

Lentils dominate with a market share of 26% of the total India pulses market in 2025.

Lentils represent the most widely consumed pulse variety across Indian households, valued for their quick cooking properties, versatile culinary applications, and superior nutritional profile. The segment benefits from strong cultural integration into daily dietary patterns, with lentil-based dishes forming staple meals across diverse regional cuisines. The government raised the MSP for lentils to INR 6,425 per quintal for the Rabi Marketing Season 2024-25, incentivizing farmers to expand cultivation and boosting domestic production capabilities.

In addition, lentils play a critical role in vegetarian protein intake, making them a preferred choice amid rising health awareness. Growing demand from urban consumers for processed and packaged lentil products is further strengthening the segment. Improved seed varieties and agronomic practices are enhancing yield stability, while government procurement and buffer stocking programs support price stability. Together, these factors reinforce lentils’ dominant position in the India pulses market by ensuring consistent supply, affordability, and sustained consumer preference across income groups.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Retail Store

- Snack Food Industry

- Flour Industry

- Others

Retail store leads with a share of 39% of the total India pulses market in 2025.

Retail store serves as the primary distribution channel for pulses, offering consumers direct access to diverse varieties through established shopping formats. The segment encompasses modern trade outlets, supermarkets, and traditional grocery stores that collectively ensure nationwide product availability. As per IBEF, India's retail industry is set to surpass INR 1,37,10,400 Crore (USD 1.6 Trillion) by 2030 from INR 81,57,859 Crore (USD 952 Billion) for the year 2024, creating enhanced distribution infrastructure for packaged pulse products.

Consumer preference for quality-assured, branded pulses is accelerating the shift towards organized retail formats that offer product traceability and consistent quality standards. Retailers are investing in dedicated pulse sections featuring premium, organic, and specialty varieties to capture evolving consumer preferences. Growing penetration of private-label pulse brands is intensifying competition and improving price affordability for consumers. Additionally, integration of digital billing, inventory management, and loyalty programs is enhancing retail efficiency and customer engagement.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India pulses market in 2025.

North India leads the pulses market owing to favorable agro-climatic conditions, extensive agricultural infrastructure, and concentration of major pulse-producing states, including Madhya Pradesh, Uttar Pradesh, and Rajasthan. The region benefits from established irrigation systems, strong agricultural extension services, and proximity to major consumption centers. As per Annual Report 2023-2024, Uttar Pradesh, with 10% output, was among the top five pulse-producing states, demonstrating the region's dominant position in pulse cultivation.

The region's large vegetarian population creates sustained domestic demand, while well-developed processing and distribution networks facilitate efficient market access. Government initiatives targeting pulse production enhancement have achieved significant success in northern states through improved seed variety distribution, farmer training programs, and enhanced procurement mechanisms. These structural advantages position North India as the primary contributor to national pulse supply and consumption.

Market Dynamics:

Growth Drivers:

Why is the India Pulses Market Growing?

Rising Population and Growing Protein Demand

India’s rapidly growing population and increasing demand for affordable plant-based protein are major drivers of the pulses market. As per macrotrends, India's total population in 2024 stood at 1,441,719,852, reflecting a 0.25% rise from 2023. Pulses form a staple component of Indian diets, particularly for vegetarian and low-income households, providing essential proteins, minerals, and micronutrients. With rising health awareness, consumers are increasingly recognizing pulses as nutritious, cholesterol-free, and sustainable protein sources. Urbanization and changing dietary habits are also encouraging higher per capita consumption of pulses through ready-to-cook and processed food formats. Government nutrition programs, including mid-day meals and public distribution schemes, further support steady demand. As income levels rise, consumers are diversifying pulse consumption beyond traditional varieties, boosting overall market volumes. The combination of demographic growth, dietary preferences, and nutritional awareness ensures consistent baseline demand. This structural consumption strength continues to drive production, trade, and investment across the India pulses market, supporting long-term growth and market stability nationwide.

Expansion of Food Processing and Value-Added Products

The expanding food processing sector is a key driver of the India pulses market. Rising demand for convenience foods has increased consumption of processed pulse-based products, such as RTE meals, snacks, flours, and protein ingredients. As per IMARC Group, the India RTE meals market size reached USD 5.75 Billion in 2024. Urban lifestyles and changing consumption patterns favor packaged and branded pulses with improved quality and shelf life. Food manufacturers are incorporating pulses into health foods, gluten-free products, and plant-based protein alternatives. This value addition increases overall pulses demand beyond traditional household consumption. Growth in organized retail and e-commerce platforms further improves market access for processed pulse products. Processing also reduces post-harvest losses and enhances farmer price realization. As domestic and export demand for value-added pulse products grows, investments in processing infrastructure increase. This structural shift from raw to processed consumption significantly supports market expansion and diversification across India.

Crop Diversification and Sustainable Farming Practices

Diversification of crops and sustainable methods of farming are stimulating the growth of the market in India. Pulses can increase soil fertility due to the property of fixing the scarcest element in the soil, which is nitrogen. Thus, pulses can be an excellent source in the crop rotation program. Farmers in India have started adopting pulses to cut down on the dependence on water-intensive crops. Promotion of sustainable agriculture practices supports pulses cultivation in rainfed and marginal areas. Government initiatives and the involvement of the private sector in the country’s market aim to support an integrated farming system that incorporates pulses. Pulses can also be easily cultivated compared to most commercial crops since they do not require many inputs. Climate change and the sustainability trend can significantly enhance the adoption of pulses in arid areas of the region due to their ability to thrive in drought situations.

Market Restraints:

What Challenges the India Pulses Market is Facing?

Dependence on Monsoon and Climate Uncertainty

The Indian pulses market is heavily reliant on monsoon rains, rendering output susceptible to climate change. Rainfall irregularities, droughts, floods, and rising temperatures have a direct impact on sowing decisions, crop growth, and yields. Since a big proportion of pulses is grown in rainfed locations, even modest weather disruptions can significantly impact output. This causes supply disruption, price fluctuations, and income uncertainty for farmers, while also increasing reliance on imports to meet domestic demand.

Low Productivity and Limited Technological Adoption

Pulses in India have lesser productivity than food grains due to the limited adoption of high-yielding seed types, mechanization, and contemporary agronomic approaches. Farmers frequently assign pulses to marginal farms with low soil fertility and limited irrigation. Inadequate access to quality inputs, extension services, and pest management technologies exacerbates yield disparities. These restraints limit output expansion and lower the competitiveness of homegrown pulses.

Inadequate Storage and Post-Harvest Infrastructure

Insufficient storage, warehousing, and post-harvest handling infrastructure pose significant hurdles to the India pulses market. Poor drying, pest infestation, and a lack of scientific storage facilities contribute to significant post-harvest losses. Product quality and shelf life are reduced due to fragmented logistics and inadequate processing capacity. These inefficiencies affect farmers' market access, value addition, and overall supply chain efficiency.

Competitive Landscape:

The India pulses market exhibits a fragmented competitive structure, characterized by the presence of numerous organized and unorganized players operating across different value chain segments. Market participants compete through brand differentiation, quality assurance certifications, and distribution network expansion. Leading players are investing in processing infrastructure modernization, product portfolio diversification, and supply chain integration to strengthen market positioning. The competitive landscape is evolving towards consolidation as organized players leverage economies of scale, technological capabilities, and marketing investments to capture market share from traditional unorganized traders. Strategic partnerships with agricultural cooperatives and farmer producer organizations are enabling efficient sourcing while ensuring consistent quality standards.

Recent Developments:

-

In October 2025, the Union Cabinet approved the 'Mission for Aatmanirbharta in Pulses' with a financial outlay of INR 11,440 Crore to be implemented from 2025-26 to 2030-31. The strategy focuses significantly on developing and distributing high-yielding, pest-resistant, and climate-adaptive pulse varieties. Trials across multiple locations will be carried out in key pulse-growing states to verify regional appropriateness.

India Pulses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, Million USD |

| Segment Coverage |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Chick Peas, Kaspa Peas, Lentils, Pigeon Peas, Fava Beans, Black Gram, Mung Beans, Others |

| End-Use Covered | Retail Store, Snack Food Industry, Flour Industry, Others |

| Region Covered | North India, East India, West and Central India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India pulses market reached a volume of 37.98 Million Tons in 2025.

The India pulses market is expected to grow at a compound annual growth rate of 5.28% from 2026-2034 to reach 60 Million Tons by 2034.

Lentils dominated the market with a share of 26%, owing to widespread culinary applications across Indian households, nutritional superiority, and strong government support through enhanced procurement mechanisms.

Key factors driving the India pulses market include the large vegetarian population seeking plant-based protein sources, proactive government policy support through enhanced MSP and production missions, expanding food processing industry applications, and rising health consciousness among consumers.

Major challenges include climate vulnerability affecting rainfed cultivation, pest and disease pressures limiting productivity, import competition affecting farmer profitability, fragmented landholdings constraining mechanization, and inadequate storage and processing infrastructure in rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)