Australia Investment Banking: Deal-Making Excellence and Growth Opportunities

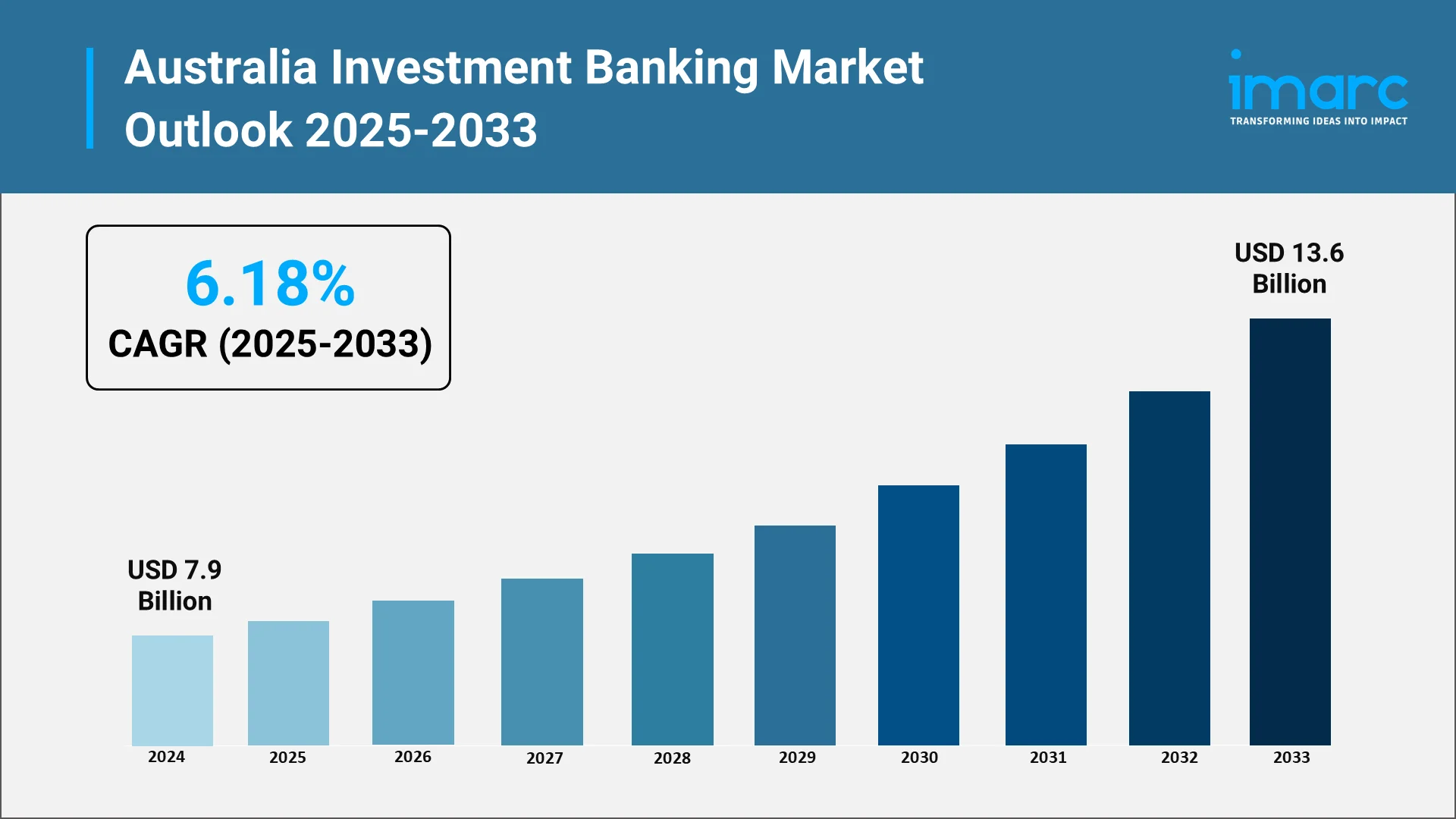

The Australia investment banking industry is experiencing transformative growth driven by technological innovation, sustainable finance initiatives, and robust mergers and acquisitions activity. With market valuations reaching USD 7.9 Billion in 2024, the sector demonstrates remarkable resilience despite global economic uncertainties.

Investment banks serve as essential intermediaries connecting corporations, governments, and institutional investors with capital markets. They provide comprehensive advisory services encompassing M&A, corporate finance advisory, equity and debt capital markets, and strategic restructuring.

Explore in-depth findings for this market, Request Sample

Introduction: Australia's Investment Banking Landscape

Australia investment banking Industry operates within a sophisticated financial ecosystem featuring strong regulatory oversight and global integration. The industry encompasses global bulge-bracket investment banks, domestic financial institutions, and specialized boutique advisory firms.

Australia's strategic position in the Asia-Pacific region establishes the sector as a gateway for international capital flows. The nation's stable political environment, transparent legal frameworks, and strong credit ratings attract significant foreign investment. Sydney and Melbourne serve as concentrated hubs of financial expertise and deal-making activity.

The Australian Securities and Investments Commission (ASIC) usually oversees financial services, implementing comprehensive regulations. Recent initiatives include enhanced climate-related financial disclosures effective January 2025, the Financial Accountability Regime strengthening accountability for directors and senior executives, and modernized banking codes expanding protections for consumers and businesses.

Recent Market News and Major Research and Development:

Record Clean Energy Investment

Australia achieved significant clean energy milestones in 2024. The Clean Energy Finance Corporation (CEFC) announced a record $4.7 billion in total commitments for the 2024-25 financial year, including AUD 3.5 billion (USD 2.29 billion) specifically for renewable energy projects and grid infrastructure which is 2.5 times more than the previous year. The largest transaction involved AUD 2.8 billion through the Rewiring the Nation Fund, including AUD 2.075 billion for HumeLink and the NSW element of VNI-West transmission infrastructure, representing the CEFC's single largest transaction since inception.

M&A Market Leadership

Goldman Sachs achieved exceptional Asia-Pacific performance during Q1-Q3 2025, with deal values increasing more than 10-fold year-over-year, elevating from 28th position to first place by deal value. The firm advised on 14 deals including four billion-dollar transactions. UBS retained volume leadership with 22 deals. In broader 9M25 rankings, JPMorgan led with USD 189 billion in buyout mandates, followed by Goldman Sachs with USD 134 billion and Citi with USD 115 billion.

Regulatory and Technology Developments

New sustainability reporting requirements became effective January 2025, mandating financial disclosures related to climate for large businesses as well as financial institutions. The Financial Accountability Regime commenced enforcement in 2024. Investment banks increasingly integrate artificial intelligence and machine learning for operational efficiency. Australia's fintech landscape experienced consolidation to 767 firms, though investment totaled AUD 1.1 billion in H2 2024. Major transactions included Experian's AUD 820 million acquisition of Illion.

Top Companies in the Australia Investment Banking Industry:

Global Investment Banking Leaders

Goldman Sachs ranks as the top fee earner with leadership in M&A advisory and equity capital markets. JP Morgan excels in equity capital markets, ranking second in Asia-Pacific M&A during Q1-Q3 2025 with USD 10.5 billion in advised transactions. UBS leads M&A volume with 22 deals. Morgan Stanley secured the number one position for total investment banking fees in Q1 2024. Citi demonstrates exceptional debt capital markets strength, raising USD 9 billion for New Zealand and Australian issuers in offshore markets in the first quarter of 2025. Since 1964, Bank of America has operated in Australia, maintaining consistent ranking in debt capital markets.

Domestic Institutions

Macquarie Group represents Australia's premier domestic investment bank, frequently ranking first in Australasia for M&A advisory. The bank's integrated business model combines investment banking with asset management and principal investing. Australia's Big Four Banks, including ANZ, Commonwealth Bank, NAB, and Westpac, maintain investment banking divisions focused on debt capital markets. Westpac led league tables in debt capital markets during Q1 2024. Specialized boutique firms including Barrenjoey and RBC Capital Markets compete through senior-level attention and sector specialization.

Opportunities and Challenges:

Major Growth Opportunities

- Expanding M&A Activity: Investment banks benefit from increasing transactions as businesses enhance operational efficiencies. Australia's stable regulatory environment encourages foreign investments, positioning the nation as preferred for cross-border deals.

- Technology Sector Growth: Technology startups and established companies raise funds through IPOs and private placements facilitated by investment banks with specialized teams, diversifying bank revenue streams.

- Infrastructure and Renewable Energy: Australia's climate targets including 82% renewable electricity by 2030 require unprecedented infrastructure investment. The government's AUD 19.7 billion commitment over ten years to Future Made in Australia industries including renewable hydrogen and green metals creates extensive deal flow.

- Digital Transformation: AI and machine learning integration enables superior analytics, automated due diligence, and enhanced client service. Digital currencies and fintech collaborations modernize offerings.

- ESG Finance: Growing emphasis on Environmental, Social, and Governance factors drives demand for green bond issuance, sustainability-linked lending, and ESG advisory services.

Critical Challenges

- Regulatory Complexity: Increasing requirements including sustainability reporting and Financial Accountability Regime compliance necessitate significant investments in systems and personnel.

- Market Volatility: Global uncertainties impact business confidence. Industry revenue contracted 4.3% annually over five years through 2024-25, reflecting challenging conditions.

- Competition: Boutique firms, private equity, and fintech platforms create pricing pressure. Online trading platforms constrain traditional stockbrokers through lower-cost models.

- Talent and Technology: Intense competition for skilled professionals creates retention challenges. Continuous technology investment represents significant capital commitments.

- Cybersecurity: Escalating threats require substantial investments in capabilities and incident response preparedness.

Future Outlook: Australia Investment Banking Industry

The market is projected to grow to USD 13.6 Billion by 2033, at 6.18% CAGR during 2025-2033. This expansion reflects strong economic fundamentals, increasing corporate activity, and Australia's energy transition financing needs. Anticipated monetary policy easing should strengthen corporate confidence, supporting increased M&A activity and IPO completions.

Technology and Sustainable Finance

Artificial intelligence and machine learning will transform operations, enabling sophisticated deal origination and due diligence automation. Investment banks successfully integrating these technologies will achieve competitive advantages. Digital asset market maturation will require traditional services adapted for cryptocurrencies and tokenized securities.

ESG considerations will transition to mainstream integration across all activities, driven by investor demand, regulatory requirements, and corporate sustainability commitments. Investment banks must develop comprehensive capabilities spanning sustainable finance structuring, climate risk assessment, and transition finance advisory.

Infrastructure Investment

Australia's commitment to 82% renewable electricity by 2030 and net-zero by 2050 necessitates unprecedented capital investment. The AUD 19.7 billion government commitment to Future Made in Australia industries creates supportive policy environment. The CEFC's AUD 2 billion recapitalization ensures continued patient capital availability, with investment banks partnering to mobilize larger private capital amounts.

Strategic Success Imperatives

Investment banks should prioritize technology excellence through continuous infrastructure investment, sustainability leadership by developing comprehensive capabilities, regulatory proactivity while engaging with authorities, client centricity through superior service quality, talent investment via competitive development, and strategic agility to adapt to changing conditions.

Why Choose IMARC Group:

Understanding the complexities and opportunities within Australia's investment banking industry requires access to reliable, data-driven market intelligence and strategic advisory capabilities. IMARC Group delivers the comprehensive insights and analytical rigor that corporate strategists, investors, and business development professionals need to make informed decisions in this dynamic sector.

- Data-Driven Market Research: Gain deeper understanding of market dynamics, competitive positioning, and growth trajectories through comprehensive market research reports examining Australia's investment banking industry across multiple dimensions including service segments, geographic markets, client categories, and emerging trends.

- Strategic Growth Forecasting: Anticipate market evolution through forward-looking analysis of emerging trends including technological disruption, regulatory developments, sustainable finance expansion, and shifting competitive dynamics across public and private capital markets.

- Competitive Benchmarking: Analyze competitive forces shaping the investment banking landscape, assess strategic positioning of leading institutions, monitor capability development initiatives, and identify competitive advantages across advisory services, capital markets products, and specialized sector coverage.

- Regulatory and Policy Advisory: Navigate the evolving regulatory landscape through comprehensive analysis of compliance requirements, policy developments, and regulatory priorities including sustainability reporting obligations, accountability frameworks, capital markets regulations, and consumer protection provisions.

- Custom Research and Consulting: Access tailored insights aligned with your specific organizational objectives whether entering the Australian market, evaluating strategic partnerships, assessing acquisition opportunities, or developing new service capabilities within the investment banking sector.

At IMARC Group, our mission is to empower financial services leaders with the market intelligence and strategic insights necessary to capture opportunities in Australia's evolving investment banking industry. Partner with us to transform market complexity into competitive advantage since informed decisions create sustainable value.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)