How Big Will the Oil and Gas EPC Industry be by 2033?

The Oil and Gas EPC Market is Powering Global Energy Infrastructure Development:

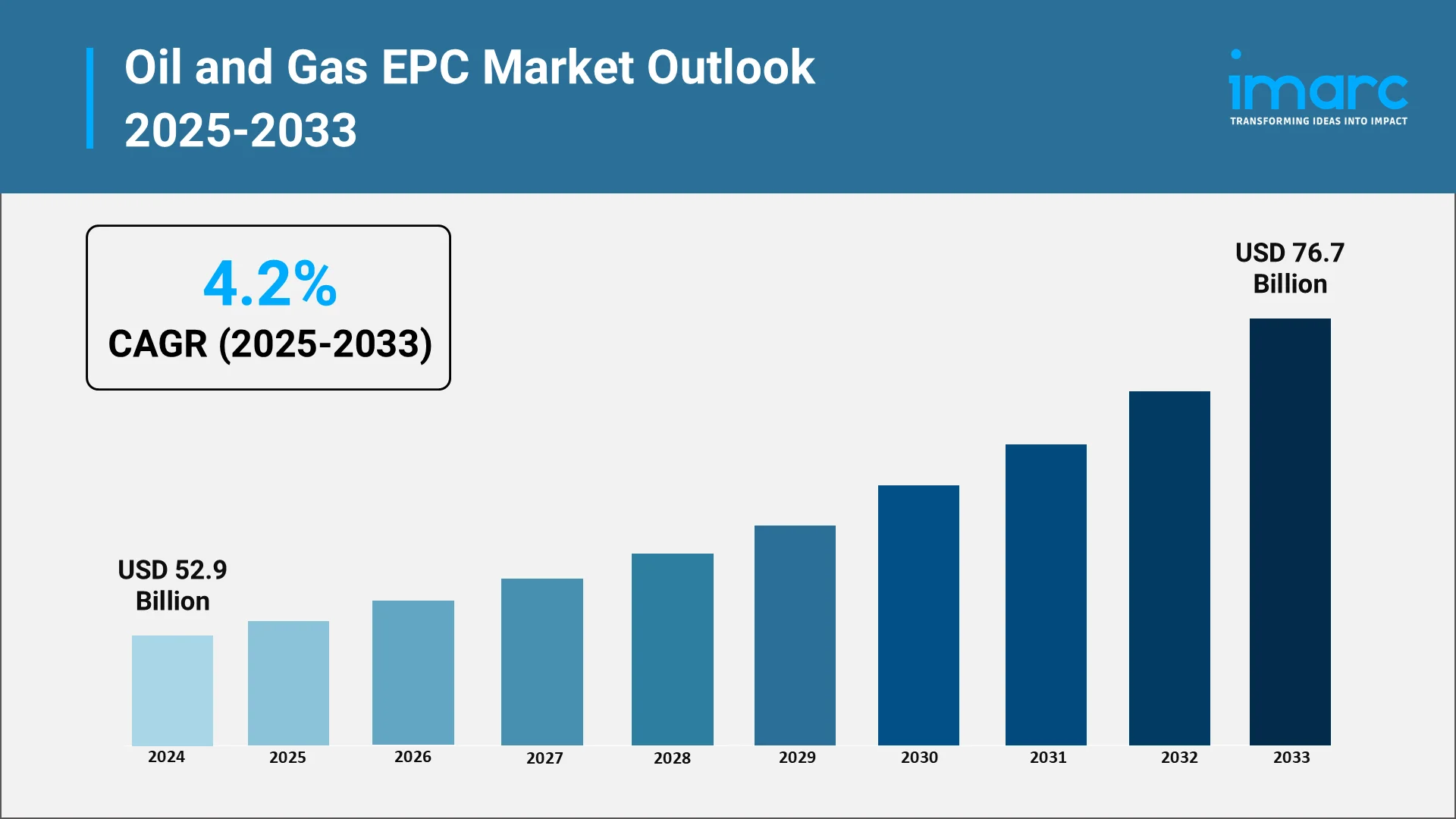

The global oil and gas EPC market is currently experiencing a remarkable transformation as it positions itself at the intersection of traditional energy demands and technological innovation. The market is demonstrating robust growth, reaching USD 52.9 Billion in 2024, depending on regional scope and market segmentation approaches. This substantial market base is supporting a major number of capital projects worldwide, including offshore platform projects and onshore installations that are collectively shaping the energy landscape.

The engineering, procurement, and construction (EPC) approach is serving as the backbone of oil and gas infrastructure development, providing integrated solutions that streamline project delivery from initial design through final commissioning. EPC contractors are currently managing major grassroots and brownfield sites in refining and petrochemical complexes globally, while simultaneously overseeing kilometers of pipeline infrastructure under various stages of construction and maintenance. This comprehensive reach is underlining the critical role that EPC services are playing in meeting the world's escalating energy requirements.

Explore in-depth findings for this market, Request Sample

Rising Global Energy Demands and Technological Breakthroughs Are Accelerating Market Expansion:

The oil and gas EPC market is being propelled forward by a convergence of powerful growth drivers that are creating unprecedented opportunities for expansion. The primary catalyst is the relentless surge in global energy consumption, particularly emanating from rapidly developing economies. As per IEA, worldwide electricity consumption increased by 4.3% in 2024 and is expected to keep growing at nearly 4% until 2027. As industrialization accelerates and urbanization intensifies in these regions, the demand for reliable energy infrastructure is skyrocketing, compelling both governmental and private sector entities to invest substantially in oil and gas exploration, production, and distribution facilities.

Technological advancement is emerging as another transformative driver that is revolutionizing the EPC landscape. Digital twin platforms are now gaining traction owing to various reasons, ranging from wells to refinery distillation columns, allowing near real-time simulation for performance and safety forecasting. Companies are also vigorously adopting digital twins for enhancing efficiency. For example, in 2025, KBC (A Yokogawa Company) revealed the introduction of Petro-SIM® v7.6, the newest version of its premier digital twin process simulation platform for both upstream and downstream oil and gas markets, encompassing refining, polymer, petrochemical, and sustainable aviation fuel (SAF) industries.

The complexity and scale of oil and gas projects are growing exponentially, particularly in deepwater exploration and liquefied natural gas (LNG) sectors. In 2025, Germany formally commenced commercial activities at its second liquefied natural gas import terminal in Wilhelmshaven port from August. The terminal, managed by the Lithuanian firm KN Energies, has already obtained its endorsement under hazardous incident regulations from the Oldenburg Trade Supervisory Authority (GAA) with no objections. The increasing trade of LNG globally is spurring massive investments in terminal infrastructure, liquefaction facilities, and transportation networks. Additionally, the expansion into challenging environments, such as ultra-deepwater fields and Arctic regions, is necessitating specialized EPC expertise that commands premium valuations.

Market Projections: Factors Pointing Toward Substantial Growth Through 2033

The forecasted trajectory of the oil and gas EPC market through 2033 is demonstrating remarkable optimism, with multiple authoritative research institutions projecting significant expansion across the forecast period. According to comprehensive market analyses by IMARC Group, the global market is expected to reach USD 76.7 Billion by 2033, with the variance reflecting different methodological approaches and regional coverage.

Breaking down these projections by project type reveals interesting dynamics. The upstream segment is driven by ongoing investments in exploration and production infrastructure. The downstream sector, while representing a smaller percentage, is witnessing significant activity with various greenfield refineries and brownfield upgrades.

The onshore versus offshore split is revealing strategic priorities within the industry. Onshore projects are leading, benefiting from lower operational costs, easier accessibility, and less stringent regulatory challenges compared to offshore counterparts. However, offshore construction projects are making up a certain portion, with deepwater and ultra-deepwater projects commanding premium valuations due to their technical complexity and specialized requirements.

Regional Powerhouses Are Emerging While New Markets Are Gaining Momentum:

The geographical distribution of the market is revealing distinct patterns of dominance and emerging growth opportunities that are reshaping the global energy infrastructure landscape. The Middle East & Africa region is commanding the largest market share. This regional dominance is stemming from the area's vast hydrocarbon reserves, ongoing mega-projects, and substantial governmental investments in energy infrastructure modernization. Countries like Saudi Arabia, UAE, Qatar, and Kuwait are driving massive EPC contracts, particularly in upstream exploration and LNG development.

North America is establishing itself as a significant player, capturing a significant portion of the market. The region's prominence is being driven by the United States' position as a major crude oil producer, coupled with substantial shale oil and gas developments across the Permian Basin, Bakken, and other prolific plays.

The Asia-Pacific region is demonstrating the fastest growth trajectory. This accelerated expansion is being fueled by China's extensive refining capacity expansion plans, India's infrastructure modernization initiatives, and Southeast Asia's burgeoning energy demands. China is leading the regional market as the primary producer of crude oil and natural gas in Asia-Pacific, while India is focusing on expanding its natural gas network and upgrading existing facilities.

Europe is holding approximately a major portion of market share with a focus on energy transition and sustainability initiatives. The European EPC market is concentrating on refinery upgrades, hydrogen-ready infrastructure development, and carbon capture installations. In 2024, Vestas obtained a solid order from First Look Solutions, a branch of Rezolv Energy and Low Carbon, to provide a complete engineering, procurement, and construction (EPC) solution for the 192 MW Vifor project located in south-eastern Romania. The order consists of 30 V162-6.2 MW turbines from the EnVentus platform operating at a mode of 6.4 MW. In addition to providing, delivering, and commissioning the turbines, Vestas is tasked with the civil and electrical works for the project. These projects reflect the continent's commitment to environmental transformation while maintaining energy security.

Digital Revolution, Sustainability Mandates, and Automation Are Reshaping Industry Standards:

The oil and gas EPC market is undergoing a profound transformation driven by various interconnected mega-trends that are fundamentally altering project execution methodologies, operational efficiencies, and competitive dynamics. Digitalization is emerging as the paramount trend, with oil and gas infrastructure projects worldwide integrating digital planning software, representing a dramatic increase. Building information modeling (BIM), 3D modeling, and advanced analytics are revolutionizing project planning, execution, and monitoring capabilities.

The integration of Internet of Things (IoT), artificial intelligence (AI), and robotics is dominating automation strategies, enabling full operational automation across EPC activities. AI-driven design optimization is enhancing engineering precision while reducing design cycles, and IoT devices are facilitating real-time monitoring of assets, optimizing operational efficiency, and minimizing downtime. These technologies are paving the way for predictive maintenance, remote site monitoring, data and asset management, and energy optimization.

Sustainability and environmental considerations are transitioning from peripheral concerns to core strategic imperatives. The incorporation of renewable energy components, energy-efficient technologies, and carbon capture capabilities into oil and gas infrastructure projects is accelerating rapidly. EPC contractors are increasingly being selected based on their ability to deliver projects that not only meet stringent regulatory standards but also contribute meaningfully to clients' sustainability objectives. The development of carbon capture and storage (CCS) technologies and the integration of renewable energy sources into traditional oil and gas operations are broadening the market scope for innovative EPC services, creating differentiation opportunities for forward-thinking contractors.

Challenges in Oil and Gas EPC Are Testing Resilience While EPC Market Opportunities Beckon Strategically:

The oil and gas EPC market is navigating a complex landscape of challenges that are simultaneously testing industry resilience and catalyzing innovation. Supply chain disruptions are emerging as a primary challenge, with lead times for equipment and services procurement extending significantly. Coupled with persistent high inflation, these disruptions are impacting equipment costs and compressing profit margins for EPC contractors. Some suppliers are being forced to perform work at a loss or, in severe cases, are unable to fulfill contractual obligations, leading to disputes and project delays.

Project delays and cost overruns remain pervasive concerns within the oil and gas EPC supply chain. Complex designs, technical complications, regulatory requirements, and unforeseen circumstances are frequently leading to execution delays. These delays are resulting in amplified costs and revenue losses for both EPC firms and their clients. Factors such as labor shortages, geopolitical uncertainties, and scope changes are contributing to project timeline extensions.

Safety and environmental compliance are presenting critical operational challenges. The industry is operating in inherently hazardous environments, making worker safety, equipment protection, and environmental preservation paramount concerns. EPC companies are needing to adhere to increasingly stringent safety regulations while implementing robust safety management systems and providing comprehensive workforce training. Environmental regulations are compelling contractors to adopt environmentally friendly practices, minimize ecological impacts, and comply rigorously with emissions and waste management standards. Failure to meet these compliance requirements is carrying severe consequences, including legal ramifications, reputational damage, and costly project delays.

Despite these formidable challenges, the oil and gas EPC market is presenting substantial opportunities for stakeholders who are positioning themselves strategically. The transition toward cleaner energy sources is creating EPC market opportunities in hybrid projects that integrate traditional oil and gas infrastructure with renewable energy components. While renewable energy is gaining prominence, oil and gas is continuing to represent a critical component of the global energy mix for the foreseeable future, ensuring sustained demand for EPC services. The complexity of modern oil and gas projects is necessitating specialized expertise, creating premium positioning opportunities for contractors with advanced technical capabilities.

The convergence of traditional energy demands with technological innovation is creating a market environment where adaptability, technical excellence, and strategic foresight are determining competitive success in the decade ahead.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)