Global Instant Coffee Market Expected to Reach USD 21.9 Billion by 2033 - IMARC Group

Global Instant Coffee Market Statistics, Outlook, and Regional Analysis 2025-2033

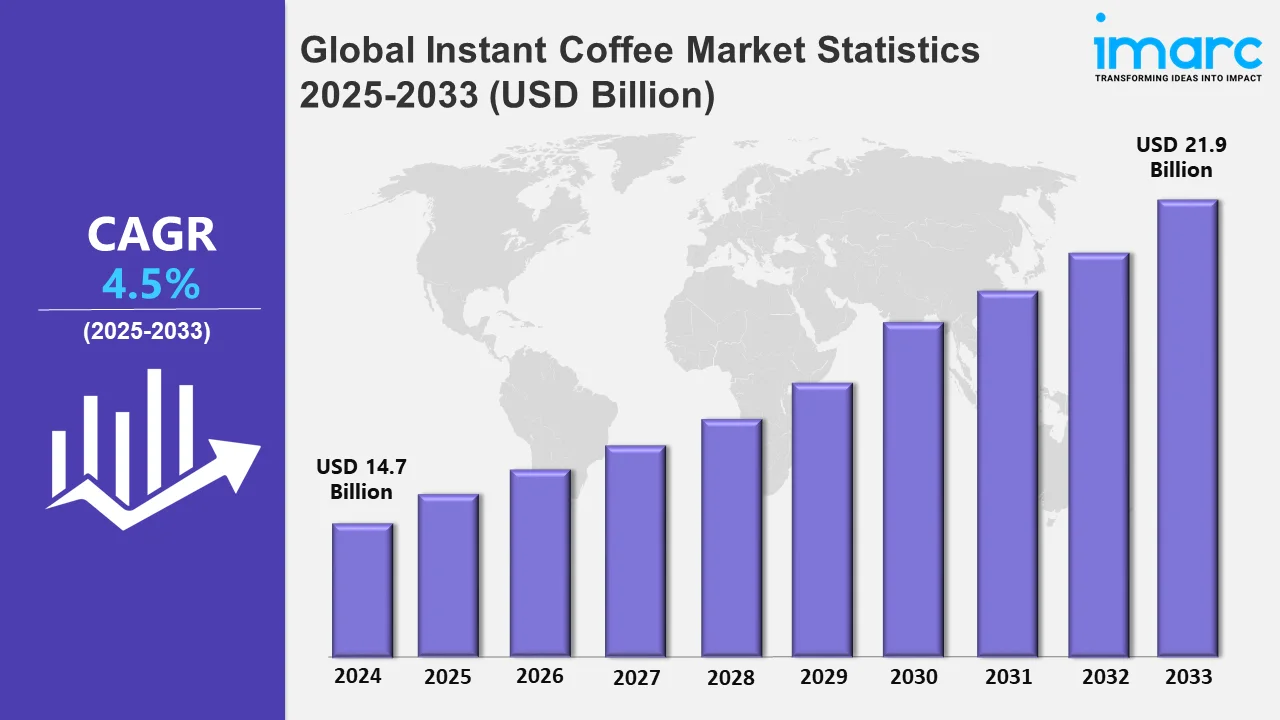

The global instant coffee market size was valued at USD 14.7 Billion in 2024, and it is expected to reach USD 21.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% from 2025 to 2033.

To get more information on this market, Request Sample

The global market is primarily driven by the rise in demand for convenient, time-saving beverage options due to busy urban populations. With the increasing influence of western lifestyles and coffee culture in emerging countries, the consumption of instant coffee has increased. Additionally, the robusta bean's inherent qualities, such as higher caffeine concentration, affordability, and versatility, significantly stimulate its appeal, driving increased consumption across diverse coffee segments Moreover, technological developments in the production process have enhanced the flavor profile of instant coffee, making it a strong competitor to brewed coffee. Also, there is a range of product offerings, from flavored and specialty instant coffees, which cater to consumers' diverse preferences. For instance, on October 7, 2024, Nestlé and Blue Bottle Coffee launched the NOLA Craft Instant Coffee Blend, a soluble version of New Orleans-Style Iced Coffee, blending coffee, chicory, and sugar for easy preparation. Catering to younger cold coffee enthusiasts, it’s available in the U.S., Japan, South Korea, and China, bringing café-quality flavor to homes globally.

In addition to this, the expansion of e-commerce platforms allows consumers to access products easily, and they can search for brands and products with ease. Furthermore, the price benefit of instant coffee over fresh-brewed coffee has further increased the market share in price-sensitive markets. Besides this, the growing awareness regarding sustainable and responsible products has made manufacturers focus on environment-friendly production and packaging practices, which is further propelling the growth of the market. For instance, on May 14, 2024, Paulig announced the introduction of its first recyclable, easy-open vacuum coffee packaging. This innovation aligns with Paulig's goal of making all packaging recyclable by 2025 and is part of a EUR 25 Million investment in sustainable production at its CarbonNeutral® Vuosaari Roastery. The packaging reduces material usage by 20% while supporting circular economy principles. Additionally, rising living costs have prompted consumers to opt for more affordable coffee blends, further strengthening robusta's popularity.

Global Instant Coffee Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, Asia-Pacific, North America, Latin America, and the Middle East and Africa. According to the report, Europe accounted for the largest market share on account of convenience, affordability, and advancements in premium and sustainable coffee products.

Europe Instant Coffee Market Trends:

Europe is a well-established market for instant coffee, with a grown coffee culture and diversified consumer preferences. While Italy and France traditionally associate with freshly brewed coffee, instant coffee has a good demand in regions like Eastern Europe due to its affordability and convenience. The United Kingdom and Germany also have high volumes, preferring premium instant blends that are balanced both on taste and convenience. Sustainability has been gaining popularity in Europe; thus, consumers have a preference for brands that emphasize sustainable sourcing and packaging methods. Instant coffee is very popular in European homes since it's one of those essentials used as a refresher. Increasing investments, innovation, and focus on quality ensures the continued development and growth of the instant coffee market in the region. For example, on March 15, 2024, New Zealand-based Cooks Coffee announced plans to raise up to USD 1 Million to expand its Esquires Coffee chain into Europe and the Middle East. The company intends to issue 8.5 million new shares to existing shareholders and select new investors. The funds will support outlet growth, digital enhancements, and potential acquisitions of independent cafés for rebranding and franchising.

Asia-Pacific Instant Coffee Market Trends:

Asia-Pacific region is one of the key contributors to the instant coffee market due to its vast population and different consumer preferences. The pace of urbanization and hectic lifestyle have contributed significantly to the demand for instant beverages, which makes instant coffee one of the most widely consumed across the region. Some of the biggest contributors in the region include China, Japan, South Korea, and Indonesia, with their unique coffee consumption habits. In China, the growing middle class and younger consumers are driving interest in premium instant coffee products, while in Japan, the market thrives on high-quality and innovative offerings. Local brands and international players compete to cater to evolving tastes while the region's cultural diversity and economic growth continue to expand the market's potential.

North America Instant Coffee Market Trends:

North America, with its innovation-driven economy and diverse consumer base, plays a role in the instant coffee market. Freeze-drying and micro-ground technology have improved flavor profiles for instant coffee, which makes it appealing to home users and outdoor enthusiasts. The rise of e-commerce platforms in the region further enables instant coffee brands to flourish. Moreover, cultural changes toward sustainability have led companies to use eco-friendly packaging and ethically sourced beans. Instant coffee has also been used in desserts and beverages other than traditional coffee drinks. North America's adaptability and innovation continue to enhance its significance in the global instant coffee market.

Latin America Instant Coffee Market Trends:

Latin America plays a dual role in the instant coffee market, as a major producer of coffee beans as well as an emerging consumer base for instant coffee products. The region is known for its high-quality beans and provides a critical supply chain foundation for global instant coffee production. Shifting urban lifestyles and inflating disposable incomes in Brazil, Mexico, and Colombia drive consumer preference toward convenient options in coffee. Though traditional brewing methods are in use, instant coffee is gaining popularity due to its easy preparation without compromising the taste among young consumers. Local brands are delivering flavors and formats suited to the local markets, thereby supporting the market growth in the region. Besides this, the location of Latin America ensures mass production and shapes emerging trends within the instant coffee segment.

Middle East and Africa Instant Coffee Market Trends:

The Middle East and Africa are witnessing growth in the instant coffee market. This development is majorly due to cultural change and urbanization. In the Middle East, coffee has deep cultural roots, often associated with traditional brewing methods like Arabic coffee. However, instant coffee is gaining popularity due to its convenience and adaptation to modern lifestyles. An instant coffee product is low cost and accessible compared with ground coffee, making it fit for the masses. The region is experiencing growth in the market, with inflating disposable income levels of consumers and high coffee consumption. Gulf countries, such as Saudi Arabia and the UAE, are experiencing a need for quality and flavored instant coffee. With this mix of traditional coffee culture and new consumer trends, the region plays a key role in the development and global instant coffee supply chain.

Top Companies Leading in the Instant Coffee Industry

Some of the leading instant coffee market companies include Nestle, Starbucks Corporation, Matthew Algie & Company Ltd., Kraft Foods Inc., Tata Consumer Products Limited, Strauss Group Ltd., Jacobs Douwe Egberts, and Tchibo Coffee International Ltd, among others. Nestlé introduced a new Nescafé Classic soluble coffee range that dissolves seamlessly in both hot and cold water on November 6, 2024. The product is available in caramel and hazelnut natural flavors and caters to the growing consumer interest in cold and flavored coffee beverages. And currently, the range is available in Central and Eastern Europe.

Global Instant Coffee Market Segmentation Coverage

- On the basis of the packaging, the market has been categorized into jar, pouch, sachets, and others, wherein pouch represent the leading segment. Packaging pouches play an important role in the instant coffee market due to its practicality and efficiency. These pouches are light in weight, easy to handle, and reduce the cost of transportation. It is the first preference for manufacturers due to its convenient size. Their flexibility accommodates various sizes for different quantities of consumption, from single servings to large amounts. The packaging also makes the product fresh due to its durability and reliability, allowing for longer shelf life and improving consumer experience. In addition, eco-friendly innovation in pouch material meets an increasingly growing consumer demand in the market for sustainable packaging.

- Based on the product type, the market is classified into spray dried and freeze dried, amongst which spray dried dominates the market. Spray-drying instant coffee is a dominant product in the instant coffee market as it is easily accessible and cost-efficient. The process includes rapid drying of coffee to render a fine powder without a change in flavor or aroma. It has a longer shelf life, making it ideal for large-scale distribution and storage, especially in markets driven by affordability and convenience. This product type appeals to a diverse consumer base, from budget-conscious individuals to businesses requiring bulk supplies. Spray-dried coffee is often preferred for its ease of preparation, requiring only hot water to create a quick and satisfying cup.

- On the basis of the distribution channel, the market has been divided into business to business, supermarkets and hypermarkets, convenience stores, online and others. Among these, supermarkets and hypermarkets account for the majority of the market share. Supermarkets and hypermarkets are major contributors to the instant coffee market as they act as a point of purchase for the vast consumer base. They carry an enormous assortment of instant coffee brands, flavors, and sizes to suit every kind of preference. They attract customers with high visibility and good pricing, and they often have in-store promotional activities that help stimulate impulse purchases and improve brand presence. The availability of supermarkets and hypermarkets significantly contributes to the importance of this distribution channel. Consumers prefer these places for one-stop shopping where they can easily compare products. Supermarkets and hypermarkets have several customers, which provides brands with an opportunity to reach numerous individuals.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.7 Billion |

| Market Forecast in 2033 | USD 21.9 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

| Units | Million Kg, Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Jar, Pouch, Sachet, Others |

| Product Types Covered | Spray Dried, Freeze Dried |

| Distribution Channels Covered | Business-To-Business, Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Nestle, Starbucks Corporation, Matthew Algie & Company Ltd., Kraft Foods Inc., Tata Consumer Products Limited, Strauss Group Ltd., Jacobs Douwe Egberts, Tchibo Coffee International Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Instant Coffee Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)