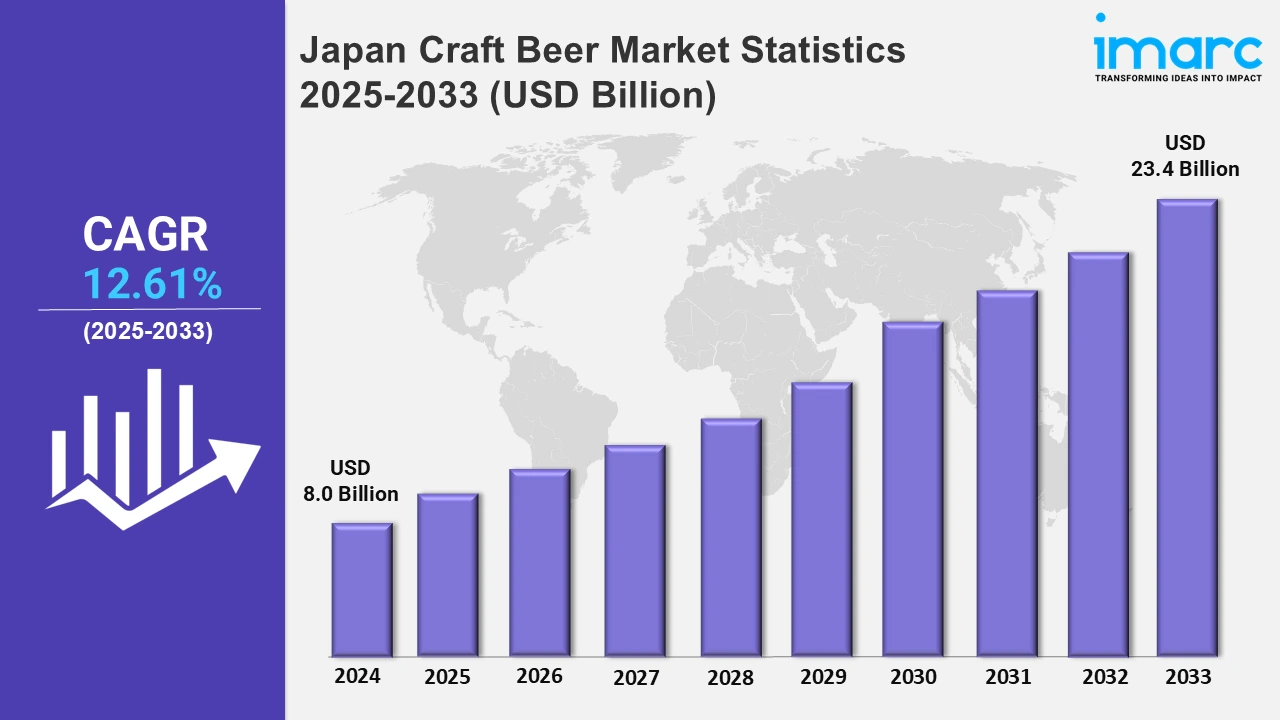

Japan Craft Beer Market Expected to Reach USD 23.4 Billion by 2033 - IMARC Group

Japan Craft Beer Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan craft beer market size was valued at USD 8.0 Billion in 2024, and it is expected to reach USD 23.4 Billion by 2033, exhibiting a growth rate (CAGR) of 12.61% from 2025 to 2033.

To get more information on this market, Request Sample

A rise in investment in technology-driven solutions is altering Japan's craft beer business. Restaurants and other companies benefit from specialized IT platforms and logistical services for craft beer, as well as e-commerce platforms for commercial clients, which improve operational efficiency and accessibility. For example, in November 2024, Yamato Holdings Co., Ltd., under the KURONEKO Innovation Fund II, invested in Best Beer Japan, a company that offers craft beer-specific IT and logistics solutions, as well as a craft beer e-commerce platform for commercial clients such as restaurants.

Moreover, bold IPAs with unique branding and the utilization of local ingredients are transforming the industry. Breweries that prioritize regional authenticity, clean water sources, and eye-catching designs are gaining popularity, particularly among festival crowds and dedicated craft beer fans. For instance, in November 2024, Daichi Mori's Teenage Brewing, located in Tokigawa, Saitama, achieved recognition in Japan's craft beer sector. The brewery, known for its robust, hop-heavy IPAs and vivid, psychedelic can design, uses clean local water and regional ingredients and has rapidly become a festival and beer fan favorite. Furthermore, Japan's craft beer sector continues to evolve to satisfy the rising demand for distinctive and high-quality beers and environmentally friendly techniques. To appeal to both domestic and international markets, breweries are using local ingredients, extending distribution networks, and implementing environmentally friendly practices. Regional craft beers, particularly those with local characteristics, have grown in favor among consumers. For example, breweries like Daisen G Beer in Tottori employ renewable energy and locally produced ingredients to meet consumer demand for sustainability. Export-focused brewers, like as Shiga Kogen Brewery, are also coming up with unique formulations to appeal to North American and European consumers, where Japanese craft beer is gaining popularity. Collaborations with local farmers also promote freshness and regional character. These advancements demonstrate the industry's commitment to quality, sustainability, and cultural representation, supporting growth and elevating Japan's standing in the global craft beer market.

Japan Craft Beer Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The elevating requirement for craft beer due to the increasing consumer demand in various regions of Japan significantly driving the growth of the market.

Kanto Region Craft Beer Market Trends:

Craft beer festivals that bring brewers and enthusiasts together are quite popular in the Kanto region. A notable example is the "Great Japan Beer Festival" in Yokohama, which showcases creative beers from both local and international brewers. This event promotes a dynamic beer culture by fostering experimentation and increasing consumer exposure to a variety of types. Such festivals highlight Kanto's reputation as a vibrant hub for Japan's expanding craft beer market.

Kinki Region Craft Beer Market Trends:

Brewpubs are a distinguishing trend in the Kinki region, combining the brewing and eating experiences. Kyoto Brewing Co. shows this by serving freshly produced craft beers and tailored tasting menus. Located in Kyoto, this brewery focuses on innovation and local flavor while providing tourists with an immersive experience. This strategy appeals to both locals and visitors, cementing the Kinki region's position as a key driver of Japan craft beer industry.

Central/Chubu Region Craft Beer Market Trends:

Collaboration with farmers emphasizes on Central/Chubu's craft beer trend. Shiga Kogen Brewery in Nagano is a leader in beers made using locally grown hops and regional ingredients. This collaboration promotes local agriculture while offering distinct, terroir-inspired tastes. Chubu breweries highlight their connection to the land by combining agriculture and brewing, resulting in beers that appeal to environmentally aware customers and boost the region's image in the craft beer sector.

Kyushu-Okinawa Region Craft Beer Market Trends:

The Kyushu-Okinawa region is notable for incorporating indigenous tropical flavors into artisan brews. Helios Brewery in Okinawa makes refreshing beverages blended with shikuwasa, a local citrus fruit that imparts distinct tropical aromas. This invention embodies Kyushu-Okinawa's cultural and geographical uniqueness, appealing to both locals and visitors. By emphasizing local resources, Kyushu-Okinawa brewers distinguish themselves in the industry.

Tohoku Region Craft Beer Market Trends:

The craft beer movement in Tohoku is defined by the revival of traditional brewing methods. Iwate Kura Beer in Iwate uses historical recipes and methods to create beers that represent the region's cultural history. These initiatives conserve Tohoku's brewing heritage while appealing to contemporary craft beer consumers. This blend of tradition and creativity enhances the Tohoku craft beer sector, establishing it as a distinct aspect of Japan's beer landscape.

Chugoku Region Craft Beer Market Trends:

Sustainability is a prominent theme in the Chugoku region's craft beer sector. Daisen G Beer in Tottori emphasizes environmentally responsible techniques like using renewable energy and utilizing local ingredients. These initiatives are consistent with rising customer demand for ecologically friendly products. Chugoku brewers contribute to the market by promoting sustainability and creating a standard for green practices in Japan's brewing sector.

Hokkaido Region Craft Beer Market Trends:

The craft beer market in Hokkaido concentrates on highlighting the region's agricultural richness. Noboribetsu Brewery makes beer using locally grown barley and hops, emphasizing freshness and regional flavor. This strategy emphasizes on Hokkaido's devotion to high-quality and locally produced products, which aligns with customer interests in authenticity and sustainability. Hokkaido, Japan's northernmost region, is quickly establishing itself as a prominent participant in the country's craft beer sector.

Shikoku Region Craft Beer Market Trends:

Community-driven brewing is a popular practice in Shikoku. Kochi Brewery works with local communities to create beers that honor regional pride and customs. This inclusive strategy strengthens brewers' relationships to local communities while promoting the region's cultural spirit. Shikoku's craft beer companies distinguish themselves in Japan's competitive market by focusing on local collaboration.

Top Companies Leading in the Japan Craft Beer Industry

Some of the leading Japan craft beer market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance. For example, in January 2024, Kirin Brewery announced plans to launch a new standard beer brand, marking its first in 17 years, aiming to strengthen its presence in the craft beer segment.

Japan Craft Beer Market Segmentation Coverage

- Based on the product type, the market has been classified into ales, lagers, and others. Ales are characterized by their strong, fruity, and fragrant tastes. Lagers are valued for their smooth, crisp, and refreshing flavor.

- Based on the age group, the market has been categorized into 21-35 years old, 40-54 years old, and 55 years and above. 21-35 years old choose inventive and fashionable flavors. 40-54 years old seek balanced and high-quality brews for refined tastes, and 55 years and above prefer conventional and smoother alternatives.

- Based on the distribution channel, the market has been divided into on-trade and off-trade. On-trade channels, such as pubs and restaurants, provide premium experiences. Off-trade channels, such as retail outlets and e-commerce, appeal to convenience-seeking customers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.0 Billion |

| Market Forecast in 2033 | USD 23.4 Billion |

| Market Growth Rate 2025-2033 | 12.61% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21-35 Years Old, 40-54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Craft Beer Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)