Mexico Minimally Invasive Surgery Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2025-2033

Mexico Minimally Invasive Surgery Market Overview:

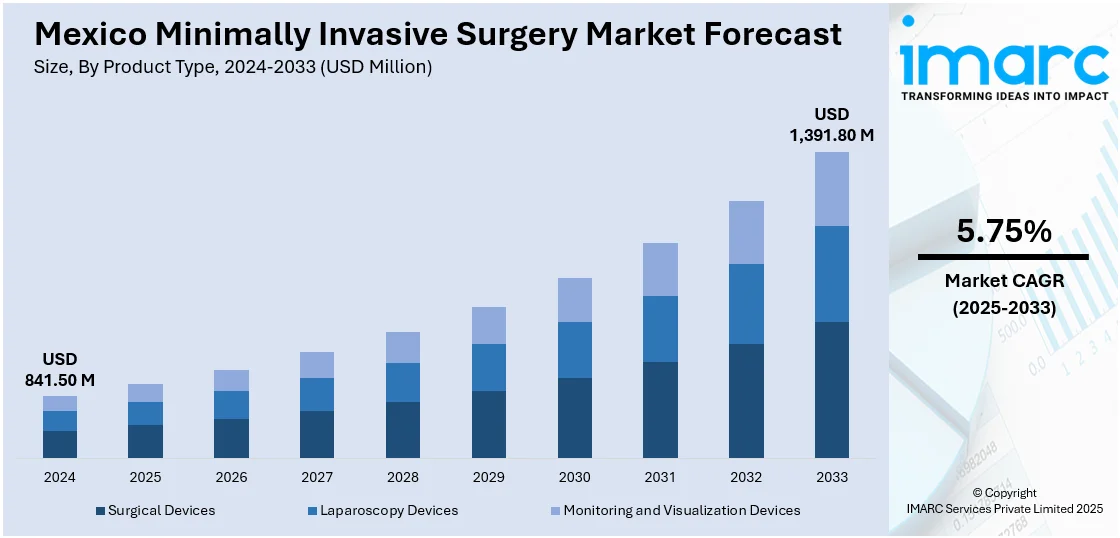

The Mexico minimally invasive surgery market size reached USD 841.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,391.80 Million by 2033, exhibiting a growth rate (CAGR) of 5.75% during 2025-2033. The market share in Mexico is expanding, driven by the rising demand for advanced medical procedures that offer faster recovery, along with the increasing number of international patients who seek affordable and reliable healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 841.50 Million |

| Market Forecast in 2033 | USD 1,391.80 Million |

| Market Growth Rate 2025-2033 | 5.75% |

Mexico Minimally Invasive Surgery Market Trends:

Growing elderly population

The rising elderly population is offering a favorable market outlook. According to the Pan American Health Organization, in 2024, individuals aged 65 and older represented 8.2% of the overall population in Mexico, marking an increase of 3.2% points since the year 2000. As people age, they become more prone to conditions like cardiovascular disease, joint issues, and gastrointestinal disorders that often need surgical treatment. Minimally invasive surgeries are preferred for older adults because they involve smaller cuts, decreased blood loss, minimized pain, and shorter hospital stays in comparison to conventional surgeries. This approach minimizes physical strain and supports quicker rehabilitation, which is essential for aging patients. Hospitals and clinics across Mexico are adopting these techniques to cater to the growing elderly population, aiming to improve outcomes and patient satisfaction. Moreover, families and caregivers prefer minimally invasive options to reduce postoperative care needs. Medical device companies continue to innovate tools and systems that enhance the precision and safety of such procedures.

Rising medical tourism activities

Increasing medical tourism activities are fueling the Mexico minimally invasive surgery market growth. As per industry reports, the overall count of medical tourists visiting Mexico ranged from 1.4 to 3 Million in 2024, with 40%-60% of them arriving from the US. Mexico has become a preferred destination due to its proximity to the United States, competitive medical costs, and availability of skilled surgeons and modern facilities. Tourists traveling for health reasons often opt for minimally invasive procedures, as they involve less pain, quicker recovery, and minimal hospital stays, which align with the travel schedules of international patients. Hospitals and private clinics in Mexico are investing in cutting-edge technologies and surgical equipment to meet the expectations of medical tourists, improving the quality and reputation of healthcare services. The growing influx of patients is driving the demand for procedures, such as laparoscopic surgeries, orthopedic interventions, and cosmetic enhancements that rely on minimally invasive techniques. Many healthcare providers offer medical tourism packages that inculcate consultation, surgery, post-operative care, and accommodation, making the experience convenient and cost-effective. Additionally, government and private sector efforts to promote Mexico as a medical tourism hub is supporting the expansion of related healthcare services, including minimally invasive surgery.

Mexico Minimally Invasive Surgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type, application, and end-user.

Product Type Insights:

- Surgical Devices

- Laparoscopy Devices

- Monitoring and Visualization Devices

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surgical devices, laparoscopy devices, and monitoring and visualization devices.

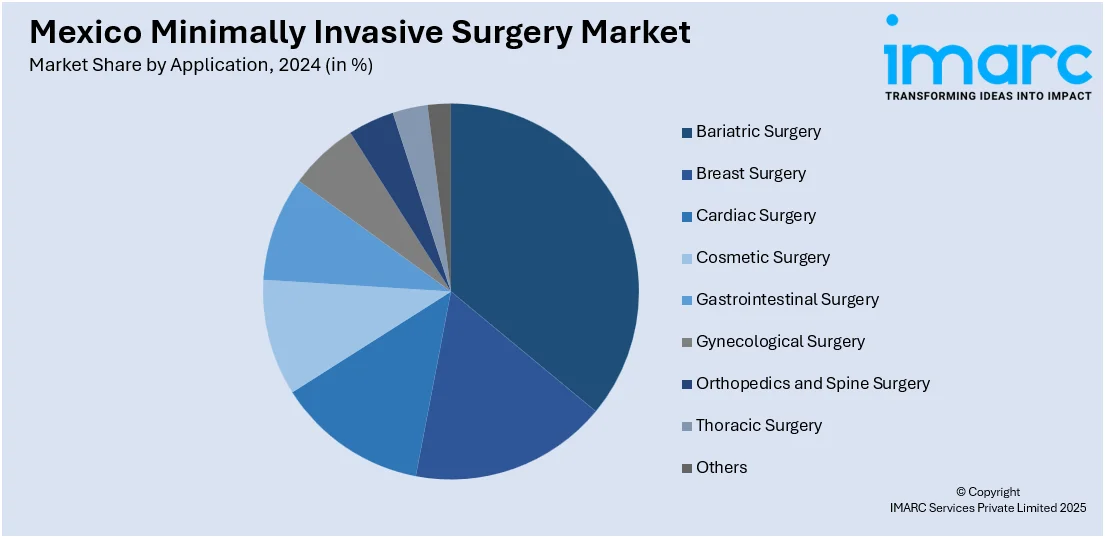

Application Insights:

- Bariatric Surgery

- Breast Surgery

- Cardiac Surgery

- Cosmetic Surgery

- Gastrointestinal Surgery

- Gynecological Surgery

- Orthopedics and Spine Surgery

- Thoracic Surgery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bariatric surgery, breast surgery, cardiac surgery, cosmetic surgery, gastrointestinal surgery, gynecological surgery, orthopedics and spine surgery, thoracic surgery, and others.

End-User Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, clinics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Minimally Invasive Surgery Market News:

- In March 2025, Longevity Medical Institute™ (LMI), Mexico's leading facility for regenerative medicine, teamed up with OncoInv, to introduce one of the most sophisticated, accessible, and thorough cancer screening initiatives in the country. This blend represented a significant advancement in the battle against cancer, providing a cohesive approach that was more informative, less invasive, and designed for a preventive care framework.

- In June 2024, CHRISTUS obtained 15 new state-of-the-art robotic surgical systems for various hospitals within its healthcare network in Mexico, Texas, Colombia, Louisiana, and Chile. CHRISTUS acquired the da Vinci 5 surgical system developed by Intuitive Surgical. Utilized for minimally invasive operations, the device included robotic arms that were entirely controlled by surgeons.

Mexico Minimally Invasive Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surgical Devices, Laparoscopy Devices, Monitoring and Visualization Devices |

| Applications Covered | Bariatric Surgery, Breast Surgery, Cardiac Surgery, Cosmetic Surgery, Gastrointestinal Surgery, Gynecological Surgery, Orthopedics and Spine Surgery, Thoracic Surgery, Others |

| End-Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico minimally invasive surgery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico minimally invasive surgery market on the basis of product type?

- What is the breakup of the Mexico minimally invasive surgery market on the basis of application?

- What is the breakup of the Mexico minimally invasive surgery market on the basis of end-user?

- What is the breakup of the Mexico minimally invasive surgery market on the basis of region?

- What are the various stages in the value chain of the Mexico minimally invasive surgery market?

- What are the key driving factors and challenges in the Mexico minimally invasive surgery?

- What is the structure of the Mexico minimally invasive surgery market and who are the key players?

- What is the degree of competition in the Mexico minimally invasive surgery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the Mexico minimally invasive surgery market forecast, and dynamics from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico minimally invasive surgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico minimally invasive surgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)