Global Paper Packaging Market Expected to Reach USD 540.4 Billion by 2033 - IMARC Group

Global Paper Packaging Market Statistics, Outlook, and Regional Analysis 2025-2033

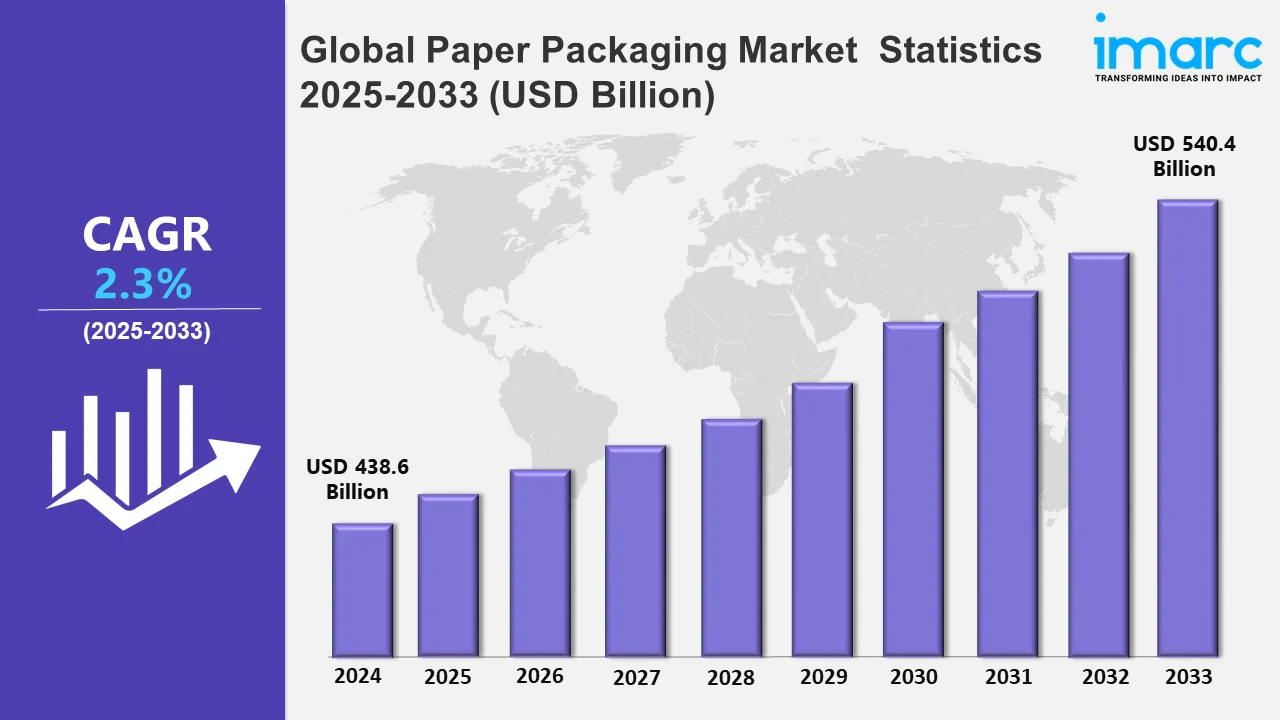

The global paper packaging market size was valued at USD 438.6 Billion in 2024, and it is expected to reach USD 540.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.3% from 2025 to 2033.

To get more information on this market, Request Sample

The paper packaging market is witnessing tremendous growth as consumers prefer greener and more sustainable packaging as compared to plastics. According to the IMARC Group, the global green packaging market size was at USD 271.2 Billion in 2024, which is likely to reach USD 415.3 Billion by 2033, indicating an increased demand for sustainable packaging options in various sectors. As environmental concerns intensify, consumers and businesses alike are looking for solutions that fit into sustainability goals. Paper packaging is recyclable, biodegradable, and made from renewable resources, making it an attractive alternative to single-use plastics. Industries such as food and beverages, consumer goods, and e-commerce are the biggest contributors to the growing demand for paper-based packaging solutions.

The growing demand for reducing plastic waste, coupled with stricter regulations and government initiatives, has escalated the shift toward paper packaging as it is a more environmentally responsible option. Moreover, increasing disposable income and lifestyle changes in emerging markets push up packaged goods demand and increase packaging demands further. Growth in the e-commerce industry has primarily been at the forefront of an increase within the paper packaging market. Moreover, with rising online retail sales, the packaging of the goods is crucial to ensure safe and efficient delivery to the consumer. Paper packaging is versatile and has strength, thus becoming a preference for shipping lighter goods such as books, electronics, and clothing. Furthermore, paper packaging enables customization and branding, allowing companies to interact with customers through an attractive design while still being functional. Technological advancements within paper manufacturing in terms of light, high strength, and innovative printing capabilities expanded the scope further. These innovative technologies enabled the companies to propose packaging solutions that would be sustainable and durable, cost-efficient, and well-suited for the growing requirements of global supply chains.

Global Paper Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of robust technological advances, rapid urbanization and rising disposable income.

Asia Pacific Paper Packaging Market Trends:

The Asia Pacific paper packaging market is driven by the rising consumer demand for green and sustainable packaging solutions. As environmental concerns grow, companies and consumers are increasingly seeking alternatives to plastic, which has led to a surge in the adoption of paper-based packaging. According to the Indian Council for Research on International Economic Relations (ICRIER), the APAC region is witnessing rapid growth in the e-commerce sector, with a valuation of over USD 6.146 Trillion by 2030. This has triggered the need for paper packaging as e-commerce companies look to expand their business to a vast number of customers. A driving aspect of growth includes the growth and expansion of retail sectors as packaged foods and beverages form a higher number of the purchasing list for every consumer. Additionally, the growing stringent governmental regulations across several of the Asia Pacific markets, in response to governments instituting policies centered on recycling or reducing plastic packaging waste. Technological improvements in paper manufacturing processes, including printability, strength, and sustainability, further support the growth of the market, providing businesses with more efficient and cost-effective packaging options.

North America Paper Packaging Market Trends:

The North America market is driven by stringent environmental regulations and increasing consumer awareness about sustainability. The region’s robust e-commerce industry and the growing demand for packaged food and beverages further boost the need for paper-based packaging. Companies are focusing on recyclable and biodegradable solutions to meet eco-conscious consumer preferences. Additionally, the adoption of advanced manufacturing technologies for paper packaging enhances productivity and efficiency. Supportive government initiatives that advocate reduced plastic usage also help spur the growth of the market throughout the region.

Europe Paper Packaging Market Trends:

Strict environmental policies in Europe are fueling the growth of the market. The EU policy on single-use plastics will encourage paper packaging instead of plastics. The regions are focusing on adopting the concept of a circular economy, thereby driving demand for recyclable and biodegradable materials. High consumer preference for sustainable and visually appealing packaging, especially in the food and beverage sectors, supports market expansion. Innovations in design and materials, coupled with the increasing adoption of luxury goods packaging, further contribute to the growth of the paper packaging market in Europe.

Latin America Paper Packaging Market Trends:

Latin America paper packaging market is stimulated by increasing awareness about eco-friendly alternatives among consumers and government regulations to reduce plastic pollution. It is also bolstered by increasing demand for paper-based packaging for food and beverage products, rising demand for eco-friendly packaging within the agriculture sector, and, more importantly, the growth in the retail and e-commerce sectors. Additionally, the manufacturers are also resorting to affordable and recyclable material, and such measures aim at filling up the increased requirement for economical sustainable packaging options available in the region.

Middle East and Africa Paper Packaging Market Trends:

The paper packaging market is driven by the fast food and beverages sectors. Growing urbanization will promote sustainable packaging, thus raising concerns about the environmental effects of plastic waste and influence the adoption of paper packaging. Government policies that encourage eco-friendly practices and investments by local paper manufacturing businesses support the growth of this market. Moreover, the retail and e-commerce sectors are rapidly expanding in the region with a demand for innovation with lightweight and cost-effective paper-based packaging solutions unique to the region's needs.

Top Companies Leading in the Paper Packaging Industry

Some of the leading paper packaging market companies include Amcor plc, DS Smith Plc, Georgia-Pacific LLC, Holmen Group, Hood Packaging Corporation, Huhtamäki Oyj, International Paper Group, Mondi Group Plc, Napco National, Nippon Paper Industries, Sappi Ltd, Smurfit Kappa Group, Sonoco Products Company, Stora Enso Oyj, and WestRock Company, among many others.

- In November 2024, Amcor received a European patent on its AmFiber Performance Paper, a paper-based packaging solution featuring a thin film barrier. Such an innovation offers recyclability, high barrier properties, and fantastic performance as a food and healthcare packaging product. In recognition of this innovation, Amcor reaffirms its position at the forefront of sustainable packaging in furthering the circular economy.

- In May 2024, The Holmen Iggesund introduced Invercote Touch, an uncoated paperboard that addresses sustainable and eye-catching packaging demands. It exhibits strength, stiffness, and printability, including a natural sense of touch. Provided in 330 GSM, it meets both the requirements of the packaging and graphics application and hence provides new opportunities for creative packaging using paper.

Global Paper Packaging Market Segmentation Coverage

- Based on product type, the market is segmented into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others. Of these, folding boxes and cases have the largest share in the market, owing to their flexibility and wide applications in food, beverages, pharmaceuticals, and personal care. Folding boxes are ideal as they find the perfect balance between cost, functionality, and aesthetics and are considered one of the preferred premium product packaging solutions. High-quality designs and branding opportunities are offered with recent improvements in material technology and printing solutions. The desire for lightweight and environmentally friendly solutions has encouraged manufacturers to use recyclable materials and adhere to the goals of a global movement toward sustainability. Folding boxes are relatively easy to assemble, store, and transport, providing logistical advantages. Further growth in the segment has also been induced by the rapid expansion of e-commerce, which relies on compact and efficient packaging, thereby making it the leader in this category.

- Based on grade, the market is categorized into solid bleached, coated recycled, uncoated recycled, and others. Uncoated recycled paper leads the market. This is due to the rising awareness among consumers toward environmental issues and government regulations encouraging sustainable practices. Uncoated recycled paper is derived from post-consumer waste, which is an economical and environmentally friendly alternative to virgin paper. It is widely used in food, beverages, and retail industries for shopping bags, wrapping paper, and food containers. Its biodegradability coupled with the recycling ease has made its popularity high; especially in markets that emphasize economies of a more circular nature. Additionally, as it is adapted to the available modern printing options, branding becomes easy and individualized, always a major thrust for businesspersons. Increasing demands toward sustainable packaging alongside the ban on single-use plastic has ensured that, to date, uncoated recycled paper maintains the highest lead in this group of packaging levels.

- Based on the packaging level, the market is divided into primary packaging, secondary packaging, and tertiary packaging. The largest share of the market is held by primary packaging. It is essential as it directly contains and protects the product, thereby providing safety, hygiene, and adherence to regulatory standards. Primary packaging is inevitable in industries such as food, beverages, healthcare, and personal care, which rely on preserving product quality and avoiding contamination. Additional functions, such as resealable pouches, tamper-evident seals, and child-resistant closures, have been provided by innovations, meanwhile, rising e-commerce, online delivery, and environmental considerations are increasing demands for durable yet attractive primary packaging. Sustainable materials, such as biodegradable films and recycled paperboard, are also picking up due to growing environmental consciousness. With advancements in printing technology, brands are using primary packaging as a marketing and differentiation tool, and this segment leads the market.

- Based on end-use industry, the market is segmented into food, beverage, personal care and home care, healthcare, and others, with food packaging accounting for the largest share. The food industry holds the largest market share. Ready-to-eat meals, frozen foods, and meal kits have gained popularity with changing consumer lifestyles, which further increased the demand for efficient packaging solutions. Microwaveable containers, vacuum-sealed bags, and biodegradable materials are some of the innovations that cater to modern consumer preferences for convenience and sustainability. Increasing uses of food ordering platforms and e-commerce have amplified the demand for durable, lightweight, as well as leak-resistant packaging. Some regulatory requirements such as food safety and ecofriendly materials have necessitated manufacturers toward innovative designs or sustainable practices resulting in food being the largest area in the application industry category in the end-uses.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 438.6 Billion |

| Market Forecast in 2033 | USD 540.4 Billion |

| Market Growth Rate 2025-2033 | 2.3% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, DS Smith Plc, Georgia-Pacific LLC, Holmen Group, Hood Packaging Corporation, Huhtamäki Oyj, International Paper Group, Mondi Group Plc, Napco National, Nippon Paper Industries, Sappi Ltd, Smurfit Kappa Group, Sonoco Products Company, Stora Enso Oyj, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Paper Packaging Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)