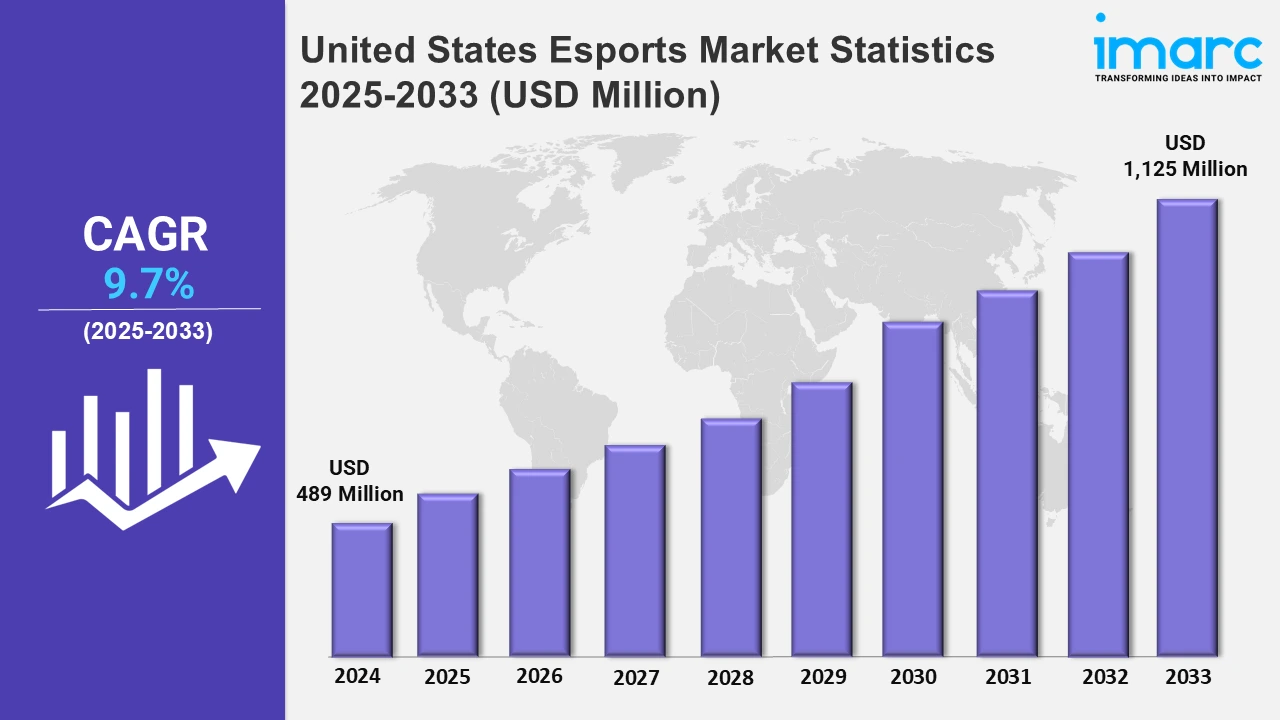

United States Esports Market Expected to Reach USD 1,125 Million by 2033 - IMARC Group

United States Esports Market Statistics, Outlook and Regional Analysis 2025-2033

The United States esports market size was valued at USD 489 Million in 2024, and it is expected to reach USD 1,125 Million by 2033, exhibiting a growth rate (CAGR) of 9.7% from 2025 to 2033.

To get more information on this market, Request Sample

Investment in esports continues to rise as companies extend support programs and increase financial assistance. More teams are receiving significant investment to improve operations, engage audiences, and elevate competitive gaming, mirroring the industry's overall ambition for sustainability and professionalism. For example, in January 2025, the Esports World Cup Foundation increased the number of teams in its Club Partner Program from 30 to 40, committing USD 20 Million to the esports sector. Participating clubs received six-figure base financing to develop their organizations and boost fan involvement for the 2025 season.

Moreover, the esports industry is experiencing more mergers and acquisitions, with investors looking to improve financial stability and grow competitive groups. Strategic takeovers provide teams with critical resources, assuring long-term growth, sustainability, and more opportunities in the ever-changing competitive gaming market. For instance, in August 2024, Guild Esports, supported by David Beckham, finalized a takeover deal with California-based investment firm DCB Sports. The acquisition was intended to maintain financial stability and provide more resources to support and develop the organization's operations. Furthermore, the US esports industry is witnessing significant investment in infrastructure, including specialized venues, training facilities, and collegiate esports programs. As competitive gaming gains popularity, corporations are establishing high-tech training facilities outfitted with cutting-edge gaming gear, analytics software, and performance coaching. Partnerships with educational institutions are also driving expansion, offering student-athletes scholarship possibilities and organized competitive situations. The rapid growth of online broadcasting platforms and gaming centers is increasing accessibility and audience involvement. For example, Belong Gaming Arenas has been developing its network of esports centers across the US, including sites in Texas, Tennessee, and Pennsylvania, providing cutting-edge facilities for players of all skill levels. These expenditures reflect the growing need for organized esports ecosystems, which is driven by increased player involvement, corporate sponsorships, and esports integration into traditional educational and entertainment sectors. This tendency is likely to grow more prevalent in the future years.

United States Esports Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The increasing viewership and audience engagement in various regions of the US is significantly driving the growth of the market. Additionally, the growing investments and sponsorships from leading brands and companies boost the growth of the market.

Northeast Esports Market Trends:

The Northeast is witnessing an increase in dedicated esports venues, which boosts community participation. District E in Washington, D.C., is a 14,000-square-foot venue near Capital One Arena that organizes esports competitions, watch parties, and gaming events. District E, which received corporate support from Monumental Sports & Entertainment, is a hotspot for esports expansion in the Northeast, drawing players and fans while connecting traditional sports with competitive gaming.

Midwest Esports Market Trends:

The Midwest is growing as a collegiate esports hub, with universities investing in competitive programs. Maryville University in St. Louis, Missouri, is a collegiate esports powerhouse with several League of Legends national championships. Meanwhile, Illinois State University developed an esports program that includes a varsity squad and an esports training center. With expanding academic and professional opportunities, the Midwest cultivates esports talent ranging from student competitors to industry professionals.

South Esports Market Trends:

Esports are growing in the South US because of retail venues and accessibility measures. Esports Arena has expanded into Walmart shops around the region, including sites in Fort Worth, Texas, and Nashville, Tennessee. These in-store gaming centers make it possible for both recreational and competitive gamers to enter local tournaments at a reasonable cost. By incorporating esports into conventional shopping spaces, the South is making competitive gaming more inclusive and accessible to a wider audience.

West Esports Market Trends:

The West has some primary locations for major esports competitions and organizations. The 2023 Valorant Champions and past League of Legends World Championships were held in Los Angeles, California, which is home to Riot Games and Blizzard Entertainment. The Crypto.com Arena and Microsoft Theater are popular locations for worldwide esports events. With its concentration of game creators and esports firms, the West continues to be the epicenter of esports in North America.

Top Companies Leading in the United States Esports Industry

Some of the leading United States esports market companies have been mentioned in the report. Key players are focusing on various developments such as product launches, partnerships, funding, and government initiatives. They are forming strategic partnerships to enhance brand presence and audience reach. For example, in October 2024, NRG, a major player in gaming, esports, and content development, signed a multi-year contract with Spectrum, one of the nation's top internet connectivity providers. This alliance seeks to offer unique gaming experiences and content for fans across the US.

United States Esports Market Segmentation Coverage

- Based on the revenue model, the market has been segmented into media rights, advertising and sponsorships, merchandise and tickets, and others. The media rights segment generates revenue through licensing agreements, in which platforms pay for exclusive broadcasting access. Advertising and sponsorships increase revenue by incorporating brand marketing into esports content, teams, and events. Merchandise and tickets contribute by selling branded gear, collectibles, and entrance fees for live tournaments.

- Based on the platform, the market is categorized into PC-based esports, consoles-based esports, and mobile and tablets. PC-based esports feature high-performance gaming and professional events. Console-based esports, which involve competitive play on game consoles, attract a large following. Mobile and tablets drive growth with easily accessible and fast-paced games.

- Based on the games, the market has been divided into multiplayer online battle arena (MOBA), player vs players (PVP), first-person shooters (FPS), and real-time strategy (RTS). Multiplayer online battle arena (MOBA) games prioritize strategic collaboration and objective-based competition. Player vs players (PVP) game focuses on direct player combat in a variety of formats. First-person shooters (FPS) game is driven by fast-paced and skill-based action. In real-time strategy (RTS) games, tactical decisions must be made in real-time.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 489 Million |

| Market Forecast in 2033 | USD 1,125 Million |

| Market Growth Rate 2025-2033 | 9.7% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Players (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Esports Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)