Australia Wealth Management Industry: Robo-Advisory Surge, Key Sectors, Leading Firms, and Future Outlook

Introduction:

Australia’s wealth management industry is undergoing a profound transformation, driven by rapid technological advancements, evolving investor behavior, and the increasing integration of artificial intelligence (AI) in financial services. The nation’s strong economic fundamentals, coupled with its expanding base of high-net-worth individuals (HNWIs) and robust superannuation system, have established a solid foundation for sustained market growth. The sector is no longer confined to traditional advisory models; instead, it is evolving toward digital-first, personalized, and data-driven platforms that emphasize efficiency, transparency, and scalability.

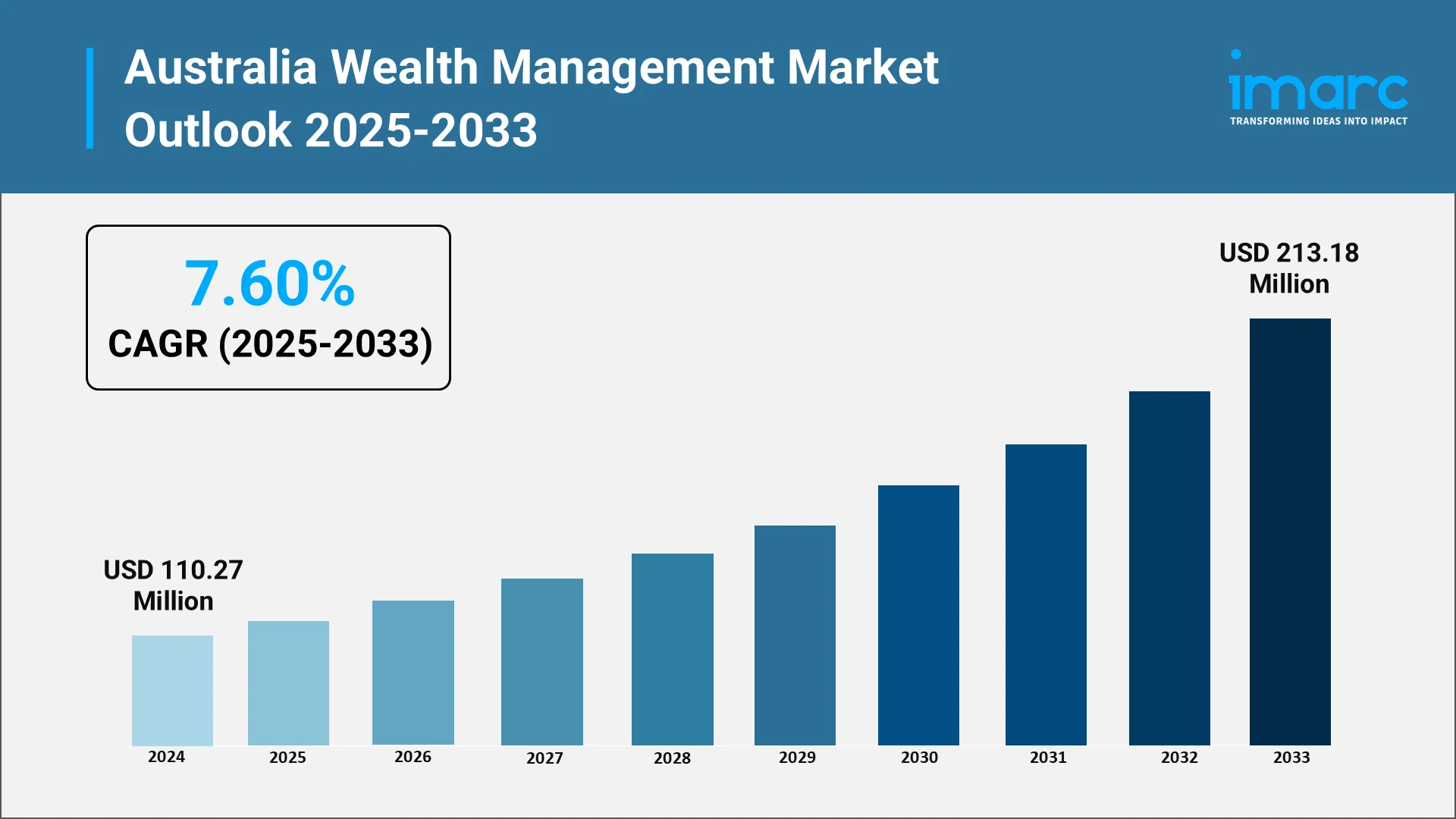

The Australia wealth management market size reached USD 110.27 Million in 2024. Financial institutions are prioritizing client-centric solutions, sustainable investing, and advanced digital interfaces to retain competitive advantage. With robo-advisory platforms gaining traction and hybrid advisory models bridging technology and human expertise, Australia’s wealth management ecosystem is poised for significant evolution. This shift marks a strategic realignment from conventional portfolio management to integrated digital ecosystems that emphasize intelligent insights and adaptive investment strategies tailored to diverse investor needs.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Australia Wealth Management Market:

Artificial intelligence has emerged as the pillar of innovation for Australia wealth management industry, allowing companies to improve efficiency, accuracy, and customization. Algorithms based on AI now form the backbone of everything from the construction of investment portfolios to risk profiling and client interactions. Through the analysis of huge data sets, these programs create actionable information that informs advisors about behavioral tendencies, market movement forecasts, and personalized financial advice.

Robo-advisory platforms are perhaps the most obvious result of AI integration. They make wealth management more accessible by delivering low-cost, automated portfolio solutions to a wider population and ensuring regulatory compliance. Operational resilience is also enhanced by AI with predictive analytics and automation that enables institutions to manage compliance, identify fraud, and optimize client acquisition strategy.

The effect runs to client relationships, too. AI-powered chatbots and virtual assistants provide instant support, whereas machine learning algorithms constantly update investment advice with performance data. The advantages are lower advisory expenses, improved asset allocation accuracy, enhanced client retention by hyper-personalization, and efficient administration processes. At the end of it, AI allows Australian wealth managers to scale their services efficiently while reserving human judgment for detailed financial choices.

Key Drivers Fueling Growth in the Wealth Management Sector:

- Rising High-Net-Worth Individual (HNWI) Population: Australia’s growing base of affluent individuals is significantly driving demand for sophisticated wealth management solutions. The number of Australians with assets exceeding USD 10 Million has reached 42,789, a 3.9% increase in one year, according to the industry reports. Australia ranks ninth globally, ahead of Hong Kong. The count of ultra-wealthy individuals is projected to continue growing in coming years. The expansion of entrepreneurial ventures, property investments, and inheritance wealth has boosted the need for comprehensive financial advisory services. Firms are increasingly targeting niche segments such as family offices and ultra-HNWIs seeking holistic financial planning, estate management, and succession strategies. This demographic growth is encouraging diversification in service portfolios, strengthening both retail and institutional client bases.

- Expansion of Superannuation Funds and Retirement Planning: Australia’s superannuation system remains one of the largest in the world, creating vast investment opportunities within wealth management. As retirees seek to preserve capital and ensure long-term income, demand for customized retirement solutions and advisory services continues to rise. Wealth management firms are developing innovative retirement income products, focusing on longevity planning and post-retirement portfolio diversification. The integration of technology in superannuation management has also increased transparency and investor confidence.

- Growing Popularity of ESG and Sustainable Investing: Environmental, Social, and Governance (ESG) considerations are increasingly shaping investment strategies in Australia. Clients are seeking portfolios aligned with ethical values and sustainability goals. Wealth management firms are responding by integrating ESG metrics into asset evaluation, offering impact investing products, and ensuring transparency in reporting. This trend not only meets investor demand but also aligns with global shifts toward responsible finance, enhancing brand reputation and long-term portfolio resilience.

The Role of Technology and AI in Wealth Management:

Technology has redefined the core architecture of Australia’s wealth management ecosystem. From client acquisition to asset allocation and compliance, digital platforms have become essential to ensuring agility and scalability. Robo-advisory platforms exemplify this evolution, offering algorithm-driven financial planning that minimizes human intervention while maintaining robust analytical precision. These systems use machine learning and predictive modeling to adapt investment recommendations dynamically in response to market volatility or client behavior.

AI further enhances personalization by integrating behavioral finance insights. By analyzing client preferences, spending habits, and life-stage objectives, firms can craft tailored portfolios that evolve with changing needs. Blockchain technology is also gaining traction in back-office operations, ensuring transparency and data integrity in transactions.

The integration of AI in compliance and risk management has been particularly transformative. Automated systems can now monitor transactions for anomalies, assess regulatory risks in real-time, and generate compliance reports efficiently. Meanwhile, hybrid advisory models where human advisors leverage AI-generated insights are becoming the industry standard, combining technological precision with human judgment to deliver superior client experiences. This convergence of technology and expertise positions Australia as one of the most technologically advanced wealth management markets globally.

Opportunities and Challenges Facing the Industry:

Opportunities:

- Expansion of Digital and Hybrid Advisory Models: The rise of digital wealth management platforms presents significant opportunities for scalability and accessibility. In September 2024, Iress launched its digital advice and education solution aimed at superannuation funds to address the needs of 11.8 million Australians lacking financial advice. The new tool, SuperSmart, offers personalized digital advice and education, tailored to member demographics, enhancing existing services for super funds and industry players.ess to self-guided and affordable financial planning tools. Firms can engage a broader audience through cost-efficient models while offering hybrid solutions that blend AI precision with human expertise. This approach allows personalized service delivery across multiple client tiers, from mass-affluent to ultra-high-net-worth investors. The growing comfort with digital financial tools ensures sustainable adoption across demographics.

- Regional Diversification and Global Investment Access: Australian investors are increasingly seeking exposure to international assets to balance risk and return. Firms offering cross-border investment solutions and digital platforms facilitating multi-currency operations are well-positioned to capitalize on this demand. Partnerships with global fund houses and the integration of AI-based currency and geopolitical risk assessment tools create new avenues for diversification and profitability.

Challenges:

- Cybersecurity and Data Privacy Risks: As wealth management becomes increasingly digital, data protection emerges as a critical concern. Cyberattacks, phishing, and data breaches can erode client trust and expose firms to regulatory penalties. Institutions must invest in robust cybersecurity frameworks, encryption protocols, and real-time threat monitoring to safeguard client assets and confidential information. Maintaining compliance with Australia’s evolving privacy regulations remains a persistent operational challenge.

- Regulatory Complexity and Compliance Costs: Constantly evolving regulations demand significant investment in compliance infrastructure. The need for continuous monitoring, documentation, and reporting places financial and operational pressure on firms. While RegTech solutions mitigate some challenges, smaller firms may struggle to maintain pace with compliance demands, potentially limiting innovation and market competitiveness.

Recent Trends, Market Developments, and Economic Impact:

Trends:

- Surge in Robo-Advisory Platforms: Australia has witnessed rapid adoption of robo-advisory services, catering to both retail and institutional investors. These platforms offer low-cost, algorithm-based portfolio management with minimal human intervention. The scalability and accessibility of robo-advisory models are expanding market reach, particularly among younger investors seeking automated yet intelligent investment solutions.

- Growth of Multi-Asset and Diversified Portfolios: Investors are increasingly diversifying portfolios across multiple asset classes, including equities, bonds, real estate, and alternatives. This trend is driven by the pursuit of stable returns amid global economic fluctuations. Wealth management firms are leveraging analytics to construct balanced portfolios that align with both performance and risk objectives.

Market Developments:

Some of the major recent market developments are:

- In October 2025, a delegation of Australia’s largest superannuation funds visited Britain to promote investment in infrastructure projects. This follows a previous summit in Washington, highlighting the potential for super funds to stimulate economic growth.

- In August 2025, the Australian Wealth Advisors Group (AWAG) launched a joint venture, OneLedger Wealth, with Melbourne-based OneLedger Group. The venture aims to enhance wealth management services, with AWAG holding a 50% stake. It follows previous equity partnerships and is expected to positively impact AWAG’s financials in the upcoming year.

- In August 2025, Goldman Sachs announced its plans to expand its private wealth management team in Australia, targeting self-made multimillionaires and family offices seeking global investment opportunities. With a current team of 13 in Sydney and Melbourne, the firm aims to leverage its global resources to cater to the growing wealth in the region.

Economic Impact:

The Australian wealth management industry plays a pivotal role in strengthening the nation’s economic framework by channeling savings into productive investments and supporting long-term financial stability. As wealth grows across demographics, increased capital allocation toward equities, real estate, and alternative assets enhances domestic investment flows. The sector’s integration with superannuation funds further contributes to economic resilience by ensuring steady capital accumulation for retirement security. Moreover, the rise of digital advisory platforms and AI-driven investment tools has improved financial inclusion, enabling broader participation in capital markets. Wealth management firms are also influencing job creation, innovation, and fiscal growth through technology partnerships and sustainable investment strategies. Overall, the industry not only enhances individual financial wellbeing but also bolsters Australia’s macroeconomic stability and investment competitiveness in the Asia-Pacific region.

Future Outlook:

The market is projected to reach USD 213.18 Million by 2033, exhibiting a CAGR of 7.60% during 2025-33, driven by the seamless convergence of technology, sustainability, and personalization. AI-driven automation will continue to redefine advisory operations, enabling predictive modeling, behavioral finance integration, and automated compliance systems. The rise of digital-first investors will push firms to adopt intuitive interfaces, transparent reporting, and on-demand advisory capabilities.

Over the next decade, hybrid advisory models are expected to dominate, offering cost efficiency without compromising trust and personalization. Sustainable investing and impact-driven portfolios will become core value propositions, reflecting a broader societal shift toward responsible finance. Additionally, the integration of blockchain and decentralized finance (DeFi) mechanisms may revolutionize transaction transparency and asset tokenization.

How IMARC Group is Guiding Innovation in the Wealth Management Landscape:

IMARC Group empowers stakeholders across the wealth management ecosystem with actionable intelligence and strategic foresight. Through data-driven insights, we help clients adapt to digital transformation, regulatory evolution, and shifting investor expectations.

- Market Insights: IMARC analyzes key trends such as the rise of robo-advisory platforms, AI-driven portfolio optimization, and sustainable investing. Our research identifies growth opportunities across private banking, superannuation, and fintech integration.

- Strategic Forecasting: We provide forward-looking projections on digital transformation, blockchain integration, and predictive analytics enabling firms to align investment strategies with long-term market shifts.

- Competitive Intelligence: IMARC tracks leading firms’ initiatives, including digital product launches, mergers, and automation strategies, helping clients benchmark performance and enhance competitiveness.

- Policy and Regulatory Analysis: Our studies decode evolving compliance frameworks, fiduciary standards, and ESG mandates, ensuring clients remain agile in a tightly regulated environment.

- Customized Consulting Solutions: IMARC designs tailored strategies to optimize digital adoption, client segmentation, and operational efficiency for sustained value creation.

As digitalization reshapes wealth management in Australia, IMARC Group remains committed to guiding firms through this period of strategic transition. Our insights empower decision-makers to adapt to a data-driven, client-centric, and sustainability-focused environment. By combining market intelligence, forecasting, and consulting expertise, IMARC Group helps organizations enhance performance, innovate responsibly, and position themselves at the forefront of the evolving wealth management landscape. For detailed insights, data-driven forecasts, and strategic advice, see the complete report here: https://www.imarcgroup.com/australia-wealth-management-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)