Top Factors Driving Growth in the GCC Outbound Travel and Tourism Market

Introduction to the GCC Outbound Travel and Tourism Industry:

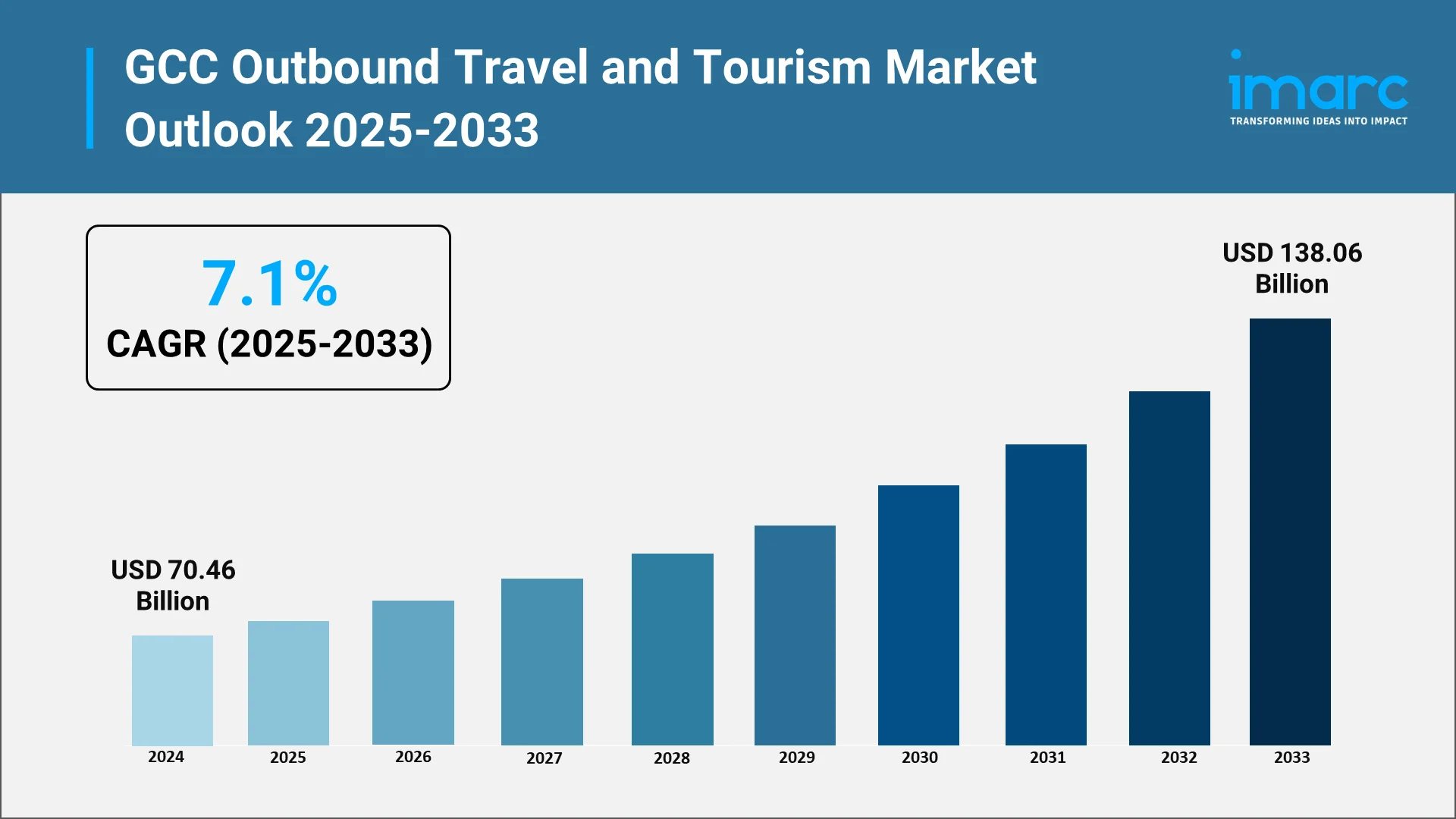

The GCC outbound travel and tourism market has experienced remarkable transformation, driven by economic prosperity, demographic shifts, and evolving consumer preferences. Citizens across the Gulf Cooperation Council nations, including Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, increasingly venture beyond borders to explore international destinations. This surge reflects a fundamental shift in how GCC travelers engage with the global tourism landscape. The GCC outbound travel and tourism market size was valued at USD 70.46 Billion in 2024.

The region's strategic position, robust aviation infrastructure, and liberalized visa regimes have positioned GCC nationals as highly sought-after tourist demographics. The GCC outbound travel and tourism market share continues expanding as travelers demonstrate distinct preferences for premium experiences, cultural immersion, and wellness journeys.

Multiple interconnected factors propel the GCC outbound travel and tourism market trends forward, from budget carrier proliferation and digital booking platforms to experiential travel and wellness tourism emphasis. The following sections examine key growth drivers reshaping this dynamic market.

Explore in-depth findings for this market, Request Sample

Growing Preference for Luxury and Experiential Travel:

Affluent GCC travelers demonstrate marked preference for luxury and experiential travel, moving beyond traditional sightseeing to seek authentic cultural encounters. This shift represents a maturation where emphasis has transitioned from destination ticking to meaningful engagement with local cultures, cuisines, and traditions. High-net-worth individuals and upper-middle-class families invest in personalized itineraries offering exclusivity and unique access.

The demand for experiential luxury manifests in various forms—from private villa rentals to curated culinary tours, adventure expeditions to immersive cultural programs. GCC travelers willingly pay premium prices for experiences providing genuine personal enrichment. This trend has prompted luxury hospitality brands to develop specialized offerings targeting GCC clientele, including Arabic-speaking concierge services, halal-certified dining, and culturally sensitive amenities.

Tour operators have responded by crafting sophisticated travel products blending luxury with authenticity. Private museum tours, behind-the-scenes cultural access, meetings with local artisans, and participation in traditional ceremonies have become integral to luxury itineraries. The experiential movement has catalyzed growth in gastronomy tourism, adventure travel, and heritage exploration, with GCC travelers showing particular interest in destinations offering rich historical narratives with world-class hospitality.

Rising Popularity of Wellness and Medical Tourism:

The intersection of wellness and medical tourism represents one of the fastest-growing segments within the GCC outbound travel market share. Increasing health consciousness among Gulf populations, combined with limitations in specialized domestic medical services, has driven substantial outbound flows to countries renowned for healthcare excellence. Thailand, India, Turkey, and select European nations have emerged as preferred destinations for GCC travelers seeking specialized treatments and comprehensive wellness programs.

Medical tourism from the GCC encompasses broad healthcare services, from cosmetic surgery and dental procedures to cardiac interventions and fertility treatments. The appeal lies in cutting-edge medical technology, cost advantages, and reduced waiting times. Many international hospitals have established dedicated wings for Middle Eastern patients, offering Arabic-speaking staff, prayer facilities, and culturally appropriate care protocols.

Parallel to medical tourism, the wellness travel segment has witnessed exponential growth as GCC residents increasingly prioritize holistic health and preventive care. Wellness retreats offering yoga, meditation, detoxification programs, and stress management attract significant numbers seeking respite from demanding urban lifestyles. Destinations like Bali, the Maldives, Switzerland, and Austria have developed specialized packages combining therapeutic treatments with luxurious accommodations. This reflects broader societal shifts toward health-conscious living.

Expansion of Low-Cost Airlines and Travel Connectivity:

The dramatic expansion of low-cost carrier networks has fundamentally democratized international travel for GCC populations, making outbound tourism accessible to middle-income families. Budget airlines operating from Gulf hubs have proliferated routes connecting secondary cities across Asia, Europe, and Africa, offering competitive fares that lower barriers to international travel. This aviation revolution has particularly benefited younger demographics and expatriate communities enjoying unprecedented mobility and destination choice.

The expansion of travel connectivity extends beyond aviation to encompass improved ground transportation, streamlined border procedures, and enhanced intermodal options. Major GCC airports have transformed into world-class hubs featuring extensive route networks, efficient transit facilities, and competitive pricing facilitating seamless international travel. Modern airport terminals with superior passenger amenities have elevated the entire travel experience, encouraging more frequent trips among Gulf residents.

Furthermore, strategic airline partnerships and codeshare agreements have expanded destination accessibility while maintaining service quality. Full-service carriers and low-cost operators increasingly collaborate to offer comprehensive coverage, allowing travelers to combine long-haul premium services with budget-friendly regional connections. This hybrid approach maximizes flexibility while accommodating diverse budgets. The resulting increase in flight frequencies and destination options has stimulated market growth by making international travel more convenient and appealing to broader demographic segments.

Increasing Digitalization and Online Travel Bookings:

The digital transformation of the travel industry has profoundly impacted GCC outbound tourism, with online travel agencies, mobile applications, and digital payment platforms revolutionizing how Gulf residents research, plan, and book international trips. The region's exceptionally high internet penetration and widespread smartphone adoption have created ideal conditions for digital travel services. Contemporary GCC travelers increasingly rely on digital channels throughout their travel journey.

Online booking platforms have empowered GCC travelers with unprecedented control over travel arrangements, enabling direct price comparisons, service reviews, and customer feedback across multiple providers. This transparency has intensified competition while enhancing consumer confidence in digital transactions. Many platforms have localized offerings for GCC markets, incorporating Arabic language options, regional payment methods, and customer service tailored to Middle Eastern cultural expectations. The convenience of 24/7 booking access particularly resonates with younger, tech-savvy demographics.

Social media platforms and travel influencer content play increasingly influential roles in shaping destination preferences among GCC populations. Visual platforms showcase aspirational travel experiences, authentic reviews, and practical tips that inspire wanderlust and inform itinerary planning. Many GCC travelers now discover destinations through social media rather than traditional advertising. The integration of booking capabilities within social platforms further streamlines the path from inspiration to reservation, encouraging impulse bookings for attractive offers.

High Disposable Income and Changing Lifestyle Preferences:

The GCC region's elevated per capita income levels and accumulated household wealth have created substantial consumer capacity for international travel. Economic prosperity manifests in multiple annual trips for many families, extended vacation durations, and willingness to invest in premium travel products enhancing the overall journey experience. The Saudi Ministry of Tourism reported that the Kingdom attracted 60.9 million domestic and international visitors in the first half of 2025, with total tourism spending exceeding SAR 161.4 Billion, reflecting 4% growth compared to the same period in 2024. This demonstrates the strong financial capacity and travel appetite characterizing the broader GCC population.

Beyond financial capacity, evolving lifestyle preferences among GCC populations have fundamentally altered attitudes toward international travel. Younger generations, particularly millennials and Generation Z, view travel not as occasional luxury but as regular lifestyle component essential for personal development and social currency. These demographics prioritize experiences over material possessions, allocating substantial income portions to travel adventures providing memorable stories and shareable content. This generational shift has expanded market demand while diversifying destination preferences and travel styles.

The changing work culture within GCC countries has also contributed to outbound travel growth, with generous vacation allowances and flexible work arrangements enabling longer international trips. Professional workers increasingly combine business travel with leisure extensions, maximizing time abroad. Family structures and social norms have evolved to embrace travel as valuable educational investment for children, with many families undertaking international trips to expose younger generations to diverse cultures, languages, and global perspectives.

Opportunities and Challenges in the GCC Outbound Travel and Tourism Industry:

The expanding GCC outbound travel and tourism market presents substantial opportunities for diverse stakeholders. Destination countries can attract high-spending Gulf travelers by developing tailored marketing campaigns, establishing direct air connectivity, simplifying visa procedures, and ensuring availability of halal food and Muslim-friendly amenities. Tourism boards and hospitality operators demonstrating cultural sensitivity stand to capture significant market share within this lucrative segment.

Technology companies and travel platform providers can capitalize on the region's digital-first approach by developing innovative solutions addressing specific pain points. Opportunities exist for Arabic-language travel applications, AI-powered personalization engines understanding Middle Eastern cultural preferences, and integrated platforms combining flights, accommodations, experiences, and destination services. Financial technology innovations facilitating seamless cross-border payments represent additional growth avenues within the digital travel ecosystem.

However, the GCC outbound travel and tourism market analysis also reveals significant challenges. Geopolitical instability in certain regions, fluctuating oil prices affecting disposable incomes, and periodic diplomatic tensions can create demand volatility. Environmental concerns and sustainability considerations increasingly influence destination choices, requiring industry adaptation. Competition among destinations has intensified, necessitating continuous innovation and differentiation. Service providers must also address infrastructure constraints, seasonal capacity limitations, and the need for culturally appropriate offerings respecting Islamic values and Middle Eastern customs.

Future Outlook for the GCC Outbound Travel and Tourism Industry:

The GCC outbound travel and tourism market is underpinned by favorable demographic trends, sustained economic capacity, and continued infrastructure development. The region's youthful population ensures a growing cohort of potential travelers with increasing purchasing power and international exposure. As GCC nations continue economic diversification initiatives and invest in education, travel propensity among nationals is expected to strengthen further.

A significant development supporting market growth is the GCC Unified Tourist Visa initiative, announced by the Gulf Cooperation Council for pilot launch in late 2025. According to UAE Minister of Economy and Tourism Abdulla bin Touq Al Marri, this Schengen-style visa will allow seamless travel across all six member states—UAE, Saudi Arabia, Oman, Qatar, Kuwait, and Bahrain—under a single digital application. The initiative represents a strategic step toward deeper regional integration and is expected to substantially boost cross-border tourism flows while reducing administrative barriers for international visitors.

Technological advancement will continue shaping market evolution, with artificial intelligence, virtual reality previews, and blockchain-based travel services offering enhanced personalization and security. The integration of biometric processing, contactless technologies, and automated customer service will streamline the travel experience. Sustainability considerations will likely gain prominence, with environmentally conscious travel options attracting growing interest from younger GCC demographics concerned about climate impact and ecological preservation.

The GCC outbound travel and tourism market size is projected to reach USD 138.06 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033. This will expand as new destination corridors emerge and previously underexplored markets gain accessibility. African tourism destinations, Central Asian countries, and secondary European cities represent growth frontiers as Gulf travelers seek novel experiences beyond traditional hotspots. The continued proliferation of experiential travel, wellness tourism, and adventure segments will diversify the market landscape while creating opportunities for specialized service providers catering to niche interests within the GCC traveler population.

Conclusion:

The GCC outbound travel and tourism market stands at an inflection point, characterized by robust growth drivers and evolving consumer behaviors promising sustained expansion. The convergence of economic prosperity, digital innovation, enhanced connectivity, and shifting lifestyle preferences has created a dynamic market environment rich with opportunities for destinations and service providers willing to invest in understanding and serving GCC travelers' unique needs.

Success in this market demands cultural intelligence, operational excellence, and continuous innovation to meet sophisticated expectations of Gulf travelers. As the industry navigates challenges from geopolitical uncertainties to sustainability imperatives, stakeholders who demonstrate agility, cultural sensitivity, and commitment to exceptional service delivery will be best positioned to capture value from this thriving market segment. The future belongs to those recognizing that serving GCC travelers requires genuine partnership, cultural respect, and dedication to creating memorable experiences that transcend borders.

Choose IMARC Group for Unmatched Market Intelligence:

At IMARC Group, we deliver comprehensive market intelligence empowering tourism stakeholders to make strategic decisions.

- Our data-driven research provides deep insights into traveler preferences, emerging trends, and competitive dynamics shaping the GCC outbound travel market.

- Through strategic growth forecasting, we help clients anticipate market shifts and identify opportunities across destinations and service segments.

- Our competitive benchmarking analyzes industry leaders to reveal best practices and differentiation strategies.

- We offer policy advisory services addressing regulatory developments, visa policies, and infrastructure initiatives affecting travel flows.

- Additionally, our custom consulting delivers tailored insights aligned with your organizational objectives, whether entering markets, optimizing offerings, or developing marketing strategies.

Partner with IMARC Group to transform market intelligence into competitive advantage in the GCC outbound travel sector. For more details, click: https://www.imarcgroup.com/gcc-outbound-travel-tourism-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)