Green Hydrogen Production Cost Model: Clean Molecules, Clear Costs

What is Green Hydrogen?

Green hydrogen is the cleanest form of hydrogen available, as it is produced through water electrolysis using the electricity generated from renewable energy sources such as solar, wind, or hydropower. Carbon dioxide emissions are zero since no fossil fuels are used. Essentially, an electrolyzer is used in the electrolysis process to split water molecules into hydrogen and oxygen. The resulting hydrogen is refined by purification, compression, or liquefaction and then fed into various applications. Green hydrogen is considered a cornerstone of the global energy transition because it can store renewable energy, decarbonize hard-to-abate sectors, and serve as a sustainable alternative to fossil-fuel-based hydrogen.

Key Applications Across Industries:

Green hydrogen is destined to play a vital role in many industries due to its versatility as a fuel, feedstock, and energy carrier. In industry, it replaces grey hydrogen at refineries, in ammonia production, and in chemical production, decarbonizing fertilizers, petrochemicals, and synthetic fuels. The steel industry is increasingly adopting green hydrogen for DRI processes, replacing coal-based reductants and enabling near-zero-emission steel production. The green hydrogen finds its application in FCEVs, ranging from buses and trucks to trains and marine vessels, in the transport sector. Hydrogen fuel cells have longer ranges and faster refueling times compared to their battery-electric counterparts, making heavy-duty and long-distance applications viable. Green hydrogen can be further transformed into e-fuels, such as e-methanol or sustainable aviation fuel, supporting decarbonization in aviation and shipping.

Another major application is energy storage. Green hydrogen has the ability to store excess renewable energy for long periods of time, hence supporting grid stability, seasonal storage, and energy security. Hydrogen can be used in power generation by way of blending it with natural gas or using it directly in hydrogen turbines. Green ammonia production, which could act as a fertilizer, marine fuel, or even a hydrogen carrier, also uses green hydrogen. Being a clean molecule, green hydrogen enhances decarbonization efforts across industries, mobility systems, and energy networks.

What the Expert Says: Market Overview & Growth Drivers

The global green hydrogen market reached a value of USD 2,477.8 Million in 2025. According to IMARC Group, the market is projected to reach USD 68,257.4 Million by 2034, at a projected CAGR of 44.55% during 2026-2034. Structural changes within the energy sector are driving the global green hydrogen market, along with policy commitments, industrial decarbonization imperatives, and technology advances. Perhaps the most powerful of all drivers is the global drive for net-zero, as many countries implement hydrogen strategies and climate policies that offer a boost to renewable-based hydrogen production. Governments are offering subsidies, tax incentives, carbon pricing mechanisms, and funding for large-scale electrolyzer installations, making green hydrogen increasingly cost-competitive.

This rapid increase in renewable energy capacity-including solar and wind-gives plentiful supplies of the low-cost electricity required for producing green hydrogen. With falling renewable energy prices, the cost of producing green hydrogen falls, which enhances its attractiveness to industries looking at alternatives to fossil fuels. Another major driver is decarbonization of hard-to-abate sectors such as steelmaking, chemicals, refining, heavy transport, and aviation. These industries have specific demands for high-temperature heat or dense energy carriers that are not accessible through electrification; green hydrogen would fill in this gap.

Large-scale adoption is also being enabled by the development of the global hydrogen economy, comprising hydrogen pipelines, storage, refueling infrastructure, and port facilities. The investment of multinational corporations and industrial clusters in hydrogen hubs integrated with value chains is creating new markets and further accelerating commercialization.

Technological advances within electrolyzers-PEM, alkaline, and solid oxide technologies-continue to improve efficiency while reducing capital costs and are allowing for modular and scalable hydrogen production systems. Substantial investments in green ammonia, synthetic fuels, and hydrogen-based energy storage are increasing the number of possible end-uses. Furthermore, geopolitical initiatives to decrease dependence on fossil fuel imports and to diversify energy supplies enhance the strategic role of green hydrogen. All these drivers combined make green hydrogen a vital part of global decarbonization and a pivot towards a robust and sustainable energy system.

Case Study on Cost Model of Green Hydrogen Production Plant

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium scale green hydrogen production plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed green hydrogen production plant in India. This plant is designed to manufacture 300 tons of green hydrogen annually.

Production Process: The production process of green hydrogen is based on the generation of hydrogen by electrolysis of water, which takes place with electricity from renewable sources, such as solar or wind, hydropower, and geothermal. The process begins with the provision of renewable electricity, which is then channeled into an electrolyzer, an industrial device that splits water (H2O) into hydrogen (H2) and oxygen (O2). Water is purified before it enters the electrolyzer by filtration, demineralization, and reverse osmosis in order to remove impurities, which could damage components within the electrolyzers. Within the electrolyzer, electricity passes through electrodes separated by a membrane, thereby causing water molecules to dissociate. Each type of electrolyzer-alkaline, AEL; proton exchange membrane, PEM; or solid oxide electrolyzer, SOEC-specifies different operating conditions, depending also on efficiency. AEL systems use liquid electrolytes, PEM systems employ a polymer membrane for high-purity hydrogen, while the operation of SOEC is at high temperatures in order to enhance its energy efficiency. Oxygen is released at the anode during electrolysis and is vented or captured for industrial use, while hydrogen builds up at the cathode. The raw hydrogen gas is then fed through drying, purification, and compression steps to remove any moisture and residual oxygen to high purity for industrial, mobility, or energy storage applications. The generated pure hydrogen can be compressed or liquefied for easier transport either in its pure form or as a derivative in the form of green ammonia or methanol. Smart systems will include renewable energy forecasting, battery storage, and controls for the smart grid to optimize electrolyzer operation and maintain continuous hydrogen production. In sum, the production process emphasizes efficiency, purity, and sustainability; hydrogen is manufactured with no carbon emissions, ensuring it can serve as a clean energy carrier.

Get a Tailored Feasibility Report for Your Project Request Sample

Raw Material Required:

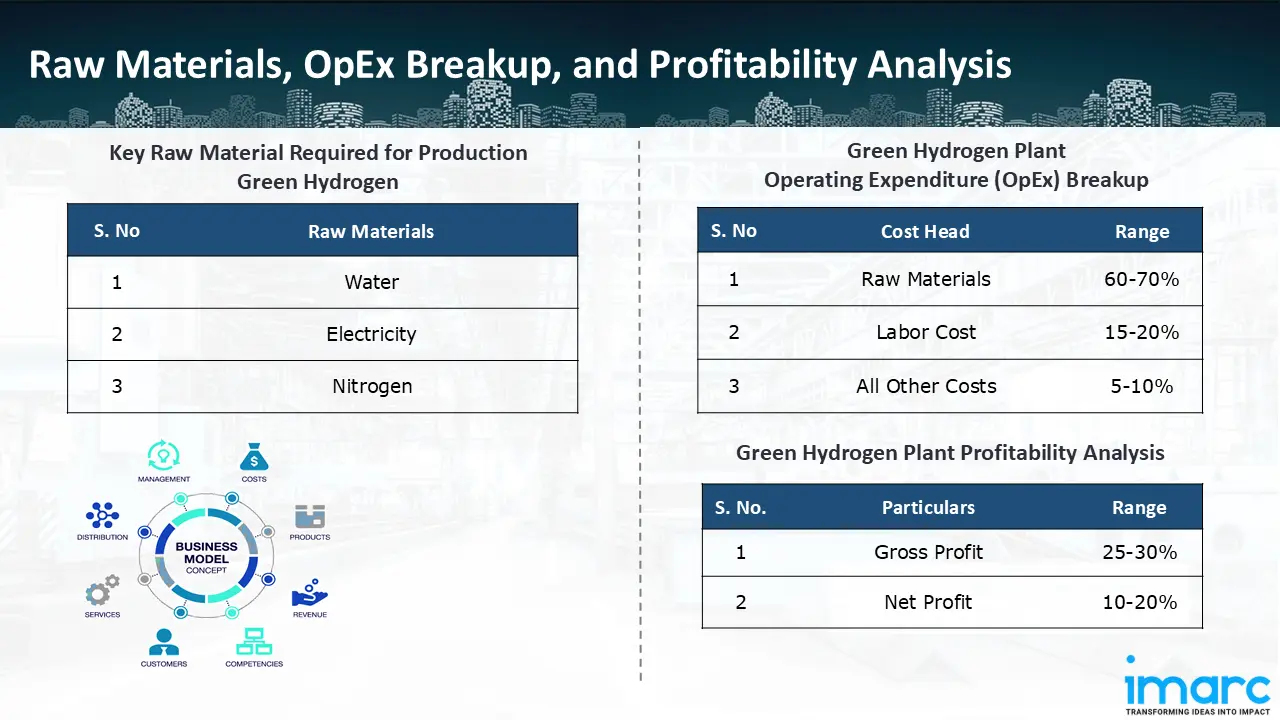

The basic raw materials required for green hydrogen production include:

- Water

- Electricity

- Nitrogen

Machine Section or Lines Required:

- Electrolyzer

- Purification

- Compression

- Storage

Techno-Commercial Parameter:

- Capital Expenditure (CapEx): Capital expenditure (CapEx) in a production plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a production plant effectively. Opex in a production plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a production plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth. Furthermore, raw material cost in green hydrogen production plant ranges between 60-70%, labor cost ranges between 15% to 20%, and all other costs ranges between 5-10% in the proposed plant.

- Profitability Analysis Year on Year Basis: We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins lie between a range of 25-30%, and net profit lie between the range of 10-20% during the income projection years, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the green hydrogen production plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, production, capital expenditure, and operational expenses. By addressing the specific requirements of production 300 tons of green hydrogen annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale production ventures.

Latest News and Developments:

- In November 2025, JSW Group started manufacturing at its massive green hydrogen facility in Vijayanagar, India. A nearby direct reduction iron (DRI) mill run by JSW Steel would be powered by green hydrogen produced by the huge Indian company. 3,800 tonnes of green hydrogen are anticipated to be produced during the pilot phase, which may be the world's largest green hydrogen deployment for steelmaking.

- In June 2025, India's first off-grid 5 MW Green Hydrogen Pilot Plant in Kutch, Gujarat, was successfully commissioned, according to Adani New Industries Limited (ANIL), marking a significant turning point in the country's clean energy transition.

- In April 2025, OMV announced the successful start-up of its largest green hydrogen generation unit in Austria, a 10-megawatt facility situated in the Schwechat refinery near Vienna. The facility, which can create up to 1,500 metric tonnes of green hydrogen annually, has been invested about EUR 25 million.

Why Choose IMARC?

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the production facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish production facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104