How Big Will be the B2B Payments Market by 2033?

The Global Payment Ecosystem Is Transforming at an Unprecedented Scale:

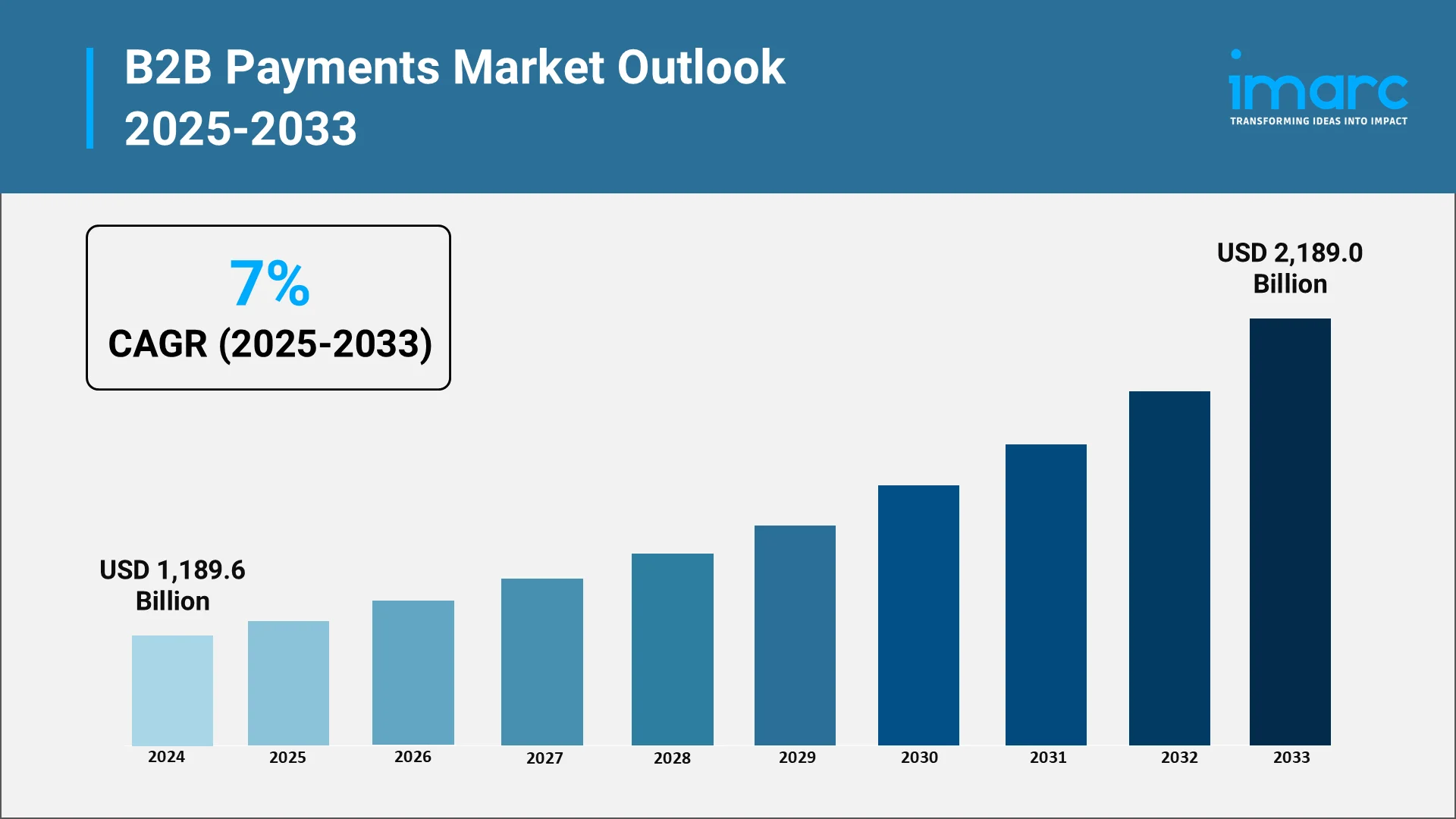

The global business-to-business (B2B) payments landscape is experiencing a fundamental transformation that is reshaping how enterprises conduct financial transactions across borders and industries. The market valued at USD 1,189.6 Billion in 2024 is projecting remarkable growth with expectations to reach USD 2,189.0 Billion by 2033, exhibiting a CAGR of 7% from 2025-2033. This exponential expansion is signaling a paradigm shift in commercial finance, driven by technological innovation, changing business expectations, and the urgent need for more efficient payment infrastructures.

The complexity inherent in B2B transactions is distinguishing this sector from consumer-facing payment systems. Business-to-business payments are promoting safer transactions for merchants requiring recurring, periodic transactions while offering a variety of functions to end users, including accounts receivable, accounts payable, payroll, and acquisition departments.

Explore in-depth findings for this market, Request Sample

Digital Revolution and Cross-Border Commerce Are Powering Market Expansion:

Multiple converging forces are propelling the B2B payments market toward unprecedented growth, with digitalization emerging as the primary catalyst transforming the commercial finance landscape. The increasing digitalization and automation in the B2B payment system is expanding demand among business owners for networking and connecting with various suppliers, distributors, and retailers worldwide, while the market is being driven by the increasing adoption of digital payment solutions, automation, and cloud-based financial systems.

The global expansion of electronic commerce is creating substantial momentum for B2B digital payments innovation. The rise of e-commerce platforms is driving the demand for seamless cross-border payments. As businesses are expanding their supplier networks across international boundaries, the necessity for payment solutions capable of handling multiple currencies, navigating diverse regulatory frameworks, and providing real-time transaction visibility is becoming increasingly critical. For example, NTT Data, OneHotel, and Mastercard together launched a simplified payment processing between online travel agents (OTA) and hotels in Thailand. This solution streamlines and digitizes the hotel payment process, automating the handling of incoming virtual card payments, removing the necessity for manual reconciliation of separate transactions, and enabling seamless processing of payments from OTAs.

The acceleration of automation technologies is revolutionizing accounts payable and accounts receivable processes across industries. Organizations are recognizing that manual payment processes are not only time-consuming but also prone to errors and vulnerable to fraud. The the rise of digital transformation and the widespread use of online payment platforms instead of traditional paper-based methods that require manual printing, mailing, processes, and administrative costs are enhancing the B2B payments market. Advanced automation systems are now enabling approval workflows, instant payment processing, and real-time tracking capabilities that were impossible with legacy systems.

Market Projections Signaling Explosive Growth Across All Segments:

The global B2B payments industry is experiencing robust growth at an impressive pace, fueled by ongoing digital transformation and the growing convergence of finance and technology. Over the next decade, the market is expected to multiply in value as businesses across all sectors migrate from traditional, paper-based transactions to fully digital ecosystems. The adoption of innovative payment solutions, real-time processing, and intelligent automation is significantly increasing transaction speed, transparency, and efficiency.

This transformation is being driven by the widespread use of cloud-based platforms, fintech partnerships, and integrated payment technologies that are simplifying complex financial workflows. Companies are now embedding payment functionalities directly into their enterprise systems, allowing seamless management of invoices, approvals, and settlements. As a result, digital transactions are rapidly becoming the standard for corporate payments worldwide.

By 2033, the global B2B payments landscape is expected to operate almost entirely within a digital framework, characterized by interconnected systems, advanced analytics, and enhanced B2B payment security standards. Businesses that are embracing this evolution today are positioning themselves at the forefront of an increasingly automated and globally unified payment environment.

Regional Dynamics Are Reshaping the Global Payment Architecture:

The geographical distribution of B2B payments growth is revealing fascinating patterns that are reflecting broader economic trends and technological adoption rates across different regions. Asia-Pacific is emerging as the undisputed leader in both current market share and future growth potential.

Asia-Pacific is a major shareholder in the market. This exceptional growth rate is being driven by several converging factors. Numerous enterprises specializing in financial technology across China, Japan, and India are providing advanced payment technologies to businesses, creating a highly competitive and innovative ecosystem. The region's large population, rapidly expanding middle class, and increasing digital literacy are combining to create ideal conditions for payment innovation.

Europe and North America are also dominating the B2B payments transaction market due to high government spending on transaction network security, advanced infrastructure, and standard rules and regulations. The European market is benefiting from increasing adoption of instant payment technology among businesses, improvements in commercial cash management systems, and rising use of digital banking services in the corporate sector.

North America is leveraging its established financial infrastructure and technological leadership to maintain a strong market position. The collaboration between traditional financial institutions and agile fintech companies is creating sophisticated hybrid solutions that are addressing the complex needs of modern enterprises.

Blockchain, Real-Time Systems, and AI Are Redefining Payment Capabilities:

The technological landscape underpinning B2B payments is undergoing a revolutionary transformation, with multiple innovations converging to create unprecedented capabilities. Blockchain technology is emerging as one of the most disruptive forces reshaping the payment infrastructure.

B2B cross-border transactions conducted on blockchain technology is rising globally. The distributed ledger technology inherent in blockchain is offering businesses enhanced transparency, reduced transaction costs, and near-instant settlement times. Traditional cross-border payments can take days to settle, while blockchain technology is allowing for near-instant international transfers and transactions operating seamlessly. Moreover, Stablecoins, a type of digital currency represented as tokens on a blockchain, have arisen as a worldwide substitute for traditional payment systems. Stablecoin circulation, primarily issued in US dollars, has increased twofold in the last 18 months but enables only around $30 billion in transactions each day, accounting for under 1 percent of worldwide monetary movements. In 2025, the Bank of North Dakota revealed intentions to introduce the Roughrider coin, marking the state’s inaugural stablecoin.

Real-time payment systems are experiencing explosive growth as businesses demand immediate transaction processing and settlement. The traditional model of multi-day settlement periods is becoming increasingly unacceptable in a business environment that demands immediate access to working capital and real-time visibility into cash positions. In 2024, payabl., a top financial services provider in Europe, has unveiled its Payment Accounts, a cloud-driven, API-first solution aimed at assisting businesses of any size in managing their daily payment requirements on a single, user-friendly platform. payabl. virtual business cards offer enterprises enhanced control, security, and insight into their expenditures.

Artificial intelligence (AI) and machine learning (ML) technologies are revolutionizing fraud detection, payment routing optimization, and process automation. AI-enhanced software helps protect businesses from unauthorized transactions, optimizing cash flow management, minimizing manual errors, and boosting productivity. These intelligent systems are identifying anomalies that might indicate fraudulent activity, analyzing transaction patterns in real-time, and automatically implementing preventive measures.

The rise of virtual cards is providing businesses with enhanced security and control over payment processes. Virtual cards are offering dynamic card numbers for each transaction, spending limits that can be adjusted in real-time, and detailed transaction data that simplifies reconciliation.

Emerging B2B Payments Opportunities Are Creating New Value Propositions:

The evolving B2B payments landscape is unveiling numerous opportunities for businesses willing to embrace innovation and adapt to changing market dynamics. The shift toward digital payments is creating demand for integrated solutions that address multiple pain points simultaneously.

Payment-as-a-Service models are gaining traction as businesses seek to outsource payment complexity to specialized providers. These comprehensive platforms are offering end-to-end solutions encompassing invoice processing, payment execution, reconciliation, and reporting within unified interfaces.

The expansion of embedded finance is opening new channels for payment innovation. Businesses are increasingly expecting payment capabilities to be integrated directly into the software platforms they use for procurement, inventory management, and supplier relationship management. This integration is eliminating friction points and enabling straight-through processing from purchase order to payment execution.

The B2B payments market in emerging economies, particularly in Asia-Pacific regions, is expanding as SMEs are using digital payment systems to improve workflows and enter global markets. Small and medium-sized enterprises (SMEs) that previously lacked access to sophisticated payment infrastructure are now gaining capabilities that were once exclusive to large corporations. This democratization of payment technology is leveling the competitive playing field and enabling smaller businesses to participate in global supply chains.

Security Threats and Legacy Systems Are Challenging Rapid Adoption:

Security threats and legacy infrastructure are slowing down the shift to modern payment systems. The rise in payment fraud is one of the biggest problems companies face. The 2025 AFP Payments Fraud and Control Survey, sponsored by Truist, found that 79% of organizations experienced attempted or actual payments fraud incidents in 2024. Human error adds to the issue, with businesses losing an estimated 1–3% of their budgets annually from mistakes in vendor or supplier payments. Because B2B transactions often involve high values, they are prime targets for cybercriminals.

Complex workflows and multiple approval steps make B2B payments especially vulnerable. Legacy systems, large transaction volumes, and multi-step verification chains create weak points that attackers exploit. Business email compromise scams, where criminals impersonate executives or vendors to trigger fake payments, are now harder to detect.

Legacy systems are another obstacle. Many firms still use hybrid setups where old enterprise software connects with newer payment platforms. These outdated systems often lack modern security features, leaving integration points exposed. Fully replacing legacy systems is costly, so many companies delay modernization despite the risks.

Internal resistance is another barrier. Many finance teams hesitate to leave behind long-standing systems. The learning curve, fear of disruptions, and uncertainty about cost savings slow progress.

Strategic Imperatives for Businesses Navigating Payment Transformation:

Organizations seeking to capitalize on the opportunities presented by evolving B2B payment systems must adopt comprehensive strategies that balance innovation with risk management. The imperative to digitize is clear, but successful implementation requires careful planning and execution.

Building security into payment infrastructure from the outset is essential rather than treating it as an afterthought. The best companies are continuously reevaluating their risks, with compliance built into the architecture of products and services rather than bolted on later. This proactive approach requires organizations to conduct regular risk assessments, implement multi-layered security controls, and foster cultures where employees are empowered to report suspicious activities without fear of repercussion.

Embracing automation while maintaining appropriate human oversight represents a delicate balance. While automated systems are offering substantial efficiency gains and reduced error rates, completely removing human judgment from payment processes can create new risks.

Strategic partnerships between traditional financial institutions and innovative fintech companies are creating synergies that accelerate innovation while leveraging established infrastructure and regulatory expertise. Banks are bringing deep industry knowledge, extensive customer relationships, and regulatory compliance capabilities, while fintechs are contributing technological agility, user experience design expertise, and innovative business models. For example, in 2025, FAB collaborated with Oracle and Mastercard to introduce MENA’s inaugural embedded B2B payment solution, improving efficiency, security, and transparency for enterprises. This partnership merges the capabilities of two industry frontrunners to transform B2B finance and payment procedures for FAB customers, improving efficiency, security, financial clarity, and supplier connections.

The future trajectory of the B2B payments market is pointing toward continued rapid evolution driven by technological innovation, changing business expectations, and the inexorable shift toward digital-first commerce. Organizations that are strategically positioning themselves to capitalize on these trends, by investing in modern payment infrastructure, prioritizing security and compliance, and fostering cultures of continuous innovation, are positioning themselves for competitive advantage in an increasingly digital global economy.

Unlocking Growth: IMARC Group’s Outlook on the Global B2B Payments Market by 2033:

IMARC Group is providing essential analysis on the Global B2B Payments Market, guiding financial institutions, enterprises, and fintech firms toward opportunities emerging through 2033. Our research supports strategic planning in digital transformation, payment innovation, and regulatory compliance through:

- Market Intelligence: Detailed insights into the digitalization of B2B payments, automation trends, and cross-border transaction innovations across industries such as manufacturing, retail, and services.

- Strategic Forecasting: Projections on market growth, transaction volumes, and adoption of advanced technologies including AI, blockchain, and embedded finance that are reshaping efficiency and transparency.

- Competitive Benchmarking: Evaluation of key global and regional players—banks, fintechs, and processors—focusing on product innovation, partnerships, and market positioning.

- Regulatory Analysis: Assessment of AML, KYC, and data protection frameworks affecting B2B payment operations, ensuring alignment with international compliance standards.

- Consulting Solutions: Customized strategies that enhance digital payment infrastructure, strengthen fraud prevention, and optimize working capital.

IMARC Group’s insights help businesses anticipate growth opportunities, mitigate risks, and lead in the rapidly evolving B2B payments landscape by 2033.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)