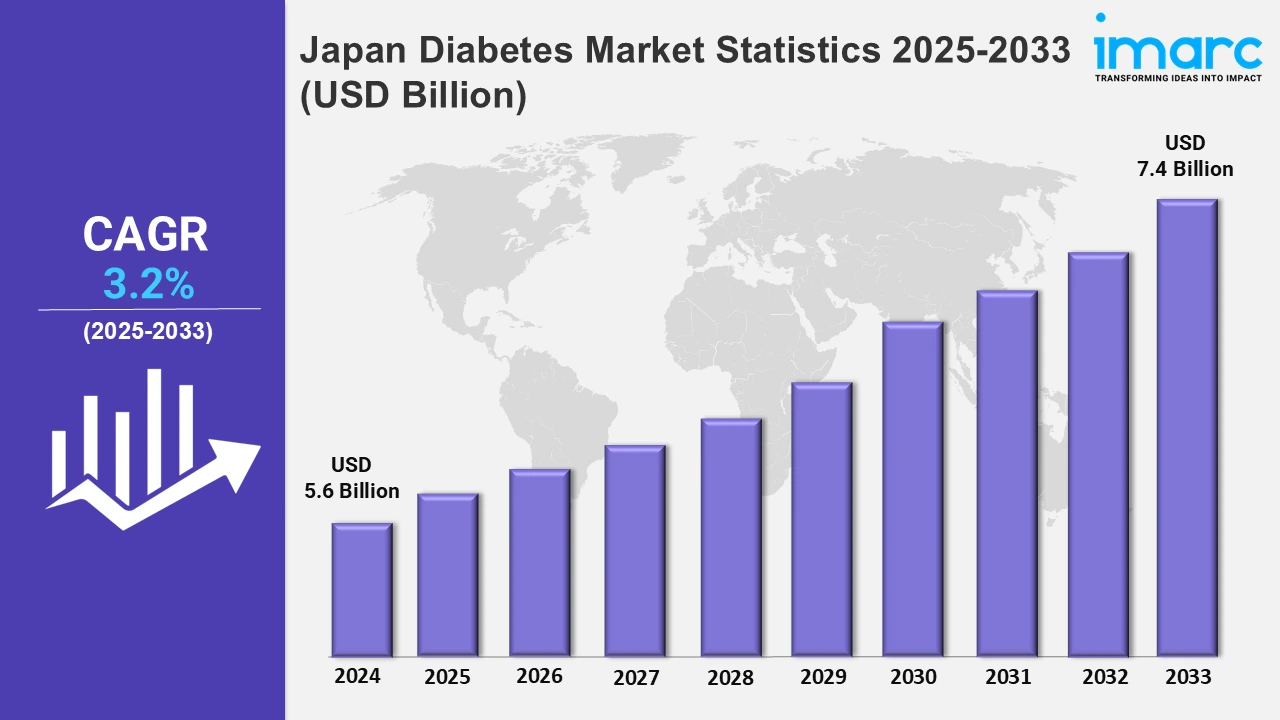

Japan Diabetes Market Expected to Reach USD 7.4 Billion by 2033 - IMARC Group

Japan Diabetes Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan diabetes market size was valued at USD 5.6 Billion in 2024, and it is expected to reach USD 7.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% from 2025 to 2033.

To get more information on this market, Request Sample

The Japan diabetes market is witnessing significant advancements driven by an aging population, rising prevalence of type 2 diabetes, and evolving therapeutic innovations. The increasing demand for effective management options for diabetes, particularly among patients with comorbidities such as renal impairment, is a notable growth factor. Additionally, Japan’s robust healthcare infrastructure and focus on personalized medicine are fueling research and development efforts aimed at addressing diverse patient needs. Several key developments highlight this trend, emphasizing the focus on safety, efficacy, and simplified treatment regimens. For example, in August 2024, Sumitomo Pharma's TWYMEEG demonstrated safety in type 2 diabetes patients with renal impairment, paving the way for regulatory discussions to update its label for use in patients with an estimated glomerular filtration rate (eGFR) below 45 mL/min/1.72m². This breakthrough addresses a critical gap in the management of diabetes among patients with compromised kidney function.

Similarly, Eli Lilly's QWINT trials, reported in September 2024, established the safety and efficacy of once-weekly insulin efsitora alfa, offering an alternative to daily insulin for insulin-naïve and transitioning patients. The ability to maintain comparable A1C reduction with fewer administrations simplifies diabetes management and enhances patient adherence. These innovations reflect the industry’s shift towards convenient and patient-centered solutions. Moreover, the growing emphasis on novel drug classes and their mechanisms of action is also shaping the Japanese diabetes treatment landscape. In November 2024, a Japanese study highlighted the potential of imeglimin, a mitochondrial function-targeting agent, to enhance incretin secretion and β-cell function. Compared to metformin, imeglimin demonstrated superior efficacy in reducing HbA1c levels, thereby making it a promising option for addressing the diverse needs of diabetes patients, including those with complex conditions. These developments underscore the increasing focus on tailoring treatments to specific patient populations, improving safety profiles, and ensuring long-term effectiveness. As Japan continues to lead in diabetes research and innovation, the integration of advanced therapeutics into clinical practice will likely remain a key driver of market growth.

Top Companies Leading in the Japan Diabetes Industry

The diabetes market in Japan is expanding through strategic partnerships, innovative therapies, and patient education programs to meet the healthcare requirements of Japan. Also, this research report provides an extended analysis of the competitive landscape in the market with all the major companies. Furthermore, companies such as Novo Nordisk and Sanofi are inventing next-generation insulin therapy and glucose monitoring technologies. In addition, they run awareness initiatives to encourage diabetes management and work with regional suppliers for efficient product distribution. Consistent with these trends, Mitsubishi Tanabe Pharma Corporation introduced a new SGLT2 inhibitor for type 2 diabetes in May 2024 called CANAGLU OD Tablets. Moreover, MTPC allied with Eli Lilly Japan in April 2023 to develop an alternative treatment for type 2 diabetes.

Japan Diabetes Market Segmentation Coverage

- On the basis of segment, the market has been categorized into oral antidiabetics and insulin, wherein insulin represents the most preferred segment. Insulin commands a sizeable portion of the market, driven by the rising incidence of diabetes among older populations and the growing preference for insulin therapies to regulate blood sugar effectively. Japan’s healthcare system, recognized for its robust diabetes care infrastructure, facilitates broad access to insulin treatments. Innovations in insulin delivery systems and formulations also contribute to improved patient outcomes. In congruence with these trends, Astellas Pharma Inc. announced a partnership with Roche Diabetes Care Japan in March 2023 to develop the Accu-Chek Guide Me monitoring system and BlueStar, an FDA-cleared digital diabetes solution by Welldoc.

Browse IMARC Related Reports on Diabetes Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)