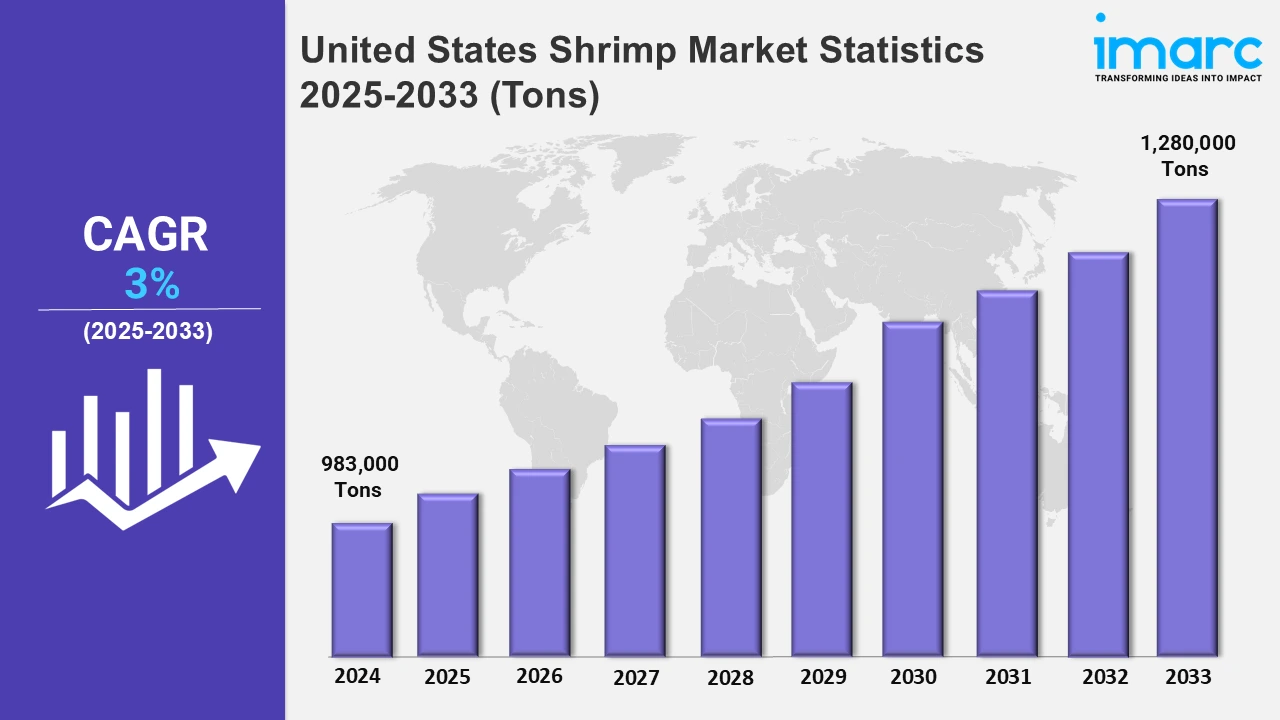

United States Shrimp Market Expected to Reach 1,280,000 Tons by 2033 - IMARC Group

United States Shrimp Market Statistics, Outlook and Regional Analysis 2025-2033

The United States shrimp market size was valued at 983,000 Tons in 2024, and it is expected to reach 1,280,000 Tons by 2033, exhibiting a growth rate (CAGR) of 3% from 2025 to 2033.

To get more information on this market, Request Sample

In the U.S. shrimp industry is experiencing growth driven by rising demand for sustainable seafood, which is pushed by increasing consumer understanding and choices for responsibly sourced items. Retailers and food service companies are expanding their seafood choices in response to consumer demand for antibiotic-free and environmentally friendly options. In this context, the market expansion is aided by the move toward high-end and value-added shrimp goods, such as frozen, ready-to-cook types. At the same time, leading companies are introducing advanced shrimp products to enhance comfort and accessibility. For instance, in November 2024, Prime Shrimp increased its footprint by joining 200 Whole Foods Markets across the country. The Louisiana-based business sells frozen, ready-to-cook shrimp from Ecuadorian aquaculture that are supplied ethically. In addition to meeting the growing demand in the Northeast, Mid-Atlantic, Southeast, and Southwest regions, this development increases the supply of domestic shrimp.

Additionally, advancements in shrimp farming technologies, such as land-based recirculating aquaculture systems, are gaining traction in the country. These systems enable year-round, sustainable shrimp production while mitigating environmental concerns associated with traditional farming. As a result, domestic shrimp production is experiencing a steady rise, reducing dependency on imports and ensuring high-quality, antibiotic-free shrimp for consumers. For example, in April 2023, Homegrown Shrimp USA launched its Florida-based RAS facility, producing 710 metric tons per year. The farm supplies premium shrimp to high-end markets while operating a hatchery that produces around 60 million post-larvae for U.S. and international shrimp farmers. This development underscores the increasing investment in innovative aquaculture solutions, aligning with the developing consumer preference for sustainable and locally sourced shrimp products.

United States Shrimp Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The growing demand for shrimp in the U.S. is driven by its versatility and convenient availability in various processed forms, thereby supporting market expansion.

Northeast Shrimp Market Trends:

The shrimp market in the Northeast is advancing through sustainable aquaculture to meet growing urban demand. In August 2024, Atarraya expanded its shrimp farming operations with a 200-tank Shrimpbox facility, using biofloc technology to reduce water waste and environmental impact. This ensures a fresh, local supply for New York City. Additionally, Suffolk County restaurants and retailers increasingly prioritize eco-friendly shrimp production, reflecting regional consumer preference for sustainable seafood over imported alternatives.

Midwest Shrimp Market Trends:

The Midwest shrimp industry is growing due to increasing indoor aquaculture, reducing reliance on coastal suppliers. Natural Shrimp expanded into new markets like Chicago, Minneapolis, and Kansas City in May 2024. Their Webster City facility, using recirculating aquaculture systems, ensures a steady supply of premium, sushi-grade shrimp. In Johnson County, restaurants are increasingly sourcing locally farmed shrimp, signaling a shift toward fresher, more sustainable seafood options as consumer awareness continues to rise.

South Shrimp Market Trends:

Southern shrimp farming is expanding with advanced breeding techniques and large-scale production. Trans-American Aquaculture improved domestic supply chains by harvesting 140,000 pounds of jumbo shrimp in Texas in December 2023. Moreover, the company concentrates on disease prevention, nutrition, and genetics to support shrimp farming in the United States. Further, companies in Cameron County favor farmed shrimp, which contributes significantly to the local economy due to improved quality control and a lesser risk of disease than imported shrimp.

West Shrimp Market Trends:

The Western shrimp industry is evolving with high-tech aquaculture methods addressing water scarcity. California shrimp farmers are adopting recirculating systems for sustainable production. Shrimp Box’s closed-loop technology in Los Angeles County is helping meet sushi restaurant demand while reducing environmental impact. As seafood consumption rises, California’s shrimp industry moves toward self-sufficiency. Local farmers aim to reduce reliance on Asian imports by supplying fresh, traceable shrimp for both retail and food service markets.

Top Companies Leading in the United States Shrimp Industry

Top shrimp companies are impelling US market growth through strategic initiatives, sustainability, and innovation. They fulfill consumer requirements for high-quality seafood by specializing in premium, ethically obtained shrimp. Ethical procurement, low environmental impact, and responsible aquaculture are examples of sustainability initiatives. Product innovation, such as value-added options and ready-to-cook meals, enhances market expansion. Strong distribution networks maximize accessibility. In April 2023, CP Foods introduced Homegrown Shrimp in Florida, which features a land-based farm with zero coastal effect and 100% water recycling. Modern aquaculture technology ensures shrimp are free of antibiotics, thereby sustaining the domestic shrimp finances with superior farmed shrimp.

United States Shrimp Market Segmentation Coverage

- On the basis of the environment, the market has been bifurcated into farmed and wild, wherein farmed represents the most preferred segment. Farmed shrimp control breeding conditions, higher yields, and consistent supply, making them a preferred choice over wild-caught varieties across seafood markets.

- Based on domestic production and imports, the market is categorized into domestic production and imports. Amongst these, imports dominate the market, driven by rising demand, lower production costs in exporting countries, and strong supply chains ensuring year-round availability in major consuming regions.

- On the basis of the species, the market has been divided into Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, and others. Among these, Penaeus Vannamei exhibits a clear dominance in the market, as it is favored for its fast growth rate, adaptability to aquaculture systems, and high consumer demand, making it the most commercially viable species in shrimp farming.

- Based on the product categories, the market is bifurcated into peeled, shell-on, cooked, breaded, and others, wherein peeled product dominates the market. Consumer prefers peeled shrimp products for convenience, widespread use in food service, and increasing retail demand for ready-to-cook seafood options.

- On the basis of the distribution channel, the market is segmented into hypermarkets and supermarkets, convenience stores, hotels and restaurants, online stores, and others. Currently, hotels and restaurants represent the largest segment in shrimp consumption, benefiting from high-volume purchasing, diverse menu applications, and growing demand for premium seafood in dining establishments.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 983,000 Tons |

| Market Forecast in 2033 | 1,280,000 Tons |

| Market Growth Rate 2025-2033 | 3% |

| Units | '000 Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Environments Covered | Farmed, Wild |

| Domestic Production and Imports Covered | Domestic Production, Imports |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Product Categories Covered | Peeled, Shell-on, Cooked, Breaded, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Stores, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Shrimp Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)