How Big Will Be the India E-commerce Logistics Industry by 2033?

Growing Online Shopping Increasing Parcel Movement Nationwide:

The exponential rise in online shopping is fueling unprecedented parcel movement across India. Consumers are increasingly relying on e-commerce platforms for everyday essentials, including fashion, electronics, grocery, and lifestyle products. Additionally, the rise of direct-to-consumer (D2C) brands has added a new dimension to the logistics ecosystem, with a growing emphasis on speed, reliability, and personalized delivery experiences.

Fashion and electronics remain dominant segments, accounting for a major share of total shipments due to frequent product launches and high order volumes. Meanwhile, the grocery and FMCG segments are witnessing the fastest growth, driven by increased adoption of online grocery delivery services in both urban and semi-urban areas. The shift in consumer preferences toward convenience and time efficiency has resulted in higher parcel volumes across pin codes, even in remote regions.

Moreover, India’s expanding digital infrastructure powered by affordable internet access and mobile commerce has democratized e-commerce beyond metro cities. Logistics companies are leveraging this momentum by investing in regional warehouses, last-mile delivery hubs, and tech-enabled fleet management systems to ensure faster order fulfillment. The integration of logistics platforms with e-commerce marketplaces has further streamlined the end-to-end delivery process, reducing lead times and improving customer satisfaction.

Explore in-depth findings for this market, Request Sample

Market Size and Growth Opportunity:

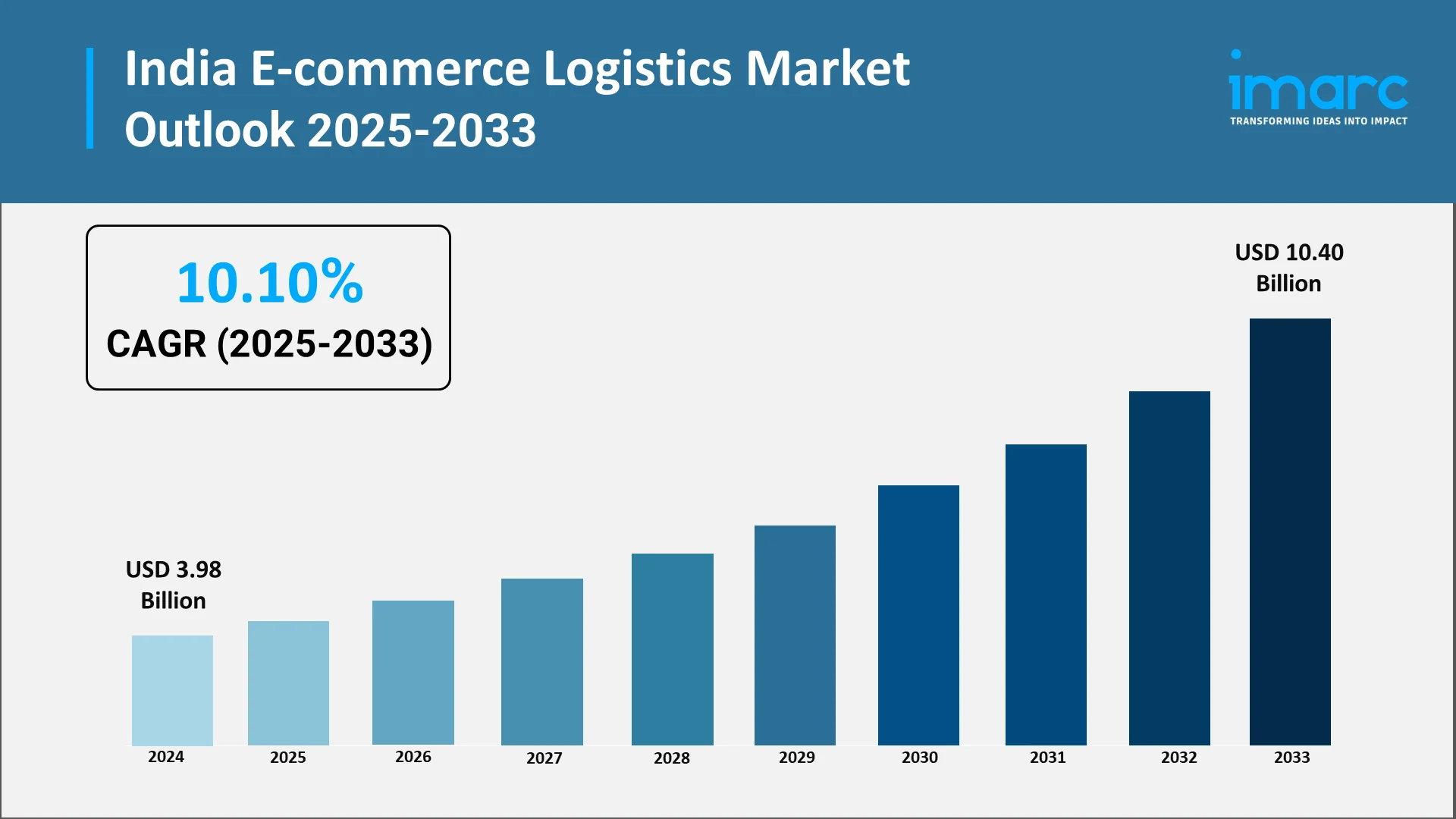

The India e-commerce logistics market size was valued at USD 3.98 Billion in 2024 and is projected to reach USD 10.40 Billion by 2033, growing at a CAGR of 10.10% during 2025–2033. This exponential growth reflects the expanding base of online shoppers, increased order frequency, and the growing penetration of organized logistics infrastructure across India’s urban and rural regions.

The market currently handles billions of deliveries annually, with volumes expected to multiply over the next decade. Tier-2 and Tier-3 cities are emerging as new growth frontiers, contributing significantly to shipment volumes as e-commerce platforms intensify their regional expansion strategies. Rising disposable incomes, improved logistics connectivity, and the proliferation of affordable smartphones have been instrumental in driving this growth.

Furthermore, government initiatives such as Digital India and the development of multimodal logistics parks under the National Logistics Policy are strengthening supply chain resilience. The adoption of electric vehicles for last-mile deliveries and sustainable logistics practices is expected to create new opportunities for eco-efficient operations.

As competition intensifies, logistics service providers are shifting from traditional models to agile, data-driven operations, focusing on faster delivery turnarounds and enhanced transparency. The introduction of hybrid delivery models combining centralized fulfillment centers with localized micro-warehouses is enabling companies to scale efficiently and manage peak order periods more effectively.

Same-day and Next-day Delivery Transforming Customer Expectations:

The rise of same-day and next-day delivery services has redefined consumer expectations in India’s e-commerce landscape. Shoppers now expect rapid, predictable, and transparent delivery experiences as a standard offering. In July 2025, Amazon launched its 10-minute delivery service, Amazon Now, in New Delhi, competing with Blinkit, Instamart, and Zepto. Supported by a INR 2,000 crore investment, the service aims to enhance its dark store network for faster deliveries. This move reinforces Amazon's focus on quick commerce in India's evolving market. This shift is compelling logistics players to rethink their distribution networks, warehouse placement, and inventory management strategies.

To meet these growing expectations, many e-commerce platforms are establishing dark stores and micro-fulfillment centers closer to key consumer clusters. These smaller, tech-enabled warehouses allow rapid dispatch and reduce delivery lead times, particularly in densely populated urban areas. The adoption of automated picking and packing solutions, along with predictive demand analytics, ensures inventory is strategically positioned to meet fluctuating order volumes.

The competition among e-commerce platforms to deliver faster has also spurred collaborations between retailers and logistics service providers. By integrating real-time tracking, advanced route optimization, and flexible delivery windows, businesses can enhance both efficiency and customer experience. Express logistics and hyperlocal delivery startups are further accelerating this trend, providing on-demand logistics solutions for everything from groceries to electronics.

In the long term, same-day and next-day delivery will become the benchmark standard across most categories, pushing companies to continuously innovate in warehouse automation, last-mile routing, and AI-driven delivery forecasting. For logistics providers, the ability to execute fast, accurate, and cost-effective deliveries will be a decisive factor for competitive advantage in the evolving market.

Smart Warehousing, Automation, and Real-Time Tracking Gaining Adoption:

Technology is revolutionizing the e-commerce logistics sector in India. Smart warehousing systems, powered by robotics, automation, and artificial intelligence, are transforming how goods are stored, sorted, and dispatched. These advancements enhance productivity, reduce manual errors, and optimize resource utilization, resulting in faster turnaround times.

AI-enabled inventory management tools are improving forecasting accuracy by analyzing purchasing patterns, seasonal trends, and regional demand variations. Meanwhile, robotic sorting systems are helping warehouses handle higher order volumes with greater precision, particularly during festive or promotional sale periods. Real-time tracking and data analytics provide end-to-end visibility across the supply chain, empowering logistics managers to make informed decisions and improve service reliability.

Moreover, Internet of Things (IoT) integration allows real-time monitoring of vehicle conditions, temperature-sensitive goods, and route performance. Combined with GPS-enabled tracking systems, this ensures transparent, traceable, and secure delivery operations. Blockchain technology is also gradually being adopted for improving transaction transparency, shipment verification, and fraud prevention in high-value consignments.

As India’s logistics ecosystem becomes more digitally integrated, automation will play a pivotal role in achieving scale, efficiency, and sustainability. The adoption of green logistics technologies such as electric delivery vehicles, automated packaging systems, and AI-based route optimization is further aligning with India’s vision for a resilient and sustainable logistics infrastructure.

Top Companies in the India E-commerce Logistics Market:

Key companies driving the India e-commerce logistics market growth include:

- Delhivery: In November 2025, Delhivery launched its intracity delivery service, Delhivery Direct, in Delhi-NCR and Bengaluru, competing with Uber and Rapido. The app enables 15-minute pickups for both small and large parcels using various vehicles. This move aims to capture the growing same-day delivery market in India, enhancing opportunities for drivers.

- Ecom Express: In March 2025, Ecom Express launched ‘Pragati’, a learning program aimed at upskilling over 4,000 delivery center managers in last-mile logistics. Utilizing a hybrid learning model, the initiative focuses on career development and local hiring, reinforcing the company’s commitment to operational excellence and a skilled workforce in India's logistics sector.

- Shadowfax: In October 2025, Shadowfax Technologies, supported by Flipkart, received Sebi approval for its IPO, targeting INR 2,000–2,500 crore to achieve an INR 8,500 crore valuation. The company aims to enhance capacity and drive growth in India’s expanding logistics sector, where e-commerce contributes 75% to its revenue.

How IMARC Group Supports Innovation in India’s E-commerce Logistics Industry:

IMARC Group provides in-depth insights into India’s rapidly expanding e-commerce logistics ecosystem, helping stakeholders navigate growth opportunities, operational challenges, and digital transformation trends. Our research empowers logistics providers, retailers, and investors to make informed, data-driven decisions through:

- Market Intelligence: We deliver actionable insights on key market shifts from rising parcel volumes and the dominance of fashion and grocery segments to the surge of D2C brands transforming delivery networks. Our analysis covers evolving consumer behavior, logistics automation, and the impact of Tier-2 and Tier-3 market expansion on distribution models.

- Forecasting and Opportunity Mapping: IMARC Group’s forecasting framework evaluates emerging opportunities in express delivery, warehousing automation, and sustainable logistics. We provide detailed projections of the India e-commerce logistics market size, revenue potential by segment, and expected CAGR trends through 2033 helping clients plan capacity, investment, and expansion strategies with precision.

- Competitive Benchmarking: We assess strategic developments among top logistics players, including innovations in last-mile delivery, technology adoption, and regional diversification. Our competitive benchmarking highlights how key companies are optimizing performance through partnerships, automation, and data-driven fleet management.

- Policy and Infrastructure Analysis: Our studies examine the impact of government initiatives such as the National Logistics Policy, Gati Shakti Master Plan, and Digital India on supply chain resilience and infrastructure expansion. We analyze how public–private collaborations and sustainability mandates are shaping the future of India’s logistics network.

- Tailored Consulting Solutions: Whether optimizing last-mile operations, evaluating warehousing strategies, or exploring new investment regions, IMARC Group offers customized consulting solutions designed to align with business objectives. Our domain expertise ensures clients stay agile, competitive, and future-ready in an evolving logistics landscape.

With the India e-commerce logistics market projected for significant growth, IMARC Group remains a trusted intelligence partner delivering strategic clarity, technological foresight, and actionable insights that drive sustainable growth across the logistics value chain. For detailed insights, data-driven forecasts, and strategic advice, see the complete report here: https://www.imarcgroup.com/india-e-commerce-logistics-marketket

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)