How the Marine Insurance Market is Shaping the Global Maritime Industry: Trends, Challenges, and Opportunities

Introduction:

The global maritime sector operates as the backbone of international trade, facilitating the movement of the world’s goods by volume. Within this vast and complex ecosystem, the marine insurance market plays an indispensable role by providing financial protection against risks inherent to maritime operations. From hull and machinery coverage to cargo, liability, and protection and indemnity (P&I) insurance, marine insurance safeguards the assets, revenues, and reputation of shipowners, cargo operators, and logistics companies.

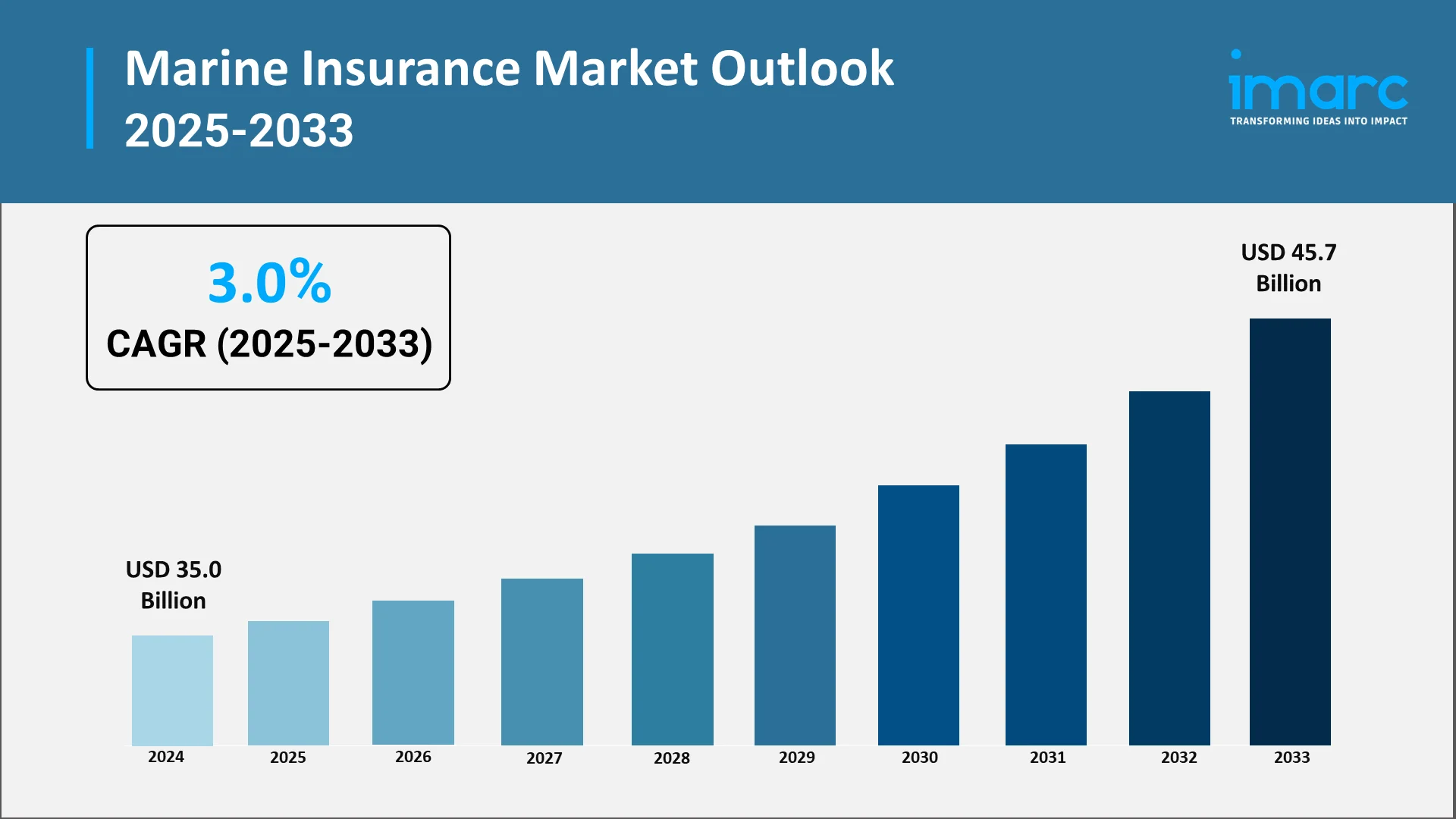

As the market continues to evolve, it is being shaped by a dynamic mix of technological innovation, regulatory transformation, and geopolitical shifts. The rise of digital underwriting platforms, predictive analytics, and automated claims processing is redefining how marine insurers assess risk and deliver value. Meanwhile, emerging risks such as cyberattacks, environmental liabilities, and climate-induced disruptions are prompting the industry to rethink conventional coverage models. The global marine insurance industry was valued at USD 35.0 Billion in 2024, and is expected to reach USD 45.7 Billion by 2033, exhibiting a CAGR of 3.0%, during 2025-2033, driven by the growing emphasis on sustainability and ESG compliance for modernized risk management frameworks tailored to the maritime economy of the future.

Explore in-depth findings for this market, Request Sample

The Role, Impact, and Benefits of Marine Insurance in the Maritime Sector:

Marine insurance acts as a stabilizing force within the maritime economy by mitigating financial uncertainty and ensuring operational continuity. It provides a structured mechanism for risk transfer, allowing shipowners and operators to navigate uncertainties such as collisions, cargo losses, equipment failures, and natural disasters with confidence.

The role of marine insurance extends beyond traditional indemnification. It fosters resilience in global supply chains, ensures financial security for maritime stakeholders, and supports regulatory compliance in international waters. By covering liabilities arising from pollution, crew welfare, and cargo handling, marine insurance underpins ethical and responsible maritime practices. In July 2025, Willis launched 'Undercover', a USD 200 Million insurance facility aimed at cargo owners facing geopolitical risks. In partnership with Markel, the solution offers tailored coverage for war, terrorism, political violence, and confiscation, ensuring clarity and reducing claims disputes amid rising political instability and uncertainty in global trade.

Additionally, the integration of advanced analytics and telematics in marine risk assessment enhances loss prevention. Insurers increasingly use vessel monitoring systems, predictive maintenance analytics, and real-time weather data to optimize coverage and reduce claim frequency. This technology-driven approach has improved the accuracy of underwriting decisions, leading to more competitive premiums and improved profitability across the value chain. Ultimately, marine insurance serves as a crucial enabler of global commerce balancing risk, facilitating trade, and promoting long-term maritime stability.

Key Growth Drivers in the Global Marine Insurance Market:

- Expansion of Global Maritime Trade and Fleet Modernization: The resurgence of international trade and the expansion of maritime logistics networks are driving the demand for comprehensive marine insurance coverage. As shipping volumes increase, vessel sizes expand, and new trade routes emerge, insurers are witnessing a corresponding rise in exposure. Fleet modernization initiatives, including the adoption of energy-efficient vessels and smart shipping technologies, further amplify the need for tailored risk protection. Insurers are capitalizing on these trends by developing modular products that cover hybrid propulsion systems, digital navigation risks, and integrated cargo tracking solutions. This expanding ecosystem continues to stimulate growth across the global marine insurance market.

- Technological Transformation in Underwriting and Claims Management: The application of artificial intelligence (AI), big data analytics, and automation is reshaping how marine insurers evaluate risks and manage claims. Predictive analytics enables underwriters to forecast potential losses based on vessel behavior, cargo type, and route volatility. Meanwhile, automated claims platforms have shortened settlement times, enhancing transparency and client satisfaction. The industry’s digital shift has also reduced administrative overheads, improved accuracy in risk profiling, and paved the way for scalable insurance products. As data-driven decision-making becomes the norm, technological innovation remains a primary catalyst for market expansion.

- Rising Focus on Environmental and Cyber Risk Coverage: With sustainability and digitalization at the forefront of maritime transformation, insurers are witnessing growing demand for products addressing new categories of risk. The transition to low-carbon fuels and the increasing adoption of smart ship systems have introduced vulnerabilities ranging from data breaches to machinery failures linked to alternative fuel usage. In response, insurers are designing ESG-aligned policies covering environmental liabilities, decarbonization compliance, and cyber defense mechanisms.

- Increased Investment in Port and Offshore Infrastructure: Large-scale investments in ports, shipyards, and offshore energy projects are creating fresh avenues for marine insurance demand. As nations upgrade maritime infrastructure and expand offshore wind and oil exploration assets, the exposure to operational and construction-related risks intensifies. Insurers offering specialized solutions such as offshore liability, construction all-risk, and marine hull coverage are gaining traction.

Regulatory Framework and Policy Landscape in the Marine Insurance Industry:

The regulatory landscape governing the marine insurance industry is designed to safeguard market integrity, protect stakeholders, and enhance global maritime safety standards. Regulatory bodies across major economies have implemented frameworks emphasizing solvency, risk management, and transparency in underwriting practices.

Compliance with international conventions such as MARPOL (International Convention for the Prevention of Pollution from Ships) and SOLAS (Safety of Life at Sea) forms the backbone of insurance obligations for vessel operators. Additionally, regulatory reforms focusing on digital compliance, anti-money laundering (AML), and know-your-customer (KYC) procedures have elevated the accountability standards of marine insurers.

In emerging markets, regulatory authorities are simplifying licensing and entry norms for foreign insurers, encouraging competition and innovation. The emphasis on harmonizing cross-border marine insurance regulations is fostering greater operational efficiency and reducing transactional friction in global trade. This evolving policy framework ensures that the marine insurance market remains robust, transparent, and adaptive to the changing dynamics of global shipping.

Government Support / Initiatives for the Marine Insurance Market:

- Promotion of Maritime Financial Hubs: Governments are actively positioning key cities as global maritime financial centers by incentivizing insurance innovation and foreign investment. Through favorable tax structures, strategic partnerships, and infrastructure development, these hubs are attracting insurers and reinsurers focused on marine and specialty lines. The creation of dedicated maritime clusters fosters collaboration between insurers, brokers, and regulators, promoting a competitive and well-capitalized insurance environment.

- Public-Private Partnerships for Risk Mitigation: Many governments have established public-private frameworks to address high-risk areas such as piracy, natural disasters, and geopolitical disruptions. In July 2025, the Indian government announced their plans to establish its first marine insurer, India Club, to provide third-party coverage for domestic vessels. This strategic initiative aims to reduce reliance on international P&I clubs, which often deny coverage under sanctions. Funding will involve fleet owners and public sector insurers, with proposals awaiting Cabinet approval. By sharing risk through government-backed reinsurance schemes and emergency funds, these partnerships stabilize the marine insurance ecosystem.

- Investment in Digital Maritime Ecosystems: Digital transformation initiatives, such as e-certification systems, blockchain-based logistics platforms, and port automation, are improving transparency across maritime operations. Governments are supporting insurers in integrating with these platforms to enable seamless policy issuance, claims verification, and fraud detection. Such efforts are reducing administrative burdens and fostering trust among market participants, thereby enhancing the efficiency and competitiveness of marine insurance offerings.

- Sustainability and Green Maritime Policies: In line with global decarbonization goals, governments are introducing green shipping programs that incentivize environmentally responsible operations. These initiatives encourage insurers to design sustainable underwriting products linked to carbon efficiency and pollution control measures. The alignment of insurance with environmental policy objectives strengthens both the credibility and future resilience of the global marine insurance industry.

Top Marine Insurance Companies Worldwide:

The global marine insurance industry is dominated by a mix of multinational insurers, mutual P&I clubs, and specialist underwriters that provide tailored solutions to the shipping sector. Key market players include:

- Allianz SE: In July 2025, Allianz Global Corporate & Specialty partnered with Hydor to enhance marine insurance in the Asia-Pacific region. The collaboration introduces a General Marine Liability product, combining Hydor's expertise with Allianz's financial strength, providing comprehensive coverage for maritime businesses, including cargo loss and third-party liabilities, up to USD 25 Million.

- Arthur J. Gallagher & Co.: In September 2025, Gallagher partnered with maritime insurance tech firm Vanguard Tech to enhance client support with risk assessment and security insights. The collaboration offers an AI platform for vessel safety monitoring, providing automated risk profiles and continuous hazard assessment, crucial amid geopolitical tensions affecting shipping routes.

- Lockton Companies: In October 2024, Lockton has launched a dedicated Offshore Projects Practice to address complex risks in the Energy, Marine, and Power sectors. Led by specialists, the team provides tailored risk transfer solutions for offshore ventures, ensuring clients can secure coverage amid evolving industry challenges and insurance market demands.

Other major key players include American International Group Inc., Aon plc, AXA S.A, Beazley plc, Brown & Brown Inc., Chubb Group Holdings Inc, Lloyd's of London, Marsh & McLennan Companies Inc., QBE Insurance Group Ltd, Swiss Re Ltd, Willis Towers Watson plc, Zurich Insurance Group Ltd., etc.

Opportunities and Challenges in the Marine Insurance Market:

Opportunities:

- Integration of Insurtech and Predictive Analytics: The marine insurance industry is witnessing a paradigm shift through the integration of insurtech and advanced analytics. Predictive modeling enables underwriters to analyze vast datasets on vessel movement, cargo characteristics, and weather conditions, allowing for more accurate pricing and risk forecasting. The adoption of digital platforms enhances transparency, speeds up claims settlement, and improves the customer experience.

- Emerging Markets and Regional Expansion: Rapid industrialization and growing maritime trade in emerging economies such as Southeast Asia, the Middle East, and Africa present significant growth opportunities. As these regions modernize their ports and expand shipping capacity, insurers have the chance to tap into new demand segments.

Challenges:

- Rising Risk Complexity and Climate Change: The increasing frequency of extreme weather events, such as hurricanes and floods, has intensified underwriting challenges for marine insurers. Climate change has made loss prediction more complex, affecting pricing accuracy and profitability. Additionally, environmental compliance obligations add financial strain to vessel operators, influencing premium structures.

- Regulatory Compliance and Market Volatility: The tightening of international regulations, coupled with fluctuating trade conditions and geopolitical tensions, adds complexity to marine insurance operations. Compliance with multi-jurisdictional standards demands significant investment in legal, operational, and reporting frameworks. Moreover, global trade disruptions such as port congestion or economic sanctions can trigger unpredictable claim patterns.

How IMARC Group is Guiding Innovation in a Rapidly Evolving Landscape:

IMARC Group supports stakeholders across the marine insurance ecosystem by delivering actionable insights that help clients navigate the evolving maritime risk environment. Our research and consulting services assist organizations in identifying growth opportunities, mitigating risks, and driving innovation in the marine insurance sector through:

- Market Insights: We evaluate global trends shaping marine insurance, such as digital underwriting, ESG-aligned policies, and cyber risk coverage. IMARC Group provides detailed analysis of market movements, including predictive analytics, blockchain-enabled claims management, and automated risk assessment, enabling insurers to optimize operations and enhance competitiveness.

- Strategic Forecasting: Clients receive forward-looking insights into marine insurance market growth, helping anticipate shifts in regulations, technology adoption, and sustainability requirements. Forecasts on automation, smart data integration, and risk modeling allow firms to make proactive investment decisions and plan for future market dynamics.

- Competitive Intelligence: We monitor developments in underwriting practices, new product offerings, and technological innovations. By benchmarking competitors, evaluating emerging risk solutions, and assessing strategic positioning, IMARC enables clients to improve performance and capitalize on market opportunities.

- Policy and Regulatory Analysis: We examine global maritime regulations, including MARPOL, SOLAS, and ESG mandates, guiding clients to maintain compliance, optimize risk management, and align underwriting practices with international standards.

- Customized Consulting Solutions: Our tailored consulting services address unique client needs, from product development to digital transformation, ensuring resilience and competitiveness in an increasingly complex marine insurance landscape.

As the marine insurance market size continues to expand amid technological innovation and sustainability imperatives, IMARC Group remains a trusted partner in delivering actionable intelligence and foresight. For detailed insights, data-driven forecasts, and strategic advice, see the complete report here: https://www.imarcgroup.com/marine-insurance-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)