Australia Travel Insurance Industry: Growth Factors, Major Players, and Future Outlook

Introduction:

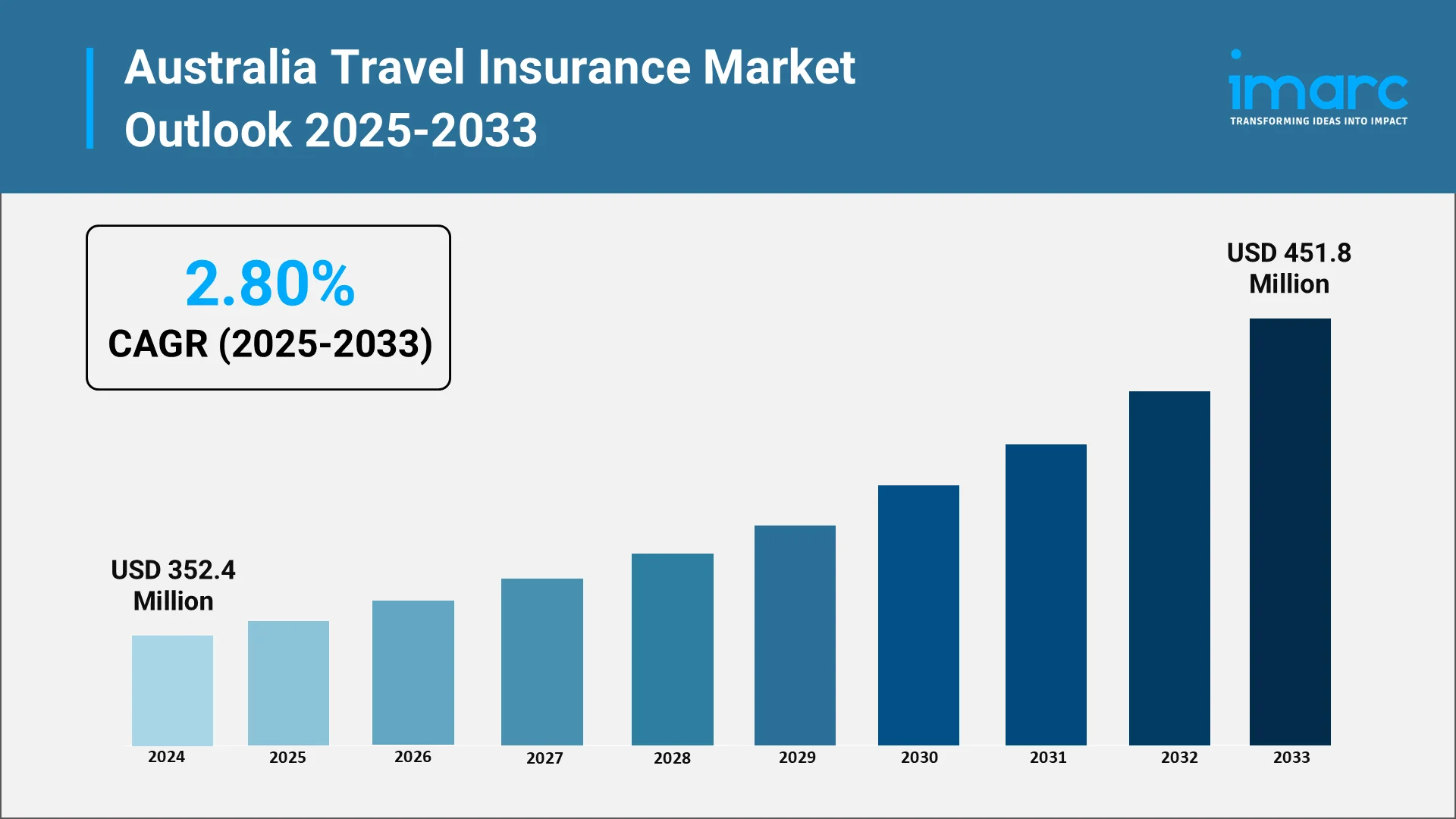

The Australian travel insurance market has grown from a value-added travel product to a necessary protection for travelers. As confidence in domestic and foreign travel increases, Australian travelers increasing value full coverage against unexpected events like medical issues, flight cancellations, and trip interruptions. Australia travel insurance market size stood at USD 352.4 Million in 2024. Moving forward, the market is expected to reach USD 451.8 Million by 2033 with a CAGR of 2.80% during 2025–2033. The revival of the industry has been fueled by shifts in consumer behavior, improved awareness of international uncertainties, and increased dependence on digital and mobile channels for policy buying and claims.

Travel insurance is no longer considered an added cost but a necessary component of travel planning. Increased online travel platforms, flexible policies, and customized insurance packages have increased the accessibility of the market. In contrast, insurers are adopting artificial intelligence, data analytics, and automation to streamline efficiency and provide faster, more transparent customer experiences. These innovations are transforming the way that insurers evaluate risks, handle claims, and communicate with policyholders, raising the bar for ease and dependability in travel insurance.

Explore in-depth findings for this market, Request Sample

Role of AI: Impact and Benefits in the Australia Travel Insurance

Artificial intelligence is transforming the operational and strategic environment of travel insurance in Australia, making operations more efficient, accurate, and accessible to underwriting, claims handling, and customer engagement. AI-powered automation has revolutionized claim processing by way of instant document validation and quicker settlement decisions. Machine learning technology is capable of checking submissions, identifying patterns, and authenticating documents, eliminating errors and providing timely compensation to the traveler during emergencies. In addition, sophisticated algorithms assist in fraud detection by scrutinizing trip information, historical claims, and behavioral factors, protecting policyholders and ensuring the integrity of the insurance process. Notably, Fast Cover, a leading Australian travel insurance provider, has partnered with Five Sigma to modernize its claims management operations. This collaboration leverages AI-driven platforms to accelerate the entire claims process, from the First Notice of Loss (FNOL) through to settlement, reducing turnaround times and enhancing customer experience.

Artificial intelligence also facilitates dynamic underwriting and customized risk assessment. Predictive analytics enable insurers to analyze travel patterns, destinations, and activity levels, providing customized coverage that responds to each traveler's profile. Not only does this lead to more fair premiums, but it also maximizes risk management, to the benefit of both insurers and customers. By applying AI in these manners, insurers are able to pre-emptively address foreseeable problems and develop more responsive, data-based policies that respond to the changing needs of travelers.

From a customer engagement perspective, AI-powered chatbots and virtual assistants have become integral to the travel insurance experience. They provide instant responses to inquiries, guide users through policy selection, and assist with claims submissions around the clock, ensuring support across time zones. Looking forward, AI in Australia's travel insurance sector goes beyond efficiency—it fuels transformation, enhances precision, lowers expense, and deepens customer connections, allowing insurers to construct durable competitive edges in an expanding digital landscape.

Recent Market News and Major Research and Development:

Australia travel insurance Industry is radically changing, dominated by consolidation, innovation, and technological progress. Major insurers are refocusing portfolios, establishing strategic alliances, and putting capital into automated, customer-centric platforms. One of the trends is end-to-end digitalization, with claims hosted in the cloud, telehealth integration, and data-driven tools making the traveler journey more efficient, enabling claim submission and tracking through mobile applications. Research and development focus on artificial intelligence and predictive modeling to allow insurers to foretell traveler requirements and spot coverage gaps ahead of time, enhancing customer trust and transparency. Partnerships between technology companies, online travel agencies, and insurers are growing embedded insurance provisions, leveraging analytics to offer tailored coverage at the point of sale. This methodology is remodeling consumer attitudes, turning travel insurance from an after-purchase add-on to a seamless, integrated component of the travel-planning process. These concerted efforts put the industry on the track towards more effective, anticipatory, and targeted travel protection.

- May 2025: Allianz Partners Australia launched an insurance product specifically designed for cruises in partnership with Norwegian Cruise Line (NCL), according to ANTARA News. The product is offered at NCL's time of booking and insures shipboard medical treatment, evacuation, and cabin confinement, said Insurance Business America. This marks the way in which embedding insurance directly into booking for travel becomes increasingly available and convenient for customers.

- June 2024: Europ Assistance formed a strategic alliance with Flight Centre Travel Group in Australia and New Zealand, stated Generali. The agreement provides travel insurance and international assistance via Flight Centre's leisure and independent travel brands, with white-label solutions and improved booking integration—a testament to increasing innovation in the distribution of travel insurance and technology-led customer interaction.

- April 2024: Battleface joined forces with Butter Insurance to launch modular travel insurance products targeted at younger Australians, as reported by battleface.com. The partnership is centered on flexible, digital-first products that can be tailored to specific traveller needs, in line with increasing trends toward insurtech innovation and changing preferences among Australia's younger traveller population.

- December 2024: Zurich Insurance Group has purchased AIG's worldwide personal travel insurance and assistance business, including the "Travel Guard" brand, according to Zurich. The acquisition deepens Zurich's global travel insurance footprint through its Sydney-headquartered subsidiary Cover-More Group, constituting a significant industry consolidation and solidifying Australia's position in Zurich's international travel insurance strategy.

Top Companies in the Australia Travel Insurance Market:

The Australian travel insurance landscape is influenced by a combination of traditional insurers, health-oriented providers, and niche travel brands. Global and domestic players compete on product differentiation, customer experience, and service innovation.

Allianz Australia remains one of the leading names in the market, providing extensive portfolios of travel policies and functioning across various distribution channels. Its extensive network and brand name provide it with a competitive advantage in retail as well as corporate travel segments.

Cover-More, which is part of the Zurich network, is another big name renowned for its proficiency in worldwide assistance services and strong network of travel partners. Its emphasis on all-around support and 24-hour emergency help has positioned it as the most desired service for travelers who value dependability.

NIB, with its health and travel insurance heritage, has also established a significant presence. Its focus on digital solutions and customer interaction has helped it perform well among young travelers looking for flexible, web-first coverage.

Other than these large brands, the industry has a number of specialized and new players that provide niche or adventure-type policies. These players compete by way of price innovation, tailored coverage features, or streamlined digital experiences. The competitive landscape as a whole promotes ongoing innovation and product development, which ultimately benefits consumers through improved choices and enhanced accessibility.

Opportunities and Challenges in the Australia Travel Insurance:

Opportunities

- Emerging Travel Segments: Growth in long-term and remote work travel provides opportunities for insurers to provide flexible insurance products for digital nomads, extended-stay travelers, and foreign students, fulfilling unmet needs in multi-month trips, work-abroad programs, and long-term health coverage.

- In-Flight Insurance Partnerships: Travel insurance in airline, hotel, and booking websites enables insurers to meet customers where they need insurance the most, increasing convenience and conversion through instant coverage in tandem with ticket purchase.

- Integration of Technology and Sustainability: Telemedicine and parametric insurance offer instant medical coverage and automatic pay for incidents such as flight delays, while environmentally friendly policies supporting low-carbon travel or rewarding sustainable practices appeal to green consumers and set insurers apart in the marketplace.

Challenges

- Cost Escalation and Profitability Pressures: Rising healthcare, logistics, and travel costs are compounding rising values of claims, making it difficult for insurers to keep premiums reasonable while balancing profitability and accessibility.

- Regulatory and Ethical Compliance: Implementation of AI and digital automation needs meticulous compliance with consumer protection legislation, transparent algorithmic decision-making, ethical treatment of customer data, and avoiding bias to retain public trust.

- Fraud, Distribution, and Environmental Risks: Insurers are confronted by fraudulent claims, especially overseas, and price competition from aggregator platforms that focus on prices, requiring investment in analytics, fraud management, and value-added services. Climate-related disruptions and global climate change also introduce uncertainty, affecting underwriting, risk modeling, and operational stability.

The future of the Australian travel insurance market is a dynamic, technology-fostered one, with a focus on hyper-personalized, digital-first experiences that are convenient, transparent, and supported in real-time. However, a recent survey by the Insurance Council of Australia (ICA) and Smartraveller revealed that one in seven Australian travelers (14%) went overseas without travel insurance on their most recent trip. This trend is particularly prevalent among younger travelers, highlighting a gap in awareness and preparedness. Product development and service delivery will become increasingly digitized, with AI, machine learning, and automation bolstering claims handling and proactive risk management. Customers will enjoy quicker settlements, dynamic pricing, and streamlined policy management through mobile interfaces. Embedded and partnership-driven distribution models will increasingly incorporate insurance within airline portals, online travel agency platforms, and fintech mobile applications, targeting in particular younger, digitally savvy consumers preferring hassle-free, on-demand solutions.

Innovation will increasingly drive market differentiation, with parametric insurance, agile policy frameworks, and on-demand insurance responding to changing traveler demands. Customer satisfaction will be improved by telehealth support and 24-hour multilingual care networks. Sustainability and ethical management will become more prominent, fueling environment-driven products and highlighting transparency in automatic decision-making and data protection. Backed by robust demand and persistent digital evolution, the market will continue to be robust. Insurers that integrate innovation with ethical AI, transparent pricing, and outstanding customer service will succeed by providing trust-driven protection, personalized service, and seamless digital offerings to fulfill the aspirations of contemporary Australian tourists.

Conclusion:

Australia's travel insurance market is undergoing a significant shift. Its evolution is being influenced by evolving travel habits, emerging technology, and changing customer expectations. Artificial intelligence is driving efficiency, precision, and customization, while collaborations and online channels are revolutionizing how travelers find and buy protection.

The convergence of changing traveler requirements, high digital uptake, and increasing knowledge of world risks is setting the Australian travel insurance sector up for sustainable growth. The future will call on insurers to walk the tightrope between innovation and integrity, with transparency, trust, and customer well-being at the heart of all products. Through doing this, the sector will continue to cement its position as an essential facilitator of secure, confident, and carefree holidays for Australians worldwide.

Driving Innovation: IMARC's Strategic Approach to Australia Travel Insurance Market

IMARC Group arms stakeholders in the travel and insurance industry with fact-based strategies for success in the emerging Australia travel insurance market. Our advisory services and research solutions allow customers to leverage emerging opportunities, mitigate risks, and drive innovation in policy development, claims handling, and customer interactions.

- Market Insights: Monitor regional trends that are influencing the Australia travel insurance market, such as rising traveler awareness, heightened demand for customized coverage, and the use of digital-first insurance products.

- Strategic Forecasting: Anticipate advances in AI-powered underwriting, automated claims settlement, and dynamic policy products, as well as regulatory changes affecting product design and distribution.

- Competitive Intelligence: Benchmark the strategies of dominant players, track innovative insurance products, and analyze the conjoining of travel assistance services, mobile apps, and customer-focused platforms.

- Policy and Regulatory Analysis: Analyze how Australian insurance regulations, licensing policies, and consumer protection strategies influence market growth and service availability.

- Customized Consulting Solutions: Engage in customized solutions for market entry, product development, pricing strategies, and collaborations with travel agencies and online platforms. IMARC's consulting facilities enable customers to adapt to the shifting Australia travel insurance landscape while ensuring they remain technology, regulatory, and consumer-centric.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)